Learn Gann Course To Have A Successful Decade In Stock Market!

What Is Gann Course?

This Gann Course is based on a unique trading technique that is popularly known as Gann Theory Course. The legendary trader, William Delbert Gann developed this fantastic methodology. Gann was a master of forecasting the future movements of the financial markets using, employing various techniques such as time cycle analysis, geometry based on natural laws, and mathematics of astronomy. Moreover, he firmly believed that to achieve success in trading, one must skilfully incorporate both X-axis (Time) and Y-axis (Price).

Hello everyone, welcome to my website which is providing you insights of Gann Theory. You will learn the Gann Analysis in the easiest way possible, as I have personally designed it.

Let me explain here about this subject with real examples of using it on the stock market and other tradable instruments.

Gann Trading Course Content: No Noise, Only effective topics are covered in the course.

Gann Natural Time Cycle,

How Gann Law of Vibrations works on every tradable instruments,

Gann Price Time Square,

How to use Gann Circle by converting important Degrees into Price & IMP Price Levels into Degrees and

Use Of VIX

Trading using Gann Angles

Mode Of Gann Theory Course Class:

Live Online (One to One)

Duration: 5 Sessions over a period of 3 weeks. 1 Session duration: 2 hours.

Return To Main Menu

What is it and Why to learn WD Gann Trading Course?

(Time Analysis / Timing stock market)

A. Prior to learning the Gann Course, an essential reminder:

Many people try their hand by doing technical analysis to TIME their trade or investment. For me, this process seems baseless as almost 99% of technical studies rely on PRICE as the raw material, which is plotted on the Y-axis of a chart. Surprisingly, the X-axis of the chart representing Time is often overlooked by most individuals, including more than 300 technical Studies.

For the analysis of TIME one needs to Learn Gann Trading Theory Course – a trading course which will solve major things.

B. Why To Learn Gann Analysis?

Fundamental analysis holds great importance as it helps you select the right company. Once you have made your selection, you need to decide when to buy it. Now, here, there is a catch. No matter how good the company you choose is, if you enter at a high valuation, your future C.A.G.R. will not be that attractive. So, you need a certain process through which you can decide AT WHAT PRICE you should be entering. Besides this, the most important factor to consider is at what time you should be entering.

This is where the need for a Gann Course arises.

Now, to solve “AT WHAT PRICE you should enter,” you need to go through a valuation process that tells you whether the price is overvalued or undervalued.

Based on a specific analysis you will be able to understand this.

(THIS PROCESS IS, FUNDAMENTAL RESEARCH – VERY TIME-CONSUMING)

You can also solve the “At what price you should enter” by applying WD Gann Trading Theory, which is simpler and less time-consuming.

Some good insights about the ultimate gann course in India

- Reality is, 90% People Looses Money, William Delbert Gann Concepts Helps You To Be Among those 10% People!

- Stock market & Nature has few similarities. Both are ever-changing, Predicting IT is Tough

- Change Is Inevitable, Knowing the Beginning & End Point Of Upcoming Change

is Possible ..!! Yes !! - Concept Of WD Gann Theory Is A Lens Through which You Can Scan Future Change. Learn this method & Go Closer.

- Traders, Your Struggle Is Timing, Moving Object Price Is A Distraction! Focus On Time!

- Learn This Gann Theory Course

(William Delbert Gann Trading Theory) & Understand how to identify trend-changing points. - WD Gann Methods Are Actually Simple and Easy to Understand. It Makes Trading Life Easy.

Recent important Gann Dates using financial astrology

- Jupiter, a slow-moving planet is changing sign on 22/4/23. Also, it is an important date as per the Gann Time Cycle analysis i.e. covered in my Gann Trading Course.

Very recent predictions made on nifty, bank nifty & other tradable instruments using the subject

Describing below image: On 4/6/24 I had said that if Nifty is crossing 21780 before 2 pm than consider it as a strong buy signal. Also hinted to buy Call options (CE) as shown in below image.

In below attached tweet, shared a possibility of Nifty reaching 19941 & 20036 post crossing 19760 level on 22/11/23. I used Gann Price Time Square as well as Gann Important Degrees here.

As a result, Nifty Successfully completed both marked levels’ journey i.e. from 19760 to 19941 & 20036.

SL size was too small, mere 45 points!!

