Tanla Platforms Stock Prediction Success: Applying WD Gann Theory and Fundamentals for Long-Term Gains

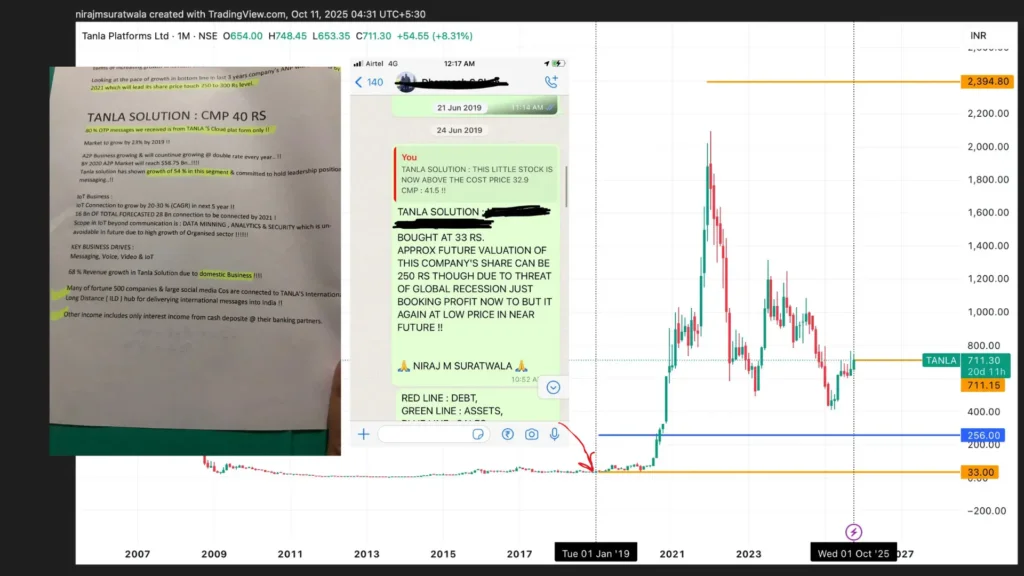

As of October 10, 2025, Tanla Platforms (TANLA.NS) shares are trading at ₹711. This is a testament to the stock’s impressive growth trajectory in the competitive cloud communications sector. Reflecting on historical performance, this marks a significant leap from its 2019 levels. In June 2019, when the stock was hovering around ₹33 per share, I issued a detailed prediction highlighting its undervalued potential. My prediction was grounded in WD Gann theory. This theory leverages geometric patterns, time cycles, and astrological influences for market forecasting. Alongside this, it included comprehensive fundamental analysis of the company’s financials, revenue growth, and industry positioning. I forecasted that Tanla Platforms could reach a minimum target of ₹256.

This projection was not based on guesswork but on a blend of price-time tools from Gann’s methods, such as the square of nine and angle trends, combined with the Fundamentals like earnings potential and market expansion in A2P messaging.

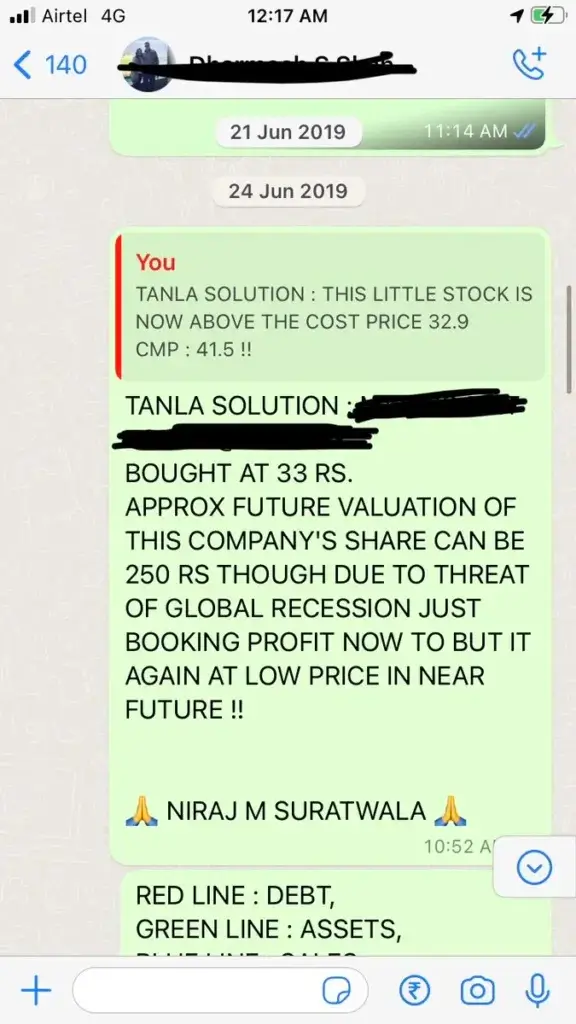

Here’s a screenshot of my original June 2019 prediction for reference:

