Learn How how to calculate gann levels

Use Of Gann 9 Square Calculator On Nifty50 To Know How To Calculate Gann Levels: Normal Case

( Detailed Explanation on how among the whole, 1 specific concept of WD Gann Theory / Method is used here. )

As per WD Gann Theory the stock’s initial 0 degree gives an idea how far the stock can reach. Here, Nifty50’s 0 degree was 17354 from where it started falling, So, as per Gann theory its possible depth was supposed to be 17096 i.e. 180 degree distance from 0 degree point. Being a Gann trader i was prepared to enter in a 1st trade @ 180 distance i.e. @ 17096 and once it is bought, it is supposed to be sold @ 0.80% or 1% gain. Here, expected 1% bounced did not happen as it was supposed to reach 180 degree before 14:30 ( refer attached tweet where it is mentioned ). So no buyside trade in this as per this logic.

Sell side trade opportunity was correct which was to be initated @ 2 levels : 17329 & 17314 . Here SL did not hit & target 17096 got printed finally at the end.

( A tweet referring the sell side trade in Nifty50 is attached below )

Important Note : Before trading on this specific WD Gann Theory / Method consider below points.

[ Movement of Nifty / Indices : Normal case 0 to 180 degree, rare case 0 to 360 degree ( Trade can be taken only if 180 or 360 degree distance is covered before 14:30 ) &

Stocks (3 digits / less volatile ) : Normal 0 to 45 degree, rare case 0 to 90 degree ( Trade can be taken only if 45 or 90 degree distance is covered before 14:30 ). ]