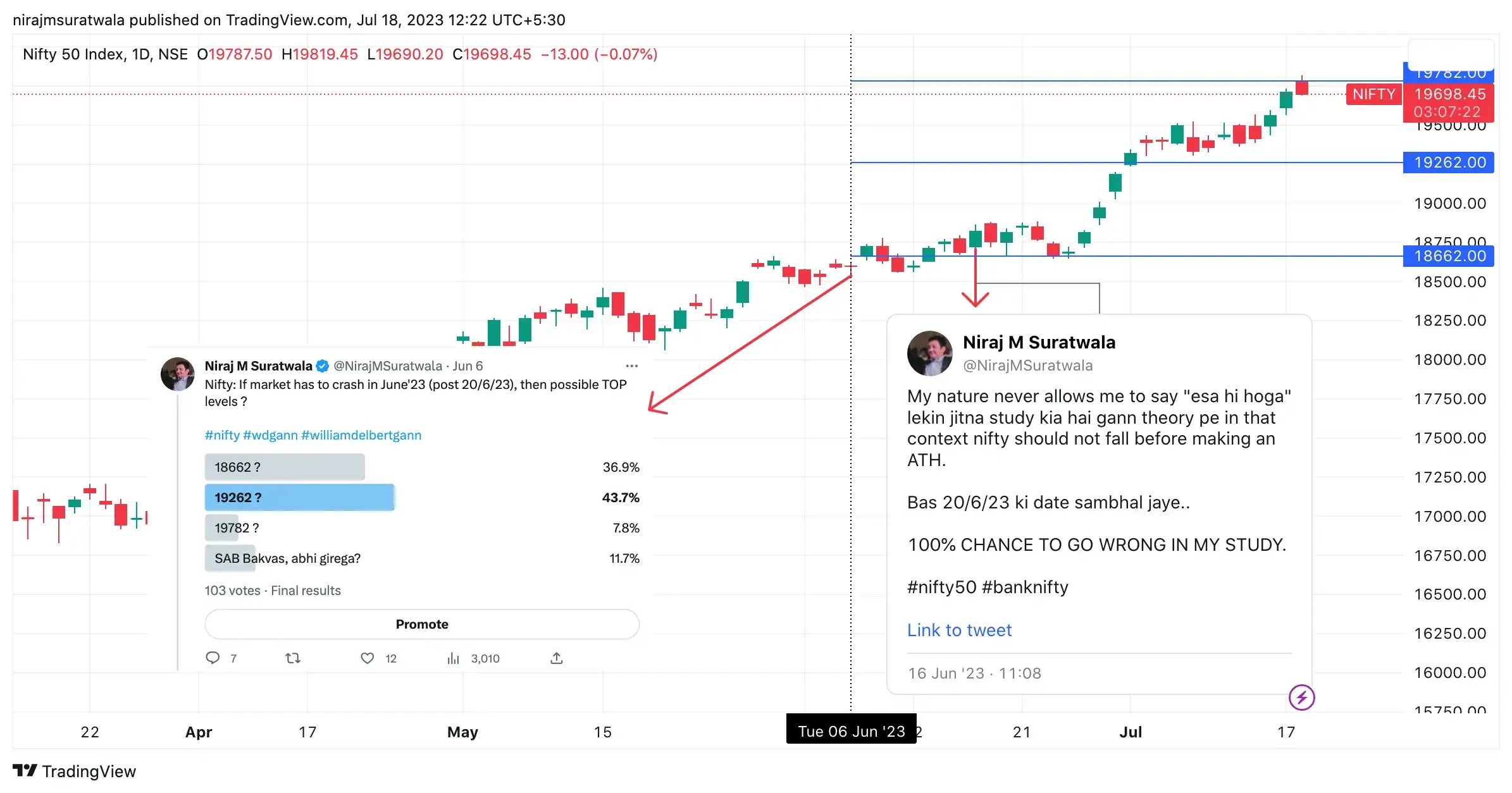

Result Of Nifty Gann Prediction: Nifty Today Reached its New All-Time High!! Blessed to catch the right price for buy-side trade again at 19375. Nifty 50 made a high of 19819. After this, HP & LP Of 17/7/23 and 12/8/23 are very important. Was not in any trade after reaching 19819. Henceforth, was supposed to wait till Nifty closing price which could be above HP or Below LP of 17/7.

Nifty prediction for 18675 level shared using Gann Course Content:

Nifty bounced well from 18675, and SL was 18650. The size of SL was just 25 points. As mentioned none of 1 hour price candle of Nifty50 could close below 18650. Check the below image for reference and for more details.

Sharing result of Gann prediction 2023 made on Nifty

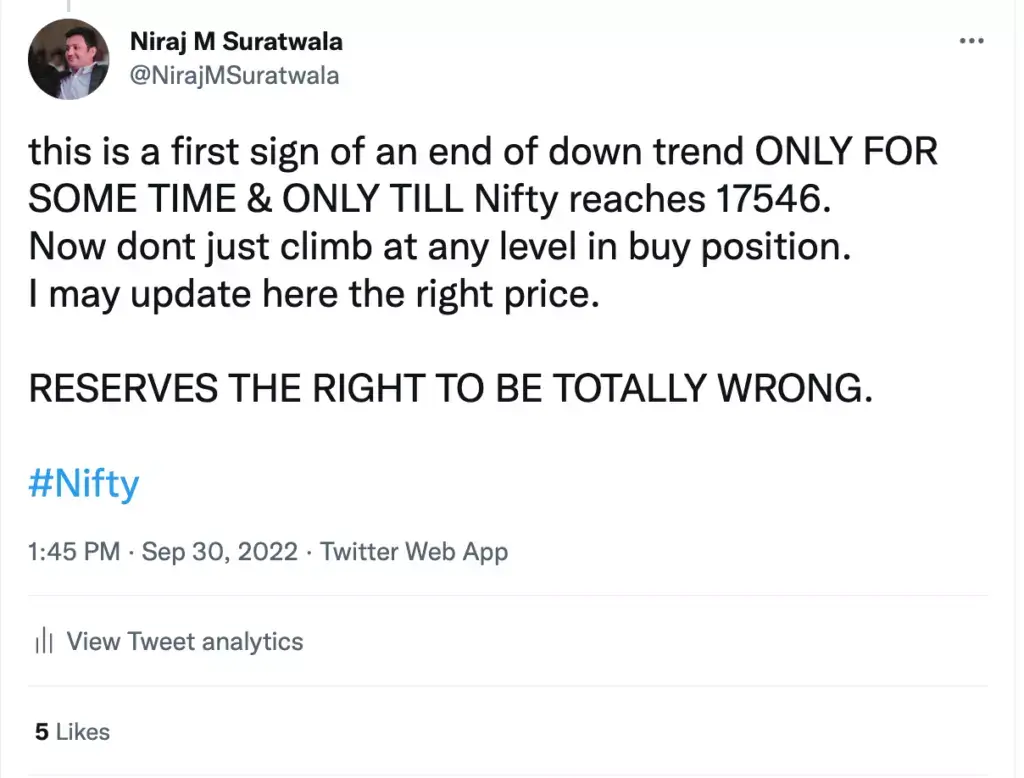

The below tweet hinted not to be on the sell-side.

My nature never allows me to say "esa hi hoga" lekin jitna study kia hai gann theory pe in that context nifty should not fall before making an ATH.

— Niraj M Suratwala (@NirajMSuratwala) June 16, 2023

Bas 20/6/23 ki date sambhal jaye..

