Case Study Of Fundamental Research And Gann Application On De Nora India

De Nora India Share Price: At the bottom of this page, sharing a real case study of combining Fundamental Research and Gann Course Content. Also, shared result of the prediction.

Click De Nora India to refer the same.

This is something that I do for my self and can not teach as it is very lengthy process and lot of patience needed to stick to your research that really really pays back multifold in future.

Yet I would love to share something that can definitely make a difference in your investing journey.

For 90% Crowd:

Understand one thing very clearly,

whatever data is available freely on any website such as screener, stockedge, NSE, BSE, Money Control etc. about a company tells us only what has happened with the company so far & effect of that used to always seen on Price much before you scrutinise the cause. Yet you need to have record of all relevant data!

To Be In 10% Crowd:

Price is always sensitive and have been reacting in present by judging the future events. So one has to judge the future events at-least just after the price has judged it. If anybody can logically and rationally read the future growth, will always be in a position to time & buy the stock at cheaper rate & can grow multifold.

To have these activities done one must need many datas, which are not available at single source, and most even don’t know from where to access relevant datas.

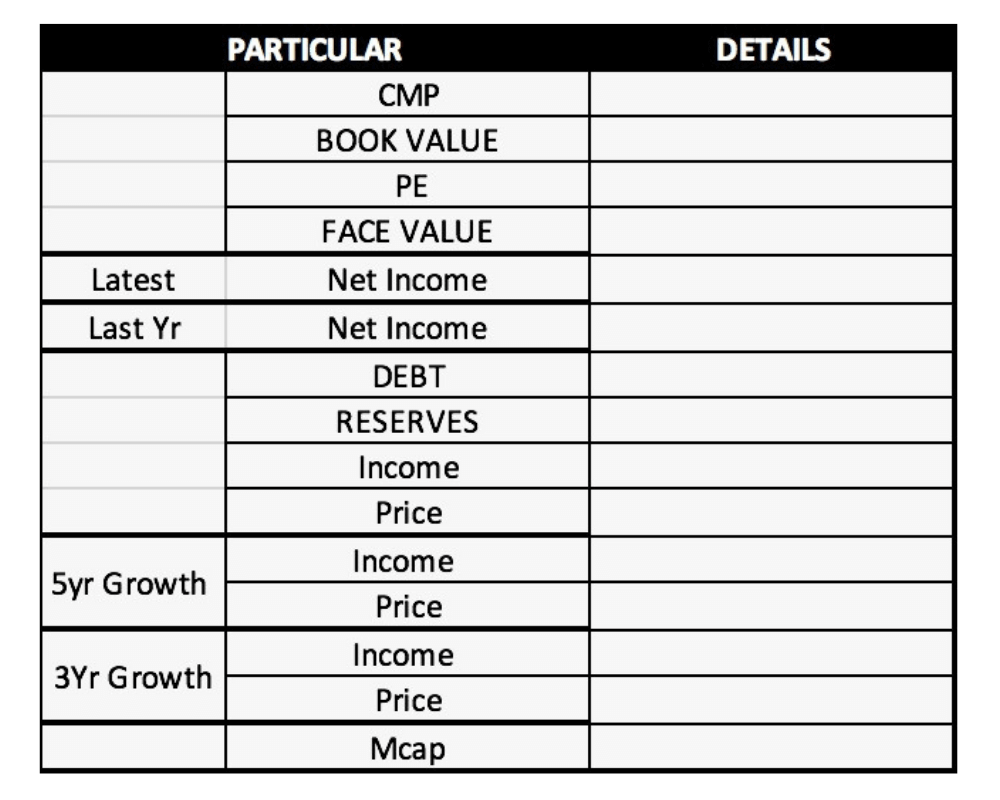

You need to walk through a process in 3 steps which is being shared : )

STEP 1

First Arrange data of any listed company in which you have an interest of making investments.

NOTE:

Step-1 gives an Idea of how is the basic fundamental hygine of your shortlisted company, and based on the assessed data in well arranged sequence you can categorise stocks in A,B & C category. What ever has happened till date, only those things can be studied here, what should happen next can be covered in next steps. Further steps are yet to be shared, I may do it soon.

