Easiest Bank nifty chart analysis for bank nifty future view.

Here just a very small concept is explored which is not even covered in my Gann Course that is based on WD Gann Theory. Purpose of sharing is just to drag your attention on “TIME” or “X-Axis”.

( Providing Gann Theory learning material in sequence order: Recent to Older)

How to predict bank nifty movement on bank nifty trading view chart is explained. It helps in making bank nifty prediction for tomorrow.

Bank nifty chart analysis for 17/6/22 to 14/10/22 Time Frame.

To make bank nifty prediction used tradingview bank nifty chart,

added 81 trading bars from 17/6/22 date, we arrive at 14/10/22.

HP & LP of 14/10 was to be considered as an important levels which are marked on tradingview bank nifty chart.

Point to be noticed :

A) Post 14/10, Bank Nifty closed above HP of 14/10 ( 39570 ) & Activated BUY Signal.

B) Bank Nifty rallied upside for good tradable points.

C) Post Buy Activation Bank Nifty did not close below the LP of 14/10 ( 39196 ) immediately means SL was not triggered.

[ HP = High Price & LP = Low Price ]

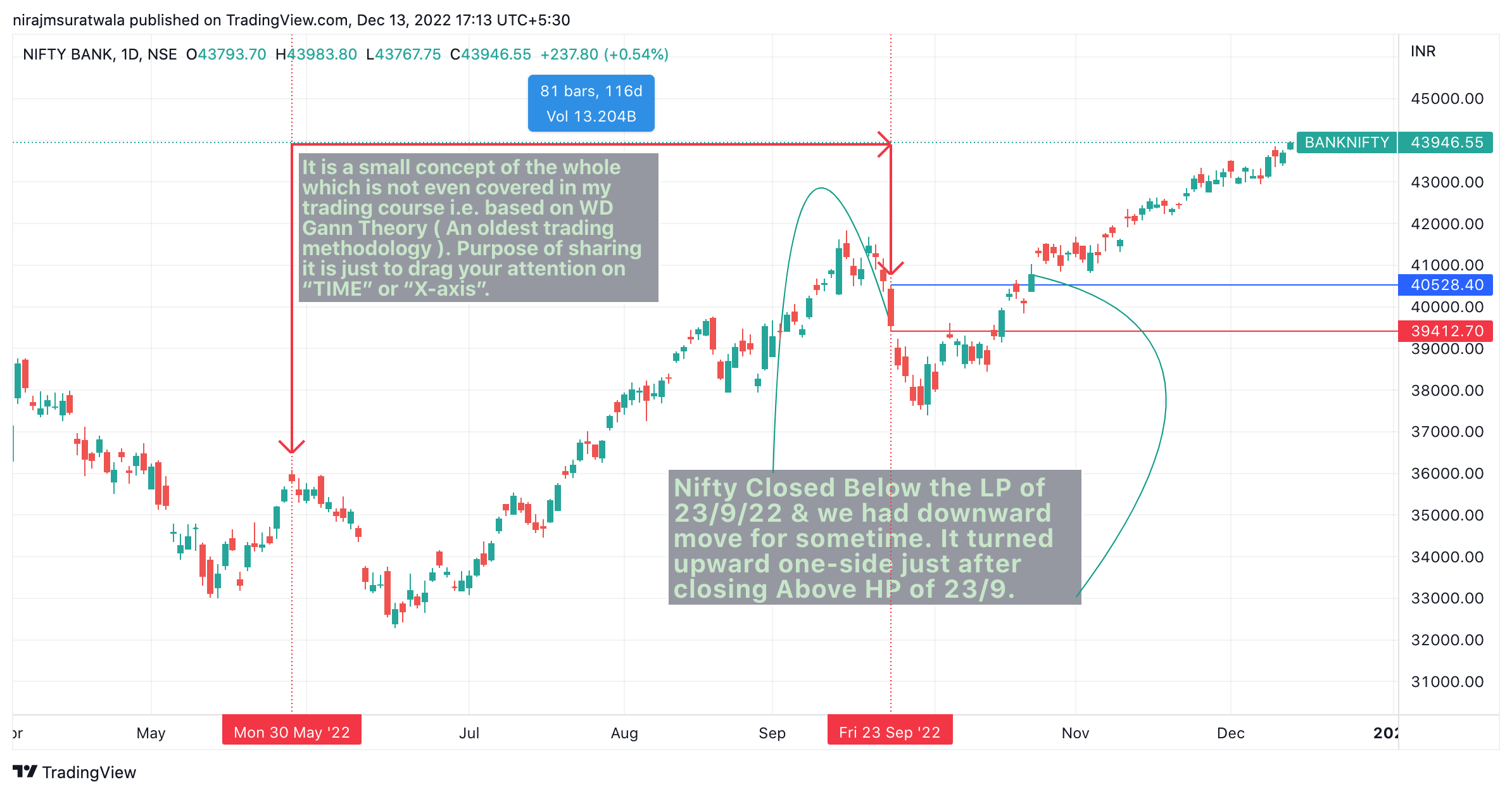

Bank nifty chart analysis for 30/5/22 to 23/9/22 Time Frame.

