Learn How To Trade In Nifty 50

Explore a concise Nifty 50 trading strategy here. My Gann Course, based on WD Gann Theory, doesn’t even cover this approach. The purpose of sharing is just to drag your attention to “time” or “X-axis.”.

(Providing Gann Theory learning material in sequence order: Recent to Older)

You must learn the Gann time cycle for a better detailed approach to time analysis.

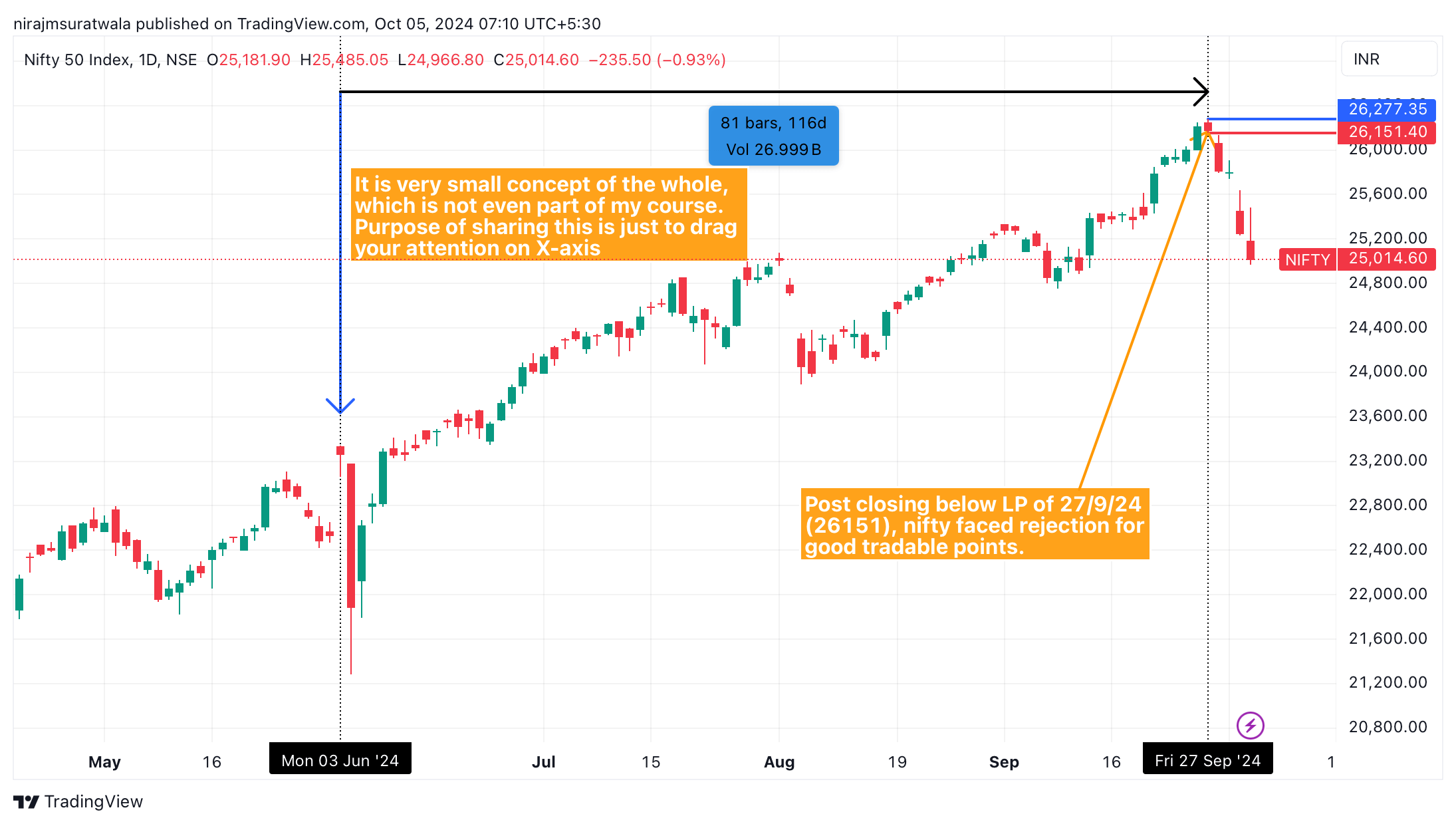

Nifty Trading Strategy: Added 81th Trading Bars from 03/06/24 & we got 27/09/24 as a Level Candle.

