What is Price Time Squaring?

Gann Price Time Square is a very important and mysterious aspect of William Delbert Gann’s research. Truly speaking no one actually knows about the exact way of doing including me who is on that struggling path too. However, I have made a way to understand how far the PRICE can move in an ongoing direction or how long TIME can hold the price till a certain TIME. For instance, Nifty recently analysed that post breaking the high price of 3/4/23, Nifty should complete its upside move by reaching 17852 from 17428 and this should be done by 17/4/23. As a result, when Nifty crossed the high price of 3/4/23 which was 17428, it reached exactly at 17852 on 17/4/23!

Besides this, it also faced strong rejection @ 17852 only AFTER REACHING THERE on 17/4/23.

So there is a strong relationship between the SPEED of PRICE & TIME,

when the PRICE advances, at a specific time, it has to halt to match the speed of TIME and vice-versa.

Sharing here one real example of using the Price Time Square model applied to Nifty. Please find attached an image that should give an idea about it.

Use Of Price Time Squaring From 22/11/23 and Its Result on Dec'23

Nifty prediction: On 22/11/23, Nifty was supposed to reach 20206 till 1/12/23.

(26/10/23 + 25 trading bars = 1/12/23)

As a result, Nifty reached 20206 exactly on 1/12/23!

(1/12/23 = 26/10/23 + 25 trading bars)

Sharing Some Examples Of Predictions Made On The Basis Of Price Time Squaring

Nifty View From 7/5/23 Onward:

As per same concept, High and Low of 5/5/23 (18216 and 18055) are very important. Going forward if we are crossing 18216 from 7/5 onwards than price can reach till 18662 till 29/5/23. For this upside move low price 18055 has to be kept as a strict SL. 18055 has to remain unbroken on closing basis (daily candle).

It was applied on Bank nifty that worked well too!

On 24/4/23, shared that Bank nifty can reach 43513 and 43619 till 8/5. It was almost a move of 2030 points from given level.

Click on Bank Nifty to access information of its reference.

Reference Of Bank Nifty Prediction For 43513

Reference Of Bank Nifty Prediction For 43619 Using Same Concept

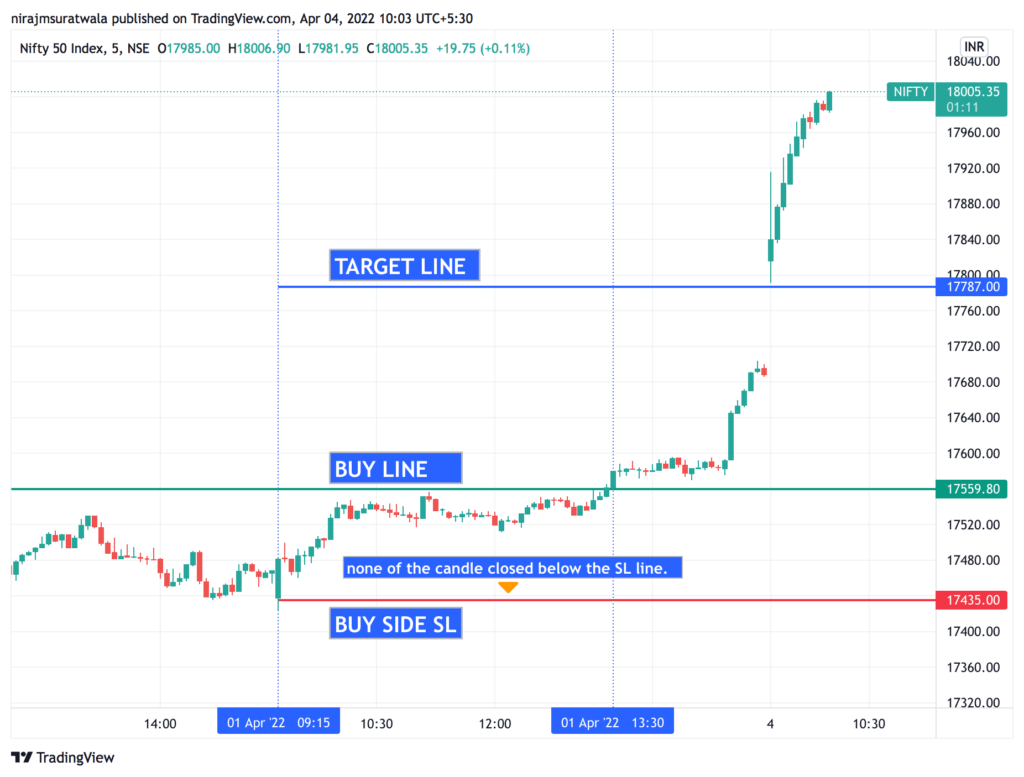

Gann Price Time Square (WD Gann Concept) worked well on Nifty 50.

