trading opportunity Or Stock Market Overview as per wd gann theory

Stocks to trade for coming days especially who wants to take a positional trade

Positional Trade 12/5/23 onwards mentioned below :

- L&T : CMP 2226. Buy above 2228, target 2345. Stop Loss 2190 ( closing basis on daily candle )

Positional Trade 10/5/23 onwards mentioned below :

- Maruti Ltd : Buy signal is generated at 9140, can again enter at this level. SL 9050 ( Closing basis on daily candle ). Target 9320 till 18/5/23.

Nifty Outlook for 1/10/22 using Gann course content is shared below:

Nifty Prediction Today As Per Gann Square Of 9

( 3/10/22 )

| Degree | NIFTY |

| 0 | 17081 |

| 45 | 17016 |

| 90 | 16951 |

| 135 | 16886 |

| 180 | 16821 |

Maruti Share’s Outlook for today ( 1/10/22 ) is shared below :

Entered in Maruti @ 8685 50% qty & Again Entering in Maruti at 8618 ( half qty cash ) & ( for intraday only ).#StocksToBuy #stocks #maruti

— Niraj M Suratwala (@NirajMSuratwala) October 3, 2022

SL yet not triggered. Added more at 8530.

— Niraj M Suratwala (@NirajMSuratwala) October 3, 2022

SL revised from 8520 to 8480 ( 15 mins closing basis )#maruti

MARUTI all trades closed. last 2 trades saved me... pic.twitter.com/9qqsjzGqxG

— Niraj M Suratwala (@NirajMSuratwala) October 3, 2022

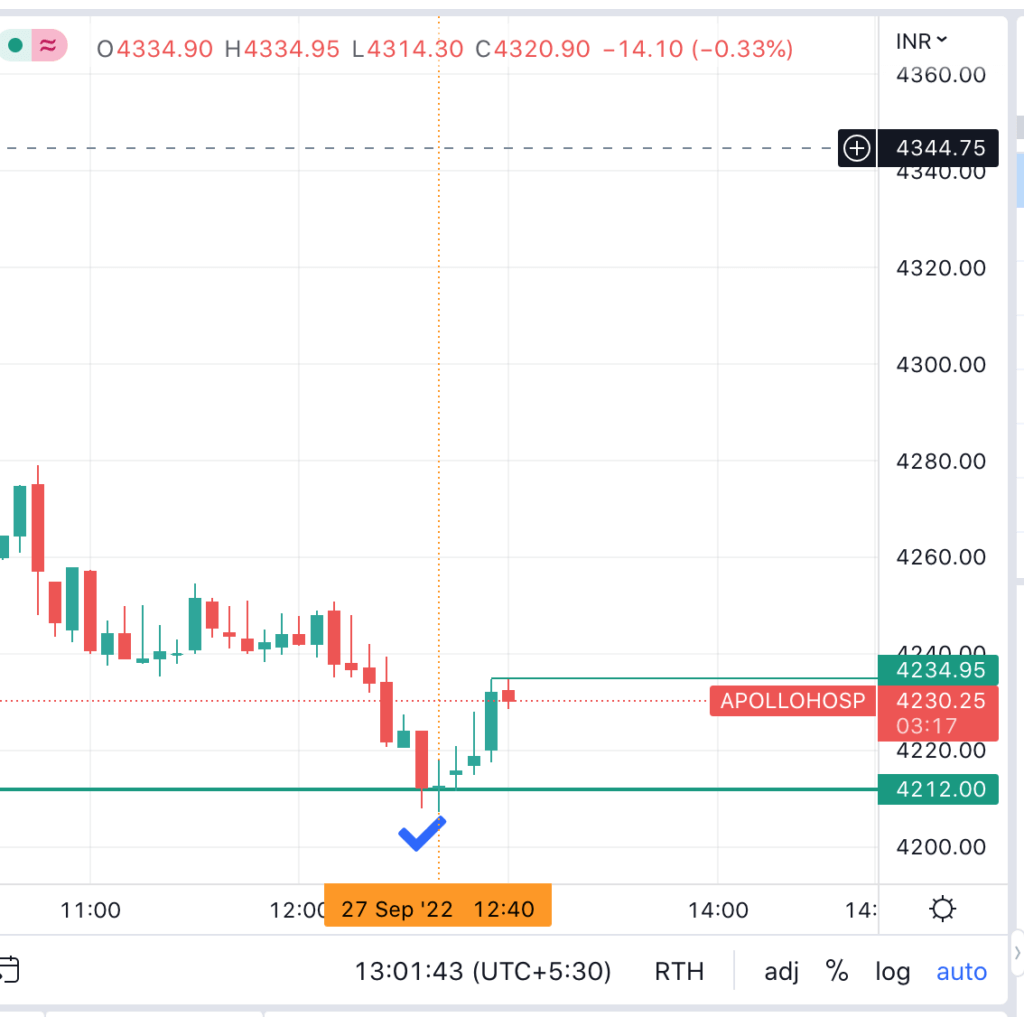

27/9/22 Update on Important Levels or Trading Opportunity for Stocks & Indices as per Gann Master Chart :

Levels are valid only for Today ( Intraday )

1) Maruti : Imp Gann level 8534.

BUY 50% QTY @ 8534 GANN LEVEL For tradable points ONLY IF IT COMES BEFORE 14:45.