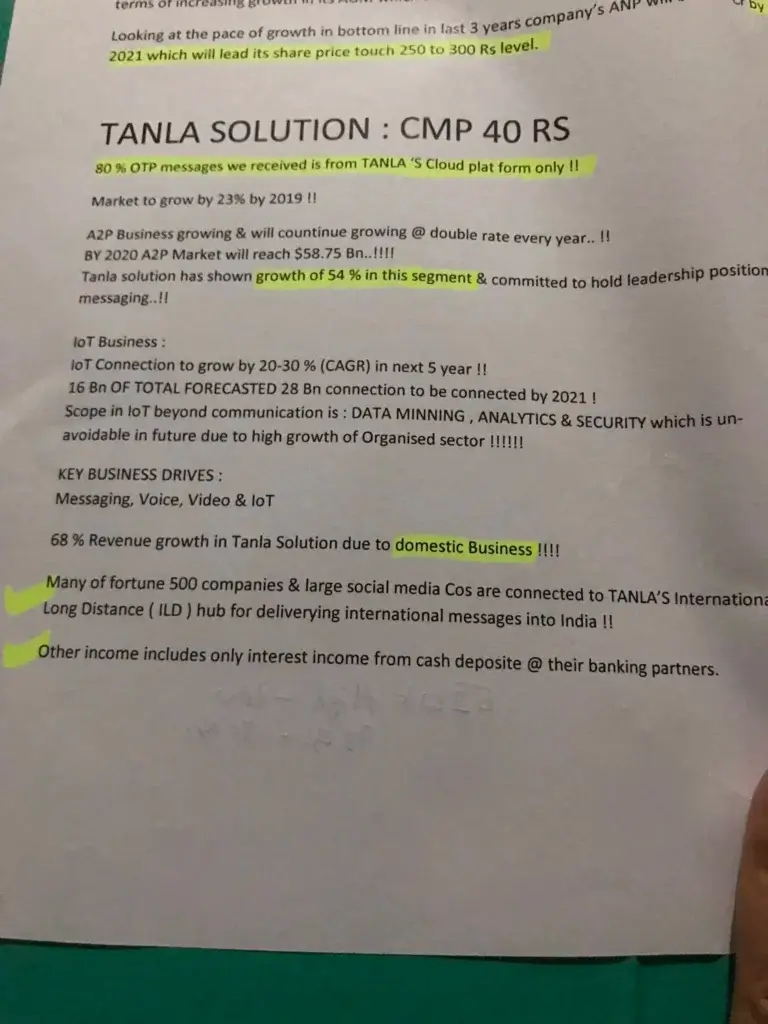

Additionally, I’m sharing below the key reasons and notes that explain why I shortlisted this stock as one of the best picks, based on a thorough fundamental analysis.

As depicted in the screenshot above, the key notes and critical reasons outlined were more than sufficient. They accurately forecasted the stock’s potential future value.

Outcome of the prediction:

As evident from the attached image below, the stock remarkably achieved the forecasted target of ₹256—a pivotal Gann level—in a mere 18 months.

Beyond the screenshot, let’s delve deeper into the advanced projections identified as early as 2019, which anticipated even greater upside beyond the initial ₹256 target. These insights, derived from extended WD Gann cycles and ongoing fundamental monitoring, highlighted a potential peak at ₹2394 amid an active 5th wave cycle. Unfortunately, the stock reversed course prematurely at ₹2096, falling short of that ambitious high due to market dynamics and external factors—yet still delivering substantial gains for early adopters.

Currently, with Tanla Platforms trading at ₹711, this represents an opportune moment for investors to re-enter the position. The compelling rationale stems from WD Gann theory: the stock’s active 5th cycle is projected at ₹2394, creating a significant and attractive gap from the current market price of ₹711—signaling substantial upside potential for those who act strategically.

Some Pages You’ll Definitely Want to Read:

Disclaimer: I am not an S.E.B.I. registered advisor. This website is purely for training and educational purposes. I shall not be responsible for your profit or loss. Please confirm with your investment advisor before making any investment decisions.