W.D. Gann Theory Accuracy

WD Gann theory is a time analysis method that traders practice to predict future market movements developed by William Delbert Gann. The theory is based on the idea that price movements are not random, but are instead based on mathematical and astronomical cycles.

W.D. Gann theory is controversial, and there is much debate about how accurate it is in predicting market movements. However, there are a number of case studies that suggest that this theory can be accurate in certain situations.

In this blog post, we will explore the accuracy of William Delbert Gann theory in modern markets.

Also visit 👉Recent Gann Prediction page for more information.

Experience Of learning the best trading course from Niraj M Suratwala:

Feedback interview 1)

Interview 2)

3)

What are the benefits of using WD Gann theory?

- You can use it to identify key support and resistance levels.

- It can be used to predict trend changes and market movements.

- Theory helps traders to identify important price levels, which can be useful when setting stop losses or profit targets.

- You should use it to analyse any type of financial instrument, including stocks, forex, commodities, and more.

- It can be used by traders of all levels, from beginners to advanced traders.

- W.D. Gann theory provides a systematic approach to trading, which can help to reduce emotions and improve trading discipline.

- William Delbert Gann theory is a time-tested method that has been used by traders for over 100 years.

How accurate is W.D. Gann theory?

Unfortunately, there is no easy answer to this question. While some traders swear by the theory, others believe that it is nothing more than guesswork. Ultimately, it is up to each individual trader to decide whether or not they believe in William Delbert Gann theory and whether or not they want to use it in their trading.

However, you need to note that it requires a significant amount of analytical skills and experience to use effectively. It is not a tool on which you should not rely upon solely. And we should always use them in conjunction with other quantitate analysis tools and market research. Even then, the accuracy of predictions made using this theory can vary greatly depending on market conditions and the trader’s ability to accurately interpret the theory.

👉 Nifty Gann Predictions

Examples Of Gann Theory Accuracy:

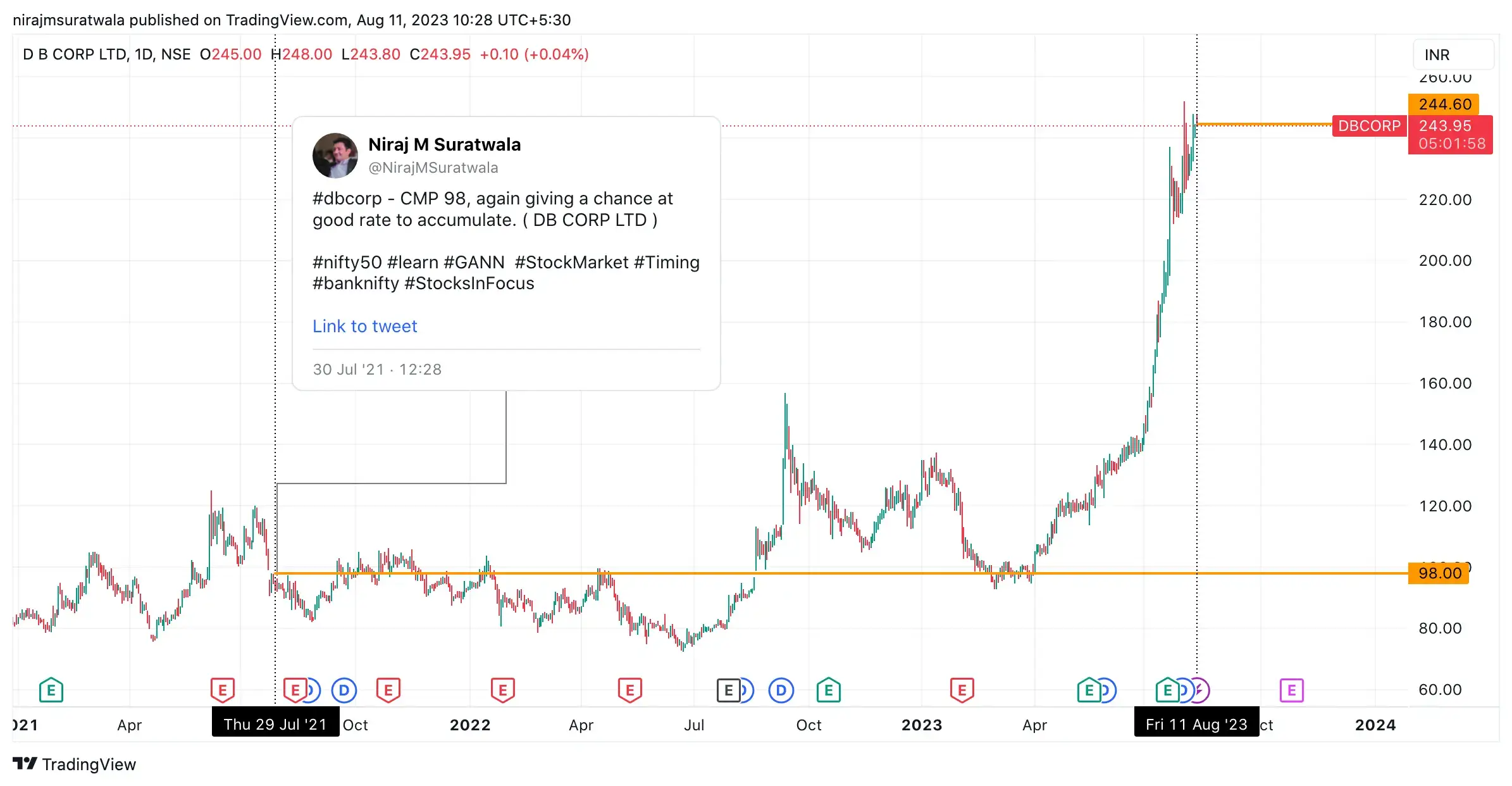

- Gann Time Cycle Applied On DBCorp For To Find Good Investment Opportunity

Gann time cycle application of Stock DB CORP

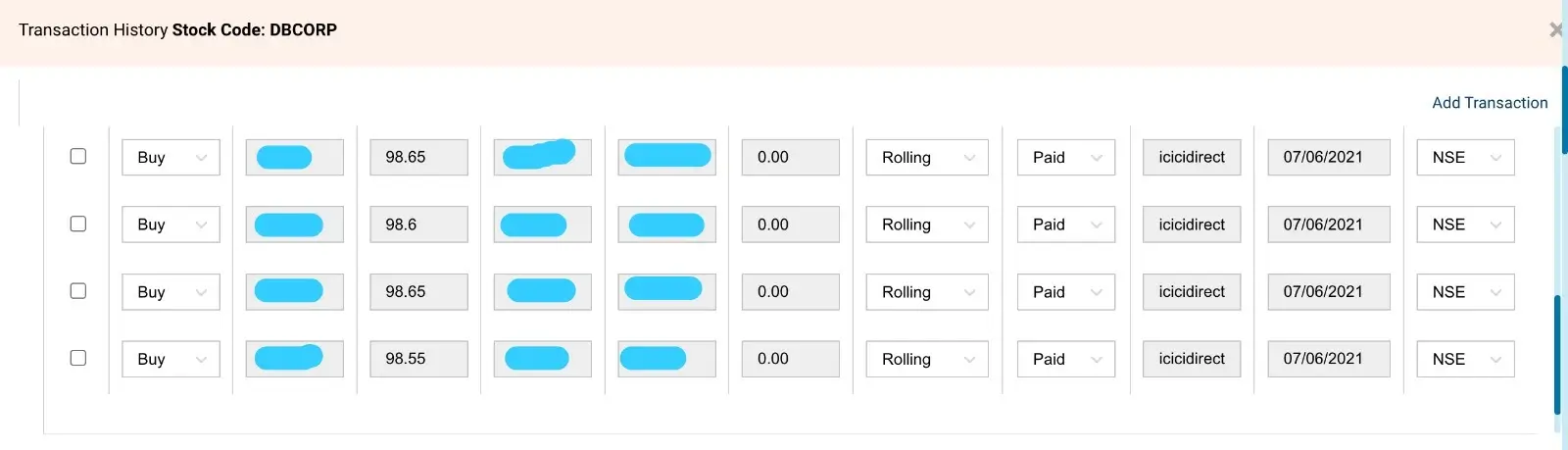

RESULT OF APPLICATION OF GANN TIME CYCLE ON DBCORP TRANSACTION - Use Of Gann Law Of Vibration On Nifty:

Reference Page Link 👉 Gann Theory Law Of Vibration Use On Nifty 50 Another Example of same concept using on Nifty 50

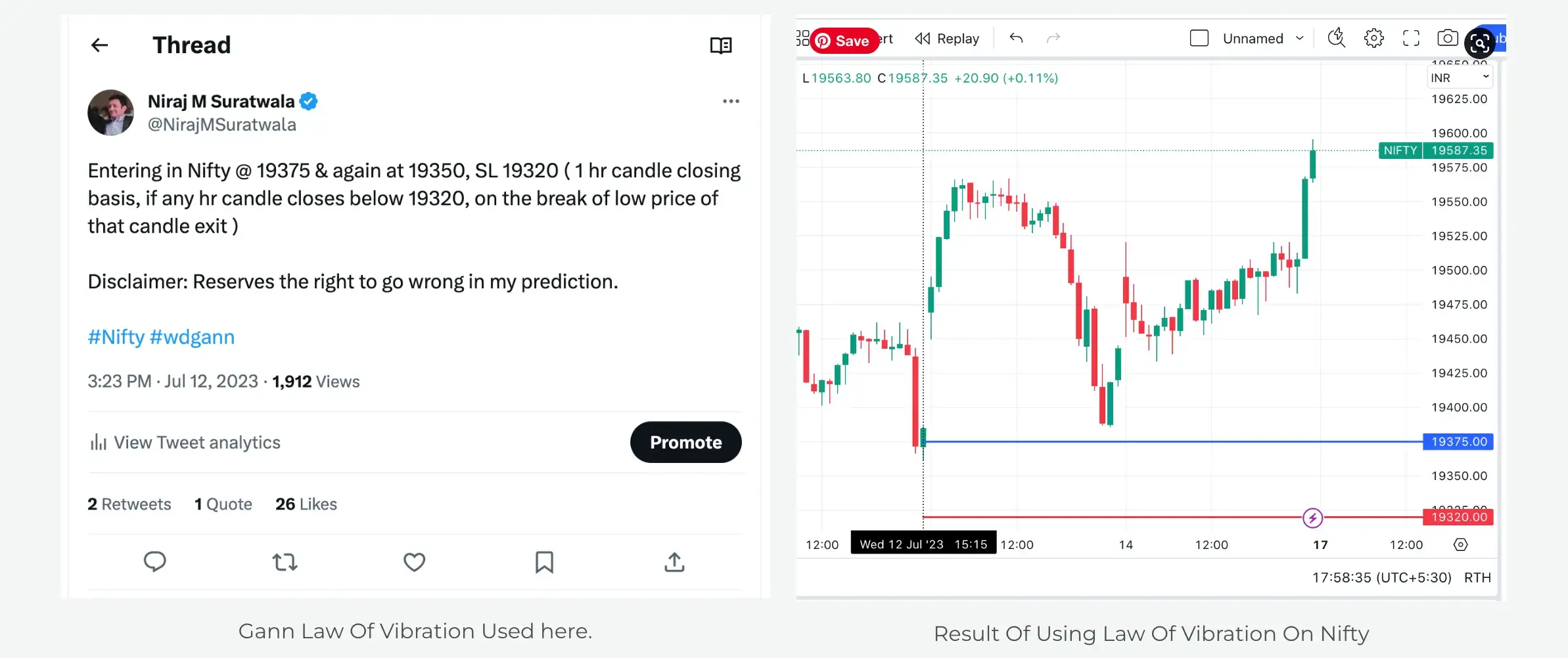

- Price Time Square Use On Nifty 50

Reference Page Link 👉 Price Time Squaring On Nifty 50 Explaining Below How Effective Is Gann Theory:

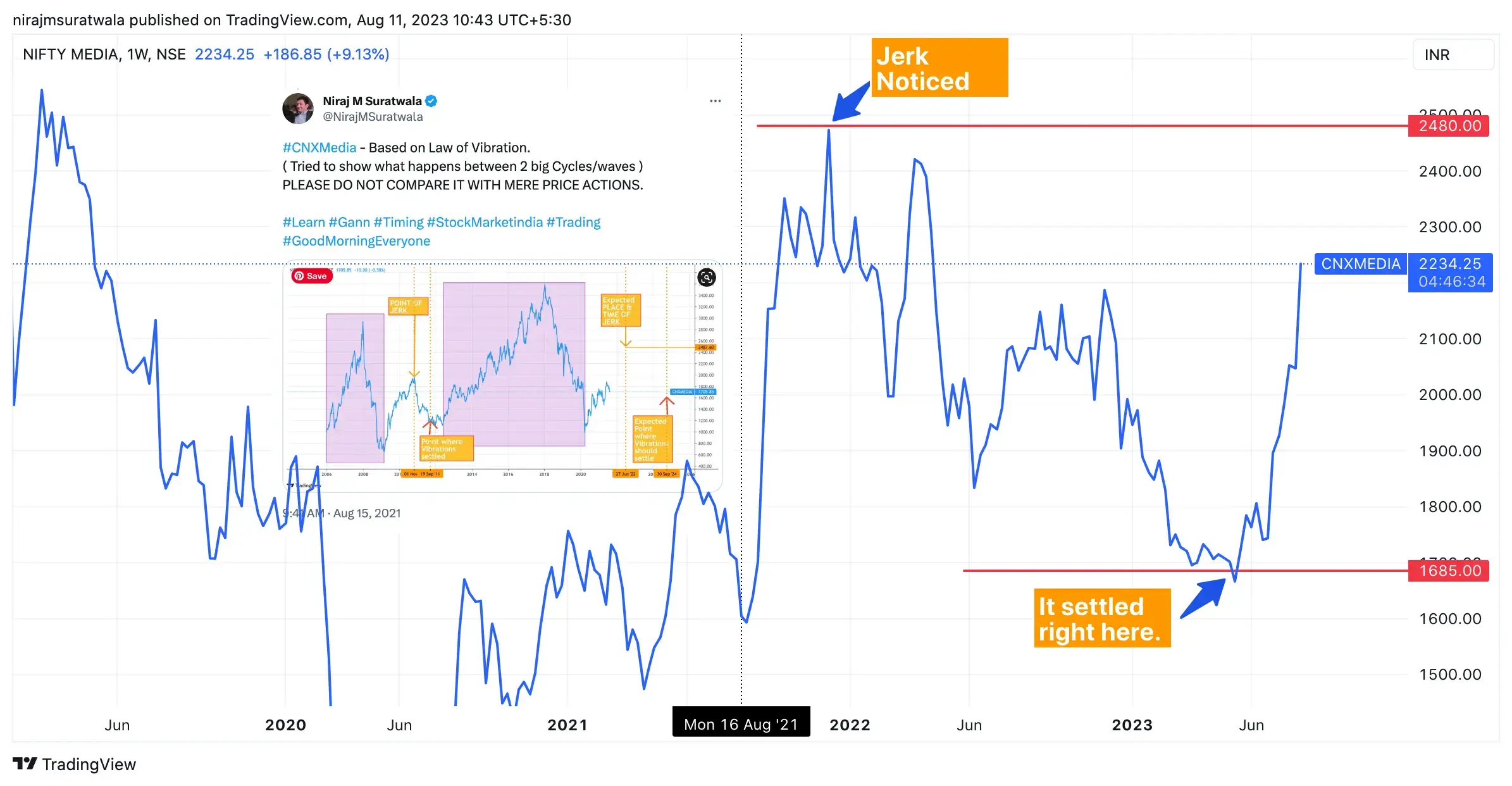

Using Natural Time Cycle And Law Of Vibration On CNX Media Index

On 15/8/21 shared that CNX Media can face a jerk at 2480, which actually happened as shown in below chart. Also, said that this jerk or rejection should get settled near 1685. As a result, it bounced back very well from 1685! (In a below attached image, refer a tweet which is pasted on CNX Media trading view chart to get reference of shared prediction).