2) ACC CMP 2344. Imp Gann Level 2306, dont buy before this. BUY 50% QTY @ 2306 Gann Level For tradable points ONLY IF IT COMES BEFORE 14:30.

5) BATA INDIA CMP 1796.Imp Gann Level 1745, Dont Buy before this. BUY 50% QTY @ 1745 Gann Level For tradable points ONLY IF IT COMES BEFORE 14:30.

ONLY IF IT COMES BEFORE 14:30.

8) CIPLA CMP 1081.Imp Gann Level 1061-65, Dont Buy before this. BUY 50% QTY @ 1065 Gann Level For tradable points, ONLY IF IT COMES BEFORE 14:30.

9 ) BERGER PAINT CMP 628. Imp Gann Level 627. BUY 50% QTY @ 628 For tradable points,

Sharing Important Reversal Time :

| 12.10 | 12.10 | 10.67 | 11.23 | MARUTI |

| 14.04 | 14.76 | 13.46 | 13.52 | RELIANCE |

| 14.20 | 14.66 | 12.15 | 12.59 | NIFTY_50 |

| 9.91 | 11.44 | 11.83 | 12.78 | NIFTY_BANK |

15/9/22 : Update on Trading opportunity. Updating this at 9:49 am.

Focus on Pharma Sector :

1) Buy Auro pharma @ 549 & 546 SL 544 ( 15 mins closing basis ) Target 650-52.

2) Buy DRR Reddy @ 4190. SL 4155. Target 4265.

3) Reliance CMP 2885. Try to catch a move from 2577 to 2595. SL 2572 closing basis 15 mins.

4) Axis bank

| 15/09/22 | ||

| Degree | AXIS BANK | |

| 0 | 806.00 | |

| 45 | 791.87 | Possibe reversal if comes before 2:30 pm today |

| 90 | 777.86 | Possibe reversal level if comes before 2:45 pm today |

5) Nifty Outlook today :

| 15/09/22 | ||

| Degree | Nifty | |

| 0 | 18096 | |

| 45 | 18029 | |

| 90 | 17962 | |

| 135 | 17895 | |

| 180 | 17828 | Only A better place to think of buying for some tradable points. |