To make bank nifty prediction used tradingview bank nifty chart,

added 81 trading bars from 30/5/22 date, we arrive at 23/9/22.

HP & LP of 14/9 was to be considered as an important levels which are marked on tradingview bank nifty chart.

Point to be noticed :

A) Post 23/09, Bank Nifty closed below LP of 23/09 ( 39412 ) & Activated SELL Signal.

B) Bank Nifty rallied Downward for some time after 23/09 date.

C) Post SELL Activation Bank Nifty did not close above the HP of 23/9 ( 40528 ) immediately. It actually turned upward just after closing above HP of 23/9 as marked on Bank nifty price chart.

[ HP = High Price & LP = Low Price ]

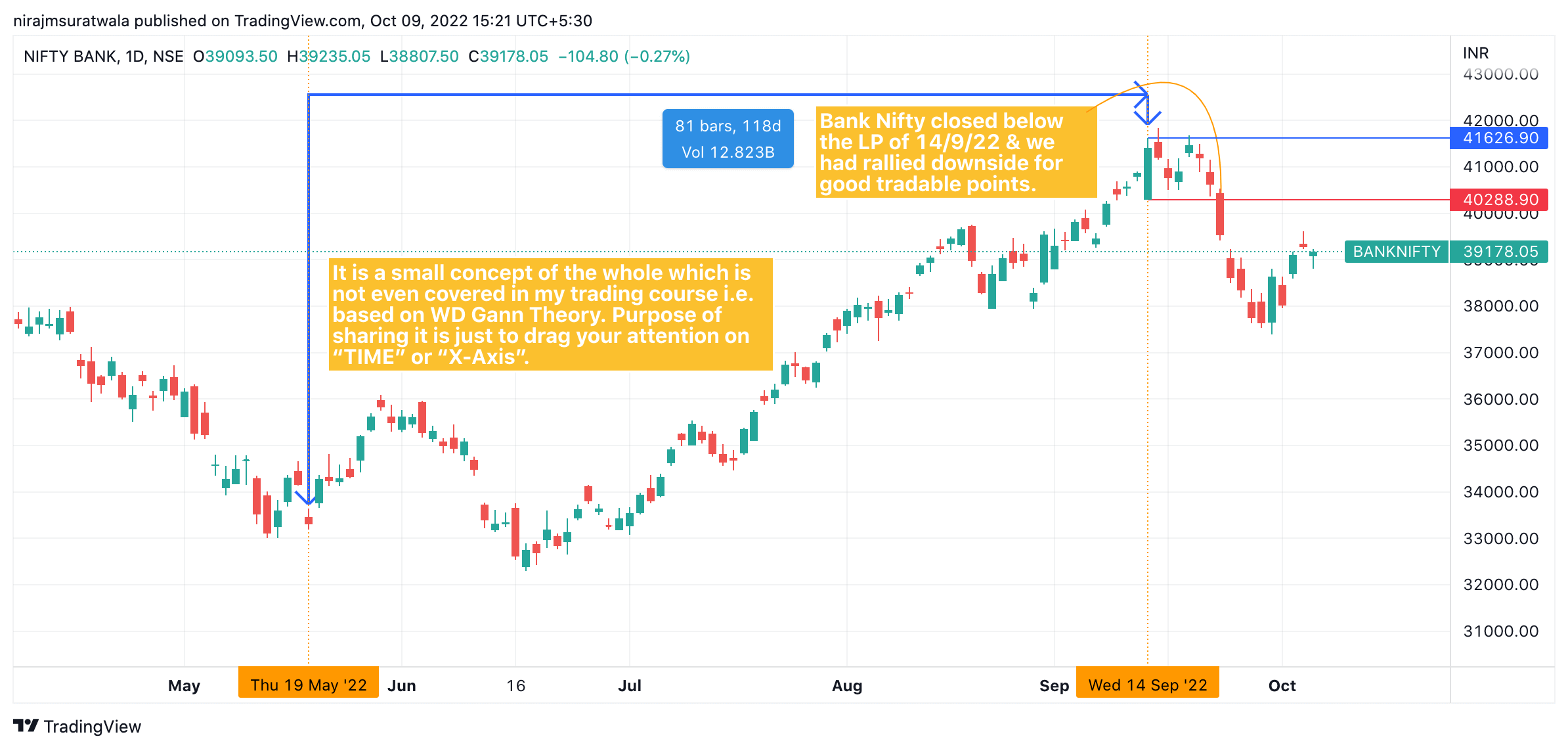

To make bank nifty prediction used tradingview bank nifty chart,

added 81 trading bars from 19/5/22 date, we arrive at 14/9/22.

HP & LP of 14/9 was to be considered as an important levels which are marked on tradingview bank nifty chart.

Point to be noticed :

A) Post 14/09, Bank Nifty closed below LP of 14/09 ( 40288 ) & Activated SELL Signal.

B) Bank Nifty rallied Downward for good tradable points after 14/09 date.