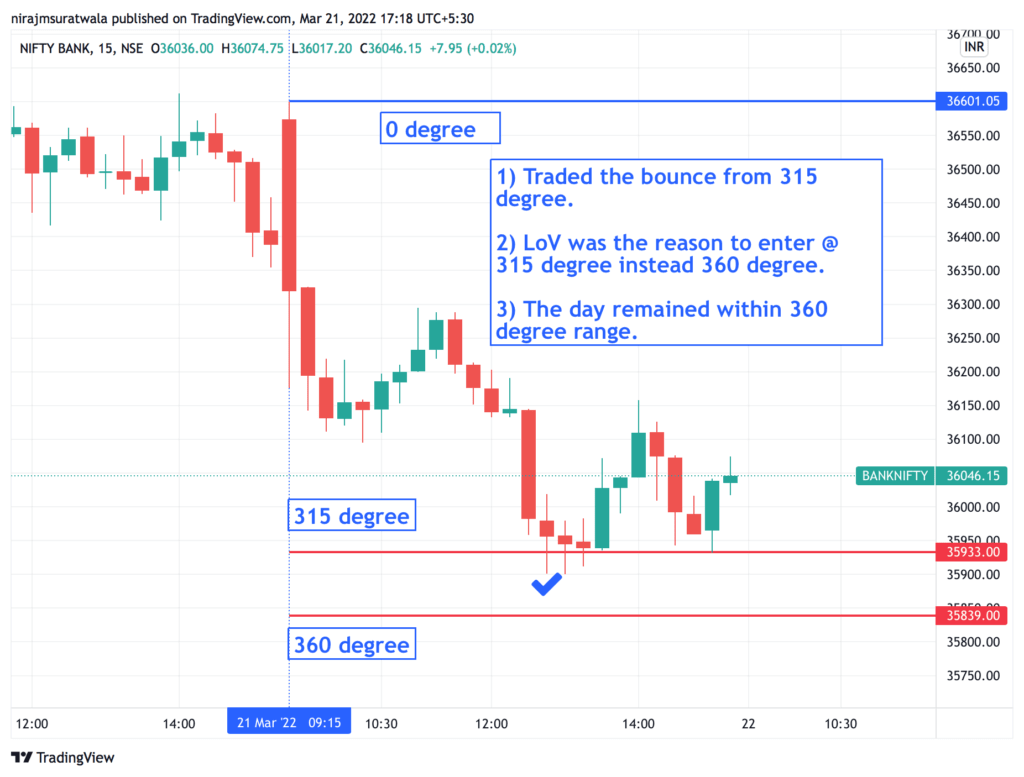

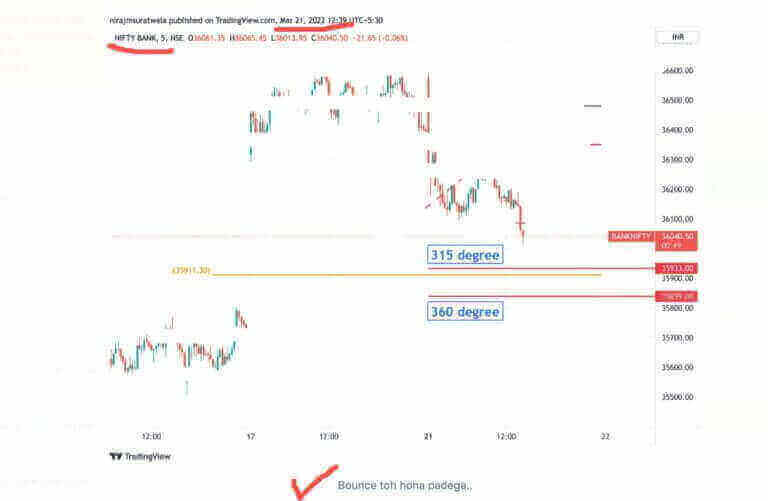

Banknifty : Normal Case of using Gann 9 Square

( Detailed Explanation on how among the whole, 1 specific concept of WD Gann Theory / Method is used here. )

Prediction : Using WD Gann theory could identify that it can stop at 315 degree which was also a level of Law Of Vibration and shall get good tradable bounce from LoV / 315 Degree.

Result : It actually bounced from LoV for good tradable bounce & 35900 CE was traded as per this. Combined 2 topics of WD Gann theory here i.e. Gann Circle & Law Of Vibration.

Reference : Attaching relevant tweet below for you reference.

Important Note : Before trading on this specific WD Gann Theory / Method consider below points.

Every stock or indices has its own capacity to move in 45 degree quantum. Normal & Extreme/Rare capacity differs from stock to stock & indices to indices.

Capacity of Nifty & Banknifty different too.

Banknifty 36065 from 35911.

— Niraj M Suratwala (@NirajMSuratwala) March 21, 2022

Traded 35900 CE.#banknifty #wdgann #gann #traders

its okay if you dont buy but at or near 360 degree, but, at least do not short below 35700, its too late for the day..

— Niraj M Suratwala (@NirajMSuratwala) March 21, 2022

Wipro : Normal case.

( Detailed Explanation on how among the whole, 1 specific concept of WD Gann Theory / Method is used here. )

Prediction : Expected rejection @ 45 degree. Initially stock’s 0 degree was marked as 604.55 & 45 degree distance upside was @ 616.

Result : It reached 45 degree distance i.e. 616 too early & face rejection of good tradable points.

Important Note : Before trading on this specific WD Gann Theory / Method consider below points.

Every stock or indices has its own capacity to move in 45 degree quantum. Normal & Extreme/Rare capacity differs from stock to stock & indices to indices.

Capacity of Nifty & Banknifty different too.

