What Is Gann Square Of 9?

This specific tool of William Delbert Gann is too mysterious. And the whole world is seeking for the right information about Gann Square Of 9. Having 22 years of experience in Stock Market has resulted in a successful practice’s of Gann square of 9 for many years. Let me tell you that it is actually a helping hand to divide movement of price in 45 degree quantum. Each tradable instrument has its own capacity to move in one direction in 45 degree quantum, some move till 90 degree, while others move till 180 degree resulting in variation thus, differing from stock to stock and indices to indices.

To sum up let me clear the whole concept to you in further paragraphs with real examples and showcasing actual application.

Table Of Content

- What Is Gann Square Of 9?

- Gann Course Content

- Detailed Explanation

- Logic behind Its Working

- Important Note

- Real Case Studies

- Frequently Asked Questions

Detailed Explanation About Gann Square of 9

For better understanding, let me explain the whole logic of Gann Square Of 9 and its working in a simple way and by taking a practical case study.

To begin with, assume that you are on a task to travel on daily basis for 24 minutes.

Now, guess which are those key influencing factors that can affect your travel distance?

Guess it ..

I would say 1st key influencing factor is TIME and 2nd is your ENERGY.

How far you can reach from “A” point is 100% dependant on how you are consuming your TIME and ENERGY within given TIME. There is another 3rd factor which shall be discussed later. Now, Let me discuss both these mentioned influencing factors first.

About Time

This is an element that remains fixed and known to everybody. You are given 24 minutes means you are supposed to travel till only that last 24th minute. So, how long you will be able to travel from your beginning point “A” is depending on how much time is there in your hand to travel further, right? Simple it is.

About Energy

This is a complex factor that has significant impact on the length of distance that you will be able to achieve in given 24 minutes of time !! It is complex because how much energy you have, is fixed but it is not known. For example, if I give same task of travelling for 24 minutes to 10 people of same age then performance of each person will surely vary from one another. But the fact that on an average certain majority of group will have a common result and few will be very good performers and rest few will have worst performance. And this is okay as it is normal persisting phenomena everywhere. Now if I only focus on common result of majority people then I can come to a logical conclusion.

Logic behind Gann Square Of 9 working in Stock Market

To explain this in a better way, let me take both TIME & ENERGY aspect in explaining a real life situation and you will notice same thing happening in stock market as well !!

Situation 1:

Assume that you are given a task to travel daily for 24 minutes and you start your day from any chosen “A” point. From this “A” point, you are consuming your Time & Energy rationally that makes you able to travel for 10 kilometres. So, here, assuming that since you have behaved rationally you are able to cover good distance and its considerable that your normal capacity to travel in one direction is 10 kilometres in 24 minutes.

Situation 2:

Next day, you are starting to travel from another chosen “A” point. In the beginning you are behaving very aggressively and irrationally to travel as fast as you can. With this approach, you are reaching at 10 kilometre distance in one direction in just 10 minutes. So, as per your normal capacity, you were able to complete 10 kilometres by taking 24 minutes and in this 2nd situation you are completing 10 kilometres in just 10 minutes !! Guess, how your body would react at that 10th minute or at that 10th kilometre point?

It’s very natural that you will feel exhausted at that 10th minute point, as you have used all your capacity before the right time !! Due to this you will either start crawling or you will fall. Exactly at such points opponent influencing factor will attack you as they keep waiting for such irrational behaviour of someone so that they can lead you where they want as it becomes easy for them.

Also, because at such spot you do have TIME left in your hand but do not have energy to retaliate !!

Both above situation has very well connection with stock market. Let me now take an opportunity to showcase exactly how it is connected, and if it is connected then which situation is tradable in intraday.

Examples Of Both Situations

First, Discussing Situation 1 ( Non-tradable )

Here, if a stock is moving in one direction at 45 degree angel means it is moving gradually and rationally. In such cases, operators never try to trade or attack as at every step stock has time and energy in hand to retaliate against the opponent force. Opponent requires huge liquidity and power to attack such move to lead it into an opposite direction.

Now Discussing Situation 2 ( Tradable )

Here, if a stock is completing its normal capacity UPSIDE before the right time ( 2:30 pm ) you will see a good rejection right from that spot. The reason is, stock has exhausted its capacity before the right time ( 2:30 pm ) so either it will just hover there or fall under the influence of opponent’s ( bears’ ) attack !!

Same way, if a stock is competing its normal capacity DOWNSIDE before the right time, you will see a good tradable reversal exactly at that spot. By this I mean, the stock will rise suddenly from that spot under the influence of opponent’s ( bulls’ ) attack !!

Return To Main Menu

Important Note : Read below explanation before using this Gann trading strategy.

Every stock has its own capacity to move in 45 Degree quantum. Normal & Extreme capacity differs from Stock to Stock & Indices to Indices . .

For Stocks (3 digits & less volatile ) :

In Normal Case it moves from 0 to 45 degree, rare case it moves from 0 to 90 degree.

So, the difference between day’s High Price & Low Price remains either 45 degree if its normal case or 90 degree in rare case.

( You may take a trade if it reaches 45 before 14:30 or it reaches 90 degree before 14:45 )

For Indices (Nifty) :

Normal case 0 to 180 degree, rare case 0 to 360 degree ( You may take a trade if it reaches 180 before 14:30 or it reaches 360 degree before 14:45 )

Note : You might not find this learning in any Gann Theory Book, to decode such things on your own you really need understanding of Natural Laws.

Return To Main Menu

Real Case Studies On Gann Square of 9

Here taking some real examples of application of Gann Square Of 9 on some stocks whose Normal capacity to move in one direction in 1 day is 45 degree and Rare capacity is 90 degree.

8/4/24: Today’s stock trading opportunity based on Gann Square Of 9

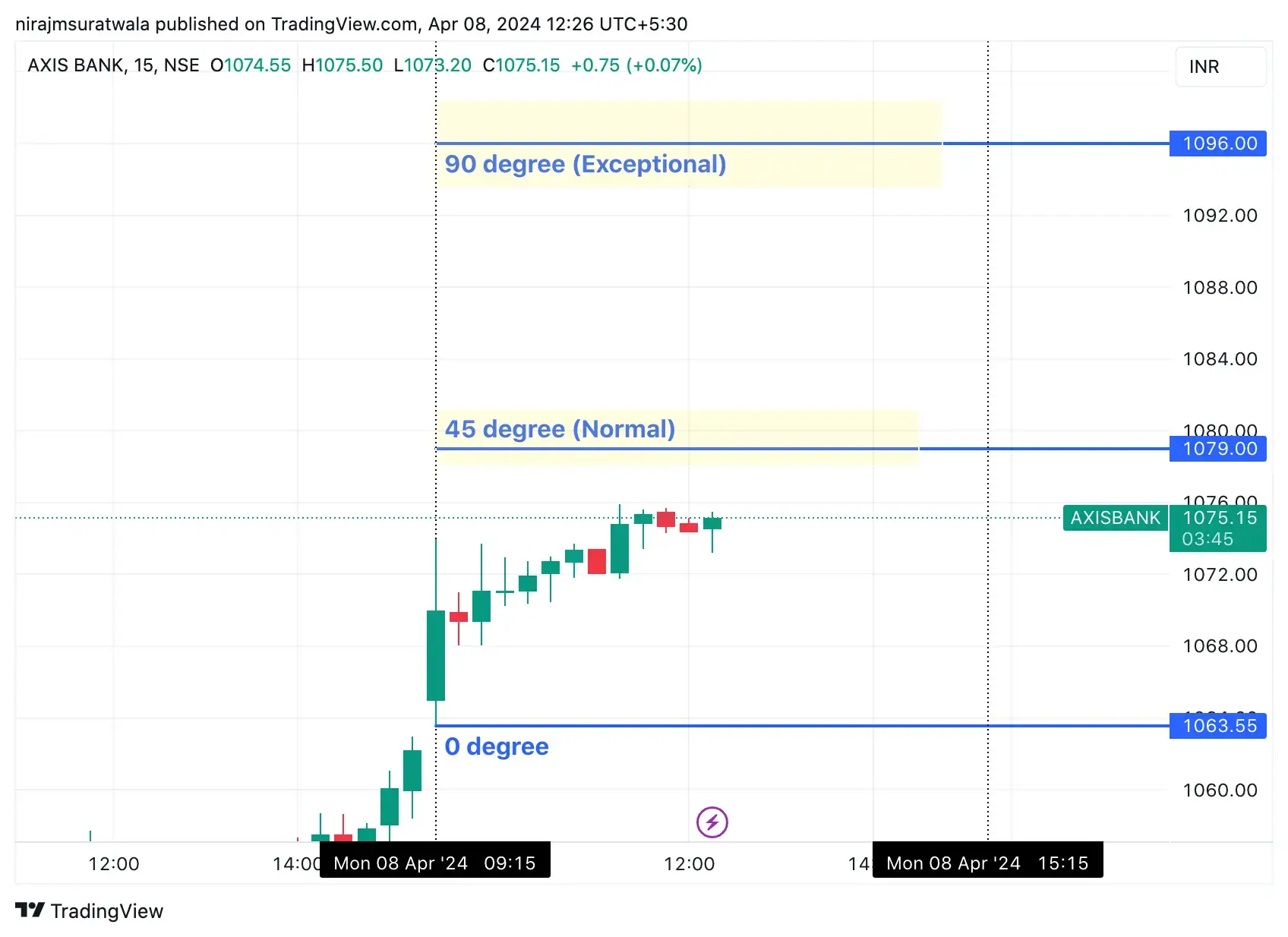

(1) About below image: On 8/4/24 at 12:26 pm shared an opportunity of getting a chance to enter in a sell side trade. For more details check out all 3 images and explanation given at the end of 3rd image.

(2) Just adding another reference of sharing stock trading opportunity in axis bank on 8/4/24.

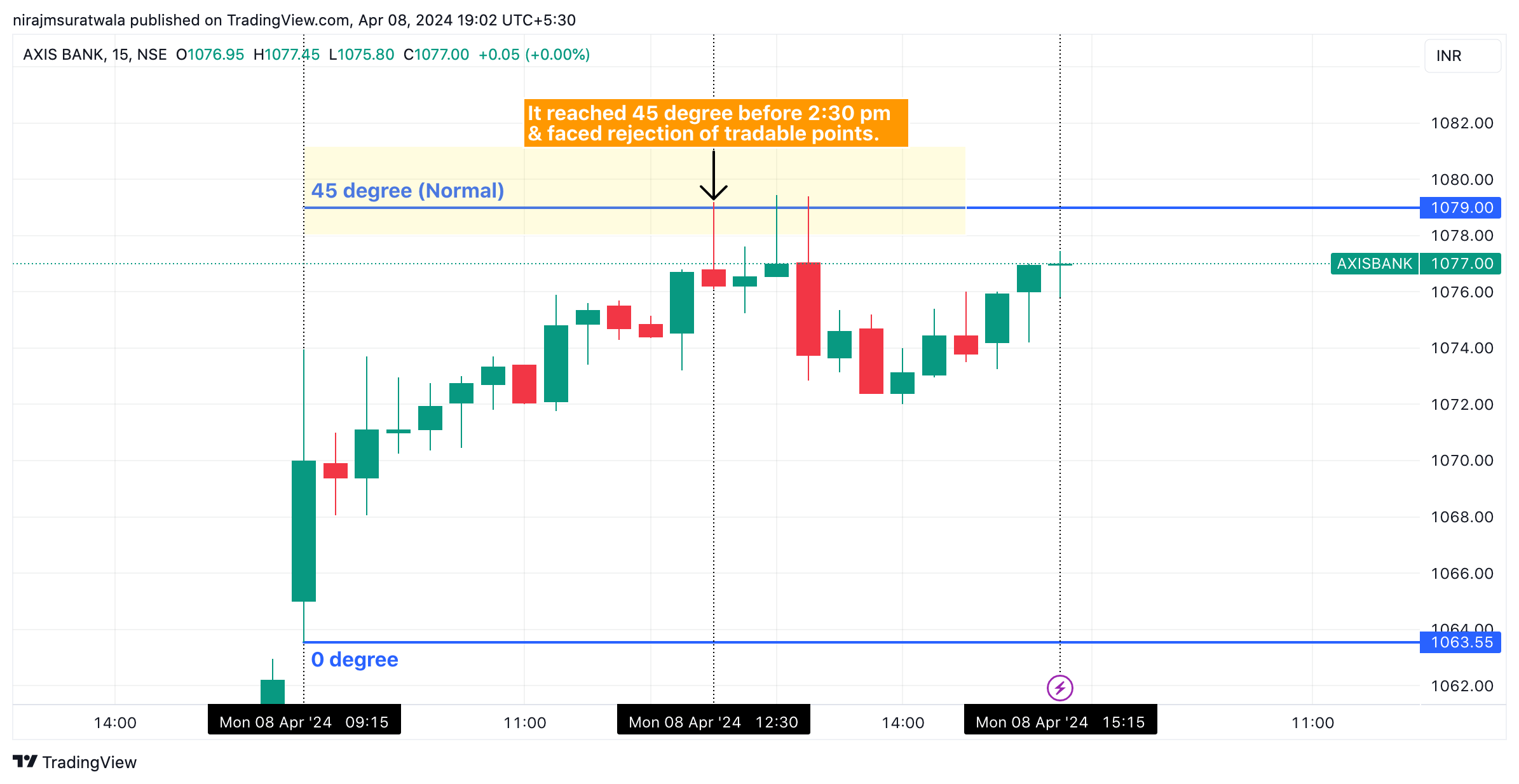

(3) Finally, Stock faced tradable points rejection at 45 degree and at the end day’s range (High-Low price) was within 45 degree only.

About above image: On 8/4/24, axis bank initially started moving upside. Due to this low price became 0 degree so as to identify its normal capacity (45 degree) of moving upside.

As seen on the chart, axis bank reached 45 degree before 2:30 pm i.e. @ 12:30 pm & we got an opportunity to enter in a sell side trade. In result, it faced rejection right at 1079 (45 degree).

Here, 0 Degree was 1063.55

45 degree was 1079 and

sell trade was supposed to be taken at 1079.

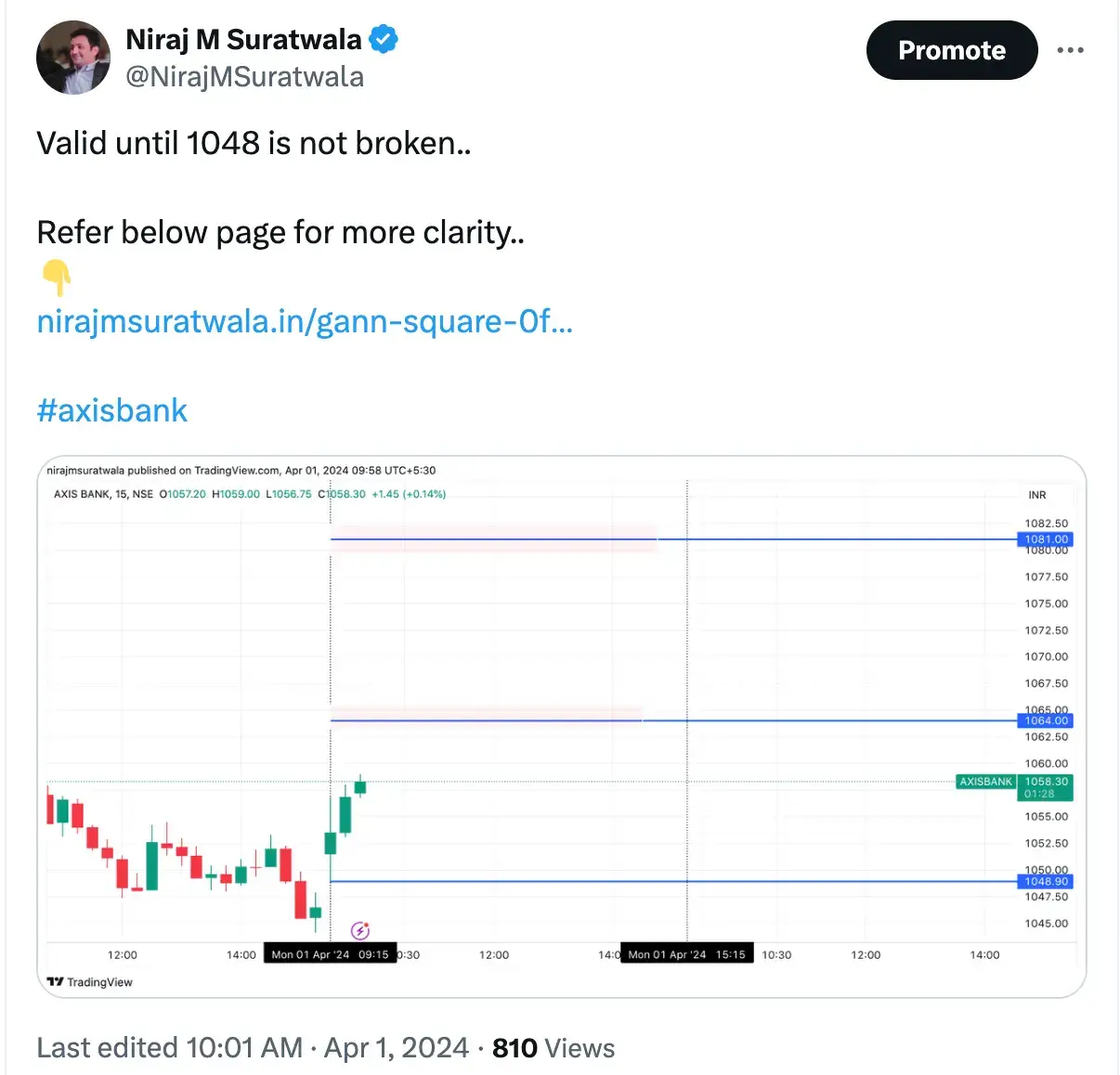

1/4/24: Trading in Stock using Gann Square Of 9

Before :-

About below image: On 1/4/24 @ 10 am, I have twitted about an opportunity of trading in Axisbank @ 1064 ( 45 degree ) and @ 1081 ( 90 degree ). For more details read second image and its explanation.

After :-

After :-

Explaining above image.. we can see that from 1st 15 mins candle, price started moving upside. Due to this we took the low price of that candle as a 0 degree and identified its 45 degree value ( normal capacity ) i.e. 1064. Also, marked 90 degree value i.e. 1081 (rare capacity).

Since, price reached at its normal capacity (1064:normal capacity) before 2:30 pm, we got a chance to go short there. In result, stock gave good tradable points rejection right from marked 45 degree level i.e. 1064. Here, there was an error of 0.25 paisa. I mean, instead facing rejection from 1064 price fell from 1063.75. This is normal and we usually trade by keeping 1 point buffer.

In above case,

0 Degree was 1048,

45 Degree was 1064 &

90 Degree was 1081.

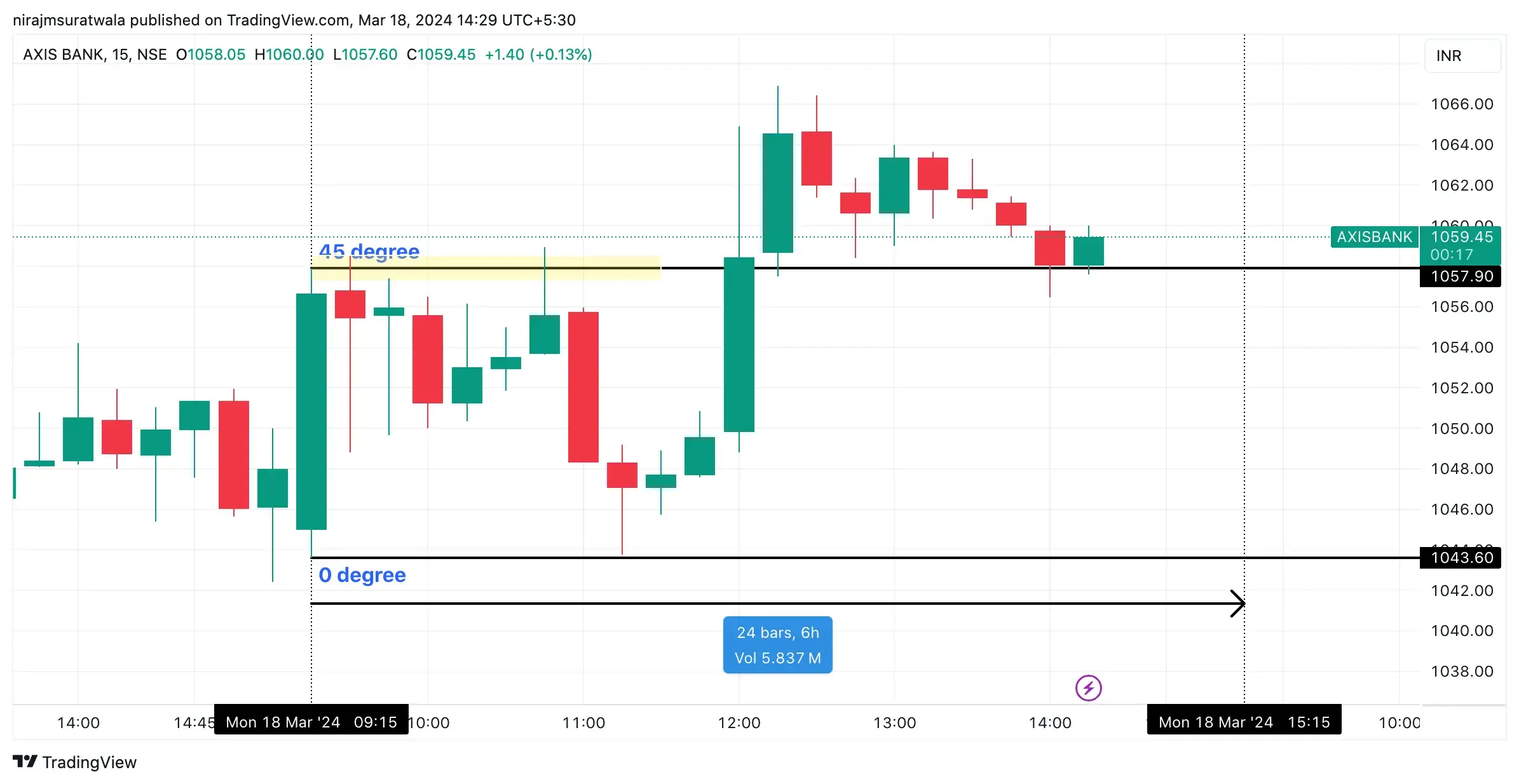

18/3/24: Stock Trading With Gann Square Of 9

From 1st 15 mins candle, Axis bank was moving upside. Due to this, Low price of that candle became 0 degree (beginning point of the up trend).

By using Gann Square Of 9, I got 45 degree value as mentioned in the chart.

As per rule, intraday sell trade could be taken at 45 degree value as stock achieved its capacity at 9:45 am (2nd 15 min price candle), means before right time (14:30).

In result, we can see stock reversed from that 45 degree value for almost good tradable points!

As disclosed in chart, here,

0 degree was 1043 and

45 degree was 1057.

15/3/24: Gann Square Of 9 Application On Stock Trading

From 1st 15 mins candle, Axis bank was moving downside. Due to this, high price of that candle became 0 degree (beginning point of the down trend).

By using Gann Square Of 9, I got 45 degree value as mentioned in the chart. As per rule, intraday buy trade could be taken at 45 degree value as stock achieves its capacity at 9:45 am (3rd 15 min price candle), means before right time (14:30).

In result, we can see stock reversed from that 45 degree value for almost good tradable points!

As disclosed in chart, here,

0 degree was 1050 and

45 degree was 1034.

12/3/24 Case of Gann Square Of 9 Application

Explanation Of Above Image:

From 1st 15 mins candle, Axis bank was moving upside. Due to this low price of that candle became 0 degree (beginning point of the upside trend).

By using Gann Square Of 9, I got 45 degree value as mentioned in the chart. As per rule, intraday sell trade could be taken at 45 degree value as stock achieves its capacity at 9:30 am, means before right time (14:30).

In result, we can see stock fell from that 45 degree value for almost good tradable points!

As disclosed in chart, here,

0 degree was 1100 and

45 degree was 1117.

11/3/24 Case of Gann Square Of 9 Application:

Here, trend moving upward after 1st 15 minutes price candle. So, low became 0 degree to analyse how much upside it can move as per its normal capacity. We saw that axis bank reached its normal capacity i.e. at 45 degree ( 1121 ) before 2:30 pm. Hence, a tradable opportunity availed there.

Note: Sell Trade was supposed to be done at 1121 but instead reversing from 1121 it reversed from 1120.

We always consider 1 point error as normal and place an order accordingly.

Post sell trade it has given successful tradable rejections.

20/10/23 Case Of Using Gann Square Of 9:

Explanation part of the selected concept of Gann which is applied on AXIS BANK Ltd On 20/10/23.

AXIS BANK LTD started moving DOWNWARD from marked 0 degree point. From here it COULD almost complete 45 degree ( Gann Angle Value ) distance before 14:30, and right at 12:45 PM made a Low of 977.75 & faced reversal !! So, instead of expected bounce @ 977 it reversed from 977.75, as shared earlier 1 point error is considered as normal & to trade within 1 point range is advisable. Finally in intraday it bounced for a good tradable points from 977 & made a high of 985.55 as shown in the Axis bank share price chart image.

Here, 0 Degree was 993 & 45 degree was 977. Conversion of Price to degree can be done by using Gann Abacus.

[ As per Gann thesis & Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here BUYING spot was 45 degree value i.e. 977. ] Values of 0 & 45degree are displayed on price chart with a small excel file, those values can be found by using Gann Calculator.

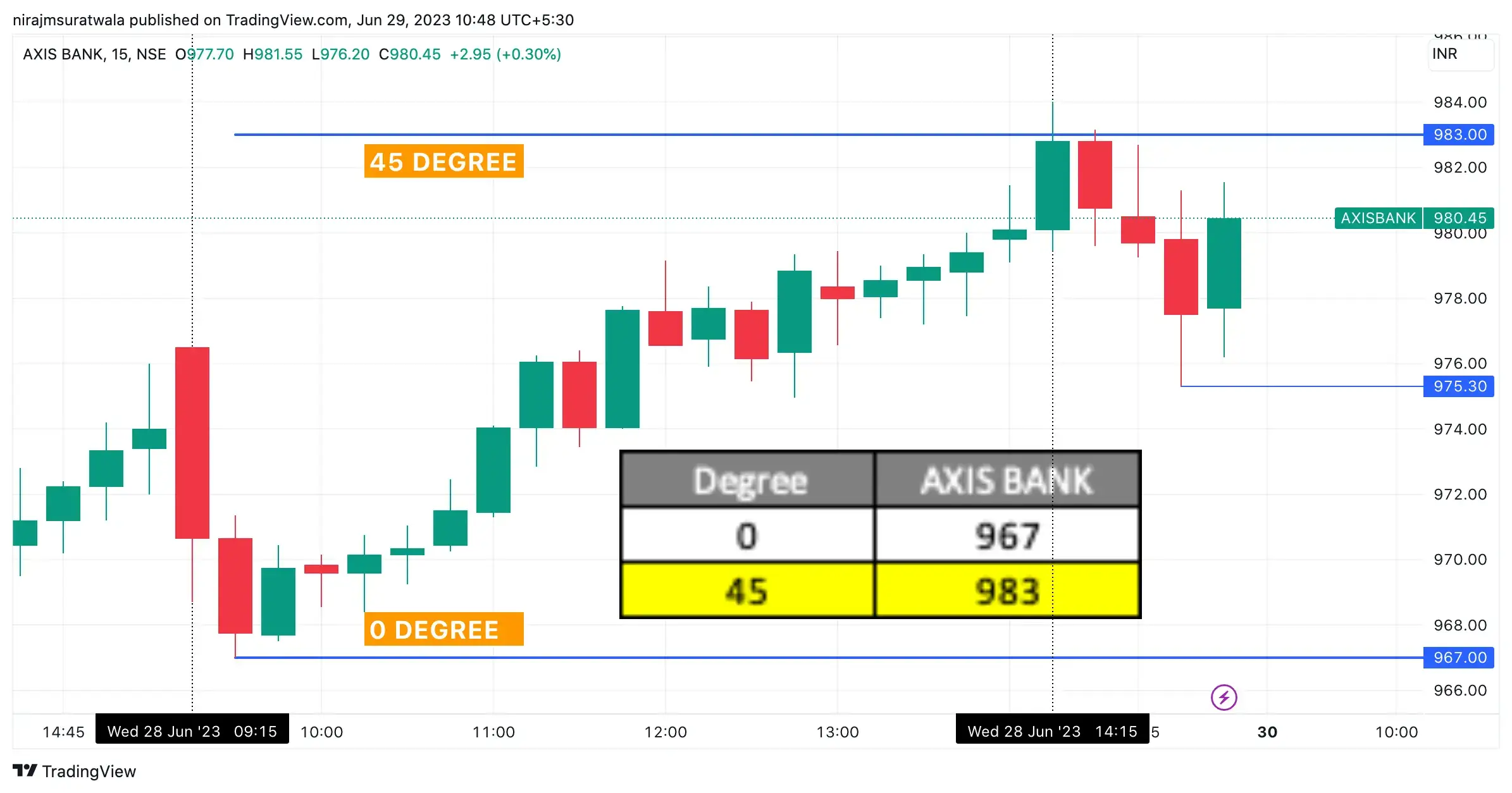

Gann Square Of 9 Application 28/6/23:

From 2nd 15 mins candle, Axis bank was moving upside. Due to this low of that candle became 0 degree (beginning point of the upside trend). By using Gann Square Of 9, I got 45 degree value as mentioned in the chart. As per rule, intraday sell trade could be taken at 45 degree value as stock achieves its capacity before right time (14:30). I result, we can see stock fell from that 45 degree value for almost good tradable points!

As disclosed in chart, here,

0 degree was 967,

45 degree was 983 and

Stock achieved its capacity @ 14:15.

Using Square Of 9 on Axisbank on 18/8/23

Explanation Of Above Image:

From 6th 15 mins candle, Axis bank was moving upside. Due to this low of that candle became 0 degree (beginning point of the upside trend). By using Gann Square Of 9, I got 45 degree value as mentioned in the chart. As per rule, intraday sell trade could be taken at 45 degree value as stock achieves its capacity at 10:30 am, means before right time (14:30). In result, we can see stock fell from that 45 degree value for almost good tradable points!

As disclosed in chart, here,

0 degree was 931 and

45 degree was 946.

Result: In the end difference between stock’s high price and low price remained within 45 degree.

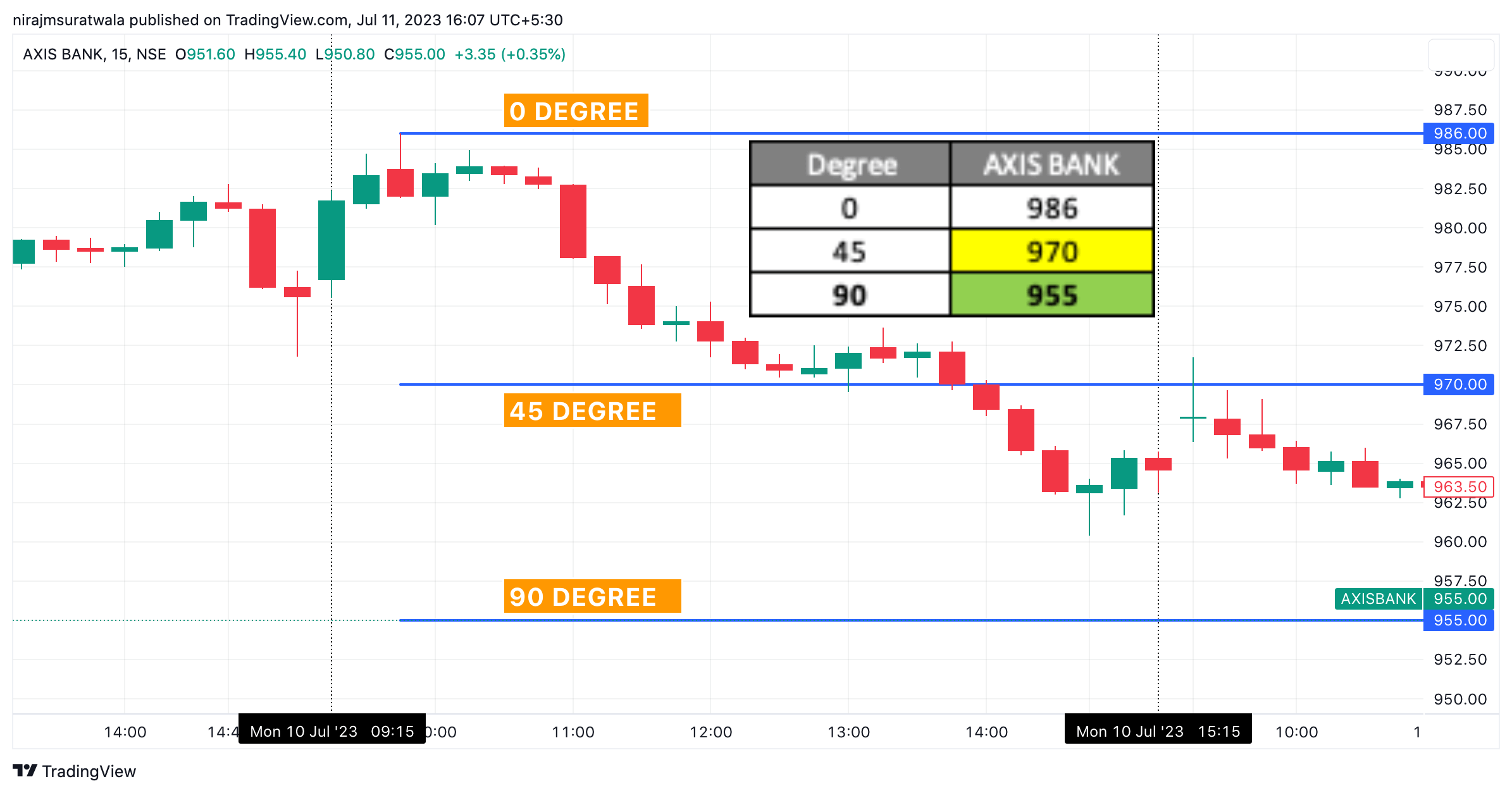

Sharing a failure case of Gann Square Of 9 (10/7/23):

Explanation Of Above Image:

We can see that from 3rd 15 minutes candle Axis Bank Ltd Stock started moving downside and to identify how much downside it can move as per its normal capacity, I took beginning point of this downside swing as a 0 degree point ( means HIGH price here ). From this 986 degree point I could calculate 45 degree value (970) by using Gann Master Chart. Stock reached at its normal capacity distance i.e. 45 degree here @ 01:00 pm ( before 2:30 pm ). As it reached 45 degree before 2:30 pm, it was supposed to bounce from 45 degree value which did not happen in this case. In the end, in such cases, intraday trade had to be squared off in loss @ 965 Rs ( opening price of 3:15 pm)

Here, 0 degree value is 986

45 degree value is 970.

Gann Square Of 9 Application Case 1:

Explanation Of Above Image:

We can see that from 1st 15 minutes candle Apollotyre Stock started moving upside and to identify how much upside it can move as per its normal capacity, I took beginning point of this upside trend as a 0 degree point ( means low price here ). From this 0 degree point I could calculate 45 degree value by using Gann Master Chart or by using Gann Calculator which are covered in my Gann Trading Course. As explained, Stock reached at its normal capacity distance i.e. 45 degree here @ 12 pm ( before 2:30 pm ) and attacked by an opponent. Due to this attack we witnessed sufficient tradable points rejection from 45 degree level.

Here, 0 degree value is 342.

45 degree value is 351.

Stock completed 45 degree distance ( normal capacity ) before 2:30 pm, got a chance to take a sell side trade at 351 Rs.

In result, stock faced rejection from 351 price level and fell downside for good tradable points.

Case 2:

Gann square of 9 case study 2

Explanation Of Above Image:

We can see that from 3rd 15 minutes candle ICICI Bank Ltd Stock started moving upside and to identify how much upside it can move as per its normal capacity, I took beginning point of this upside swing as a 0 degree point ( means low price here ).

From this 0 degree point I could calculate 45 degree value by using Gann Master Chart or by using Gann Calculator which are covered in my Gann Trading Course.

As explained, Stock reached at its normal capacity distance i.e. 45 degree here @ 11:15 am ( before 2:30 pm ) and attacked by an opponent. Due to this attack we witnessed sufficient tradable points rejection from 45 degree level.

Here, 0 degree value is 875.

45 degree value is 890.

As stock completed 45 degree distance ( normal capacity ) before 2:30 pm, got a chance to take a sell side trade at Rs. 890.

In result, stock faced rejection from 890 price level and fell downside for good tradable points.

Case 3:

Explanation Of Above Image:

We can see that from 2nd 15 minutes candle Axis Bank Ltd Stock started moving downside and to identify how much downside it can move as per its normal capacity, I took beginning point of this downside swing as a 0 degree point ( means HIGH price here ). From this 0 degree point I could calculate 45 degree value by using Gann Master Chart or by using Gann Calculator which are covered in my Gann Course. As explained, Stock reached at its normal capacity distance i.e. 45 degree here @ 01:00 pm ( before 2:30 pm ) and attacked by an opponent. Due to this attack we witnessed sufficient tradable points BOUNCE from 45 degree level.

Here, 0 degree value is 873.85.

45 degree value is 858.

As stock completed 45 degree distance in one direction ( normal capacity ) before 2:30 pm, got a chance to take a BUY side trade at 858 Rs.

In result, stock faced REVERSAL from 858 price level and fell UPSIDE for good tradable points.

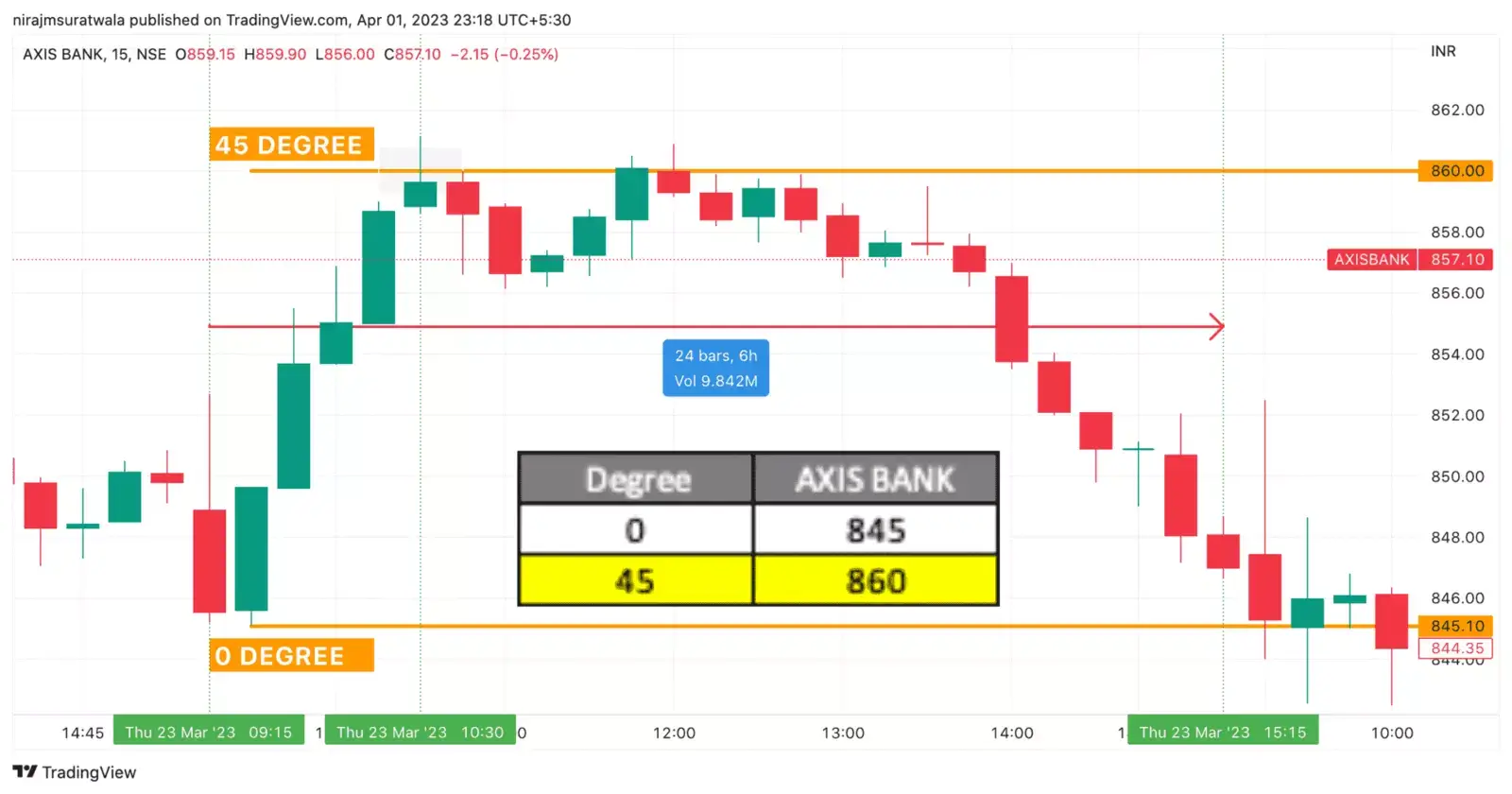

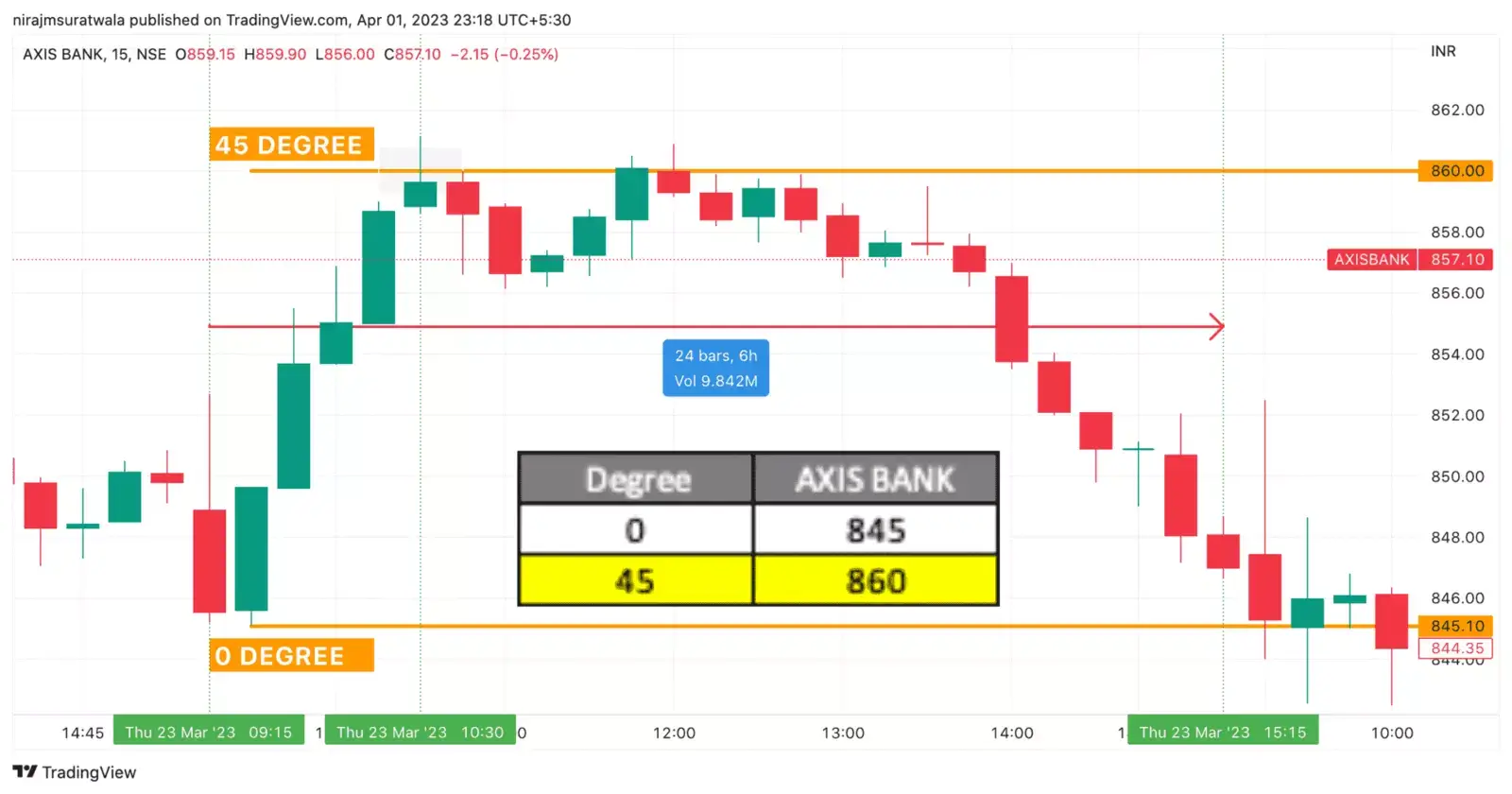

Case 5:

Concept of Gann theory applied on AXIS BANK Ltd On 23/3/23.

AXIS BANK LTD started moving Upward from marked 0 degree point. From here it could complete 45 degree ( Gann Angle Value ) distance at 10:30 am ( before 2:30 pm ). We noticed good tradable rejection right from 45 degree i.e. 860 !!

Here, 0 Degree was 845 & 45 degree was 860. Conversion of Price to degree can be done by using Gann Calculator.

[ As per Gann method & Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here SELLING spot was 45 degree value i.e. 860. ] Values of 0 & 45 degree are displayed on price chart with a small excel file, those values can be found by using Gann Calculator.

Note : AXIS BANK’S range of the day i.e. High Price & Low Price, as per the Normal Case, remained within 45 degree.

As per the standard study & observation have shared more than 50+ examples Of WD Gann Hypothesis which you may find here or on twitter handle.

If you can read between lines you will enjoy reading Gann theory book.

👉Know More

Case 6:

Concept of Gann theory applied on AXIS BANK Ltd On 03/10.

AXIS BANK LTD started moving Upward from marked 0 degree point. From here it could complete 45 degree ( Gann Angle Value ) distance so early in 1st 15 minutes only. We noticed good tradable rejection right from 45 degree i.e. 740 !!

Here, 0 Degree was 726 & 45 degree was 740. Conversion of Price to degree can be done by using Gann Calculator.

[ As per Gann method & Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here SELLING spot was 45 degree value i.e. 740. ] Values of 0 & 45 degree are displayed on price chart with a small excel file, those values can be found by using Gann Calculator.

👉Know More

Case 7: Realise Gann Square Of 9 Success Rate

Concept applied on AXIS BANK Ltd On 29/9.

AXIS BANK LTD started moving Downward from marked 0 degree point. From here it could complete 45 degree ( Gann Angle Value ) distance before 14:30 & it hovered there for some time & reversed. We noticed good tradable reversal from 717 !!

Here, 0 Degree was 730 & 45 degree was 717. Conversion of Price to degree can be done by using Gann Calculator.

[ As per the concept & Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here BUYING spot was 45 degree value i.e. 717. ] Values of 0,45 & 90 degree are displayed on price chart with a small excel file, those values can be found by using Gann Calculator.

If you can read between lines you will enjoy reading Gann theory book.

👉Know More

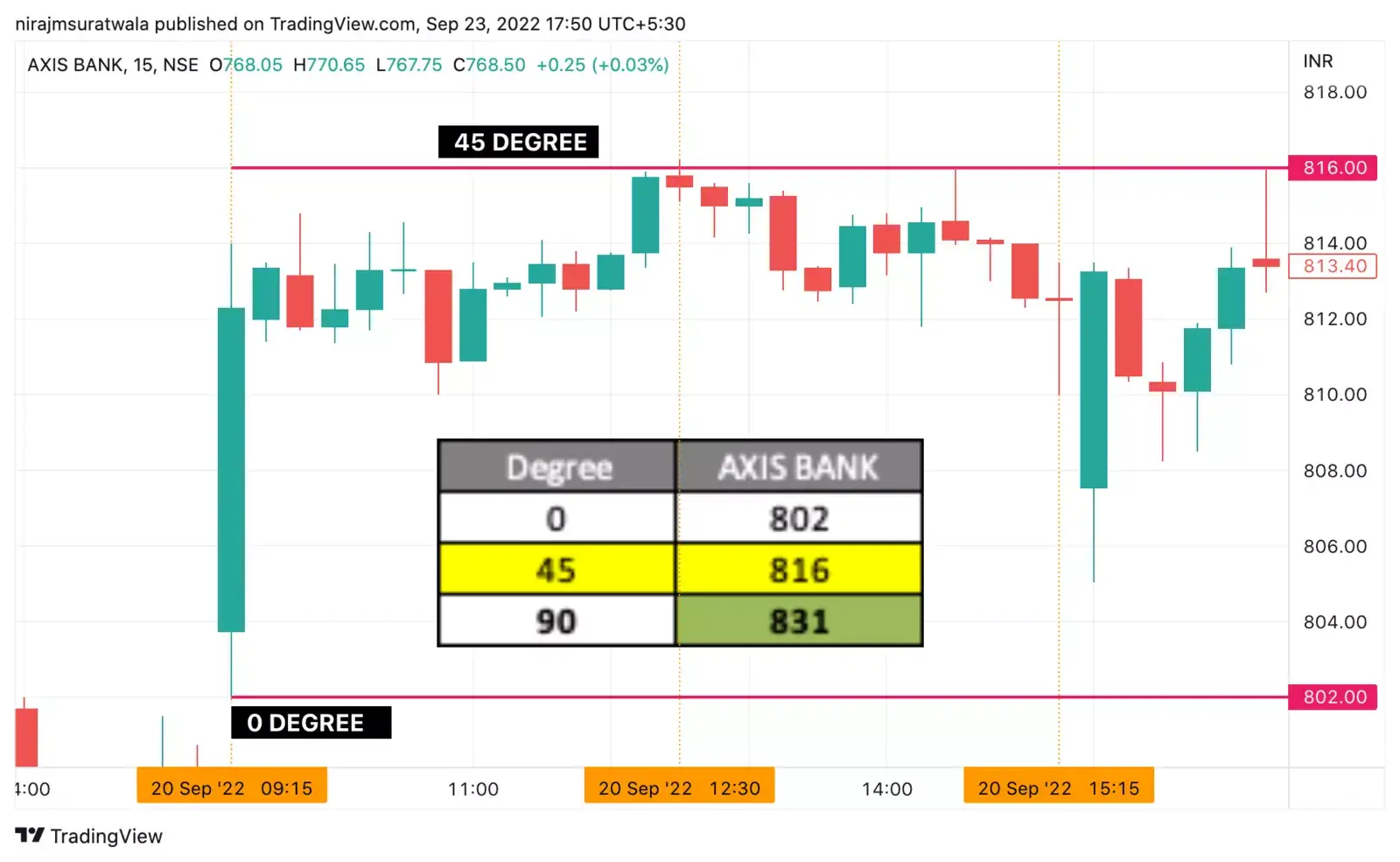

Case 8: Sharing how to identify Gann square of 9 support and resistance

Concept of Gann theory applied on AXIS BANK Ltd On 20/9.

AXIS BANK LTD started moving UPWARD from marked 0 degree point. From here it could complete 45 degree ( Gann Angle Value ) distance before 14:30 & right at 12:30 PM made a TOP of 816 & reversed. It faced rejection right from 816 !!

Here, 0 Degree was 802 & 45 degree was 816. Conversion of Price to degree can be done by using Gann Abacus.

[ As per Gann thesis & Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here SELLING spot was 45 degree value i.e. 816. ] Values of 0,45 & 90 degree are displayed on price chart with a small excel file, those values can be found by using Gann Calculator.

Case 9: Using Gann Square of nine calculator

Explanation part of the selected concept of Gann which is applied on AXIS BANK Ltd On 16/9.

AXIS BANK LTD started moving UPWARD from marked 0 degree point. From here it COULD almost complete 45 degree ( Gann Angle Value ) distance before 14:30, and right at 12:30 PM made a High of 790 & faced rejection !! So, instead of expected rejection @ 790 it corrected from 789, as shared earlier 1 point error is considered as normal & to trade within 1 point range is advisable. Finally in intraday it fell for a good tradable points from 789 & made a low of 778 as shown in the Axis bank share price chart image.

Here, 0 Degree was 776 & 45 degree was 790. Conversion of Price to degree can be done by using Gann Abacus.

[ As per Gann thesis & Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here SELLING spot was 45 degree value i.e. 790. ] Values of 0,45 & 90 degree are displayed on price chart with a small excel file, those values can be found by using Gann Calculator.

Case 10:

Does Gann Square Of 9 Work Is Answered

Explanation part of the selected concept of Gann which is applied on AXIS BANK Ltd On 6/4/23.

AXIS BANK LTD started moving DOWNWARD from marked 0 degree point. From here it COULD almost complete 45 degree ( Gann Angle Value ) distance before 14:30, and right at 14:15 PM made a Low of 849 & faced reversal !! So, instead of expected reversal @ 848 it bounced from 849, as shared earlier 1 point error is considered as normal & to trade within 1 point range is advisable. Finally in intraday it rises for very few points instead of good tradable points from 849 & made a top of 854. Since we trade for 7-8 points profit which we did not get on this day, trade had to be closed at 3:15 pm ( last 15 min candle opening price ) at just few points (5 points ) profits.

Here, 0 Degree was 863 & 45 degree was 848. Conversion of Price to degree can be done by using Gann Abacus.

[ As per Gann thesis & Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here BUYING spot was 45 degree value i.e. 849/848. ] Values of 0,45 & 90 degree are displayed on price chart with a small excel file, those values can be found by using Gann Calculator.

Note : AXIS BANK’S range of the day i.e. High Price & Low Price, as per the Normal Case, remained within 45 degree.

👉Know More

Case 11:

Sharing How To Plot Gann Square Of 9 In Tradingview?

Update of 15/9 AXIS BANK Ltd : Once it Completed 45 degree downside, it stop right there. Though tradable points bounce was not noticed as we vouch for at-least 6 points gain in such trades at 45 degree Gann level.

AXIS BANK LTD started moving Downward from marked 0 degree point. From here it could complete 45 degree angle distance before 14:30. It took good support there !!

BUY side trade was activated at 792 Gann level & supposed to book profit at 798 level, instead 798 it made a high of 797.75 so id did not give a chance to exit at expected points & at the end trade was supposed to be closed at cost price at 15:15.

Here, 0 Degree was 806 & 45 degree indicator value was 792.

[ As per Gann thesis & Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here BUYING spot was 45 degree value i.e. 792. ]

👉Know More

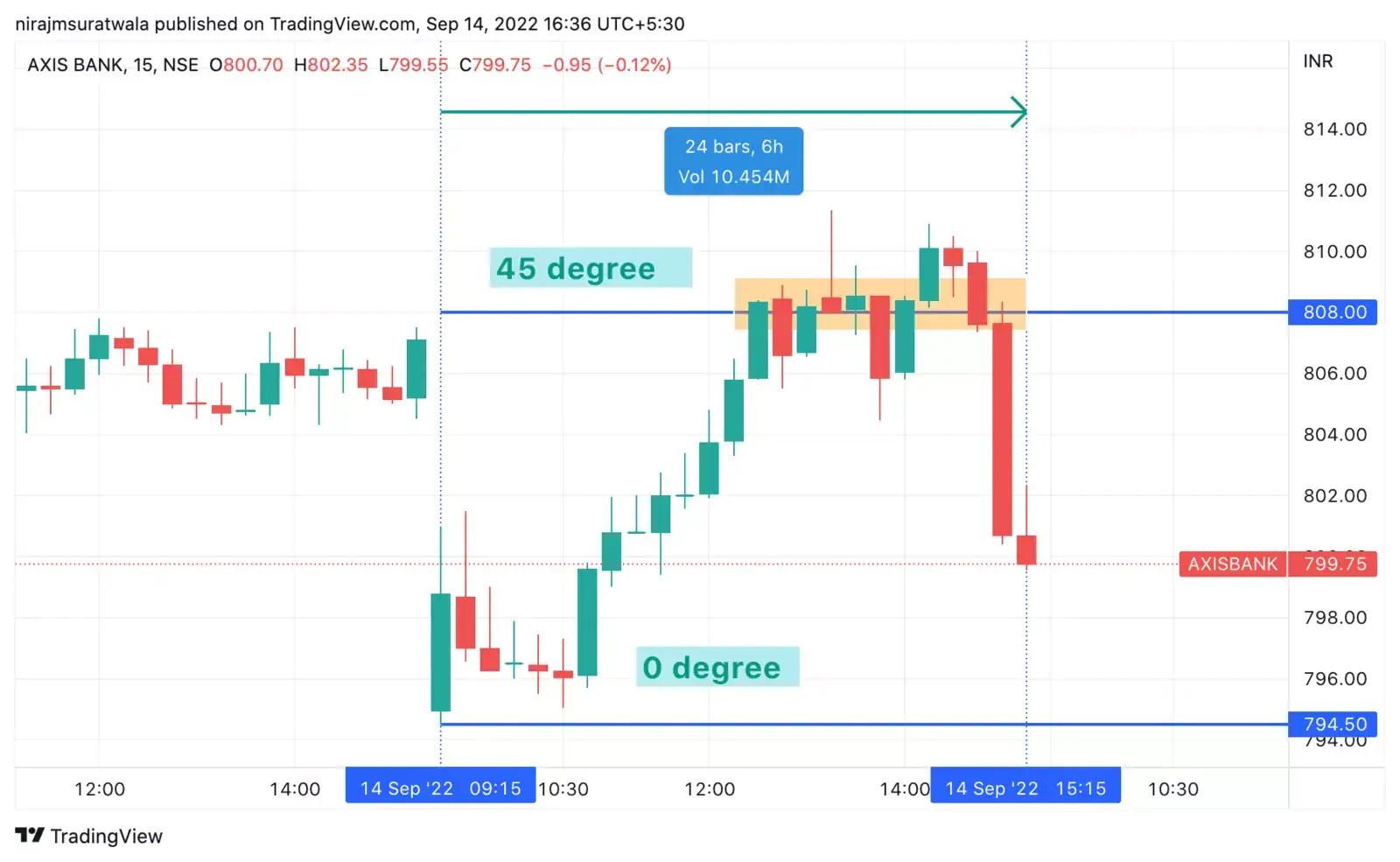

Case 12:

Know what are gann numbers

Explanation part concept which is applied on AXIS BANK Ltd On 14/09. Once Completed 45 degree, it gave good tradable points rejection at 45 degree Gann level i.e 808 as marked by yellow colour box on axis bank share price chart.

AXIS BANK LTD started moving UPWARD from marked 0 degree point. From here it could complete 45 degree angle distance before 14:30. Here it faced rejection of a good tradable points !!

SELL side trade was activated at 808 level & supposed to book profit at 800 level which did not come.

Here, 0 Degree was 794 & 45 degree indicator value was 808. Conversion of Price to degree can be done by using Gann Abacus.

[ As per Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here SELLING spot was 45 degree value i.e. 808. ] Values of 0 & 45 degree are displayed on price chart, those values can be found by using Gann Calculator.

Case 13:

What is gann level and its use is explained

Explanation part of the selected concept which is applied on AXIS BANK Ltd On 08/08. Once Completed 45 degree, it kept on hovering at 45 degree level whole day i.e. 742 as marked by yellow colour box on price chart.

AXIS BANK LTD started moving UPWARD from marked 0 degree point. From here it could complete 45 degree angle distance before 14:30. Here it faced rejection but it was not a rejection of a good tradable points !!

SELL side trade was activated at 742 & supposed to book profit at 735 level which did not come.

Finally in intraday position was to be closed in loss @ 744 @ 15:15.

Here, 0 Degree was 728 & 45 degree indicator value was 742. Conversion of Price to degree can be done by using Gann Abacus.

[ As per Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here SELLING spot was 45 degree value i.e. 742. ] Values of 0,45 & 90 degree are displayed on price chart with a small excel file, those values can be found by using Gann Calculator.

Case 14: Learn How To Use Gann Square

Explanation part of the selected concept which is applied on AXIS BANK Ltd On 26/5.

AXIS BANK LTD started moving UPWARD from marked 0 degree point. From here it could complete 45 degree angle distance before 14:30 i.e. @ 13:30 as marked it on the chart. Here it faced rejection but it was not a rejection of a good tradable points !!

SELL side trade was executed at 681 & supposed to book profit at 674 level which did not come & it reversed from there.

Finally in intraday booked the position at 1 point loss @ 15:15.

Here, 0 Degree was 668 & 45 degree indicator value was 681. Conversion of Price to degree can be done by using Gann Abacus.

[ As per Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here SELLING spot was 45 degree value i.e. 681. ] Values of 0,45 & 90 degree are displayed on price chart with a small excel file, those values can be found by using Gann Calculator.

👉Know More

Case 15:

Answering a question “How do you use Gann square in trading view?”

Explanation part of the selected concept applied on AXIS BANK Ltd On 25/5.

AXIS BANK LTD started moving DOWNWARD from marked 0 degree point. From here it COULD NOT complete 45 degree ( gann angle value ) distance before 14:30, but right at 12:45 PM made a low of 660.05 & reversed !! So, instead of expected 659 it bounced from 660, as shared earlier 1 point error is considered as normal & to trade within 1 point range is advisable. Finally in intraday it bounced for a good tradable from 660.05 & made a high of 667 as shown in the Axis bank share price chart image.

Here, 0 Degree was 672 & 45 degree was 659. Conversion of Price to degree can be done by using Gann Abacus.

As per Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here BUYING spot was 45 degree value i.e. 659.

Values of 0,45 & 90 degree are displayed on price chart with a small excel file, those values can be found by using Gann Calculator.

Case 16:

Sharing how to identify gann square of 9 support and resistance of Axis bank

Explanation part of the selected concept which is applied on AXIS BANK Ltd On 24/5.

AXIS BANK LTD started moving upward from marked 0 degree point. From here it completed 45 degree distance within 1st 15 mins only, too early & faced rejection of good tradable points.

Here, 0 Degree was 668 & 45 degree was 681. Conversion of Price to degree can be done by using Gann Abacus.

As per William Delbert Gann Thesis, In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here Selling spot was 45 degree value i.e. 681. Values of 0,45 & 90 degree are displayed on price chart with a small excel file, those values can be found by using Gann Calculator.

Case 17:

Realise gann square of 9 success rate

Explanation part of the selected concept which is applied on AXIS BANK Ltd On 23/5

AXIS BANK LTD started moving upward from marked 0 degree point. From here it completed 45 degree distance & faced rejection of good tradable points.

Here, 0 Degree was 668 & 45 degree was 681. Conversion of Price to degree can be done by using Gann Totaliser.

In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here Selling spot was 45 degree value i.e. 681.

Values of 0,45 & 90 degree are displayed on price chart with a small excel file, those values can be found by using Abacus of Gann.

Case 18:

Know how to use gann sq9 indicator?

Explanation part of the selected concept of W D Gann which is applied on AXIS BANK Ltd On 20/5

AXIS BANK LTD started moving upward from marked 0 degree point. From here it completed 45 degree distance but did not face any rejection. Thought it just stoped there & closed at 45 degree only.

Here, 0 Degree was 658 & 45 degree was 671. Conversion of Price to degree can be done by using Gann Calculator.

As Per Gann Model, In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here Selling spot was 45 degree value i.e. 671.

Values of 0,45 & 90 degree are displayed on price chart with a small excel file, those values can be found by using Gann Abacus.

Case 19:

Does gann square of 9 work is answered

Explaining application part of the concept on AXIS BANK Ltd On 19/5

AXIS BANK LTD started moving upward from marked 0 degree point. From here it did complete 45 degree distance & had rejection of tradable points.

Here, 0 Degree was 641 & 45 degree was 654. Conversion of Price to degree is possible by using Gann Totaliser.

As Per William Delbert Gann Proposition, In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here Selling spot was 45 degree value i.e. 654.

Values of 0,45 & 90 degree are displayed on price chart with a small excel file, those values can be found by using Gann Abacus.

Case 20:

Sharing how to plot gann square of 9 in tradingview?

Explaining application part of the concept on AXIS BANK Ltd On 28/3/22

AXIS BANK LTD started moving downward from marked 0 degree point. From here it did complete 45 degree distance & had a really well bounce of good tradable points.

Here, 0 Degree was 728 & 45 degree was 715. Conversion of Price to degree is possible by using Gann Calculator.

As Per William Delbert Gann Logic, In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here buying spot was 45 degree value i.e. 728.

CASE 20:

Know what are gann numbers?

Explaining application part of the concept on AXIS BANK Ltd on 29/3

AXIS BANK LTD was moving downward from 0 degree point. From here it did not completed 45 degree distance & did not get a trading opportunity.

Here, 0 Degree was 741.50 & 45 degree was 727. Conversion of Price to degree is possible by using Gann Totaliser.

As Per Gann Idea, In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here buying spot was 45 degree value i.e. 727.

| Downside | |

| 29/03/22 | |

| Degree | AXIS BANK |

| 0 | 741 |

| 45 | 727 |

| 90 | 714 |

| 135 | 701 |

| 180 | 688 |

To Learn W D Gann Trading Course click below button for relevant information about the Trading Course that covers major topics that I personally practice in my own Trading & Investing career.

CASE 21:

What is gann level and its use is explained

| Upside | |

| 30/03/22 | |

| Degree | AXIS BANK |

| 0 | 741 |

| 45 | 755 |

| 90 | 768 |

| 135 | 782 |

| 180 | 796 |

30/3/22 Explanation of Applied Gann Methodology :

AXIS BANK LTD started moving Upward from marked 0 degree point. From here it completed 45 degree distance resisted & moved further upside. It tried touching 90 degree but could not even touch 90 degree value i.e. 768. Here Only 1 trading opportunity was visible i.e. @ 45 degree post 12 pm ( after failing in reaching 90 degree ). So, Even if participated @ 45 degree initially i.e. @ 755, finally after 12 pm noticed tradable rejection till 746.

Basically only 1 trade was possible @ 45 degree.

Here, 0 Degree was 741.30 & 45 degree was 755 & 90 degree was 768. With Gann Calculator conversion of price to degree is possible.

CASE 22:

Explaning what are the major gann levels?

| Upside | Downside | |||

| 31/03/22 | 31/03/22 | |||

| Degree | AXIS BANK | Degree | AXIS BANK | |

| 0 | 751 | 0 | 761 | |

| 45 | 765 | 45 | 747 | |

| 90 | 779 | 90 | 734 | |

| 135 | 793 | 135 | 720 | |

| 180 | 807 | 180 | 707 | |

31/3/22 Explanation :

1) AXIS BANK LTD started moving Downside from marked 0 degree point. From here it did not complete 45 degree distance downside so did not get trading opportunity of buying it @ 45 degree.

Here, 0 Degree was 760.95 & 45 degree was 751. With Gann Totalizer conversion of price to degree is possible.

2) After the sharp recovery from 751.30, considered this level as a 0 degree to check what max upside distance it can cover. So after marking 751.30 as a 0 degree level could mark upside 45 degree level & this day Axis bank did not reach 45 degree value upside also, So we did not get trading opportunity of going short at 45 degree upside.

Here, 0 Degree was 751.30 & 45 degree was 765.

CASE 23:

Learn how to use Gann Square

| Upside | |

| 01/04/22 | |

| Degree | AXIS BANK |

| 0 | 755 |

| 45 | 769 |

| 90 | 783 |

| 135 | 797 |

| 180 | 811 |

1/4/22 Explanation :

AXIS BANK LTD started moving Upside from marked 0 degree point. From here it did complete 45 degree distance upside and good trading opportunity of selling it was @ 45 degree. Right @ 45 degree upside it had good tradable rejection!

Here, 0 Degree was 755.15 & 45 degree was 769. With Gann Abacus conversion of price to degree is possible.

In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trading opportunity in opposite direction was selling at 45 degree value upside i.e. @ 769. Using Calculator of Gann, values of 0,45 & 90 are findable.

CASE 24: Answering a question “How do you use Gann square in trading view?”

| Upside | |

| 04/04/22 | |

| Degree | AXIS BANK |

| 0 | 767 |

| 45 | 781 |

| 90 | 795 |

| 135 | 809 |

| 180 | 823 |

4/4/22 Explanation :

AXIS BANK LTD started moving Upside from marked 0 degree point. From here it did complete 45 degree distance upside and good trading opportunity of selling it was @ 45 degree. Right @ 45 degree upside it had good tradable rejection!

Here, 0 Degree was 767 & 45 degree was 781 With Calculator of Gann, conversion of price to degree is doable.

In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trading opportunity in opposite direction was selling at 45 degree value upside i.e. @ 781.

CASE 25: Does gann square of 9 work is answered

| Upside | |

| 05/04/22 | |

| Degree | AXIS BANK |

| 0 | 777 |

| 45 | 791 |

| 90 | 805 |

| 135 | 819 |

| 180 | 834 |

5/4 Explanation :

AXIS BANK LTD started moving Upside from marked 0 degree point. From here it did complete 45 degree distance upside and good trading opportunity of selling it was @ 45 degree. Right @ 45 degree upside it had good tradable rejection !

Here, 0 Degree was 777 & 45 degree was 791.

In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trading opportunity in opposite direction was selling at 45 degree value upside i.e. @ 791.

CASE 26: Know how to use gann sq9 indicator?

| Downside | |

| 06/04/22 | |

| Degree | AXIS BANK |

| 0 | 779 |

| 45 | 765 |

| 90 | 751 |

| 135 | 738 |

| 180 | 724 |

6/4 Explanation part of application of the concept on AXIS BANK Ltd :

AXIS BANK LTD started moving Downwards from marked 0 degree point. From here it did not complete 45 degree distance downside hence, no trading opportunity of selling it was @ 45 degree.

Here, 0 Degree was 779.95 & 45 degree was 766 With Gann Abacus conversion of price to degree is possible.

In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trading opportunity in opposite direction was to buy at 45 degree value downside i.e. @ 766. which did not happen.

CASE 27: Using Gann Square of nine calculator

| Upside | |

| 05/04/22 | |

| Degree | AXIS BANK |

| 0 | 777 |

| 45 | 791 |

| 90 | 805 |

| 135 | 819 |

| 180 | 834 |

5/4/22 Explanation part of application of the concept on AXIS BANK Ltd :

AXIS BANK LTD started moving Upside from marked 0 degree point. From here it did complete 45 degree distance upside and good trading opportunity of selling it was @ 45 degree. Right @ 45 degree upside faced good tradable rejection !

Here, 0 Degree was 777 & 45 degree was 791 With Gann Calculator conversion of price to degree is possible.

In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trading opportunity in opposite direction was selling at 45 degree value upside i.e. @ 791.

CASE 28: Realise gann square of 9 success rate

| Upside | |

| 08/04/22 | |

| Degree | AXIS BANK |

| 0 | 789 |

| 45 | 803 |

| 90 | 817 |

| 135 | 832 |

| 180 | 846 |

8/4/22 Explanation part of application of the concept on AXIS BANK Ltd :

AXIS BANK LTD started moving Upwards from marked 0 degree point. From here it did not complete 45 degree distance upside hence, no trading opportunity of selling it @ 45 degree was visible.

Here, 0 Degree was 789 & 45 degree was 803.

In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trading opportunity in opposite direction was to sell at 45 degree value downside i.e. @ 803. which did not happen.

CASE 29: Sharing how to identify gann square of 9 support and resistance

Explanation part of application of Gann Hypothesis on AXIS BANK Ltd on 11/4/22.

AXIS BANK LTD was moving Upwards from 0 degree point. From here it did not complete 45 degree distance upside hence, there was no trading opportunity of selling it @ 45 degree.

Here, 0 Degree was 786.05 & 45 degree was 800.13.

AXIS BANK LTD started moving Downside from 0 degree point. From here it did not complete 45 degree distance downside hence, no trading opportunity of buying it @ 45 degree was visible.

Here, 0 Degree was 794.25 & 45 degree was 780.

[ As Per Gann Approach, In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trading opportunity in opposite direction was to sell at 45 degree value upside i.e. @ 800 which did not happen & to Buy at 45 degree distance downside i.e. 780 which did not happen too. You can find Gann values of 0,45 & 90 by using Gann Calculator.

Note

AXIS BANK’S range of the day i.e. High Price & Low Price, as per the Normal Case, remained with 45 degree.

CASE 30:

Sharing how to plot gann square of 9 in tradingview?

Explanation part of application of Gann Methodology on AXIS BANK Ltd on 12/4/22.

AXIS BANK LTD started moving Upwards from marked 0 degree point. From here it did complete 45 degree distance upside and had to have a tradable rejection ( providing reference of a trading opportunity of selling it @ 45 degree )

Here, 0 Degree was 777.80 & 45 degree was 791.80. With Calculator of Gann conversion of price to degree is possible.

[ As Per Gann Belief, In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trading opportunity in opposite direction was to sell at 45 degree value upside i.e. @ 791.80. ]

Note

AXIS BANK’S range of the day i.e. High Price & Low Price, as per the Normal Case, remained with 45 degree after reaching too close to 90 degree which remained untouched.

CASE 31:

Know what are gann numbers?

Explanation part of application of the Gann Concept on AXIS BANK Ltd on 13/4/22.

AXIS BANK LTD started moving Downwards from marked 0 degree point. From here it did complete 45 degree distance downside hence, trading opportunity of buying it was @ 45 degree was possible.

Here, 0 Degree was 805 & 45 degree was 791.

[ As Per William Delbert Gann Conception, In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trading opportunity in opposite direction was to Buy at 45 degree value downside i.e. @ 791.]

Note

AXIS BANK’S range of the day i.e. High Price & Low Price, as per the Normal Case, remained with 45 degree.

CASE 32:

What is gann level and its use is explained

Explanation part: MGL Ltd started moving downward from marked 0 degree point. From here it completed 45 degree distance too early & bounced for tradable points.

Here, 0 Degree was 756 & 45 degree was 742.

[ In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here BUYING SPOT was 45 degree value i.e. 742. ]

Movement of MGL Ltd : Normal case 0 to 45 degree & rare case 0 to 90 degree ( You may take a trade if it reaches 45 before 14:30 or it reaches 90 degree before 14:45 )

Very soon will share Gann Square Of 9 pdf here.

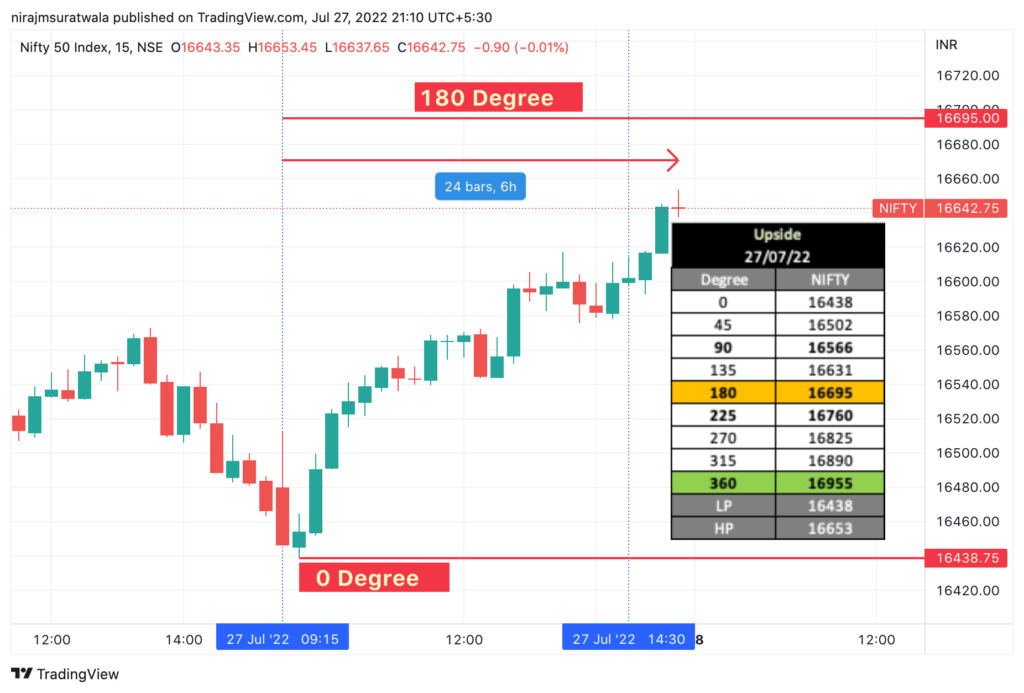

CASE 33: Explaining what are the major Gann Levels?

Explanation: Nifty 50 started moving Upward from marked 0 degree point. From here it could not complete 180 degree distance, So there was no trading opportunity today in Nifty future as per this concept.

Here, 0 Degree was 16438 & 180 degree was 16695.

[ In Normal Case I prefer to trade when it reaches 180 degree before 14:30 or it reaches 360 degree before 14:45. A trade in opposite direction, e.g. here SELLING spot was 180 degree value i.e. 16695. ]

Nifty 50’s range of the day i.e. High Price & Low Price, as per the Normal Case, remained with 180 degree.

CASE 34: Learn how to use Gann Square

Concept of Gann theory applied on AXIS BANK Ltd On 23/3/23.

AXIS BANK LTD started moving Upward from marked 0 degree point. From here it could complete 45 degree ( Gann Angle Value ) distance at 10:30 am ( before 2:30 pm ). We noticed good tradable rejection right from 45 degree i.e. 860 !!

Here, 0 Degree was 845 & 45 degree was 860.

[ As per Gann method & Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here SELLING spot was 45 degree value i.e. 860. ]

Note : AXIS BANK’S range of the day i.e. High Price & Low Price, as per the Normal Case, remained within 45 degree.

As per the standard study & observation have shared more than 50+ examples Of WD Gann Hypothesis which you may find here or on twitter handle.

If you can read between lines you will enjoy reading Gann theory book.

Case 35: Answering a question “How do you use Gann square in trading view?”

| Downside | |

| 28/03/22 | |

| Degree | MGL Ltd |

| 0 | 766 |

| 45 | 752 |

| 90 | 739 |

| 135 | 725 |

| 180 | 712 |

| 225 | 698 |

| 270 | 685 |

| 315 | 672 |

| 360 | 659 |

| HP | 766 |

| LP | 738 |

Explanation part on how to use WD Gann Theory concept on MGL Ltd :

MGL Ltd started moving downward from marked 0 degree point. From here it completed 90 degree distance bounced really well for good tradable points.

Here, 0 Degree was 766 & 90 degree was 739.

[ In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here buying spot was 90 degree value i.e. 739. ]

Case 36:

Shaing how to identify gann square of 9 support and resistance

WIPRO Ltd : Rare Case

| Downside | |

| 28/03/22 | |

| Degree | WIPRO |

| 0 | 609 |

| 45 | 597 |

| 90 | 585 |

| 135 | 573 |

| 180 | 561 |

| 225 | 549 |

| 270 | 537 |

| 315 | 526 |

| 360 | 514 |

| HP | 609 |

| LP | 597 |

Explanation part of WD Gann Theory usage on Wipro Ltd :

Wipro Ltd was moving downward from marked 0 degree point. From here it completed 45 degree distance bounced really well for good tradable points.

Here, 0 Degree was 609.05 & 45 degree was 597.

[ In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here buying spot was 45 degree value i.e. 597. ]

Wipro Ltd’s range of the day i.e. High Price & Low Price, as per the Normal Case, remained with 45 degree in both directional move.

ENQUIRY

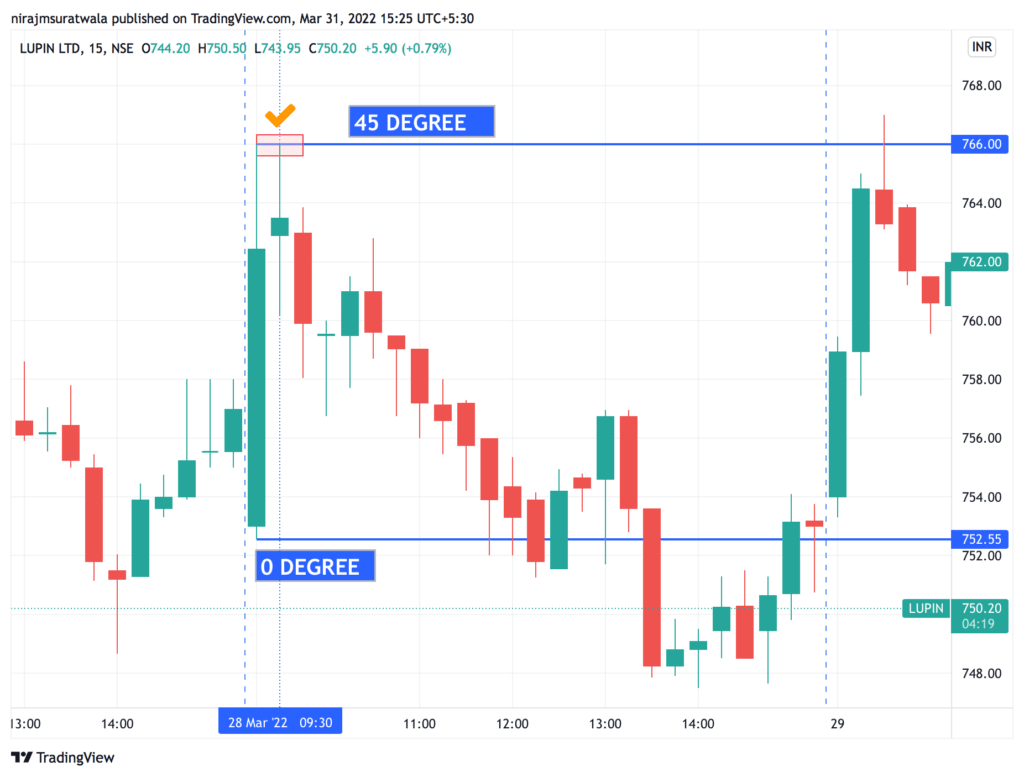

Case 37: Realise Gann Square Of 9 Success Rate

LUPIN Ltd : Rare Case

| Upside | |

| 28/03/22 | |

| Degree | LUPIN |

| 0 | 753 |

| 45 | 766 |

| 90 | 780 |

| 135 | 794 |

| 180 | 808 |

| 225 | 823 |

| 270 | 837 |

| 315 | 852 |

| 360 | 866 |

| LP | 748 |

| HP | 766 |

Lupin Ltd started moving Upward from marked 0 degree point. From here it completed 45 degree distance & rejected really well for good tradable points.