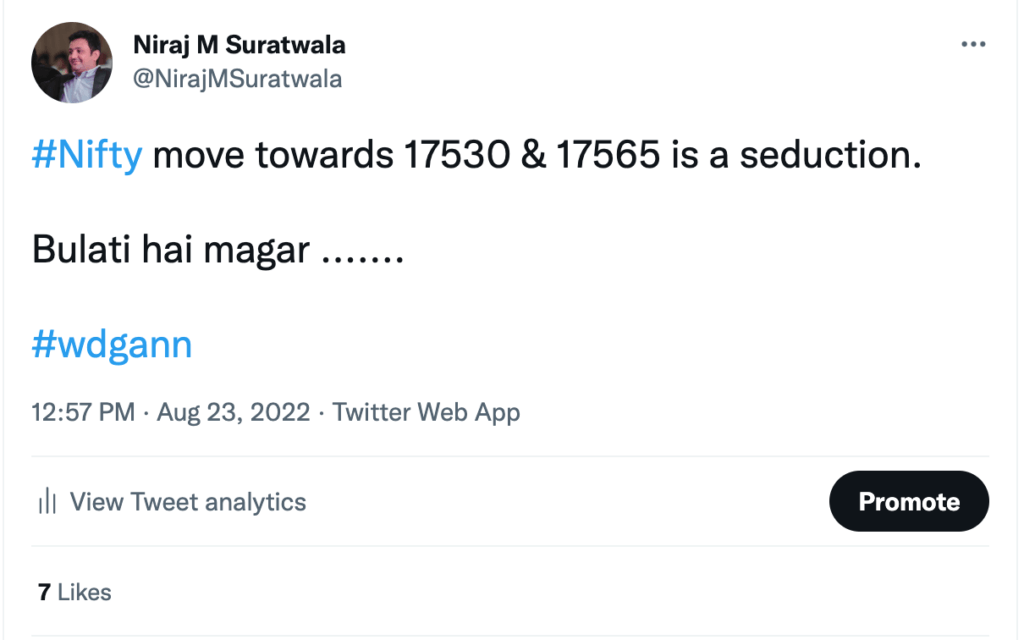

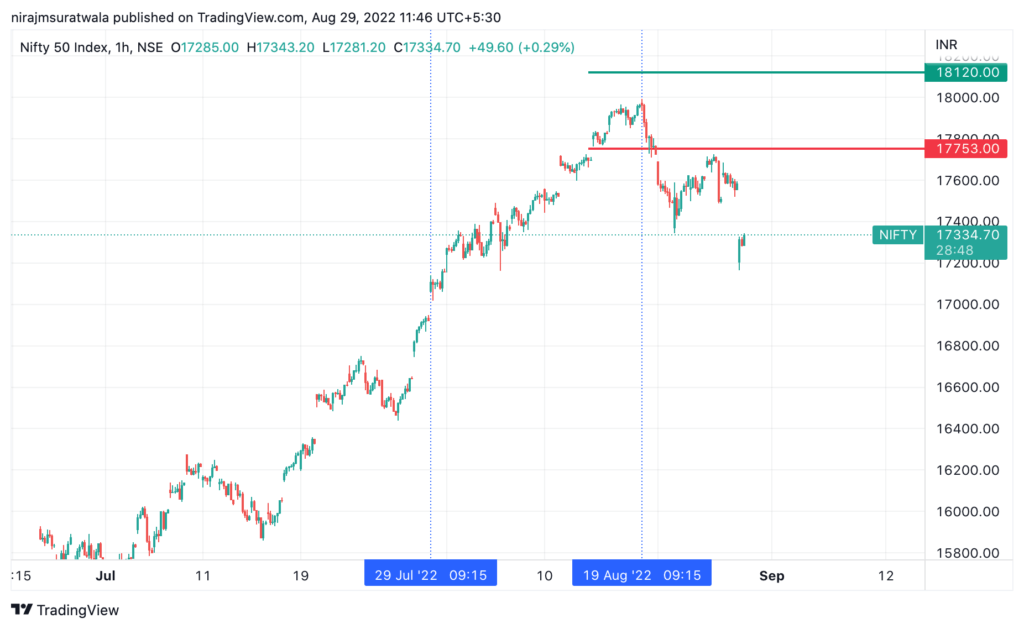

Recent Prediction On Nifty 50 Using WD Gann Theory (A trading opportunity was hinted)

24/8/22 ( Updating this @ 18:22 today ) As Per Gann Master Chart or Gann Square Of 9:

Axis Bank Share Price Movement Overview as per Gann Master Chart : Normal Case.

It was a no Trade Day !

( Axis bank could not complete 45 degree distance so did not get a chance to trade a tradable rejection at 756 ).

The day’s Range ( HP – LP ) Remained within 45 degree.

ICICI Bank Share Price Movement Overview as per Gann Master Chart or Gann Square Of 9 : Normal Case.

1) No Trade here too in ICICI Bank Share Price, as it completed 45 degree distance, but could not reach there before 14:30 so it was not supposed to be traded for a tradable rejection.

2) Day’s range ( HP – LP ) Remained within 45 degree only.

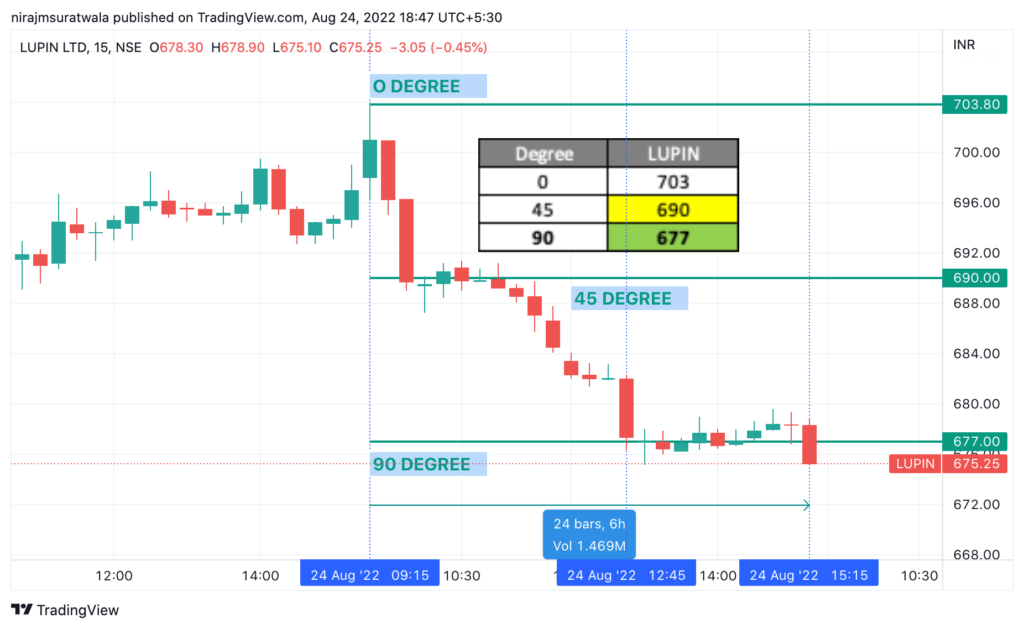

LUPIN Share Price Movement Overview as per Gann Square Of 9 or Using Gann Calculator : Rare Case

1) Since I Saw it little later, here I entered at 683 first in cash segment ( half quantity ) & waited for 677 to come to enter again with balance half quantity.

2) Lupin did not reverse from 683 & falling down, when it touched 677 i.e. 90 degree value @ 12:45, Instead buying in Cash segment I entered in buy side trade by buying an option CE 680 STRIKE 25/8 Exp @ 4:05 & struggled whole day.

3) Cash quantity bought at 683 was booked in loss at 676.50 at 15:20 & Booked profit in CE of 680 Strike @ 5.30.

Understand one thing that why initially it hovered only at 45 degree !! Than again Stoped falling right at 90 degree.

Result of today’s trade is not that attractive though not in loss & in net gain.

Point to be noted or To Learn an imp thing here is .. on 23/8/22 Lupin Share Price moved 180 degree !!!! Which is very rare, generally have witnessed it to move 45 degree in normal case & 90 degree in rare case. If this could have been considered earlier I would not have entered in this at 45 degree.

1) Nifty

24/8/22 ( Updating this @ 12:05 today )

As Per Gann Master Chart or Gann Square Of 9 :

Nifty : CMP 17612

1) Today It should not not make a high above 17765 before 14:30. If it comes there before 14:30, you can go with a tradable rejection. ( Basically if assume the low of the day you can predict it max possible High of the day with this and if that comes before 14:30 trade in opposite direction can be taken )

2) Axis Bank Share Price ( CMP ) 748.

Tradable rejection level is 756 ( A possible max high of the day ) if comes before 14:30.