Nifty50, As Per Price Time Square:

Nifty can reach 17787 till 13/4/22 if HP of 31/3/22 17559 is crossed. SL could be LP of 31/3/22 i.e. 17435 on a closing basis.

(It has to hold LP of 31/3/22 i.e. 17435.)

As Per LoV:

2 Reversal levels: 17187 & 17072. (Short Time Frame)

Disclaimer: Reserved the right to be wrong.

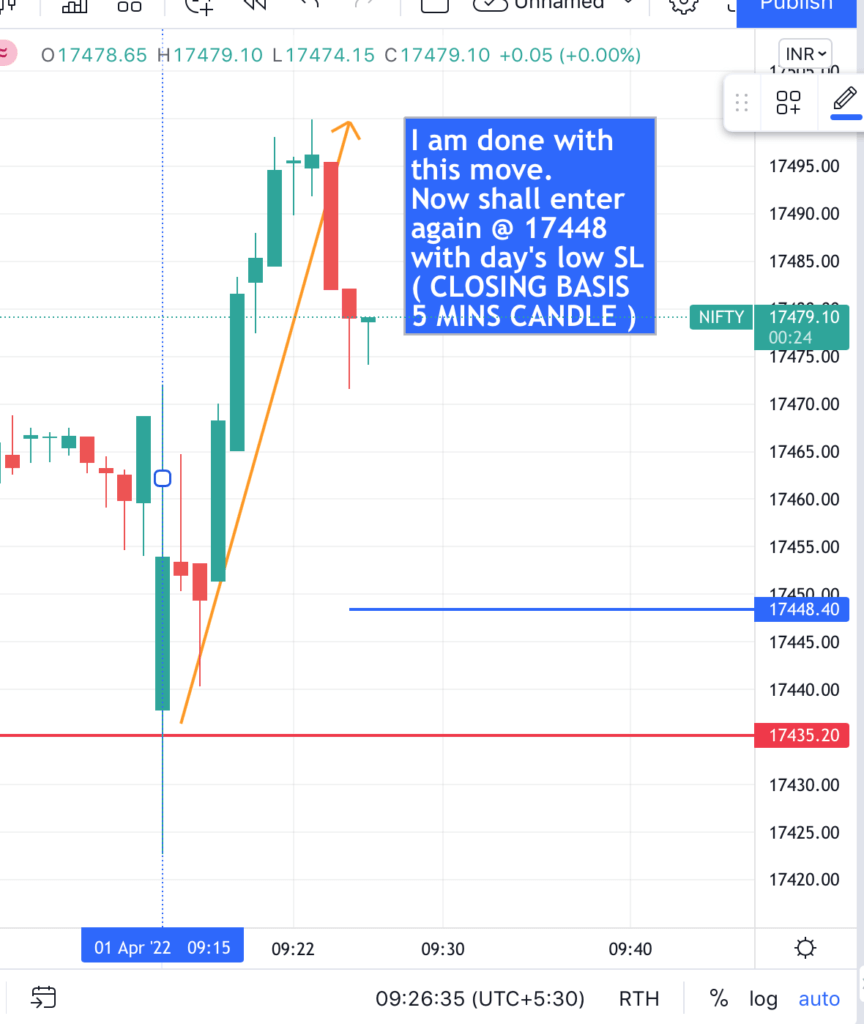

Bought Nifty50 when it was crossing 17435 with 17430 SL. Exited @ 17490. Now shall enter again @ 17448 with 17425 SL (closing basis 5 mins candle).

SPOT Always.