C) Post SELL Activation Bank Nifty did not close above the HP of 14/9 ( 41626 ) for a good period of time & fell constantly for more than 3500 points.

[ HP = High Price & LP = Low Price ]

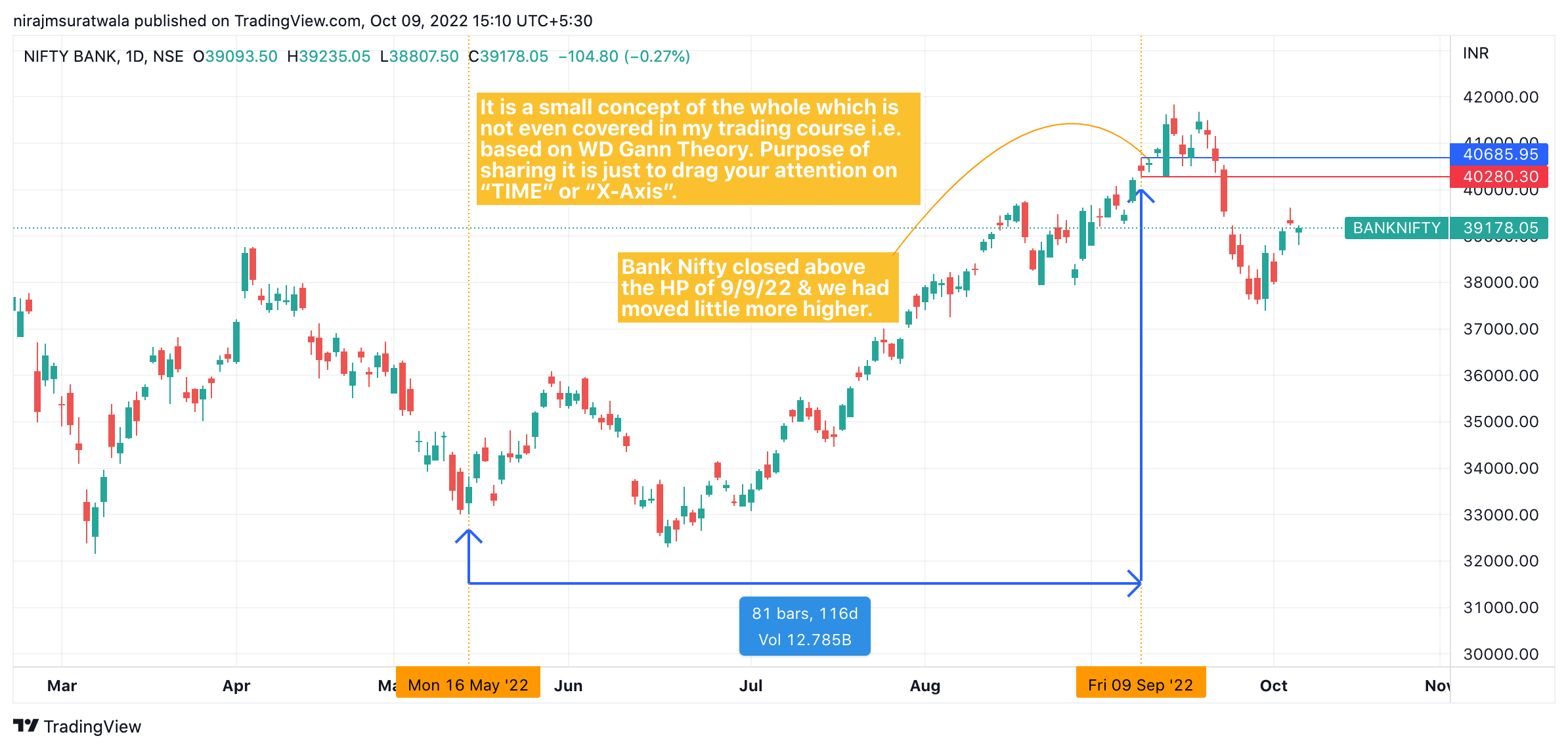

To make bank nifty prediction used tradingview bank nifty chart,

added 81 trading bars from 16/5/22 date, we arrive at 9/9/22.

HP & LP of 9/9/22 was to be considered as an important levels which are marked on tradingview bank nifty chart.

Point to be noticed :

A) Post 9/09, Bank Nifty closed above HP of 9/09 ( 40685 ) & Activated BUY Signal.

B) Bank Nifty rallied Upward for little higher further after 9/09 date.

C) Post BUY Activation Bank Nifty did not close below the LP of 9/9 ( 40280 ) for a good period of time & rallied little higher for more than 1500 points.

[ HP = High Price & LP = Low Price ]

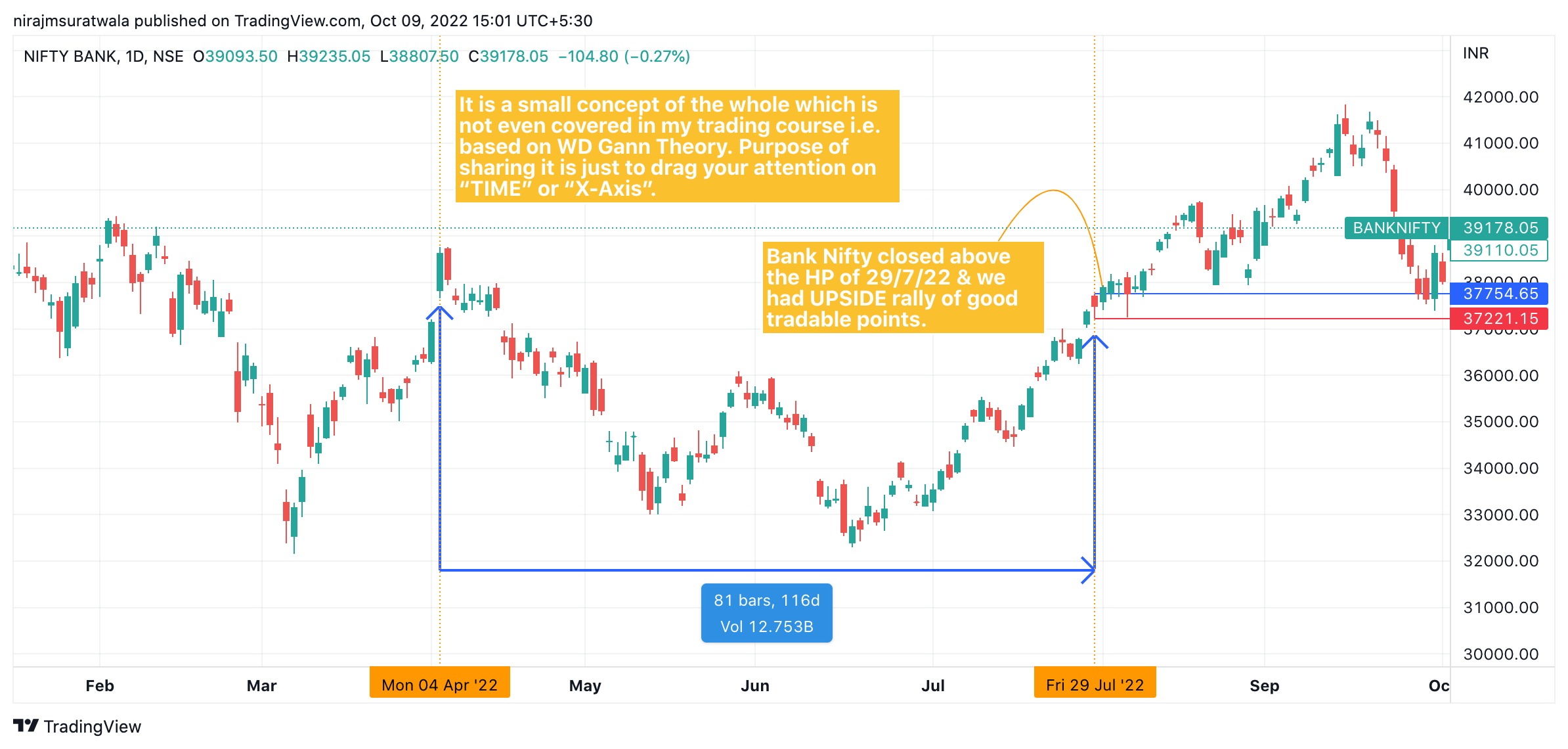

To make bank nifty prediction used tradingview bank nifty chart,

added 81 trading bars from 04/4/22 date, we arrive at 29/7/22.

HP & LP of 29/7/22 was to be considered as an important levels which are marked on tradingview bank nifty chart.

Point to be noticed :

A) Post 29/07, Bank Nifty closed above HP of 29/07 ( 37754 ) & Activated BUY Signal.

B) Bank Nifty rallied Upward for good tradable points after 29/07 date.

C) Post BUY Activation Bank Nifty did not close below the LP of 29/7 ( 37221 ) for a good period of time & rallied constantly for more than 2500 points.

[ HP = High Price & LP = Low Price ]

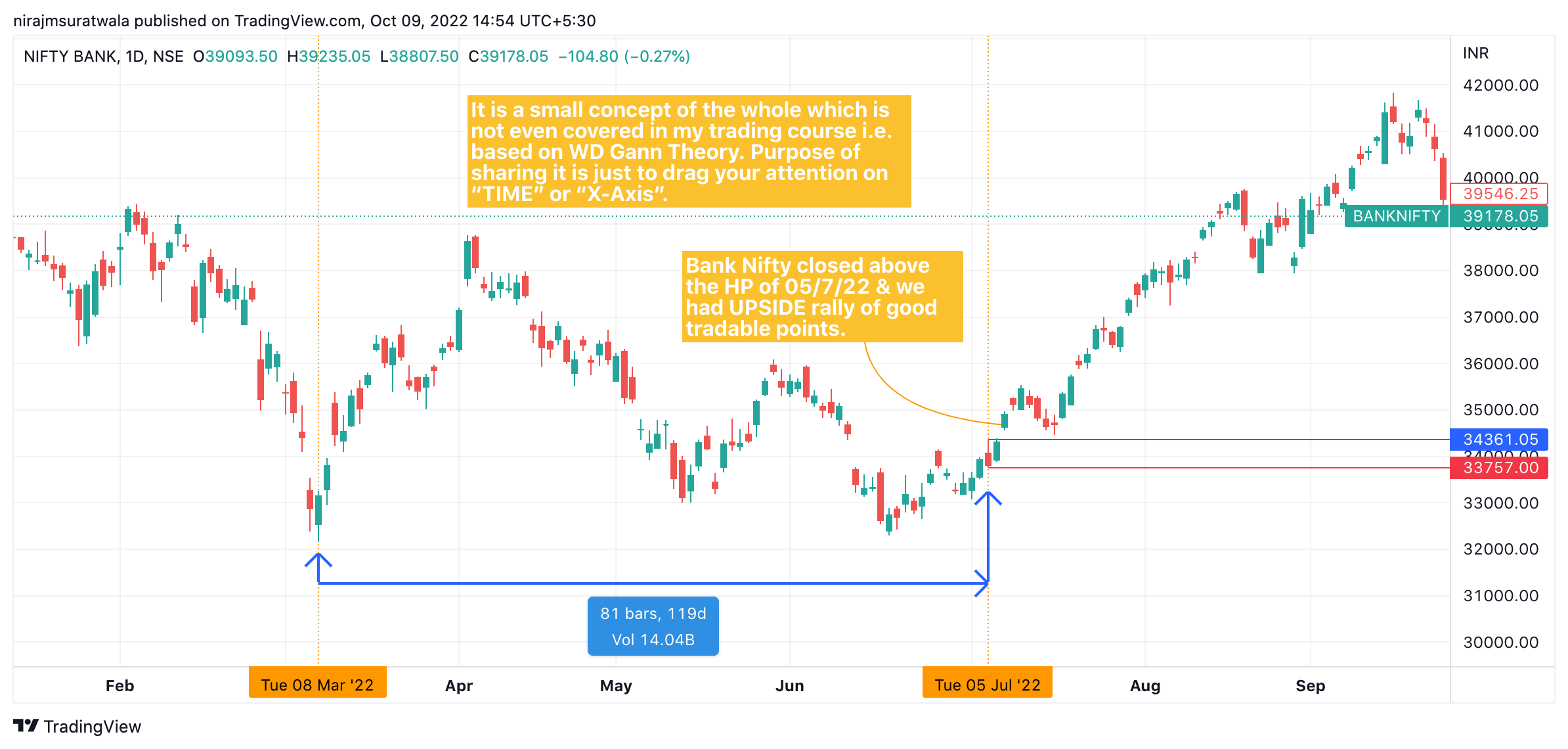

To make bank nifty prediction used tradingview bank nifty chart,

added 81 trading bars from 08/3/22 date, we arrive at 5/7/22.

HP & LP of 5/7/22 was to be considered as an important levels which are marked on tradingview bank nifty chart.

Point to be noticed :

A) Post 5/07, Bank Nifty closed above HP of 5/07 ( 34361 ) & Activated BUY Signal.

B) Bank Nifty rallied Upward for good tradable points after 5/07 date.

C) Post BUY Activation Bank Nifty did not close below the LP of 10/6 ( 33757 ) for a good period of time & rallied constantly for more than 3000 points.

[ HP = High Price & LP = Low Price ]

To make bank nifty prediction used tradingview bank nifty chart,

added 81 trading bars from 10/2/22 date, we arrive at 10/6/22.

HP & LP of 10/6 was to be considered as an important levels which are marked on tradingview bank nifty chart.

Point to be noticed :

A) Post 10/06, Bank Nifty closed below LP of 10/06 ( 34346 ) & Activated SELL Signal.

B) Bank Nifty rallied Downward for some tradable points after 10/06 date.

C) Post SELL Activation Bank Nifty did not close above the HP of 10/6 ( 34752 ) for a good period of time & fell constantly for more than 1500 points.

[ HP = High Price & LP = Low Price ]

To make bank nifty prediction used tradingview bank nifty chart,

added 81 trading bars from 08/2/22 date, we arrive at 08/6/22.

HP & LP of 08/6 was to be considered as an important levels which are marked on tradingview bank nifty chart.

Point to be noticed :

A) Post 08/06, Bank Nifty closed below LP of 08/06 ( 34831 ) & Activated SELL Signal.

B) Bank Nifty rallied Downward for some tradable points after 08/06 date.

C) Post SELL Activation Bank Nifty did not close above the HP of 08/6 ( 35449 ) for a good period of time & fell constantly for more than 2500 points.

[ HP = High Price & LP = Low Price ]

To make bank nifty prediction used tradingview bank nifty chart,

added 81 trading bars from 03/2/22 date, we arrive at 03/6/22.

HP & LP of 03/6 was to be considered as an important levels which are marked on tradingview bank nifty chart.

Point to be noticed :

A) Post 03/06, Bank Nifty closed below LP of 03/06 ( 35175 ) & Activated SELL Signal.