Reference Page Link 👉 Combined Application Of Law Of Vibration And Natural Time Cycle

- Gann angle use on nifty 50 to seek both right TIME as well as Right PRICE (LoV helped Too)

Gann Theory Prediction

It is an another good example of Gann Theory Accuracy.

Gann theory worked well again on Nifty!

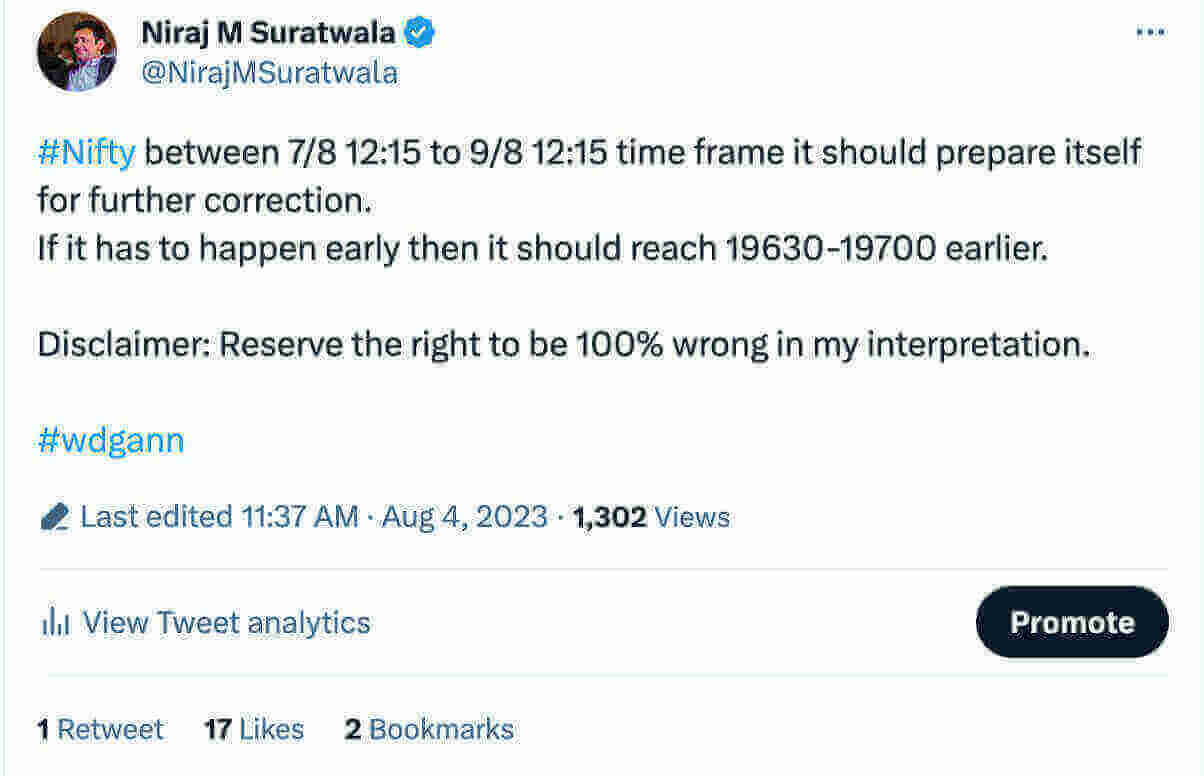

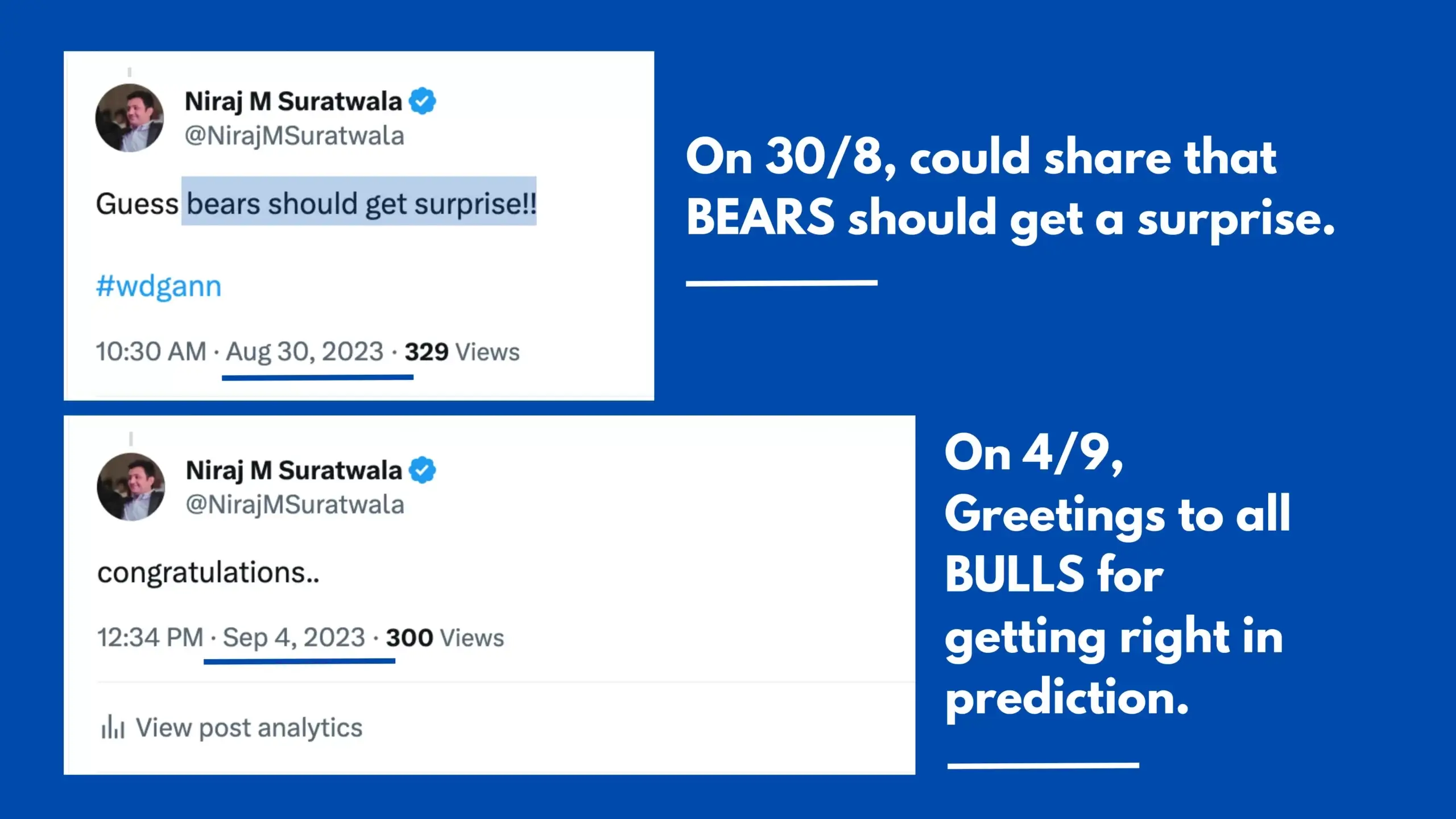

Sharing an accuracy of Nifty prediction made on the basis Gann Theory and its actual result.

Read and Refer below attached 3 images carefully.

Image 1: This image tells how I could analyse probable trend in Nifty

Image 2: In this image sharing how I gave hint about an upcoming event in Nifty

Image 3: An actual results of predicted trend in Nifty.

Are there any drawbacks to using Gann theory?

Like all trading tools, it has also some limitations. There are a few potential drawbacks to using Gann thesis that traders should be aware of.

- First, Gann Analysis is based on past market price data, this means that it cannot be used to predict future price movements with an 80% accuracy approx. There will always be some degree of uncertainty when using this theory.

- Next, It can be complex and difficult to understand, this means that it may take some time for traders to learn how to use it effectively.

- Finally, Gann Concept only works in certain markets. It is not effective in all markets and may not be suitable for all traders.

Final Thoughts

What Is Gann Theory? It is a valuable tool for traders. However, it is important to be aware of its limitations and not solely rely on it for making trading decisions. Traders should continue to conduct thorough market analysis and use a variety of technical analysis tools to make informed trading decisions.

Read More: