Wd Gann Theory/Method’s Trading Learning Material and Outlook of Nifty 50 or Stock market: My favourite topic Law Of Vibration was used in provided predictions.

WD Gann Theory Applied on Stock (Dabur) to see how trading opportunity is to be identified and how to trade on it..!! This concept of gann theory is very helpful for those who prefer stock trading.

Outlook and trading opportunities in Stocks, Nifty 50, Stock market & on other tradable instruments as per WD Gann theory & Astrology is shared in this page.

WD Gann Theory Trading: Trading Using Gann Circle on Axis Bank from 28/3 to 8/4 that worked well !! learn wd gann trading theory

Gann Theory Concept, Price Time Square applied on Nifty 50 that worked well!! 1/4 Learning Material.

Learning Material For Trading In Stock (mgl, wipro, lupin, mahindra & mahindra, mcdowell, axis bank, jubilant pharma, berger paint & dabur) At Right Time & Price 28/3

Learning Material For Trading In Banknifty At Right Time & Price 28/3

Learning Material For Trading In Nifty50 At Right Time & Price 28/3

Learning Material & Outlook of Nifty 50, Banknifty or Stock market: 24/3/22 (How to trade in Stock market using WD Gann theory is explained here)

Learning Material & an experiment done on Nifty50. Results on nifty50 of 1 concept of Gann Theory is explained step by step. learn wd gann trading theory and get edge.

Learning Material & Outlook of Nifty 50, Stock or Stock market: 21/3/22 (How to trade in Stock market using WD Gann theory is explained here)

WD Gann Theory/Method's Trading Learning Material & Outlook of Nifty 50, Stock or Stock Market: 17/3/22 (How to trade in Stock market using WD Gann theory is explained here)

WD Gann Trading Learning Material & Outlook of Nifty 50, Stock or Stock market: Mahindra & Mahindra Ltd. (How to trade in Stock market using WD Gann theory is explained here)

Gann Method's Trading Learning Material & Outlook of Nifty50, Stock or Stock market: Axis Bank Ltd. (How to trade in Stock market using WD Gann theory is explained here)

WD Gann Learning Material & Outlook of Nifty 50, Stock or Stock market: AXIS Bank Ltd. (How to trade in Stock market using WD Gann theory is explained here)

WD Gann Theory/Method's Trading Learning Material & Outlook of Nifty 50, Stock or Stock market: Mcdowell or United Spirits Ltd. (How to trade in Stock market using WD Gann theory is explained here)

WD Gann Theory/Method's Trading Learning Material & Outlook of Nifty 50, Stock or Stock market: Mahindra & Mahindra Ltd. (How to trade in Stock market using WD Gann theory is explained here)

WD Gann Theory/Method's Trading Learning Material & Outlook of Nifty 50, Stock or Stock market: LUPIN Ltd. (How to trade in Stock market using WD Gann theory is explained here)

WD Gann Theory/Method's Trading Learning Material & Outlook of Nifty 50, Stock or Stock market: WIPRO Ltd. (How to trade in Stock market using WD Gann theory is explained here)

WD Gann Theory/Method's Trading Learning Material & Outlook of Nifty 50, Stock or Stock market: JSW Steel Ltd. (How to trade in Stock market using WD Gann theory is explained here)

WD Gann Theory/Method's Trading Learning Material & Outlook of Nifty 50, Stock or Stock market: MGL Ltd. (How to trade in Stock market using WD Gann theory is explained here)

WD Gann Theory/Method's Trading Learning Material & Outlook of Nifty 50, Stock or Stock market: ICICI Bank Ltd. (How to trade in Stock market using WD Gann theory is explained here)

WD Gann Theory/Method's Trading Learning Material & Outlook of Nifty 50, Stock or Stock market: Berger Paints Ltd. (How to trade in Stock market using WD Gann theory is explained here)

WD Gann Theory/Method's Trading Learning Material & Outlook of Nifty 50, Stock or Stock market: 28/2/22 (How to trade in Stock market using WD Gann theory is explained here)