B) Bank Nifty rallied Downward for some tradable points after 03/06 date.

C) Post SELL Activation Bank Nifty did not close above the HP of 03/6 ( 35929 ) for a good period of time & fell constantly for more than 2500 points.

[ HP = High Price & LP = Low Price ]

To make bank nifty prediction used tradingview bank nifty chart,

Added 81 trading bars from 24/1/22 & we arrive at 25/5/22. HP & LP of 25/5 is marked on Bank nifty price chart.

Point to be noticed :

A) Post 25/5 Bank Nifty closed Above HP of 25/5 ( 34722 ) & Activated BUY Signal. ( Here Spot chart is taken )

B) Bank Nifty rallied Upward for some tradable points after 25/5

C) Post BUY Activation Bank Nifty did not immediately close below the LP of 25/5 ( 34285 ) for a good period of time & rose constantly for 1000 points.

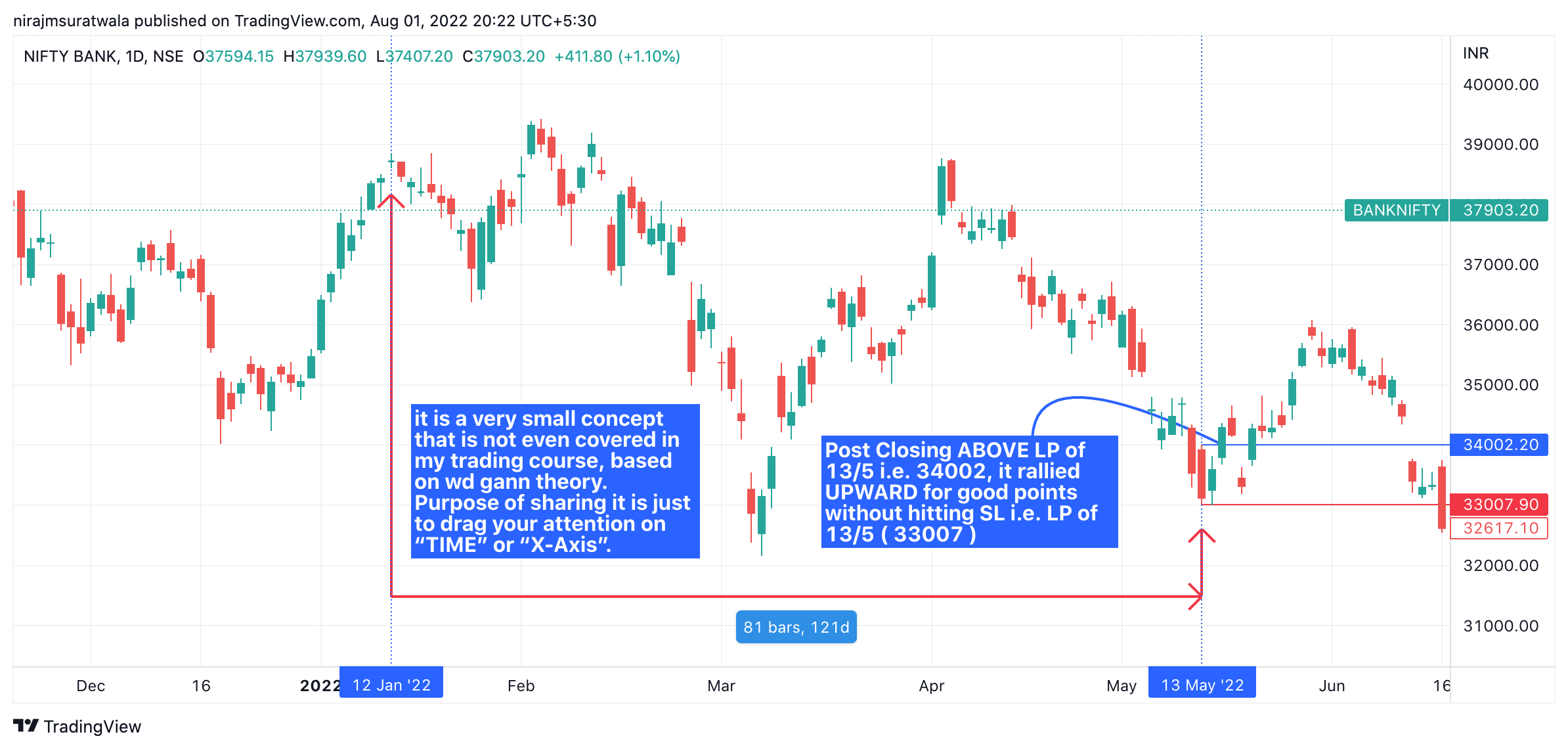

On Tradingview Bank Nifty Chart added 81 trading bars from 12/1/22 & we arrive at 13/5/22. HP & LP of 13/5 is marked on Bank nifty price chart.

Point to be noticed :

A) Post 13/5 Bank Nifty closed Above HP of 13/5 ( 34002 ) & Activated BUY Signal.