Here, 0 Degree was 752.55 & 45 degree was 766.

[ A trade in opposite direction, e.g. here Selling spot was 45 degree value i.e. 766. ]

Contact Us

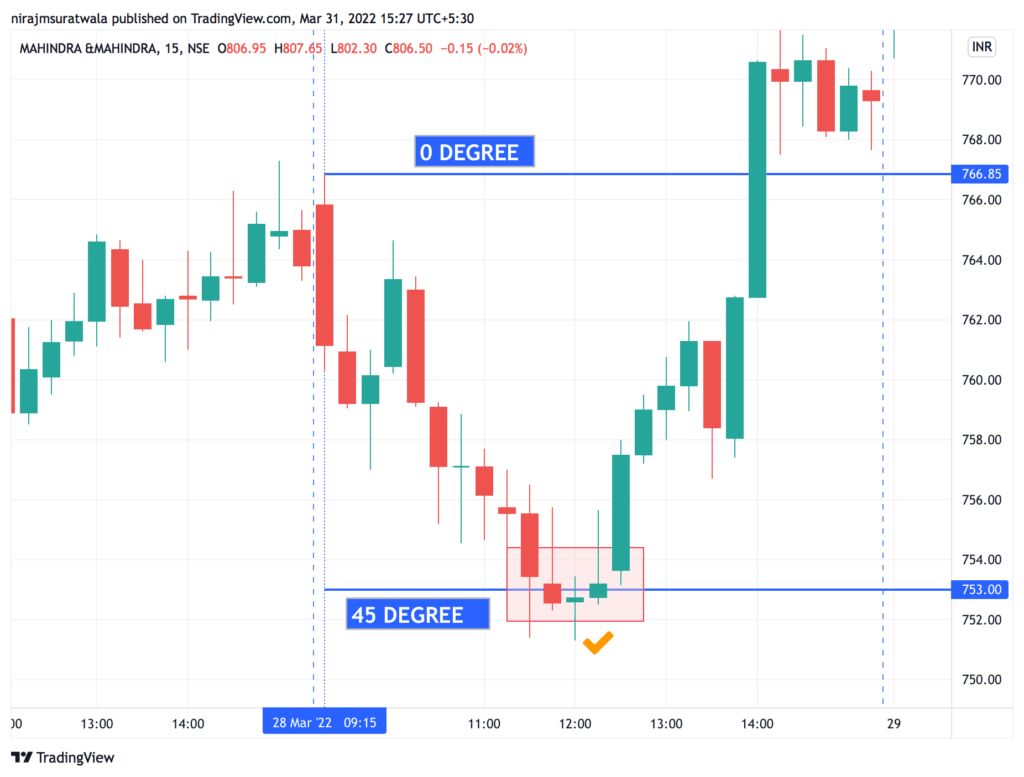

CASE 38: Know how to use gann sq9 indicator?

Mahindra & Mahindra : Normal Case

| Downside | |

| 28/03/22 | |

| Degree | Mahindra |

| 0 | 767 |

| 45 | 753 |

| 90 | 739 |

| 135 | 726 |

| 180 | 712 |

| 225 | 699 |

| 270 | 686 |

| 315 | 673 |

| 360 | 660 |

| HP | 772 |

| LP | 751 |

Explanation part of application of wd gann theory on Mahindra & Mahindra Ltd :

Mahindra & Mahindra Ltd started moving Upward from marked 0 degree point. From here it completed 45 degree distance & bounced really well for good tradable points.

Here, 0 Degree was 766.85 & 45 degree was 753.

[ In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here Buying spot was 45 degree value i.e. 753. ]

Mahindra & Mahindra Ltd’s range of the day i.e. High Price & Low Price, as per the Normal Case, remained with 45 degree.

CASE 39: Does gann square of 9 work is answered

Mcdowell Ltd : Normal Case

| Downside | |

| 28/03/22 | |

| Degree | Mcdowell |

| 0 | 891 |

| 45 | 876 |

| 90 | 861 |

| 135 | 847 |

| 180 | 832 |

| 225 | 818 |

| 270 | 804 |

| 315 | 790 |

| 360 | 776 |

| HP | 891 |

| LP | 868 |

Explanation part of application of this concept on Mcdowells ( United Spirits ) Ltd :

Mcdowells ( United Spiritis ) Ltd started moving Upward from marked 0 degree point. From here it completed 45 degree distance & bounced really well for good tradable points.

Here, 0 Degree was 891 & 45 degree was 876.

[ In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here Buying spot was 45 degree value i.e. 876. ]

Note as per the standard study, observation & shared more than 50+ examples ( you may find some examples of this from blogs & twitter handle, incase if you struggle message here will try sharing the link of a relevant thread )

Mcdowells ( United Spirits ) Ltd’s range of the day i.e. High Price & Low Price, as per the Normal Case, remained with 90 degree.

CASE 40: Sharing How To Plot Gann Square Of 9 In Tradingview?

| Downside | |

| 28/03/22 | |

| Degree | Axis Bank |

| 0 | 728 |

| 45 | 715 |

| 90 | 701 |

| 135 | 688 |

| 180 | 675 |

| 225 | 662 |

| 270 | 649 |

| 315 | 637 |

| 360 | 624 |

| HP | 728 |

| LP | 715 |

Explanation part of WD Gann Theory Concept application on Axis Bank Ltd :

Axis Bank Ltd started moving Upward from marked 0 degree point. From here it completed 45 degree distance & bounced really well for good tradable points.

Here, 0 Degree was 728.60 & 45 degree was 715.

[ In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here Buying spot was 45 degree value i.e. 715. ]

Axis Bank Ltd’s range of the day i.e. High Price & Low Price, as per the Normal Case, remained with 45 degree.

CASE 41: Know What Are Gann Numbers?

| Downside | |

| 28/03/22 | |

| Degree | JUBILANT PHARMA |

| 0 | 433 |

| 45 | 423 |

| 90 | 412 |

| 135 | 402 |

| 180 | 392 |

| 225 | 383 |

| 270 | 373 |

| 315 | 363 |

| 360 | 354 |

| HP | 433 |

| LP | 408 |

Jubilant Pharma Ltd 28/3:

Jubilant Pharma Ltd started moving Upward from marked 0 degree point. From here it did complete 90 degree distance & bounced well for good tradable points.

Here, 0 Degree was 433 & 90 degree was 412.

[ In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here Buying spot was 90 degree value i.e. 412. ]

Axis Bank Ltd’s range of the day i.e. High Price & Low Price, as per the Rare Case, remained with 90 degree.

CASE 42: What is Gann Level And Its Use Is Explained

| Downside | |

| 28/03/22 | |

| Degree | BERGER PAINT |

| 0 | 691 |

| 45 | 678 |

| 90 | 665 |

| 135 | 652 |

| 180 | 639 |

| 225 | 627 |

| 270 | 614 |

| 315 | 602 |

| 360 | 590 |

| HP | 691 |

| LP | 672 |

Berger Paints Ltd 28/3:

Berger Paints Ltd started moving Upward from marked 0 degree point. From here it completed 45 degree distance & bounced well for good tradable points.

Here, 0 Degree was 691.85 & 45 degree was 678.

[ In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here Buying spot was 45 degree value i.e. 678. ]

Berger Paints Ltd’s range of the day i.e. High Price & Low Price, as per the Rare Case, remained with 45 degree.

ENQUIRY

CASE 43: Explaining what are the major gann levels?

| Downside | |

| 28/03/22 | |

| Degree | Dabur |

| 0 | 524 |

| 45 | 513 |

| 90 | 501 |

| 135 | 490 |

| 180 | 479 |

| 225 | 468 |

| 270 | 458 |

| 315 | 447 |

| 360 | 436 |

| HP | 524 |

| LP | 512 |

Explanation part of WD Gann Theory concept application on Dabur Ltd :

Dabur Ltd was moving Upward from marked 0 degree point. From here it did complete 45 degree distance & did bounce well for good tradable points.

Here, 0 Degree was 524.15 & 45 degree was 513.

[ In Normal Case I prefer to trade when it reaches 45 degree before 14:30 or it reaches 90 degree before 14:45. A trade in opposite direction, e.g. here Buying spot was 45 degree value i.e. 513. ]

Dabur Ltd’s range of the day i.e. High Price & Low Price, as per the Rare Case, remained with 45 degree.

ENQUIRY

Frequently Asked Questions On Gann Square Of 9

Q : Does this concept work in Intraday?

A : Yes, you can use it only for intraday. You can not use identified levels for next trading day. This is because, we remain unaware of that next day where it will open and which will be its 0 degree. So, we need to mark 0 degree when new day trading session begins and when you get a right beginning point ( “A” point ) of the trend and not a beginning point of the day.

Q : Is this tool sufficient for intraday trading and can be dependent only on this tool?

A : No! We can figure out that when and where this tool can fail. With the help of Law Of Vibration it is possible. However, with this tool you would be in a position to at-least analyse how far the trend can reach in intraday in one direction so that you don’t take a wrong trade in opposite trend in middle of the trend.

Q : What if some one wish to only take positional trades and not intraday, then how this tool adds value?

A : For positional traders, yes it is useful but there is a total different approach of this tool.

Q : Is it easy to practice for a beginner who does not know about WD Gann Theory?

A : Yes, it is possible. There will be less noise on your trading view chart when a trader practices this concept.

Q : What is the frequency of getting an intraday opportunity with Gann Square Of 9 tool?

A : In a month, I would say if you stick to 1-2 stocks you may get 8-9 trading opportunities out of 22 trading sessions.

Q : What is the accuracy or winning ratio of this tool?

A : When solely relying on this tool for practice, I would confidently assert that it functions correctly over 60% or even 70% of the time. Reference article

Read More:

Welcome !! It can be a direction solution it is known which is your 0 degree point & LoV spot.

Niraj M Suratwala, is a profound financial astrologer who aces in Gann theory. If one wants to go for quality Investing in stocks must follow him. His theory leads to upscaling your quality Investing

Thank you !!!

Hello Sir,

Hope you’re doing good!!

I have one query Sir. How to identify for any stock what is normal case or what is rare case.

For example: In JSW Steel, sometimes it bounce back from 45 degree and some days it bounce back from 90 degrees. So how to identify whether 45 degrees is normal case or 90 degrees is normal case.

Thanks!!

Hi Harpreet. All is well here thank you.

Process of calculation normal & rare capacity is covered in the course.