WD Gann Theory/Method's Trading Learning Material & Outlook of Nifty50, Stock or Stockmarket: 25/2/22 (How to trade in Stockmarket using WD Gann theory is explained here)

WD Gann Theory/Method's Trading Learning Material & Outlook of Nifty50, Stock or Stockmarket: 22/2/22 (How to trade in Stockmarket using WD Gann theory is explained here)

WD Gann Theory/Method's Trading Learning Material & Outlook of Nifty50, Stock or Stockmarket: 21/2/22 (How to trade in Stockmarket using WD Gann theory is explained here)

WD Gann Theory/Method's Trading Learning Material & Outlook of Nifty50, Stock or Stockmarket: 18/2/22 (How to trade in Stockmarket using WD Gann theory is explained here)

WD Gann Theory/Method's Trading Learning Material & Outlook of Nifty50, Stock or Stockmarket: 15/2/22 (How to trade in Stockmarket using WD Gann theory is explained here)

WD Gann Theory/Method's Trading Learning Material & Outlook of Nifty50, Stock or Stockmarket: 14/2/22 (How to trade in Stockmarket using WD Gann theory is explained here)

WD Gann Theory/Method's Trading Learning Material & Outlook of Nifty50, Stock or Stockmarket: 11/2/22(How to trade in Stockmarket using WD Gann theory is explained here)

WD Gann Theory/Method's Trading Learning Material & Outlook of Nifty50, Stock or Stockmarket: 10/2/22(How to trade in Stockmarket using WD Gann theory is explained here)

WD Gann Theory is experimented & explained how it can help in trading stock & stockmarket. here nifty50 is taken & applied this experiment on it to find trend changing points of nifty50.

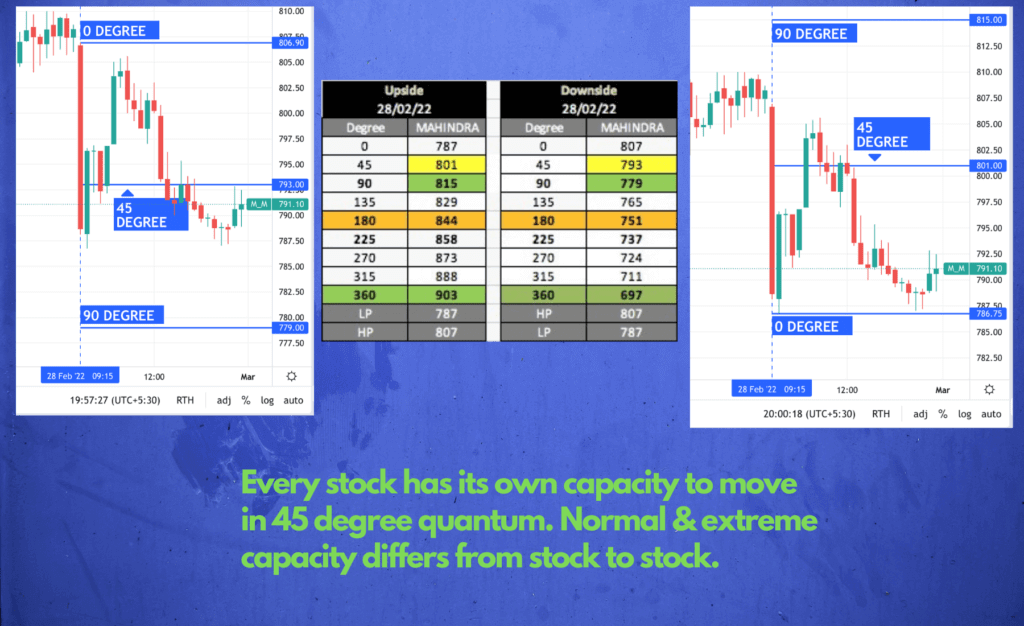

Outlook Of Mahindra & Mahindra share as per wd gann theory for 28/2/22

Mahindra & Mahindra: Normal Case

- From 0 degree ( 806 ) to 45 degree ( 793 ) distance covered & bounced well.