100% CHANCE TO GO WRONG IN MY STUDY.#nifty50 #banknifty

Sharing result of prediction made on Nifty50 using Gann Trading Course content:

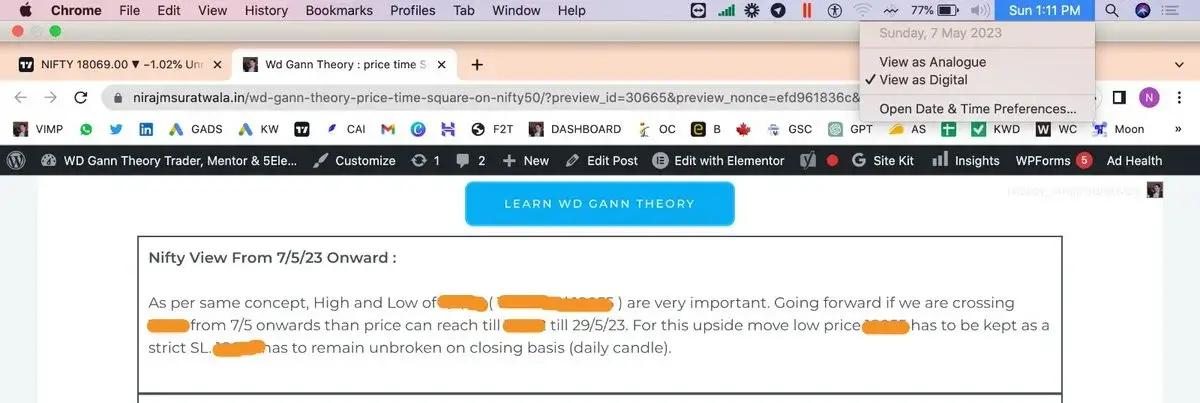

On 7/5/23 Mentioned in the article about Nifty’s move from 18662 till 29/5/23.

Refer to 3 images for reference. I have applied Price time square here to analyse an ongoing upside trend.

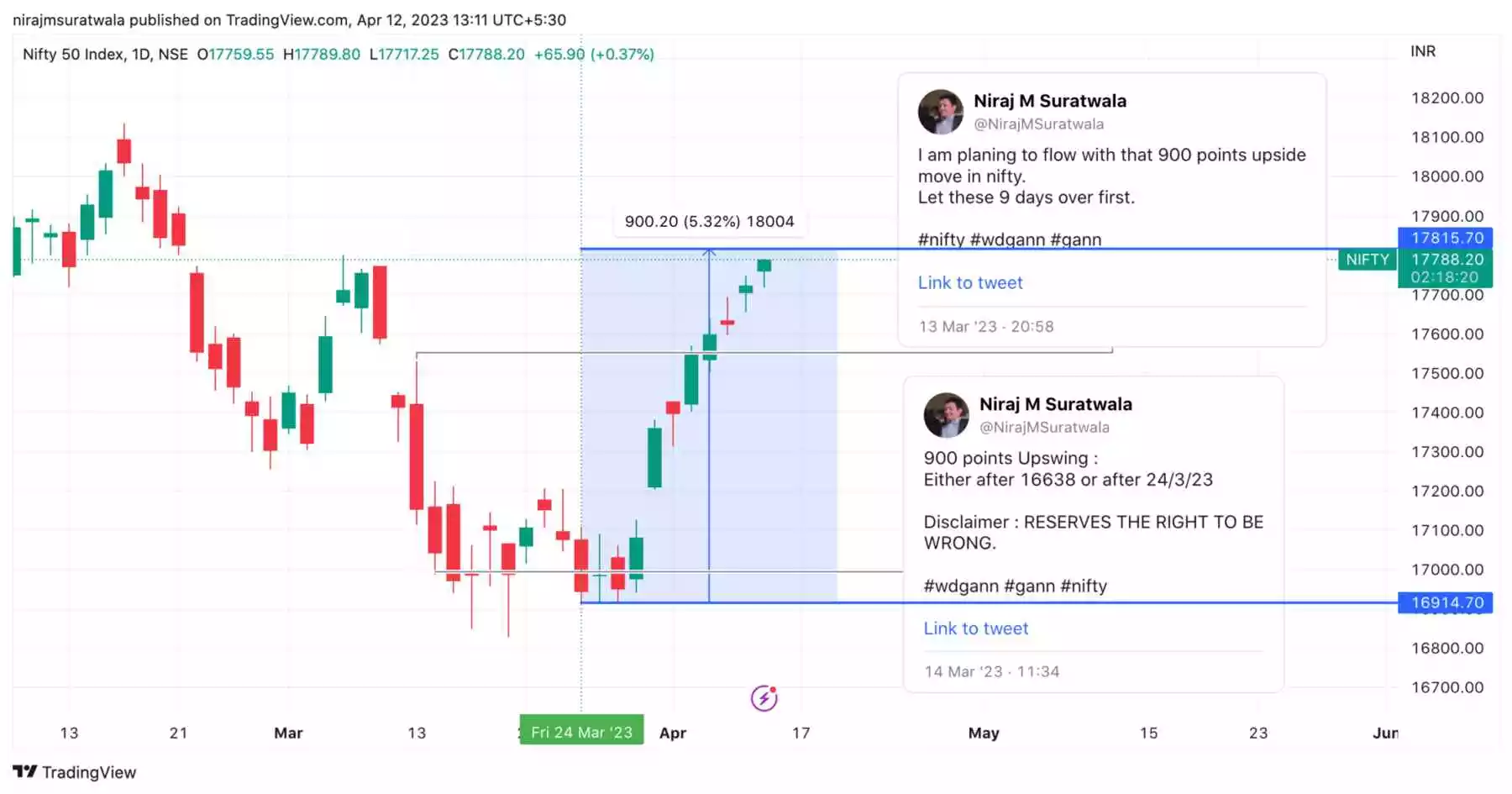

Use same concept on Nifty 50 Prediction for 13/3/23 to 13/4/23.

On 13/3/23 Could realise that from 24/3/23 Nifty 50 can move upside for 900 points and that successfully happened!

We can use the Law Of Vibration to make such a prediction, this topic is an important part of my WD Gann Stock Market Course.

On 13/3/23 shared that post 9 days expecting 900 points rise & it started happening just right after the 9th day. In 4 days 464 points rise done, and half is due. Gann Theory Course Content applied on Nifty 50 to predict the right time.

Blessed to share again right Time & Price in Nifty by using provided Gann Course Content.

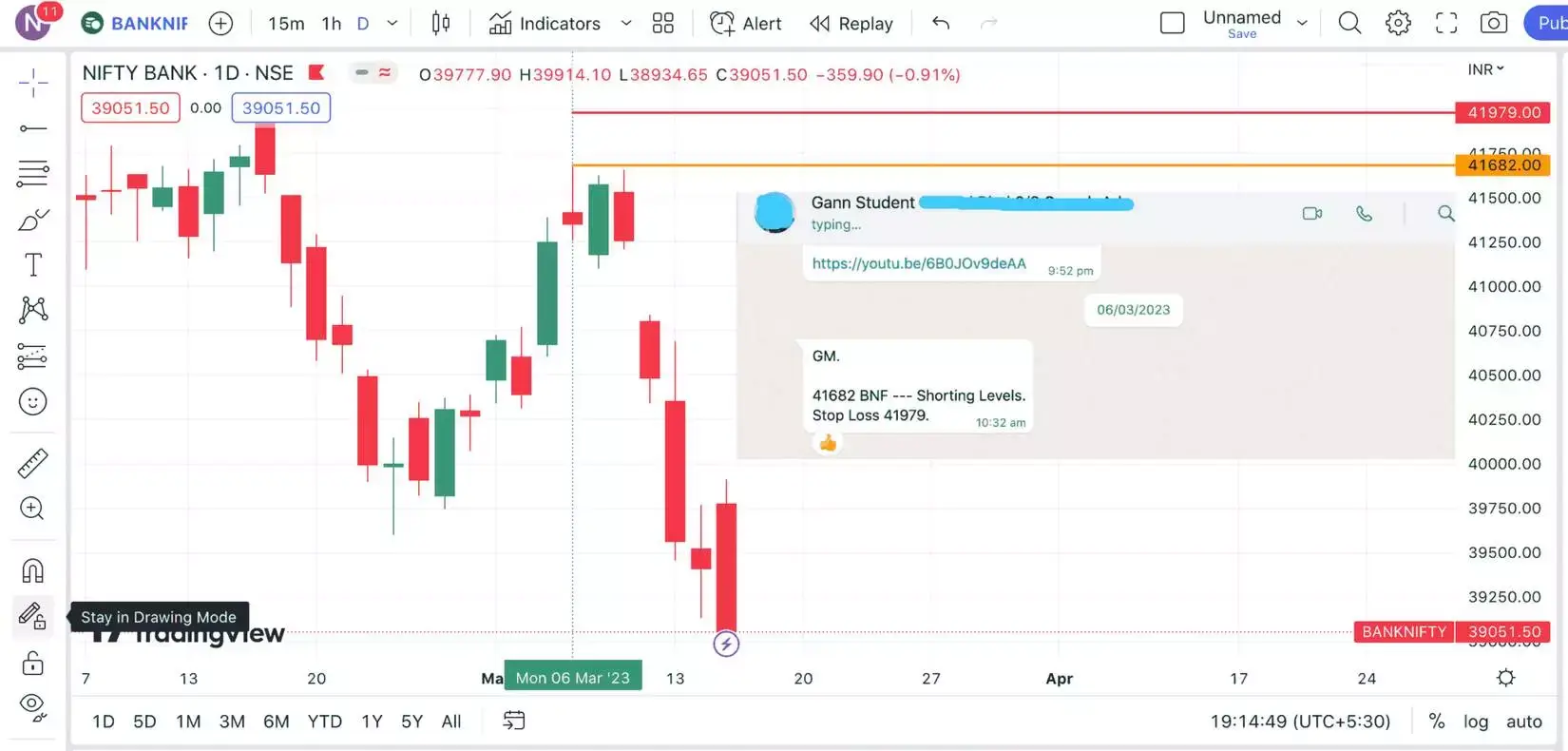

Below is an example of the Use of Gann Course Content on Bank Nifty.

An important topic (Law Of Vibration) of the Gann Course applied on Bank nifty by a student was amazing.

