Explored Swing Trading Experiment Using WD Gann Strategy

How you can do the same is guided step by step. All you need to do is back test & forward test this Swing trading experiments in market & observe what happens.

Swing Trading As Per WD Gann Strategy 5 On NIFTY50

Swing Trading As Per WD Gann Strategy 4 on NIFTY50

Experiment 3 on NIFTY 50

Experiment 2 On NIFTY 50

Experiment 1 On NIFTY50

Note: From WD Gann Book named as tunnel through the air & have taken 1 specific topic i.e. Time Cycles. Consider this just as an experiment of WD Gann theory & do not directly start trading on this in Nifty 50 until you do sufficient backtesting or exploration of this specific topic of Gann theory. Purpose of sharing it is just to bring your attention on such topics where X & Y (Time & Price) both axis is is taken into account in research work. There is a proper way to predict right turning points of Nifty which is well covered in my trading course.

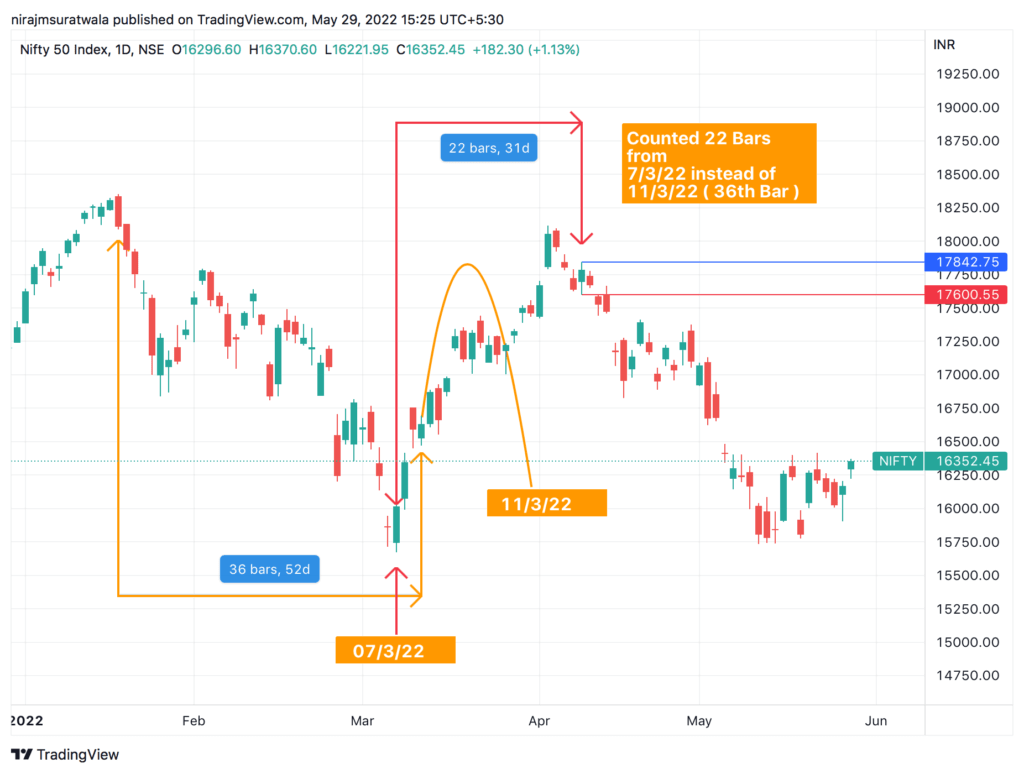

Taking WD Gann Theory Swing Trading experiment further

As per given comments on 36 number sharing some more information here..

Nifty50 : Case 6 ( Gann Theory experiment )

Nifty50 : Case 5 ( Gann Theory experiment )

Note : From WD Gann Book named as tunnel through the air & have taken 1 specific topic i.e. Time Cycles. Consider this just as an experiment of WD Gann theory & do not directly start trading on this in Nifty50 until you do sufficient backtesting or exploration of this specific topic of Gann theory. Purpose of sharing it is just to bring your attention on such topics where X & Y ( Time & Price ) both axis is is taken into account in research work.

Nifty50 : Case 4 ( Gann Theory experiment )

Note : From WD Gann Book named as tunnel through the air & have taken 1 specific topic i.e. Time Cycles. Consider this just as an experiment of WD Gann theory & do not directly start trading on this in Nifty50 until you do sufficient backtesting or exploration of this specific topic of Gann theory. Purpose of sharing it is just to bring your attention on such topics where X & Y ( Time & Price ) both axis is is taken into account in research work.

Nifty50 : Case 3 ( Gann Theory experiment )

Note : From WD Gann Book named as tunnel through the air & have taken 1 specific topic i.e. Time Cycles. Consider this just as an experiment of WD Gann theory & do not directly start trading on this in Nifty50 until you do sufficient backtesting or exploration of this specific topic of Gann theory. Purpose of sharing it is just to bring your attention on such topics where X & Y ( Time & Price ) both axis is is taken into account in research work.

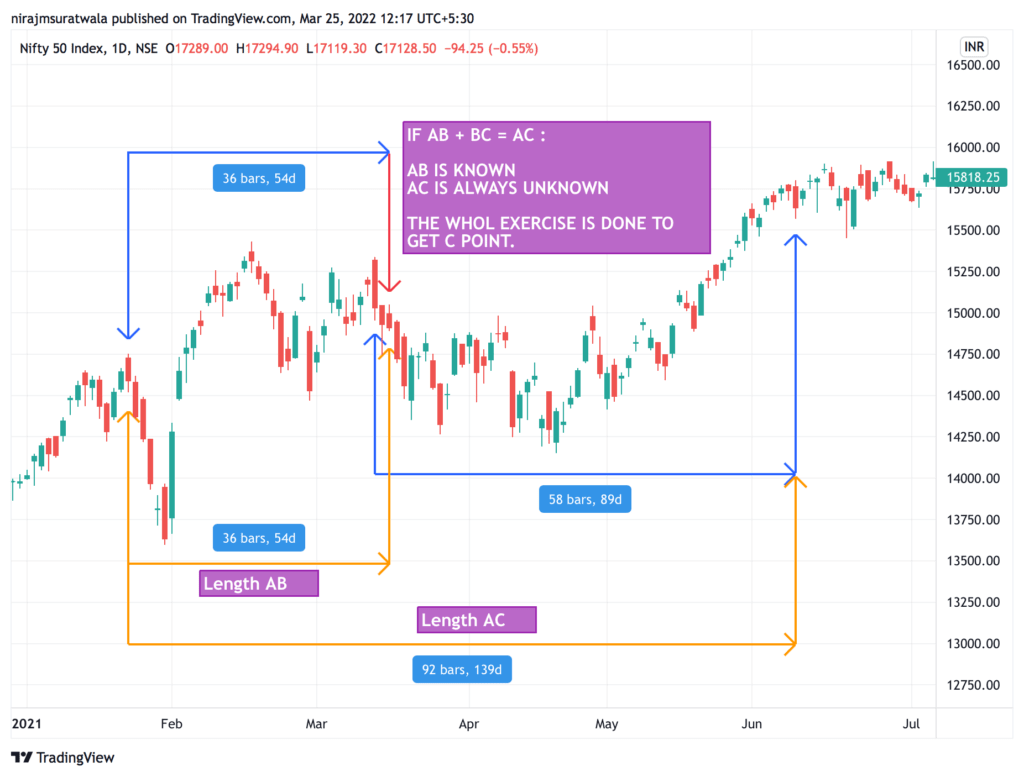

Nifty50 : Case 2 ( Gann Theory experiment )

Deliberately calculated 58 trading bars from a different spot which was an actual trend changing point.

Note : From WD Gann Book named as tunnel through the air & have taken 1 specific topic i.e. Time Cycles. Consider this just as an experiment of WD Gann theory & do not directly start trading on this in Nifty50 until you do sufficient backtesting or exploration of this specific topic of Gann theory. Purpose of sharing it is just to bring your attention on such topics where X & Y ( Time & Price ) both axis is is taken into account in research work.

Nifty50 : Case Study 1 ( Gann Theory experiment )

Deliberately calculated 58 trading bars from a different spot which was an actual trend changing point.

Note : From WD Gann Book named as tunnel through the air & have taken 1 specific topic i.e. Time Cycles. Consider this just as an experiment of WD Gann theory & do not directly start trading on this in Nifty50 until you do sufficient backtesting or exploration of this specific topic of Gann theory. Purpose of sharing it is just to bring your attention on such topics where X & Y ( Time & Price ) both axis is is taken into account in research work.

Home » WD Gann Theory Blogs » Swing Trading experiment Using WD Gann Strategy On Nifty 50

Have a query, when the swing is >36 how shall we execute this experiment?

I need to provide another image that contains further calculation..

Generally 36 Bars covers a specific moon cycle, itself it is 1 energy cycle and 36 trading bars equals approx 54 calendar days so within this trend usually changes, try & check..

Sir

Gann Saab used factor of 1.4 (derived from 7 calender days/5 trading days) for conversion of TD to CD. As per your calculation it is 1.5 (54 CD/36 TD). Is that also experiment or is it approximation to derive a cycle of 17 (lunar cycle of 28 CD)

It is an experiment.. trying to arrive at C point..

I already have an another way to arrive at Price part of “C” point as well as Time part of “C” point ( Decoding Price part was very difficult but execution is simplified & made very easy, Decoding Time part was difficult & tedious in execution as well )

Some examples of your way of calculating point c time & price points. Plz

Is the excel table based on Gann concepts?

Yes It is !!

Could you please share remaining calculations? thanks

Sure, very soon.

Updated..

Thanks.