- Post revising 0 degree to 786.75 rejection noticed @ 45 degree distance i.e. 801.

- Was also prepared to enter @ 90 degree distance at both side i.e. to short @ 815 & to buy @ 779.

[ Movement of Nifty / Indices : Normal case 0 to 180 degree, rare case 0 to 360 degree.

Stocks (3 digits / less volatile ) : Normal 0 to 45 degree, rare case 0 to 90 degree. ]

Outlook Of Lupin share as per wd gann theory for 28/2/22

Lupin Normal: Normal Case

- From 0 degree ( 728 ) to 45 degree ( 742 ) distance covered.

- Could have taken position if it could happen before 2 pm which did not happen.

- No trade in this, at the ned it just stoped at 45 degree i.e. @ 742.

[ Movement of Nifty / Indices : Normal case 0 to 180 degree, rare case 0 to 360 degree.

Stocks (3 digits / less volatile ) : Normal 0 to 45 degree, rare case 0 to 90 degree. ]

Outlook Of Wipro share as per wd gann theory for 28/2/22

WIPRO rare case: Trade closed @ no profit no loss.

- From 0 degree (544) to 45 degree (556) distance covered.

- Position taken @ 556 & also punched order add more @ 568.

- Expected rejection @ 45 degree i.e. @ 556 could not happen & it just hovered around 45 degree whole day. At the end closed the position @ 556

[Movement of Nifty/Indices: Normal case 0 to 180 degree, rare case 0 to 360 degree.

Stocks (3 digits/less volatile): Normal 0 to 45 degree, rare case 0 to 90 degree.]

Outlook on Nifty, Stocks & Stock Market as per WD Gann theory for 9/2/22

Nifty ( Spot level )

Let 8/2/22 day close.

On 9/2/22 if Nifty is crossing HP of 8/2 it should move upside..

If Nifty is breaking LP Of 8/2 than it should fall further..

Example for Buy-side trade : Suppose HP of 8/2 is 100 Rs & on 9/2 it is opening @ 102 than not to trade, wait for price to come at least @ 99.99 than if it is crossing 100, it should be considered as an activation of buy trade. Vice/versa for Sell side trade.

Now exit is totally depends on your risk appetite, generally target should be at-least 1/2 of the range of 8/2 day. Range = HP – LP of 8/2/22.

SL – If buy gets activated than LP of 8/2 is SL & if sell gets activated than HP of 8/2 is your SL.