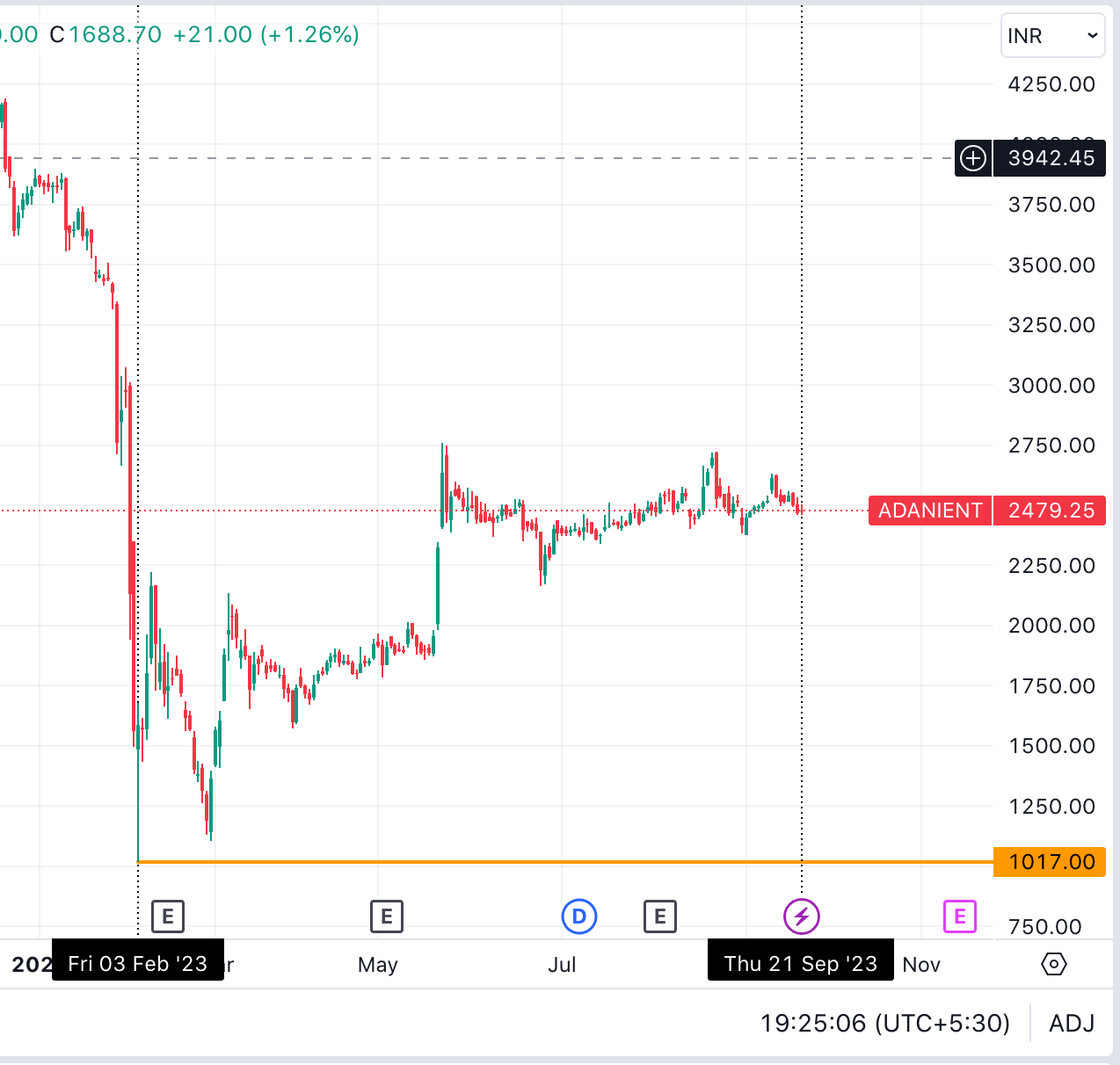

Use of Gann Theory Course Content on Adani Enterprise Ltd as mentioned Below.

One 03/02/23, a buy-side opportunity for Adani Enterprise was shared at 1017, which marked the bottom of the year!

Adding Adani enterprise in portfolio at 1017 & will add again at 630.#Adani #AdaniEnterprises

— Niraj M Suratwala (@NirajMSuratwala) February 3, 2023

After 1st entry in Adani Enterprise share @ 1017 it made high of 2200 on 8/2/23.

Adani Enterprise Price Today

Below, Use of Gann Trading Course Content on Crude Oil.

Last rise in Crude Oil for 9632 is due from 8763.

— Niraj M Suratwala (@NirajMSuratwala) June 2, 2022

Reserves The Right To Be Totally Wrong !

So, if you notice, Crude Oil had actually a long bearish period from 2-6-22 to till date i.e. March’23 !!

I was blessed to do the right prediction for the crude oil price on 02-06-22 at 10:10 am when it was traded at 8793. I tweeted that it would first bounce from 8763 and then have its last rise till 9632.

Below is an example of Nifty 50 prediction using Gann Trading Course content for the 19/1/23 to 24/3 period.

Sharing more examples of benefits of Same Concept On Nifty50

Sharing a thread of 7-8 Tweets which have shown how in Nifty I could identify All Tops & Bottoms ( almost all ) from 22/4/21 till to date. A brief explanation is also provided along with each prediction. You just need to spend some time on it to realise and accept that there is some Magic that works beyond Logic. That Magic is 100% scientific and Logical!!

Open The Tweet don’t directly jump to the Time Cycle blog but go through all the attached 9 Tweets well !!

All the best !!

Though overview was bearish, expected an upside rally from 11/10/22.

Nifty moved upside from 11/10/22 till 1/12/22 ( from 16950 to 18887 )

On 1/12/22 Gave an hint of end of the trend. Surprisingly Nifty made its All Time High right on 1/12/22 & till date it is falling as expected as per the original Gann Time Cycle View.

1 hint ..

— Niraj M Suratwala (@NirajMSuratwala) December 15, 2022

Avg of total of Planetary degree was number 9 on 1/12/22 !!#wdgann #astrology #stockmarket

Nifty Prediction based on Gann theory from 26/11/22 onwards & for 2023.

Don’t hold longs if Nifty either closes below 26/11 LP or below 26/12 LP.#Nifty #banknifty #StockMarket

— Niraj M Suratwala (@NirajMSuratwala) December 9, 2022

Now sharing successful case of applying Gann Theory on Bank nifty and few more belongs to Nifty50.

Gann theory prediction On Bank nifty : On 9/11/22 @ 9:45 shared 41350-41165 levels to re-enter. Good result seen right from 41350.

So Bank Nifty moved 2000 points from 41350 Gann Level.

I shared the Nifty Prediction for 2022 using Gann Theory, specifically applying the concept of the Law Of Vibration.

Some helpful Resource to know more about Trading Strategies Covered in my Trading Course based on Gann Theory. I have explained Gann Theory for intraday trading in detail.

In my Course based on Gann theory, I cover the usage of Gann Square of 9 on some 3-digit stocks.

Use of Gann calculator to identify trend reversal points ( this topic is covered in my online gann theory course )

Gann Master Chart Used on axis bank to explain "how to trade in stock using gann theory ( it is also a part of the Gann Master Course ) Using Gann theory for intraday really works.

