Explained What Is WD Gann & How To Apply It On Stocks:

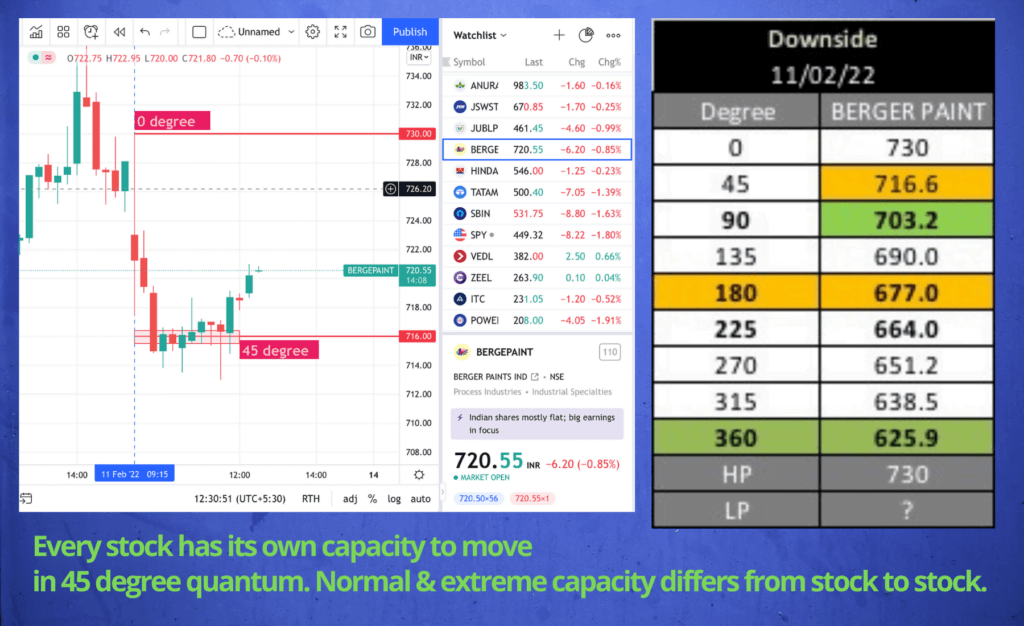

Berger Paint Share

A good example of normal case :

Stock moved from 0 degree to 45 degree gradually but before 2:30 pm,

as expected bounce noticed from that 45 degree distance i.e. 716 for good tradable points!

[Movement of Nifty / Indices: Normal case 0 to 180 degree, rare case 0 to 360 degree.

Stocks (3 digits / less volatile): Normal 0 to 45 degree, rare case 0 to 90 degree.]

Berger Paint rare case :

- Initially from opening high / 0 degree it went straight down towards 90 degree, i.e. from 681 to 655! Thanks to Law Of Vibration that suggested to waited till 650 & enter there instead 45 degree (668) or 90 degree (655) PROVIDED REFERENCE OF 650 AT THE BOTTOM by sharing a tweet.

- Once it reached at 650 it really bounced well & made a high of 698.20!

- As an extreme rare case it just stoped @ 180 degree instead of 90 degree!

[Movement of Nifty / Indices : Normal case 0 to 180 degree, rare case 0 to 360 degree.

Stocks (3 digits / less volatile): Normal 0 to 45 degree, rare case 0 to 90 degree.]

To learn Gann Square Of 9 click below button for relevant information about the amazing trading course

Berger Paint should bounced from 650 ?

— Niraj M Suratwala (@NirajMSuratwala) February 28, 2022

( bounce for only today for good tradable points )#bergerpaint #stockstowatch #stocks #gann #trading #wdgann