B) Bank Nifty rallied Upward for sufficient tradable points after 13/5

C) Post BUY Activation Bank Nifty did not close below the LP of 13/5 ( 33007 ) for a good period of time & Rise constantly for more than 1500 points.

On Tradingview Bank Nifty Chart added 81 trading bars from 20/12/21 & we arrive at 19/04/22. HP & LP of 19/04 is marked on Bank nifty price chart.

Point to be noticed :

A) Post 19/04 Bank Nifty closed Below LP of 19/04 ( 35926 ) & Activated SELL Signal.

B) Bank Nifty rallied Downward for sufficient tradable points after 19/04

C) Post SELL Activation Bank Nifty did not close above the HP of 19/04 ( 37123 ) for a good period of time & Fell constantly for more than 2500 points.

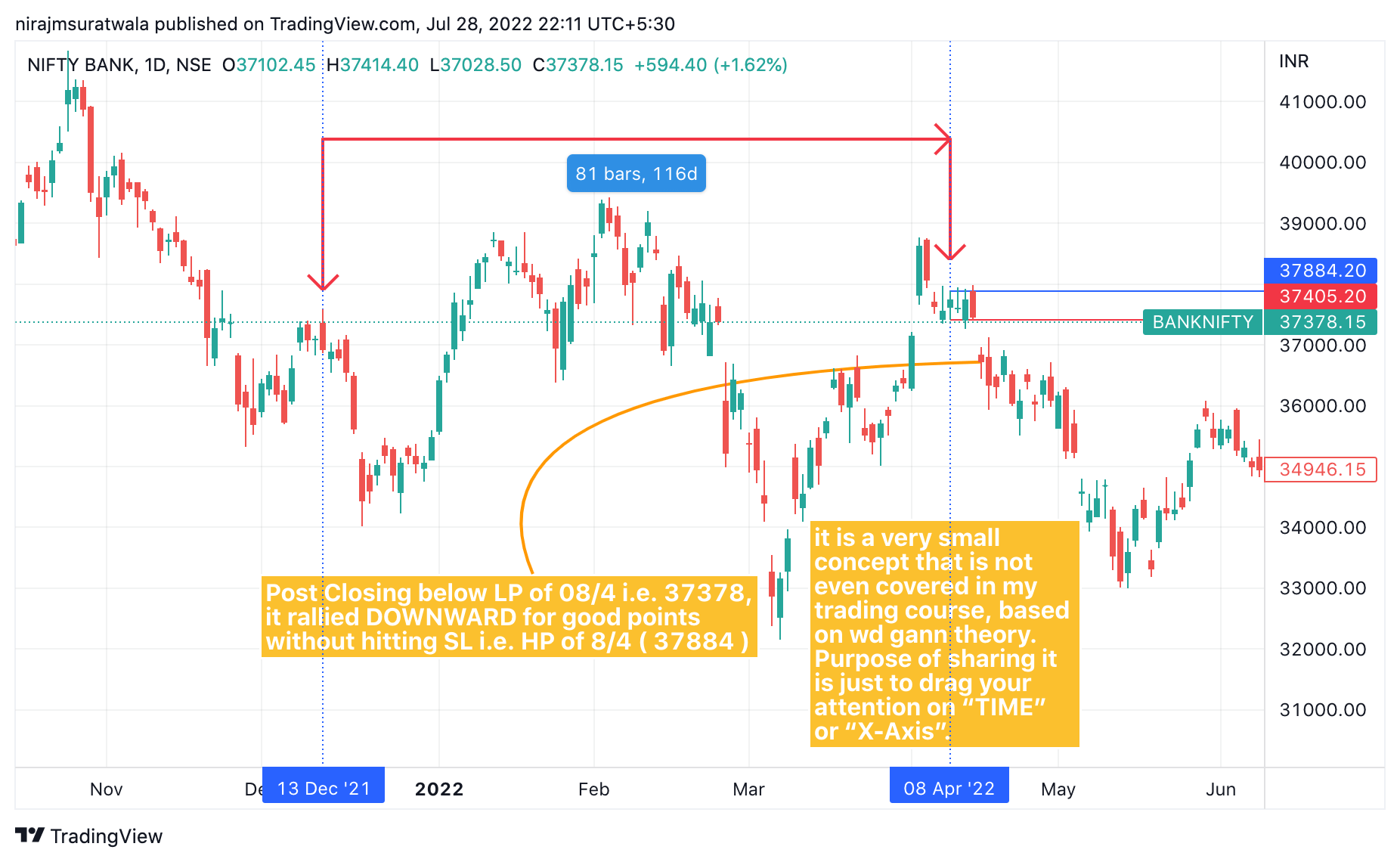

On Tradingview Bank Nifty Chart added 81 trading bars from 13/12/21 & we arrive at 08/04/22.

HP & LP of 08/04 is marked on chart.

Point to be noticed :

A) Post 08/04 Bank Nifty closed Below LP of 08/04 ( 37378 ) & Activated SELL Signal.

B) Bank Nifty rallied Downward for sufficient tradable points after 08/04

C) Post SELL Activation Bank Nifty did not close above the HP of 08/04 ( 37884 ) for a good period of time & Fell constantly for more than 4000 points.