Very primary application of WD Gann Analysis on nifty ( in my Ultimate Gann Course on Gann Analysis covering advanced version of it )

I have explained different topics of the Best Course in India on a single page, covering all the explained concepts.

Gann Time Cycle, a small part is explained (this is basic, advanced version is covered in WD Gann Trading Course)

Case Studies

Out of those given WD Gann course content, have demonstrated their use by covering majority of the topics.

Click below button to access information

Explained The Gann Time Cycle Course Below:

In my Gann Theory Course have covered Gann Time Cycle. Let me explain little more about what is Gann Time Cycle ?

We everyone know that what has happened in past does repeat in future but we do not know which past’s event has an effect in which upcoming year !! In my Gann Course, we explore the Law Of Cause And Effect, which mathematically explores the concept of Natural Time Cycle. This allows us to calculate the relationship between past events and future dates. Such dates are sufficient enough to predict upcoming trend of the market. The Gann Time Cycle course has an essential element called Gann Time Cycle, which we further explore with its basic aspects. You can click on the below image.

Gann Time Cycle (30 Years)

— Niraj M Suratwala (@NirajMSuratwala) June 20, 2022

Duration Of Word Timeline : 30Yrs

Instruments covered : Major Indian Indiceshttps://t.co/6Vl4z74M1n

Learn WD Gann Theory & Realise value of Time Cycle !

Traders can improve their Timings by Learning Gann !#wdgann #Time_cycle #gann #trading

Before Learning Gann Trading Course Read below article carefully

It is a bitter truth & fact that in this world proportion of richest people of the whole population is less than 10% !!

Yes, 90% people belongs to poor, middle & upper middle class .. !! This is fact & might sound common to common people because you have inculcated a tendency that this is a prevailing trend & you have to adjust your self with this instead trying to find why is the case so .. ? And how you can be among those 10% people .. ? Anyways lets not go towards motivational story . .

So, my point was to share that the same ratio of 90:10 is also prevailing in stock market. Yes, .. !!

Distinction between 90% Traders and 10% Traders:

In Stock Market, 90% people looses money & 10% people make tremendous amount of money in stock market by trading & investing into stock market.

To be among those 10% successful people or traders or investors who are on winning side most of time, you need to be or your need to fit yourself into below given 3 categories :

Category 1: Powerful Political Person

The one who can influence the cause of the effect or who drives / holds the authority of taking major Economical & Financial Decision,

Category 2: Powerful Businessman / women

They are among those who holds the power to influence people’s mind or sentiment through stimulating Digital platforms or Virtual Spaces e.g. Money control, stockedge, news channels, blogs on different financial websites etc. etc.

Category 3: A LUCKIEST person or A MOST DESCIPLINED PERSON!!

Rest all types of Stock market participants fall under those 90% category .. !!

Now before knowing how to be a successful stock market Trader or investor being among those 90% people, you must realise and accept how you are failing and why you are failing in this field.

To make you realise your self being among those 90% people & to make you understand “why” part lets walk through an example ..

To be continue . .

Real Case 1: Using Gann Circle On Axis bank

How The Gann concept was to be used to trade in Axis bank on 22/2/23 is explained further.

Firstly, stock started moving downside from marked 0 degree point ( refer above image ). Right from marked 0 degree level 843, it could complete 45 degree distance before 2:30 pm. This means, it has exhausted its capacity before the right time. By this I mean, if this stock either completes its normal capacity ( 45 degree ) before 2:30 pm or rare capacity ( 90 degree ) before 2:45 pm then a trade in an opposite direction can be taken.

To clarify, in this example axis bank reached 829 ( 45 degree ) before 2:30 pm. As a result we go good tradable bounce right from that spot.

Return To Main Menu

Real Case 2: Using Gann Techniques for Stock Market Analysis

Explanation part of the selected concept of Gann which is applied on AXIS BANK Ltd On 23/1.

AXIS BANK LTD started moving DOWNWARD from marked 0 degree point. From here it COULD NOT complete 45 degree ( gann angle value ) distance before 14:30, but right at 11:45 AM made a low of 924.45 & reversed !! So, instead of expected 924 it bounced from 924.45, as shared earlier 1 point error is considered as normal & to trade within 1 point range is advisable. Finally in intraday it bounced for a good tradable from 924.45 & made a high of 935 as shown in the Axis bank share price chart image.

Here, 0 Degree was 939 & 45 degree was 924. Conversion of Price to degree can be done by using Gann Abacus.

As per Gann thesis & Normal Case, I prefer to trade either when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. As per rule, trade in opposite direction, for example, here BUYING spot was 45 degree value i.e. 924. Values of 0,45 & 90 degree are displayed on price chart with a small excel file, those values can be found by using Gann Calculator.

Note : AXIS BANK’S range of the day i.e. difference between High Price & Low Price remained within 45 degree.

As per the standard study & observation have shared more than 50+ examples Of WD Gann Hypothesis which you may find here or on twitter handle.

Return To Main Menu

Real Case 3: Using Tool Of Gann Market Projections Course

Explanation part of the selected concept of Gann which is applied on AXIS BANK Ltd On 16/12/22.

AXIS BANK LTD started moving UPWARD from marked 0 degree point. From here it COULD almost complete 45 degree ( Gann Angle Value ) too early on 2nd candle ( distance before 14:30 ), and right at 10am made a High of 945.20 & faced rejection !! So, instead of expected rejection @ 946 it corrected from 945.20, as shared earlier 1 point error is considered as normal & to trade within 1 point range is advisable. Finally in intraday it fell for a good tradable points from 945.20 & made a low of 929 as shown in the Axis bank share price chart image.

Here, 0 Degree was 931 & 45 degree was 946. Conversion of Price to degree can be done by using Gann Abacus.