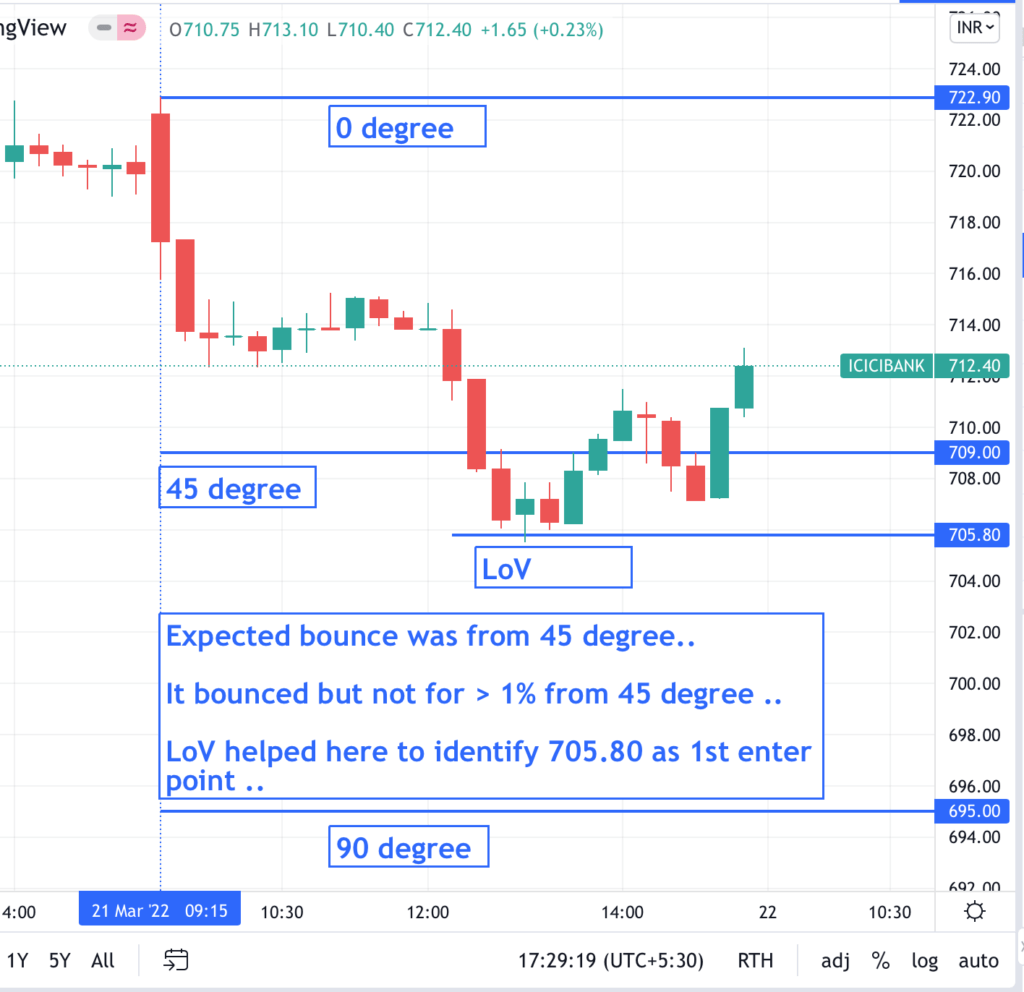

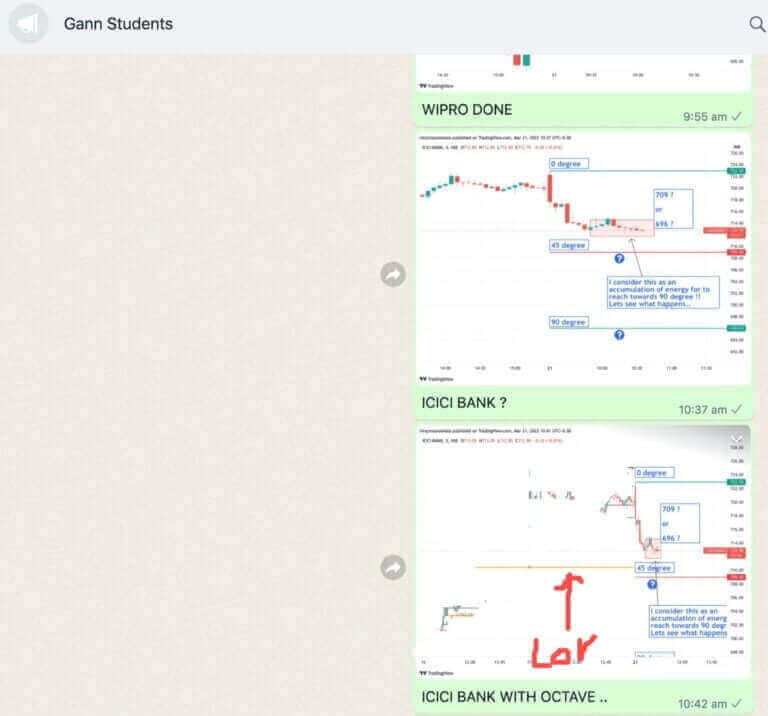

ICICI Bank : Normal case.