3) ICICI Bank Share Price ( CMP ) 866.

Tradable rejection level is 874 ( A possible max high of the day ) if comes before 14:30.

4) LUPIN Share Price ( CMP ) 684.

Tradable BOUNCE level is 690 ( A possible max high of the day ) if comes before 14:30. Currently traded at reversal level a from here expecting it to bounce.

27/5/22

- Nifty50 : As Per LoV it should bounce from 16045 & as per Gann Circle it should bounce from 16074.

( For 16074 day’s high 16329 has to remain untouched now ).

15:10 : Nifty50 crossed the day high 16329 so 16074 remained invalid. - Maruti : CMP 7890. As per Price Time Square, immediate target is 8023 & 8287 once 7839 is crossed. SL is 7620 closing basis. ( Not attractive deal as risk reward no not favourable )

26/5/22

- Wipro : CMP 445. I would enter in buy side trade once at 440 today.

- Axis Bank : CMP 669. If comes at 660 can enter in buy side trade for a tradable bounce.

1:04 : No trade till now as it did not come at given level. Now expecting a tradable rejection at 681. 681 is 45 degree from day’s low i.e. 668. - ICICI Bank : CMP 719. Lets wait for 711, if coming there than can enter buy-side trade for a tradable bounce.

- Bajaj Finance : Intraday Buy side traders should hold their temptation until it comes at 5710-5648 area.

Risky traders can enter at 5744 with 5720 SL too, if SL gets triggered than wait for 5648 for 2nd Trade.

25/2/22

- Axis bank : CMP 667. Expecting bounce at 2 points, 659 & 649.

- Nifty50 : Expecting a tradable bounce at 15969. In worst case 15852 can be the bottom of the day.

- Wipro : CMP 446. It can not fall below 439 for the day. 440 is a good price to enter for a tradable bounce.

- Godrej Properties : CMP 1417 & LP 1402.

1394 is the ideal price where one can enter or even at CMP too as its not too far.

Both Time & Price have passed at a common point.

Any day closing above 1480 will confirm its move towards 1675.

SL has to be 1340 on closing basis. - CNX FMCG : it looks like it is in danger zone. CMP 36825 & further correction upto 35207 possible.

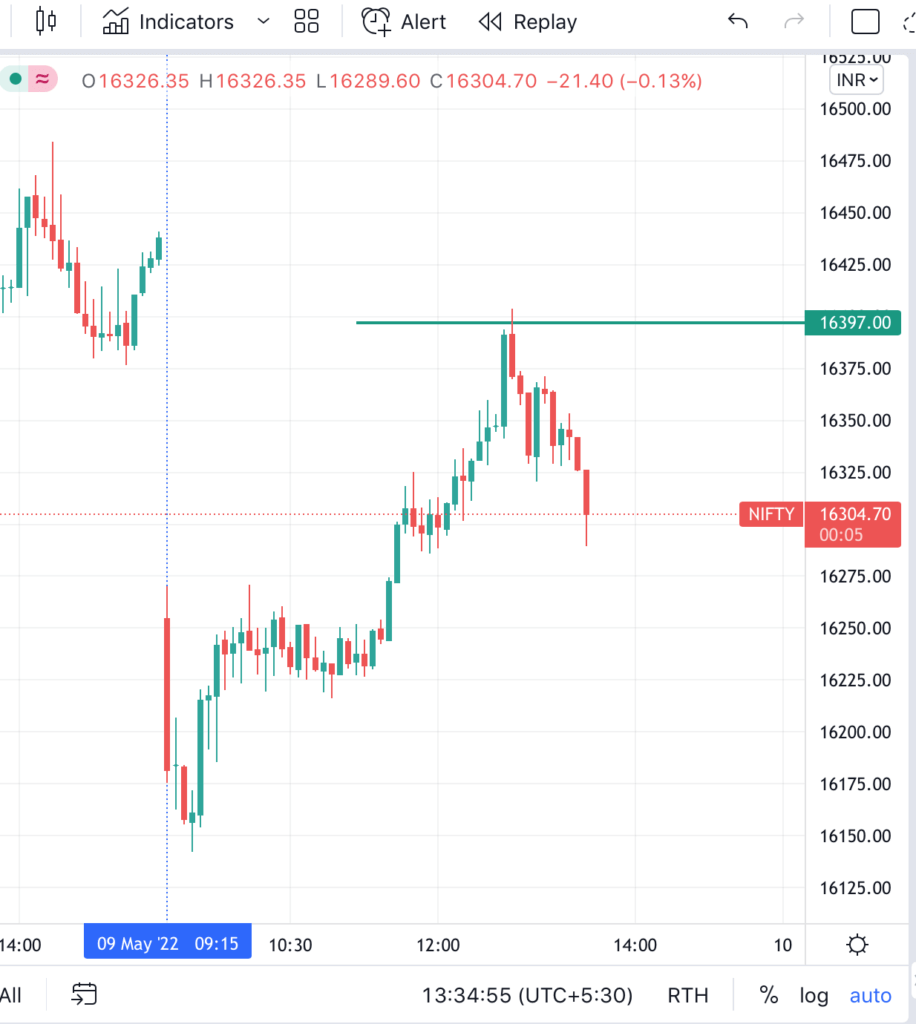

( 11/5/22 : View on FMCG remains valid until it does not closes above 37174. If it is closing above 37174 than I wont make any plan to go short in this sector ) - Nifty50 : Looking at tradable rejection at 16397 & 16461.

- Crude Oil : CMP 8449. Expecting rejection from 8635, post rejection it can again touch 7654 level. SL has to be 8831 on closing basis.

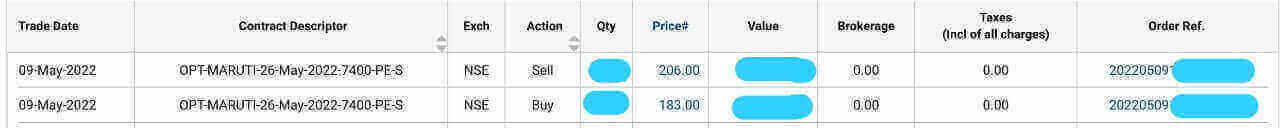

- Maruti : CMP 7292.

Expecting tradable rejection at 225 degree i.e. @ 7343. ( SL has to be 7365 on closing basis 15 mins, once triggered would again attempt at 7412 with 7435 SL on closing basis )

OPT-MARUTI-26-May-2022-7400-PE CMP : 240 Rs. Watchout its reaction at 138-107 level.

Identified target as per wd gann theory 7654 printed

WD Gann Theory applied on crude oil (expected rejection noticed)

WD GANN THEORY APPLIED ON MARUTI & TRADE CLOSED

Attempted at 7414 only instead 7343.

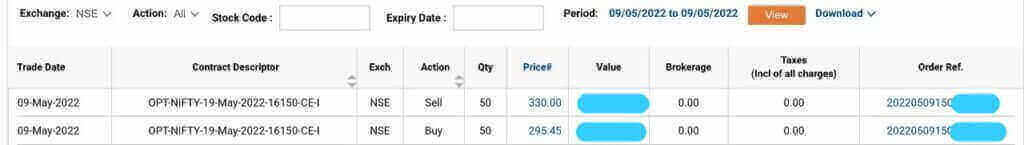

WD GANN THEROY ON NIFTY50: Post trading expected rejection at 16397, now traded expected bounce at 16235

Nifty50 : after trading rejection @ 16397 now trading a tradable bounce @ 16235.

— Niraj M Suratwala (@NirajMSuratwala) May 9, 2022

Hint of probability of tradable bounce at Gann level was given at 9:34 am which is encashed as shown in below provided image !! Gann theory helps in knowing the right time & price

OPT-NIFTY-12-May-2022-15950-CE CMP 300

— Niraj M Suratwala (@NirajMSuratwala) May 9, 2022

&

NIFTY50 @ 16150.. If it is coming at 15950 than its CE can fall well from 300 to 100 level ( approx ) there can enter for a good tradable bounce.

now rejection in nifty50 at 16397 noticed for a good tradable points, wd gann theory helps !!

Trading Opportunity as per WD Gann Theory in Stocks or Indices

Trading opportunity in Dabur ( stock ) as per wd gann theory ( 6/5/22 ) Intraday only

Expecting bounce at 515.

DABUR : Bounced from 515 for tradable points. Closed the trade @ 519.

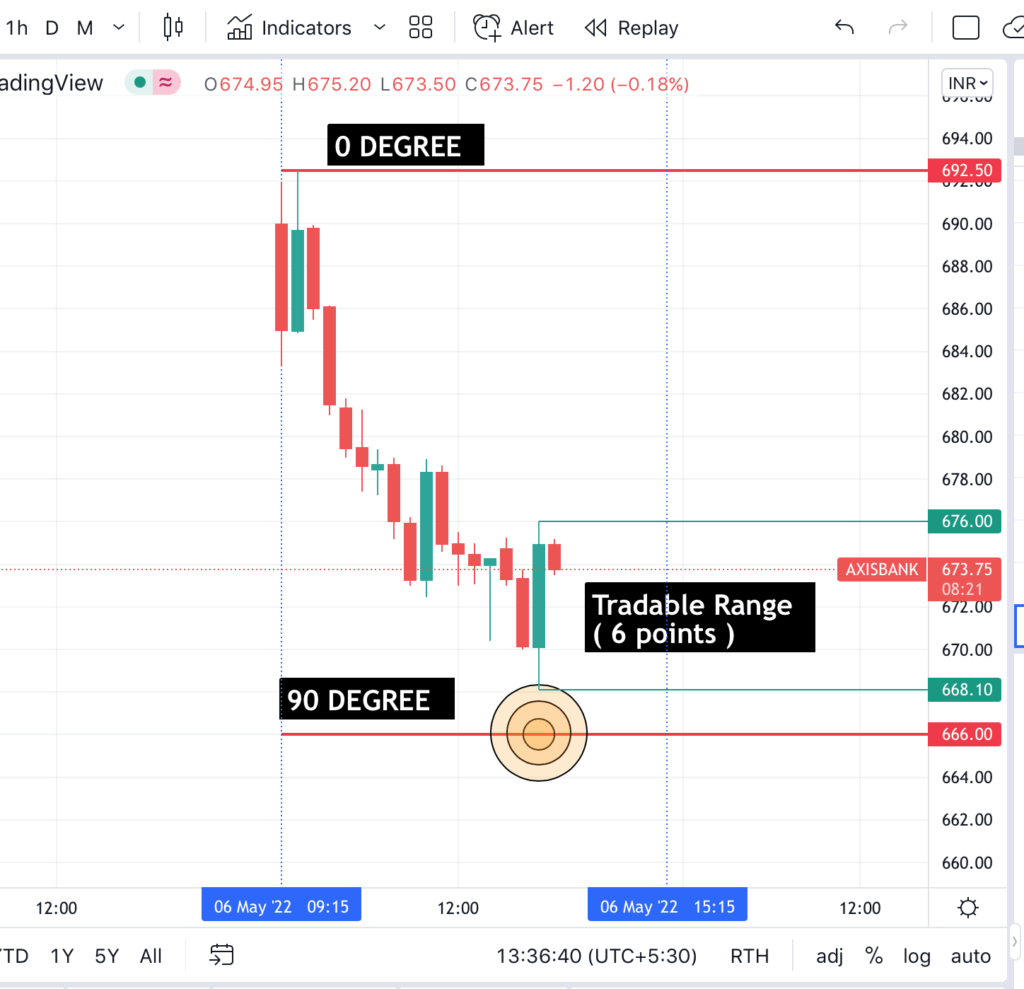

Trading opportunity in Axis bank as per WD GANN THEORY : CMP 674. 6/5/22 ( Intraday opportunity )

Expected bounce traded & trade closed @ right time.

Considering 0 degree as 692 than 90 degree value stands at 666 & 45 degree stands at 679.

There is a reason why to avoid 45 degree ( LoV )

I will enter in buyside trade if Axis bank comes at 666 before 14:45 for a quick tradable bounce.

[ Movement of Nifty / Indices : Normal case 0 to 180 degree, rare case 0 to 360 degree.

Stocks (3 digits / less volatile ) : Normal 0 to 45 degree, rare case 0 to 90 degree. ]

Trading Opportunity in a Nifty50 6/5/22 AS PER WD GANN THEORY

In “Upside” option “0 degree” is revised from 16382 to 16351. If 16351 remains unbroken than sell side trade can be taken @ 180 degree value upside i.e. 16608 only if it comes before 14:30.

( As per Gann Circle we do not trade at 0 Degree & Keep target as 180 degree, we trade at 180 degree if it is completed within desired time ) ( While using Law Of Vibration with Gann Circle, we get a common entry point of trade i.e. at 0 degree & vice a versa. )

| Upside | Downside | |||

| 06/05/22 | 06/05/22 | |||

| Degree | NIFTY | Degree | NIFTY | |

| 0 | 16351 | 0 | 16482 | |

| 45 | 16415 | 45 | 16418 | |

| 90 | 16479 | 90 | 16354 | |

| 135 | 16543 | 135 | 16290 | |

| 180 | 16608 | 180 | 16226 | |

| 225 | 16672 | 225 | 16163 | |

| 270 | 16737 | 270 | 16099 | |

| 315 | 16802 | 315 | 16036 | |

| 360 | 16866 | 360 | 15972 | |

| LP | 16351 | HP | ? | |

| HP | ? | LP | 16382 | |

Nifty50 if day’s low 16382 remains untouched than day’s possible high in normal case is 180 degree value i.e. 16639.

In rare case it completes 360 degree.

In opposite direction can trade @ 180 degree value if it comes before 14:30 & @ 360 degree if it comes before 14:45.

Sharing below a Tweet in which attached all past predictions made on L&T Info & L&T Techno till date.

#LTI : sharing all tweets/predictions made on L&T Info in a sequence ( PFA )#Gann hai ToH Gain hai !!

— Niraj M Suratwala (@NirajMSuratwala) July 14, 2021

IT DOES TELL THE RIGHT TIME !!#Nifty #nifty50 #NiftyBank #GANN #wdgann #banknifty #traders #astrofinance #StocksToWatch #StockMarketindia #stocks #Time

Trading Opportunity in a stock ( L&T INFO ) 5/5/22 AS PER WD GANN THEORY

L&T Info : CMP 4773

ON 21/1/21 It was calculated that this stock, till 26/8/22 can Touch 2 Price levels i.e. 4884 & 4031. Now 4884 is printed where 50% quantity can be bought first. Remaining 50% quantity can be again bought @ 4031.

Note : CMP is 4773 & time left for 4031 is 26/8/22, means it has more time left for lesser points. So Those who have not bought this stock yet can add it at CMP & wait for 4031 level where should enter again.

Target for L&T Info is 6620 & 7230. Precise time of 6620 & 7230 price can be identified once either Price comes @ 4031 or before this price it passes 26/8/22 time.

Sharing below a Tweet in which attached all past predictions made on L&T Info & L&T Techno till date.

#LTI : sharing all tweets/predictions made on L&T Info in a sequence ( PFA )#Gann hai ToH Gain hai !!

— Niraj M Suratwala (@NirajMSuratwala) July 14, 2021

IT DOES TELL THE RIGHT TIME !!#Nifty #nifty50 #NiftyBank #GANN #wdgann #banknifty #traders #astrofinance #StocksToWatch #StockMarketindia #stocks #Time

Home » WD Gann Theory Blogs » Trading Opportunity As Per WD Gann Theory

Disclaimer

I am not a S.E.B.I. registered advisor. All my sharing are broadcasted for educational purpose only. Do your own research before making any trades or investments.

CLICK ON BELOW BUTTON TO ACCESS ALL MAJOR INFORMATION ABOUT WD GANN THEORY ( A TRADING METHOD ) IN 1 SINGLE PAGE:

Hi there! Would you mind if I share your blog with my twitter group?

There’s a lot of people that I think would really appreciate your content.

Please let me know. Thank you

Yes off-course, you can share !!