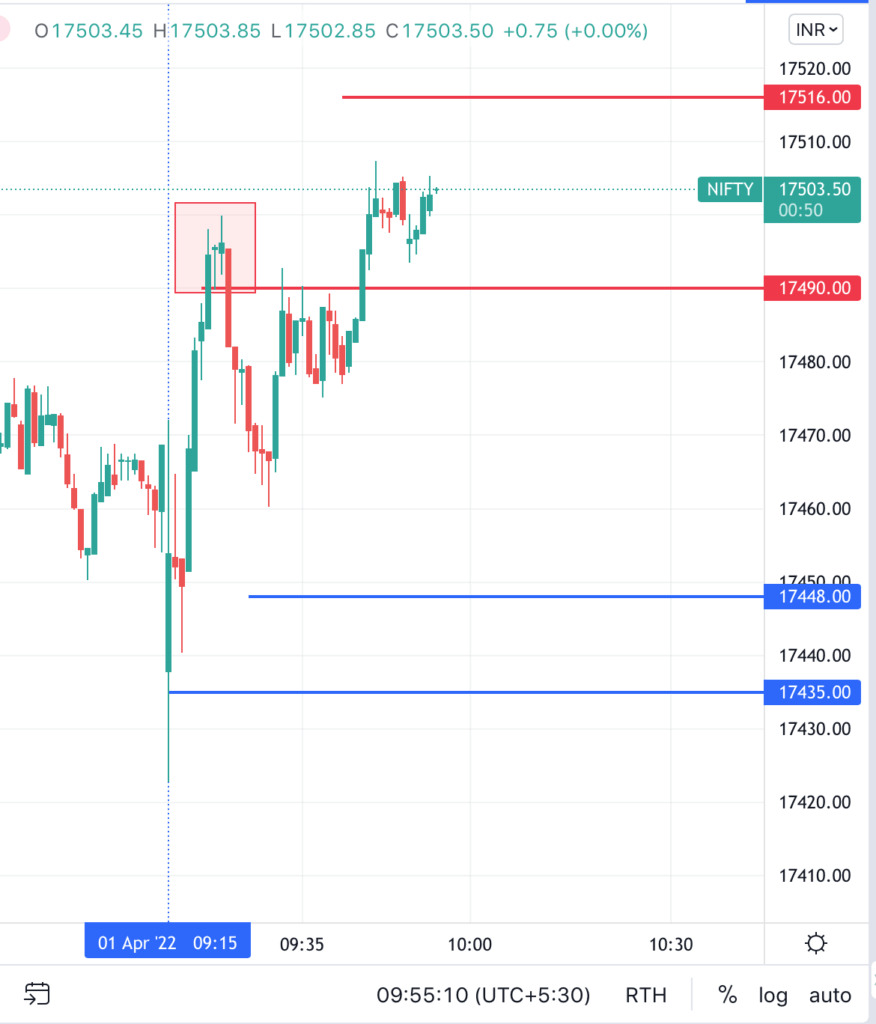

Nifty 50: in its next move reversed from 17460 & was waiting for 17448 (12 points error). expecting 2nd rejection @ 17516, if it happens then shall revise my buying spot.

Nifty 50 as per WD gann circle :

If Day’s low 17422 remains untouched then its possible High of the day as per Normal Case can be 17687 (180 degrees) &

as per Rare case 17954 (360 degrees)

Note as per the standard study of Gann Square Of 9 and more than 50+ examples (you may find some examples of this from blogs & Twitter handles, in case you struggle with messages here will try sharing the link of a relevant thread)

Nifty’s range of the day i.e. High Price & Low Price, as per the Normal Case, remained at 180 degrees in both directional moves.

[Movement of Nifty/Indices: Normal case 0 to 180 degrees, rare case 0 to 360 degrees (Trade can be taken only if 180 or 360-degree distance is covered before 14:30),

Stocks (3 digits / less volatile): Normal 0 to 45 degrees, rare case 0 to 90 degrees (Trade can be taken only if 45 or 90-degree distance is covered before 14:30).]

| Upside | |

| 01/04/22 | |

| Degree | NIFTY |

| 0 | 17422 |

| 45 | 17488 |

| 90 | 17554 |

| 135 | 17621 |

| 180 | 17687 |

| 225 | 17754 |

| 270 | 17820 |

| 315 | 17887 |

| 360 | 17954 |

| LP | 17422 |

| HP | ? |

To Learn more about this concept you can read a book written by Tony Plummer.

Here sharing a link that will redirect you to the right place. Click on “Tony Plummer“.

Thank You.

Sir

If Nifty crosses 90⁰ only till 2.30 pm, then what is the probability or trade strategy

if in different direction it moves within 90 degree twice than I consider it as it has wasted energy & 180 degree distance remains unachievable on both side.

Are you choosing some specific dates or random one?

Specific