On Tradingview Bank Nifty Chart added 81 trading bars from 29/11/21 & we arrive at 25/03/22.

HP & LP of 25/3 is marked on chart.

Point to be noticed :

A) Post 25/3 Bank Nifty closed Above HP of 25/3 ( 35700 ) & Activated BUY Signal.

B) Bank Nifty rallied upward for sufficient tradable points after 25/3.

C) Post BUY Activation Bank Nifty did not close below the LP of 25/3 ( 35203 ) for a good period of time & Rise constantly for more than 3000 points.

On Tradingview Bank Nifty Chart added 81 trading bars from 25/10/21 & we arrive at 18/02/22.

HP & LP of 18/02 is marked on chart.

Point to be noticed :

A) Post 18/02 Bank Nifty Closed below LP of 18/2 ( 37304 ) & Activated Sell Signal.

B) Bank Nifty rallied downward for sufficient tradable points after 18/2.

C) Post Sell Activation Bank Nifty did not close above the HP of 18/2 ( 37817 ) for a good period of time & fell constantly for more than 4000 points.

Explained how to trade in bank nifty future using gann master chart. ( This concept is covered in my trading course )

(A)

Bank nifty started moving downward from marked 0 degree point. From here it tried to go closed to 180 degree distance which it could not complete & bounced before touching it.

Here, 0 Degree was 35572 & 315 degree was 34915.

[ In Normal Case I prefer to trade when it reaches 315 degree before 14:30 or it reaches 360 degree before 14:45. A trade in opposite direction, e.g. here could have bought if it could have touched 315 degree value i.e. 34915. ]

In my actual Trading process usually I do not miss such reversals / rejections as Law Of Vibration ( LoV ) depicts the right level or you can say it adds more filter to the study to identify a highly probable point of reversal or rejection. Today’s LoV was 34979 which did not come either & missed it as it made a low of 35016.

(B)

Once it started reversing upside, Revised its 0 degree point which was 35016. From this revised 0 degree point it went upside & went towards 315 distance, once it reached there tradable rejection noticed as marked in 2nd Price Chart of Bank nifty.

Here 0 Degree was 35016 & 315 degree was 35674.

[ In Normal Case I prefer to trade when it reaches 315 degree before 14:30 or it reaches 360 degree before 14:45. A trade in opposite direction, e.g. here could have sold if it could have touched 315 degree value i.e. 35674, In trading hours went to watch R R R movie so did not trade 🙂 ]

Note as per the standard study, observation & shared more than 50+ examples ( you may find some examples of this from blogs & twitter handle, incase if you struggle message here will try sharing the link of a relevant thread )

Bank nifty’ range of the day i.e. High Price & Low Price, as per the Normal Case, remained with 315 degree in both directional move.

Movement of Bank nifty : Normal case 0 to 270 & 315 degree, rare case 0 to 360 & 360+45 degree ( Trade can be taken only if 315 or 360 degree distance is covered before 14:30 ),

Stocks (3 digits / less volatile ) : Normal 0 to 45 degree, rare case 0 to 90 degree ( Trade can be taken only if 45 or 90 degree distance is covered before 14:30 ).

As per WD Gann Master Chart:

As Per Gann Square Of 9: Every stock has its own capacity to move in 45 Degree quantum. Normal & Extreme capacity differs from Stock to Stock and Indices to Indices . .

| Upside | Downside | |||

| 28/03/22 | 28/03/22 | |||

| Degree | BANKNIFTY | Degree | BANKNIFTY | |

| 0 | 35016 | 0 | 35572 | |

| 45 | 35110 | 45 | 35478 | |

| 90 | 35203 | 90 | 35384 | |

| 135 | 35297 | 135 | 35290 | |

| 180 | 35391 | 180 | 35196 | |

| 225 | 35485 | 225 | 35102 | |

| 270 | 35580 | 270 | 35008 | |

| 315 | 35674 | 315 | 34915 | |

| 360 | 35769 | 360 | 34822 | |

| LP | 35016 | HP | 35572 | |

| HP | 35770 | LP | 35016 | |

To Learn WD Gann Theory / Method’s Course click below button for relevant information about the Course that covers major topics that I personally practice in my own Trading & Investing career.

After looking at gap down opening & little bounce my action plan of trading on the basis of WD Gann Theory is given as under :

1) Prepared to buy at 35564 with 35380 SL on closing basis ( 15 mins ) – Spot levels always..

2) Now since it is moving up from 35581 instead 35564 would plan to enter if the day high is crossed & sustained. If buying here than target would be 35959 & 36074.

12:08 pm : Exited half @ 1st target & half @ revised SL 35650.

3) Incase if it does not cross day’s high than will follow 1st point mentioned above.

4) In case if it corrects and breaks 35380 than will update what to do..

12:08 pm : Yes now it time to identify depth which seems like 35390 is worst case. I shall participate @ 35570 & @ 35390. ( both levels has to come before 14:30 than only can expected good tradable bounce. )

So what do you expect from me?