[ As per Gann thesis & Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here SELLING spot was 45 degree value i.e. 946. ] Values of 0,45 & 90 degree are displayed on price chart with a small excel file, those values can be found by using Gann Calculator.

Note : AXIS BANK’S range of the day i.e. High Price & Low Price, as per the Normal Case, remained within 45 degree.

Real Case 4: Using Top-notch Gann Course Tool on Axis bank

Explanation part of the selected concept of Gann which is applied on AXIS BANK Ltd On 28/11.

AXIS BANK LTD started moving UPWARD from marked 0 degree point. From here it COULD almost complete 45 degree ( Gann Angle Value ) distance before 14:30, and right at 13:30 made a High of 899.50 & faced rejection !! So, instead of expected rejection @ 900 it corrected from 899.50, as shared earlier 1 point error is considered as normal & to trade within 1 point range is advisable. Finally in intraday it fell for a good tradable points from 899.50 & made a low of 888 as shown in the Axis bank share price chart image.

Here, 0 Degree was 885 & 45 degree was 900. Conversion of Price to degree can be done by using Gann Abacus.

[ As per Gann thesis & Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here SELLING spot was 45 degree value i.e. 900. ] Values of 0,45 & 90 degree are displayed on price chart with a small excel file, those values can be found by using Gann Calculator.

Note : AXIS BANK’S range of the day i.e. High Price & Low Price, as per the Normal Case, remained within 45 degrees.

Return To Main Menu

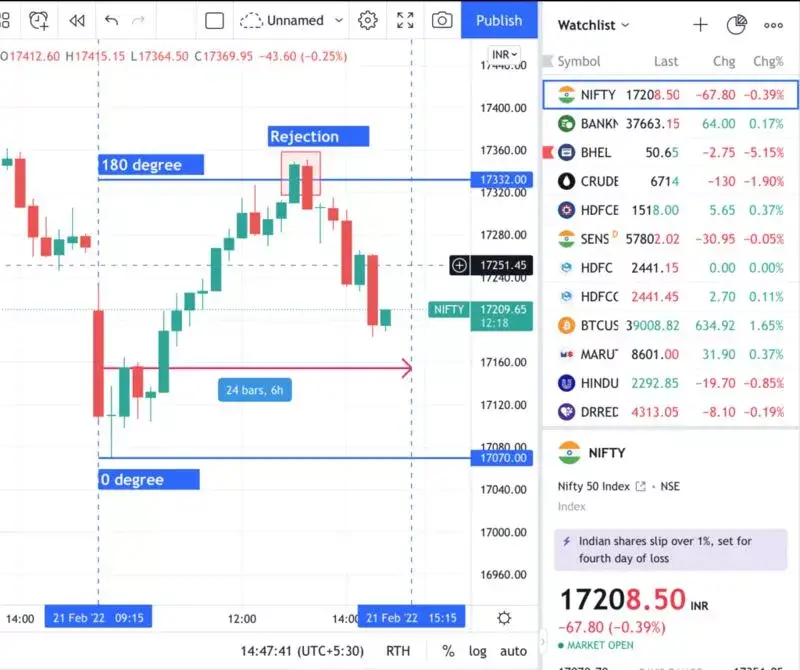

Real Case 5: Stock Market Forecasting Courses William Delbert Gann

Nifty : Done for the day

Normal Case : (Just completed 180 degree, sufficient time is left, rejection expected)

It moved from 0 degree towards 45 degree i.e. 17070 to 17332, remained within the range & bounced well.

[ Movement of Nifty / Indices : Normal case 0 to 180 degree, rare case 0 to 360 degree.

Stocks (3 digits / less volatile ) : Normal 0 to 45 degree, rare case 0 to 90 degree. ]

Nifty Faced rejection of 100+ points.

Real Case 6: Using Gann Theory Academy technique On Berger Paint

Normal Case :

It moved from 0 degree towards 45 degree i.e. 739 to 725, remained within the range & bounced well. After the bounce rejection at the same level for good tradable points. Day’s bottom & rejection was more accurate with

LoV ( Law Of Vibration ) than Gann Circle.

[ Movement of Nifty / Indices : Normal case 0 to 180 degree, rare case 0 to 360 degree.

Stocks (3 digits / less volatile ) : Normal 0 to 45 degree, rare case 0 to 90 degree. ]

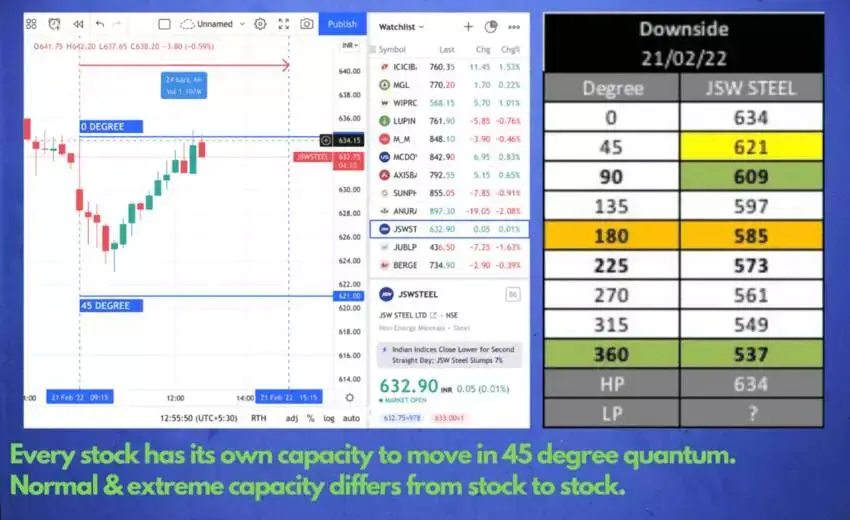

Real Case 7: Using Gann Theory Tutorial method On JSW Steel

Normal Case:

It moved from 0 degree towards 45 degree i.e. 634 to 621, remained within the range & bounced well. Here also day’s bottom was caught with more accuracy by

LoV ( Law Of Vibration ) than Gann Circle.