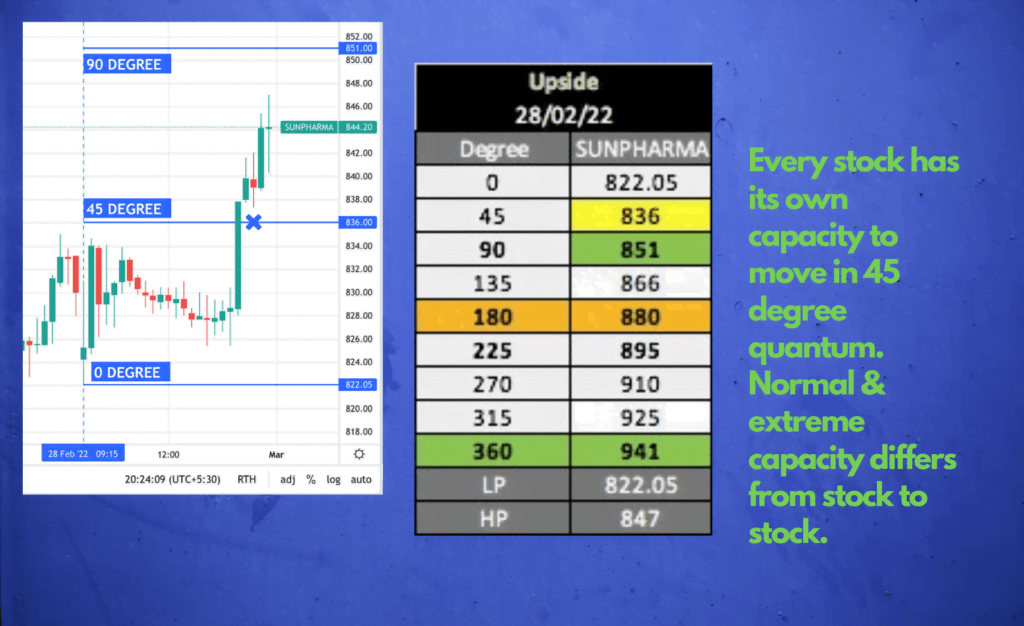

wd gann theory/method’s learning material & outlook of Sunpharma Ltd for 26/2/22

Sunpharma: Rare case

- From 0 degree ( 822 ) to 45 degree ( 836 ) distance covered & did not face rejection. Failed here.

- As a rare case it remained within 90 degree distance i.e 851, high made was 847 only.

- 90 degree distance it did not complete may be due to till 13:30 it changed its directions twice @ 45 degree.

[ Movement of Nifty / Indices : Normal case 0 to 180 degree, rare case 0 to 360 degree.

Stocks (3 digits / less volatile ) : Normal 0 to 45 degree, rare case 0 to 90 degree. ]

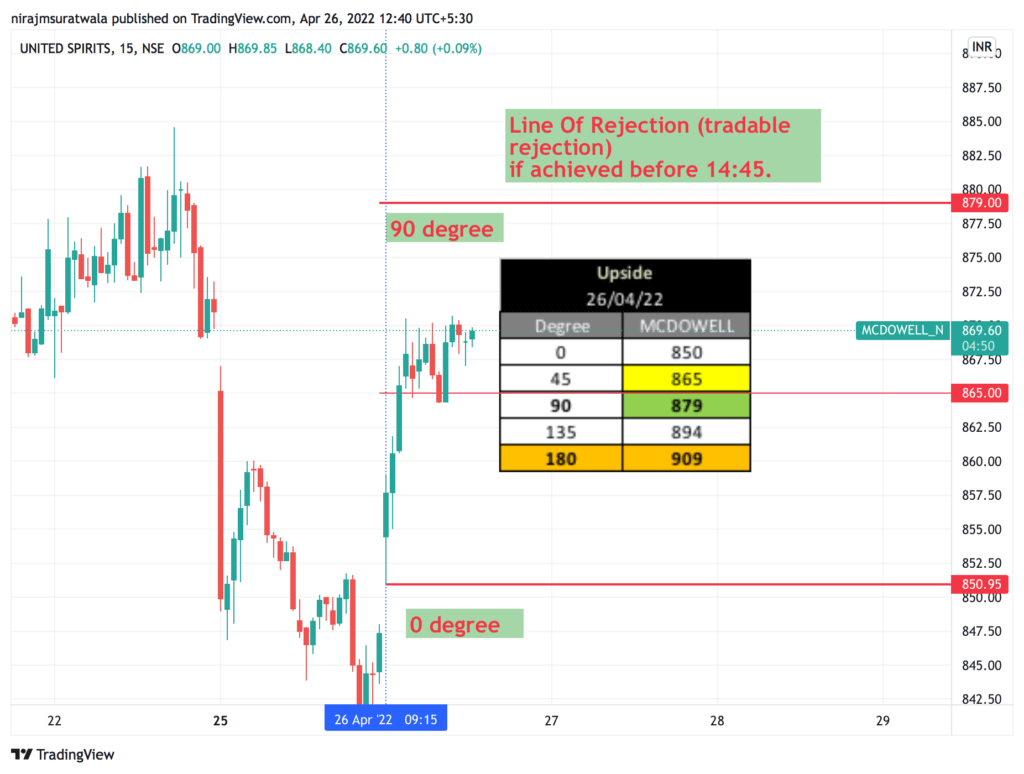

For 26/4/22 : Note - Tradable rejection/reversals in 3 digits stocks possible @ 45 degree only if it is achieved before 2:30 pm. Same way possible rejection / reversal @ 90 degree in 3 digits stocks possible only if it is achieved before 2:45 pm.

- Mahindra CMP 730. Expect tradable rejection at 738.

( adding further stocks info soon.. ) - Nifty50 : rejection at 180 valid till 0 degree value is maintained.

- Nifty50 : LoV level is 17353.

Upside 26/04/22 Degree NIFTY 0 17110 45 17175 90 17241 135 17307 180 17373 225 17439 270 17505 315 17571 360 17637 LP 17110 HP ? - Banknifty to face tradable rejection at 36378. ( Typing error : actual rejection level is 36736 )

- WIPRO : CMP 533, Tradable bounce is expected @ 525.

Downside 26/04/22 Degree WIPRO 0 537 45 525 90 514 135 503 180 492 - ICICI BANK : CMP 758, Tradable bounce expected at 754 ( normal case ). If considered rare case than tradable bounce at 742. ( I would participate at both levels by distributing trading qty at equal proportion at both levels.

Downside 26/04/22 Degree ICICI BANK 0 768 45 754 90 741 135 727 180 714 - AXIS BANK : CMP 794. Tradable rejection @ 802 ( normal case ). If considered a rare case than good tradable rejection possible at 815 level.

Upside 26/04/22 Degree AXIS BANK 0 788 45 802 90 816 135 831 180 845

MCDOWELL: OUTLOOK AS PER WD GANN THEROY (GANN TRADING THEORY)

1. nifty50 26/4/22

No Trade Day as per Gann Circle :

Nifty50 made a new low so earlier 0 degree revised from 17110 to 17064 so as to get revised upside 180 degree value i.e. 17326.

Nifty50 could not complete 180 degree value distance within whole day in either directions & just remained within 180 degree value.

| Upside | |

| 26/04/22 | |

| Degree | Nifty50 |

| 0 | 17064 |

| 45 | 17129 |

| 90 | 17195 |

| 135 | 17261 |

| 180 | 17326 |

| 225 | 17392 |

| 270 | 17458 |

| 315 | 17524 |

| 360 | 17591 |

| LP | 17064 |

| HP | 17223 |

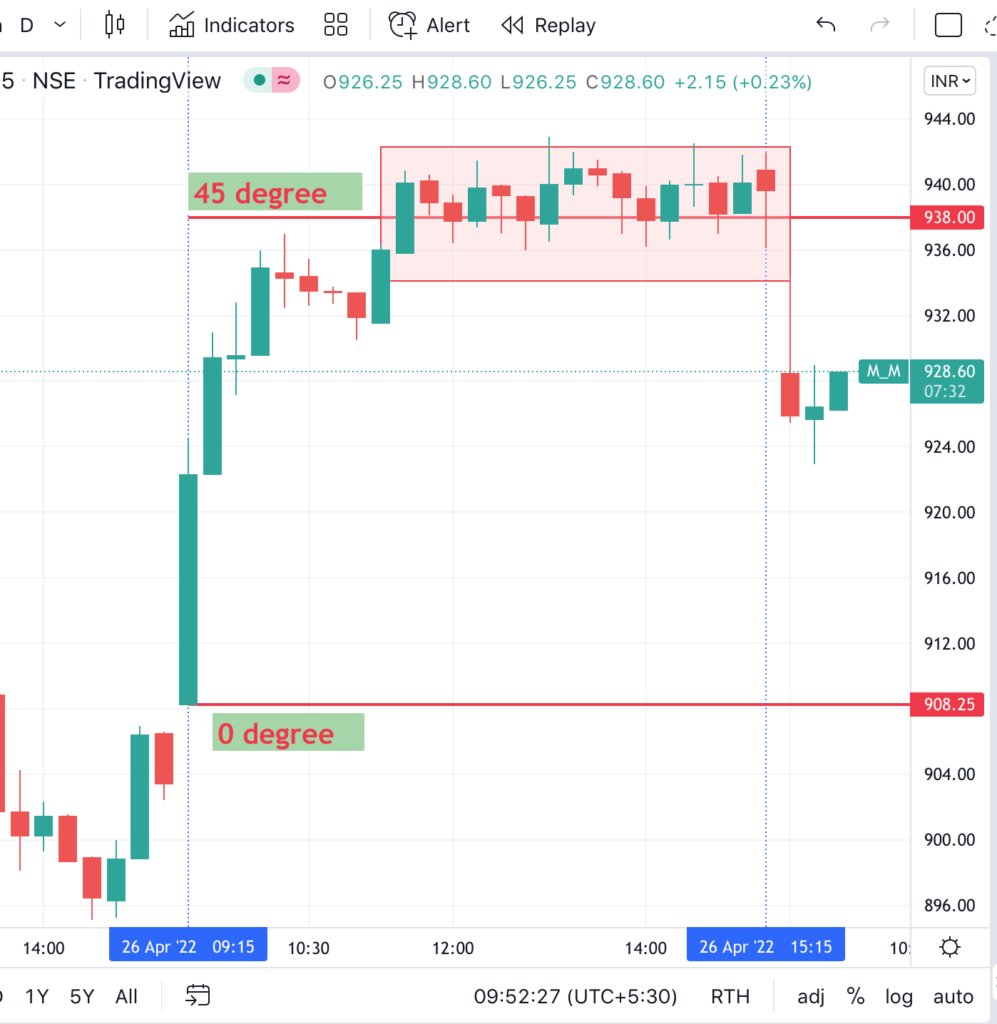

2. Mahindra:

Trade with no profit no loss !!

Mahindra & Mahindra completed 45 degree distance within 2:30 pm & a tradable rejection was expected right from 938.

Here we could not get tradable rejection ( a rejection of 7-8 points ).

Though the whole day it just stoped & hovered at 45 degree i.e. @ 938 & day closed there.

| Upside | |

| 26/04/22 | |

| Degree | Mahindra |

| 0 | 908 |

| 45 | 923 |

| 90 | 939 |

| 135 | 954 |

| 180 | 970 |

BANKNIFTY:

No trade as it could not reach at expected rejection line.

WD Gann Theory/Method's Trading Learning Material & Outlook of Nifty50, Stock or Stockmarket: 9/2/22(How to trade in Stockmarket using WD Gann theory is explained here)

On a normal course, daily price range (HP – LP) of indices remains within 180 degree value.

In rare case it covers 360 deg value.

In Stock (3 digits) : normal case 45 deg, rare case 90 deg

MGL Ltd

An example of rare case in which 3 digits Stock broke 45 degree in 1st candle

& completed 90 degree distance on 3rd candle & reversed well !!

United Spirits/mcdowell

#hdfcbank

— Niraj M Suratwala (@NirajMSuratwala) December 21, 2021

Gann methods Learning material :

On a normal course, its daily price range (HP-LP) remains within 180 degree value. In rare case it covers 360 deg value.(refer attachment)#stocks : normal case 90deg, rare case 180deg 👈#gann #seekers #traders #OptionsTrading pic.twitter.com/ktBDDCBF7L

#Maruti 27/12 : 4 digits but high value stock.

— Niraj M Suratwala (@NirajMSuratwala) December 30, 2021

Gann methods Learning material :

On a normal course, its daily price range(HP-LP) remains within 180 degree value.

In rare case it covers 360 deg value.(refer attachment)#gann #trading #Options #investing #StockMarket #stocks pic.twitter.com/IZPUbwQMSP

#Hindustanuniliver

— Niraj M Suratwala (@NirajMSuratwala) December 21, 2021

Gann methods Learning material :

On a normal course, its daily price range (HP-LP) remains within 180 degree value. In rare case it covers 360 deg value.(refer attachment)#stocks :normal case 90deg, rare case 180deg👈#gann #seekers #traders #OptionsTrading pic.twitter.com/XHM98Vm8w7

#nifty 20/12/21 : #Learning material & update

— Niraj M Suratwala (@NirajMSuratwala) December 17, 2021

many people pre-assume d #trend & take trade in advance accordingly, U SHOULD NEVER DO THIS.

Allow 20/12/21 2 close 1st than lets c how market reacts above its HP. I shall update on this on right #time#gann #retailers #stockmarkets pic.twitter.com/J4afC4Sniy