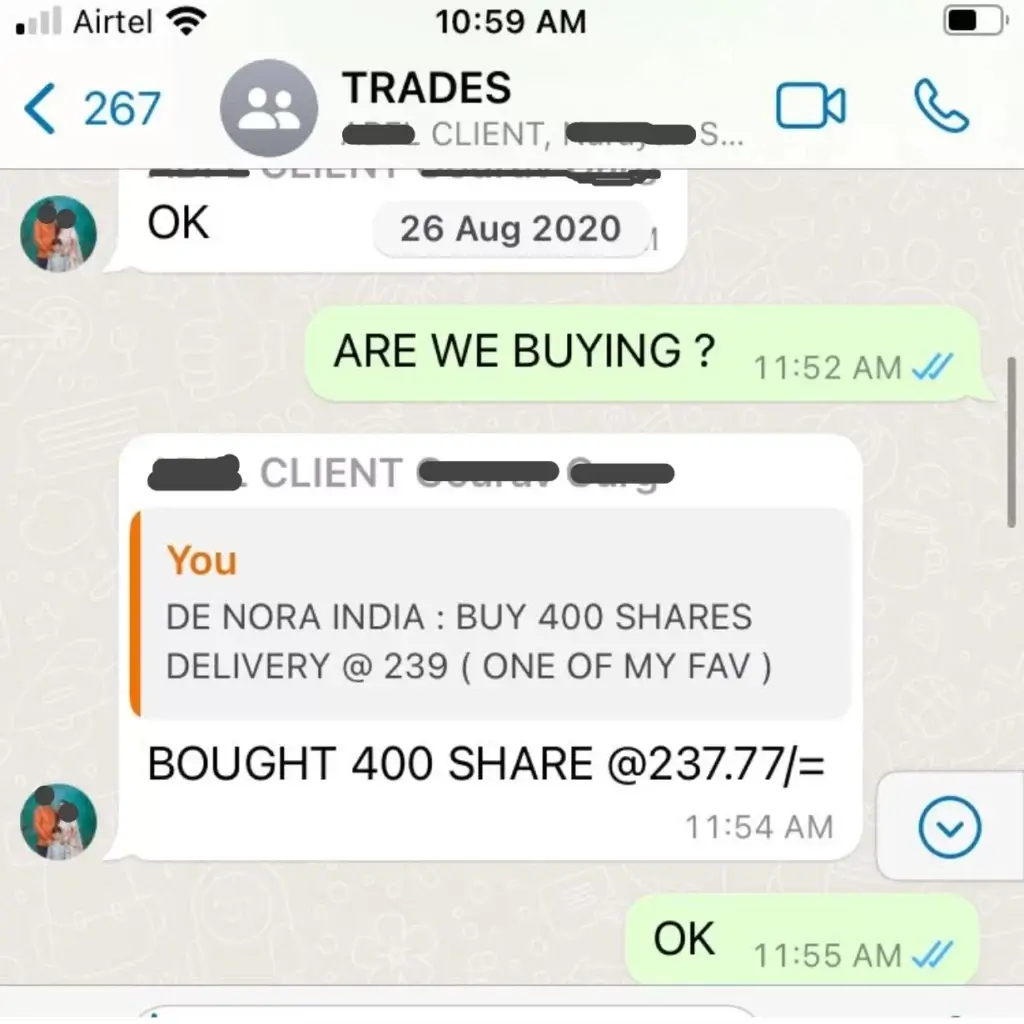

De Nora Share Price: Sharing Benefits Of Combining Fundamental Research And WD Gann Theory In the Right Way

Case study of Fundamental Research on ADANI GREEN Energy:

In below image, left hand side shared a WhatsApp message which was sent on 10/6/20 about Adani Green Energy. I mentioned about a great opportunity to invest in Adani Energy on 10/6/22 when this stock was being traded at 260 Rs. The key reason why I said that is it’s huge amount of On-hand Order book valued around 45,000 Crores INR !!

Ax expected company’s bottom line (net profit) to grow PRICE has shown the effect of this. Price of Adani Green Energy moved from 260 to 3050 (All time high) & currently being traded at 1740.

What will happen once the company will be able to complete & execute whole of their order book worth 45,000 Crore INR?

This stock experienced a steep correction starting on 1/4/2022. The Gann theory course content helped identify a buying opportunity at 520 during this significant decline.