( Detailed Explanation on how among the whole, 1 specific concept of WD Gann Theory / Method is used here. )

Prediction : Expected bounce from LoV instead 45 Degree. ICICI Bank initially 0 degree was marked @ 722.90 & expected bounce was from 45 degree. Law Of Vibration ( An imp topic of WD Gann theory ) helped to identify more precise bounce level which was identified as 705.80.

Result : It reached 45 degree distance i.e. 709, hovered there the whole day and bounced for tradable points from LoV level i.e. 705.80

Reference : Attaching relevant tweet/ chat screenshot below for you reference.

Important Note : Before trading on this specific WD Gann Theory / Method consider below points.

Every stock or indices has its own capacity to move in 45 degree quantum. Normal & Extreme/Rare capacity differs from stock to stock & indices to indices.

Capacity of Nifty & Banknifty different too.

MGL Ltd : Normal case.

( Detailed Explanation on how among the whole, 1 specific concept of WD Gann Theory / Method is used here. )

Prediction : Expected bounce from 45 Degree. MGL Ltd initially 0 degree was marked @ 775 & expected bounce was from 45 degree.

Result : It reached 45 degree distance i.e. 761 & bounced for good tradable points !!

Important Note : Before trading on this specific WD Gann Theory / Method consider below points.

Every stock or indices has its own capacity to move in 45 degree quantum. Normal & Extreme/Rare capacity differs from stock to stock & indices to indices.

Capacity of Nifty & Banknifty different too.

Berger Paint : Normal To Rare case.

( Detailed Explanation on how among the whole, 1 specific concept of WD Gann Theory / Method is used here. )

Prediction : Expected rejection from 45 Degree. In Berger Paint Ltd initially 0 degree was marked @ 699 & expected rejection was from 45 degree i.e. from 712.

Result : It reached 45 degree distance i.e. 712 & rejected for good tradable points !!

Reference : Attaching relevant tweet/ chat screenshot below for you reference.

Important Note : Before trading on this specific WD Gann Theory / Method consider below points.

Every stock or indices has its own capacity to move in 45 degree quantum. Normal & Extreme/Rare capacity differs from stock to stock & indices to indices.

Capacity of Nifty & Banknifty different too.