[ Movement of Nifty / Indices : Normal case 0 to 180 degree, rare case 0 to 360 degree.

Stocks (3 digits / less volatile ) : Normal 0 to 45 degree, rare case 0 to 90 degree. ]

Real Case 8: Using Gann Theory Course method On Axis Bank

Normal Case :

It moved from 0 degree towards 45 degree i.e. 788 to 774, remained within the range & bounced well. Day’s bottom was caught with more accuracy with

LoV ( Law Of Vibration ) than Gann Circle.

[ Movement of Nifty / Indices : Normal case 0 to 180 degree, rare case 0 to 360 degree.

Stocks (3 digits / less volatile ) : Normal 0 to 45 degree, rare case 0 to 90 degree. ]

Real Case 9: Using Gann Theory Course method On Mahindra

Normal Case:

It moved from 0 degree towards 45 degree i.e. 849 to 834, & bounced really well.

[ Movement of Nifty / Indices : Normal case 0 to 180 degree, rare case 0 to 360 degree.

Stocks (3 digits / less volatile ) : Normal 0 to 45 degree, rare case 0 to 90 degree. ]

FAQs On Gann Course (Video Format)

Q-1: Introduction Of Student who recently learned Gann Course. (Duration- 1.24 mins)

Q-2: How Student Found A Right Mentor To Learn Gann Trading Course? (1.45 Minutes)

Q-3: Why Student Choose Niraj M Suratwala To Learn Gann Trading Course? (1.46 minutes)

Q-4: Trading Experience Before & After Learning Gann Trading Course? (2.01 minutes)

Q-5: Most Effective Topic Of Gann Trading Course? (2.15 minutes)

Q-6: How Accurate Is Gann Theory? (1.32 minutes)

Q-7: Who Can Learn Gann Theory Course? (1.51 minutes)

Q-8: Free Resources V/s Paid Mentorship (4.22 minutes)

Q-9: How Is The Application Part Of Gann Trading Strategies? (2.48 minutes)

FAQs On Gann Courses

Q-1: What is Gann Trading Course?

Answer: Gann Trading Course is a trading program based on W.D. Gann Theory, also known as Gann Trading Theory, is a unique approach employed by traders to anticipate patterns and price fluctuations in the stock market. This methodology was originally formulated by William Delbert Gann. His theory encompasses a comprehensive analysis of historical, current, and future market outcomes through the lens of Gann Angles. Moreover, Gann theory enables predictions of past value trends by leveraging the progression of angles.

Q-2: Who was William Delbert Gann?

William Delbert Gann was an influential American stock market trader, back in 1935. William Delbert Gann was also a 33 degree Freemason of the Scottish Rite Order.

Q-3: What is Gann used for?

Answer: For predicting right time or right price of entering into a trade.

Q-4: Did Gann do intraday trading?

Answer: Gann was also an intraday trader but did not focus much on only intraday trading.

Q-5: How accurate is Gann Theory?

Answer: Well, there is no foolproof method to trading success. Though, Gann theory course can be helpful for identifying potential turning points in the market. It is not 100% accurate and should be used in prudently with having a good risk management practice in place. Also, Gann trading rules are there to follow that helps in trading safely in stock market.

Q-6: Who should learn this Gann Course?

Answer: Not only Gann course but any stock market course can be suitable for only those who has an another income source. The reason is, You have to wait till the right time and price. Now, until you don’t get that right time or price you have to wait and only those can wait who are not totally dependent on stock market income.

Q-7: In what ways does W.D. Gann Trading Theory contribute to profit generation in trading?

Answer: Gann Theory revolves around the idea of predicting price movements by analysing three fundamental principles. These principles are based on the belief that future price behaviour can be forecasted using specific techniques and observations. By understanding these principles, traders aim to make informed decisions in the financial markets.

- Time: The first property examined in Gann Theory is time. According to this principle, the analysis of historical price patterns can reveal cycles and recurring trends. By identifying these patterns, traders can anticipate future price movements and determine optimal entry and exit points for their trades.

- Price: The second property studied in Gann Theory is price. This principle suggests that prices move in specific geometric patterns and ratios. These patterns can be identified using various tools, such as Gann angles, Gann Square Of 9, Levels we identify using Law Of Vibrations and Price Time Square method. By analysing these price patterns, traders can make predictions about future price levels and potential areas of support and resistance.

- Geometry: The third property analysed in Gann Theory is geometry. This principle states that price movements exhibit geometric relationships and proportions. Traders use various geometric tools. For example, Gann angles and squares, to identify these relationships and anticipate future price levels. By applying these geometric concepts, traders can determine potential turning points and project price targets.

Q-9: What advantages does W.D. Gann Trading Theory offer in the realm of trading?

Answer: By incorporating the Gann Angle into trading strategies, traders can gain insights into future market trends. This framework enables analysts to efficiently interpret market movements. When utilising this approach, the advantage of plotting Gann angles lies in their consistent rate of progression. This consistency empowers traders to make predictions about future price movements. Learning and implementing this strategy is highly beneficial for individuals aspiring to pursue a career as a stockbroker.

Return To Main Menu

Disclaimer For Online Gann Trading Course

Whatever Gann Course Content delivered to student is for educational purpose only. We recommend thoroughly understanding the strategies and exercising your own judgment. By this I mean, double check them in your backtesting before applying them in live markets. It is advisable to start with paper trades initially to gain practical experience. As a result, it shall refine your skills of using real capital in stock market.

Trading stocks or indices or commodity or any tradable instruments inherently involves market risk. Hence, users must exercise their own discretion when participating in live market trading. It is essential for individuals to understand the potential risks involved and make informed decisions based on their own assessment and analysis.

I, as the provider, cannot be held responsible for any losses or damages incurred by the student/client in any capacity. It is the individual’s sole responsibility to bear any potential consequences arising from their trading activities.