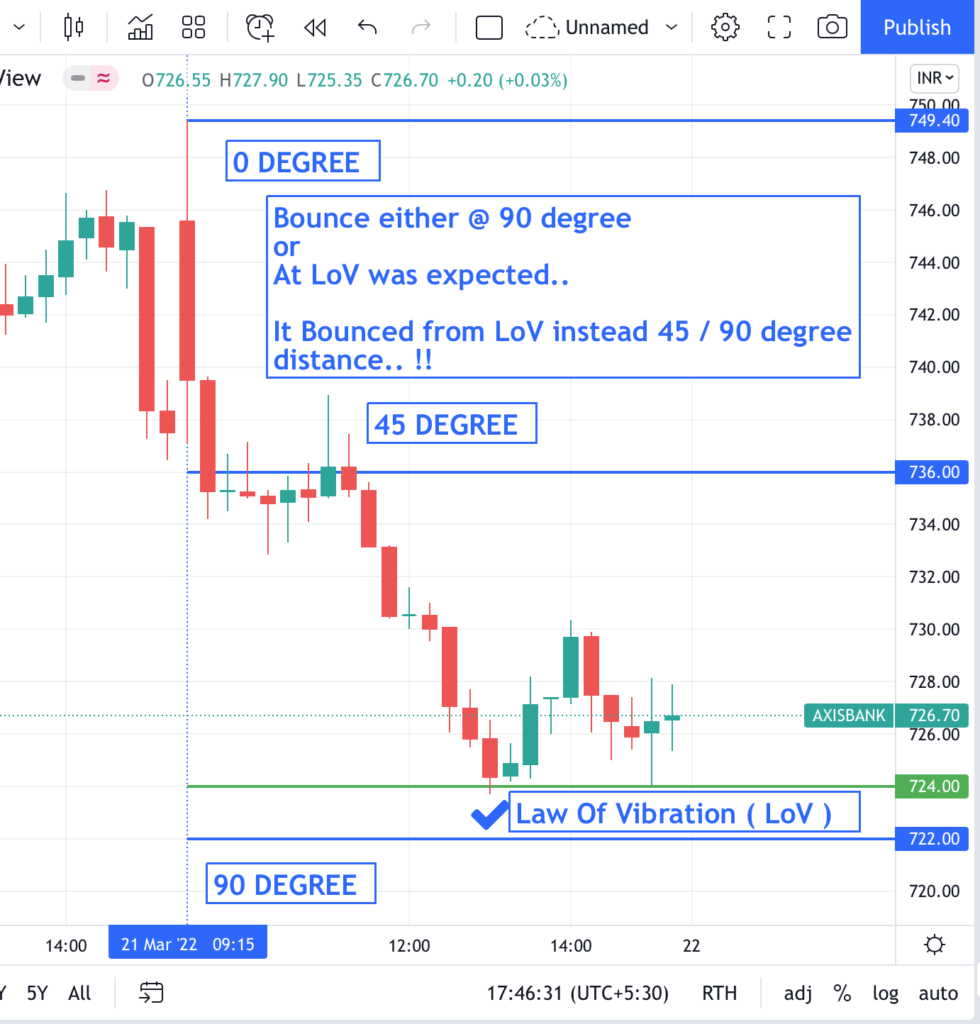

AXIS Bank : Rare case.

( Detailed Explanation on how among the whole, 1 specific concept of WD Gann Theory / Method is used here. )

Prediction : Expected bounce from 90 Degree instead 45 degree. In Axis bank Ltd initially 0 degree was marked @ 749.40 & expected bounce was from 90 degree i.e. from 722.

And as per Law Of Vibration ( A specific method of WD Gann Theory ) expected bounce from 724.

Result : It could not reache 90 degree distance i.e. 722 & bounced for good tradable points from 722 ( Lov ) instead bouncing from 90 degree ( 722 ) !!

Important Note : Before trading on this specific WD Gann Theory / Method consider below points.

Every stock or indices has its own capacity to move in 45 degree quantum. Normal & Extreme/Rare capacity differs from stock to stock & indices to indices.

Capacity of Nifty & Banknifty different too.

Mahindra & Mahindra : Normal case

( Detailed Explanation on how among the whole, 1 specific concept of WD Gann Theory / Method is used here. )

Prediction : Expected rejection from 45 Degree. In Mahindra & Mahindra Ltd initially 0 degree was marked @ 780 & expected rejection was from 45 degree i.e. from 794.

Result : It could not complete 45 degree distance before 14:30 so no trade opportunity was availed in this.

Important Note : Before trading on this specific WD Gann Theory / Method consider below points.

Every stock or indices has its own capacity to move in 45 degree quantum. Normal & Extreme/Rare capacity differs from stock to stock & indices to indices.

Capacity of Nifty & Banknifty different too.

Lupin Ltd : Rare case.

( Detailed Explanation on how among the whole, 1 specific concept of WD Gann Theory / Method is used here. )

Prediction : Expected rejection from 45 Degree. In Lupin Ltd initially 0 degree was marked @ 765 & expected rejection was from 45 degree i.e. from 779.

Result : It could not complete 45 degree distance before 14:30 so no trade opportunity was availed in this.

Important Note : Before trading on this specific WD Gann Theory / Method consider below points.

Every stock or indices has its own capacity to move in 45 degree quantum. Normal & Extreme/Rare capacity differs from stock to stock & indices to indices.

Capacity of Nifty & Banknifty different too.

JSW Steel : Normal case.

( Detailed Explanation on how among the whole, 1 specific concept of WD Gann Theory / Method is used here. )

Prediction : Expected rejection from 45 Degree. In JSW Steel initially 0 degree was marked @ 686 & expected rejection was from 45 degree i.e. from 699.

Result : It could complete 45 degree distance before 14:30 and face good tradable rejection !!

Important Note : Before trading on this specific WD Gann Theory / Method consider below points.

Every stock or indices has its own capacity to move in 45 degree quantum. Normal & Extreme/Rare capacity differs from stock to stock & indices to indices.

Capacity of Nifty & Banknifty different too.

Thats good to know !! Wish you achieve you dream..

also keen to find a point how this comment is related to the subject of this blog.