Explanation of the below image:

In Nifty, added 81 trading bars from 03/06/24 and arrived on 27/9/24. After closing above the high price of 27/9/24 we witnessed a very good downside move.

Try to find what is that common affecting element in below image? Is that common factor is 81 trading bars?

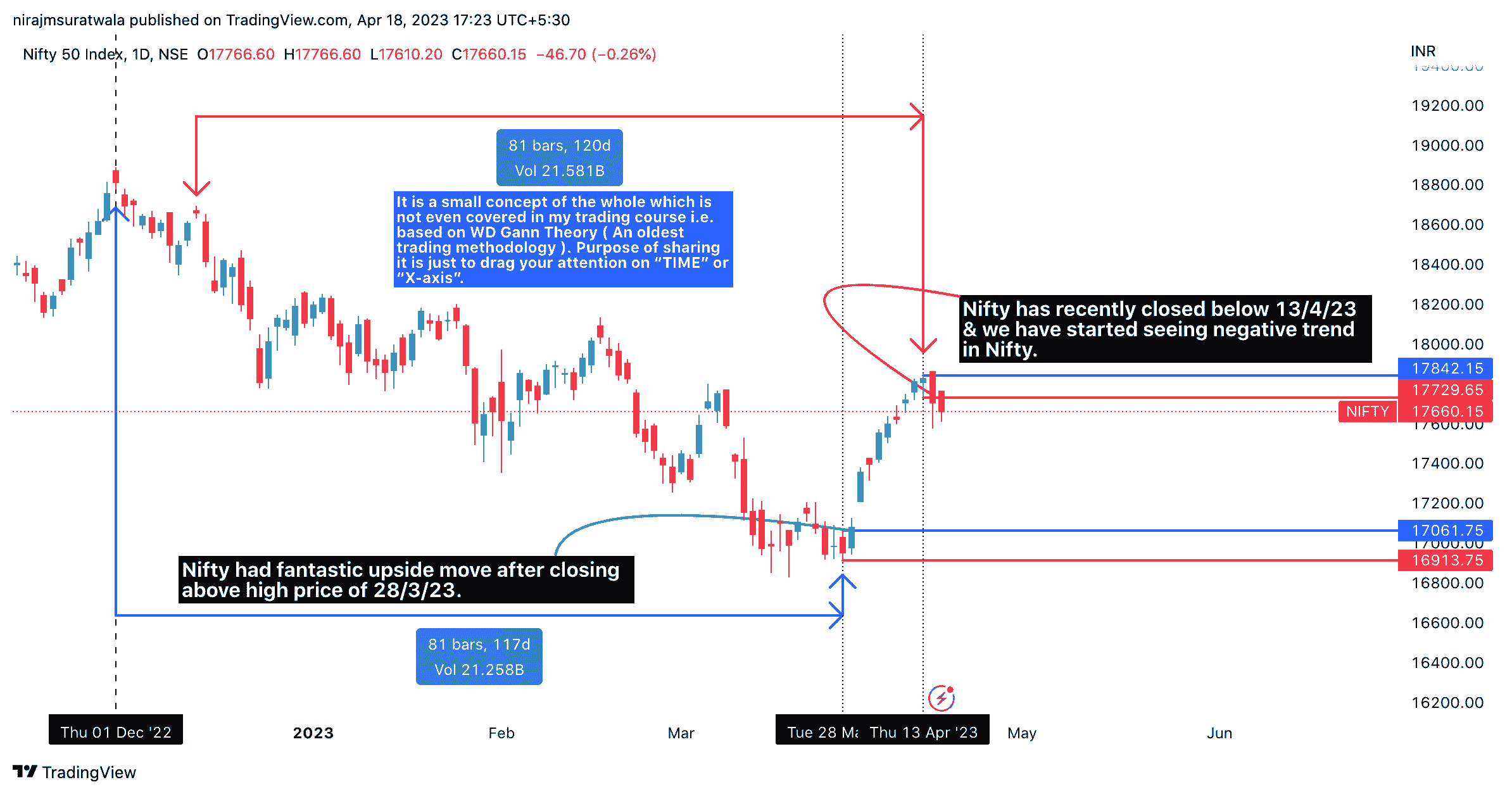

Nifty Trading Strategy: Added 81th Trading Bars from 26/12/22, and we got 26/04/22 as a Level Candle. (How to trade in nifty 50 & nifty prediction 2023 explained)

Explanation of the below image:

In the Nifty index, adding 81 trading bars from December 26, 2022, results in April 26, 2023.

After the index closes above the high price of April 26, 2023, it experiences a significant upward movement.

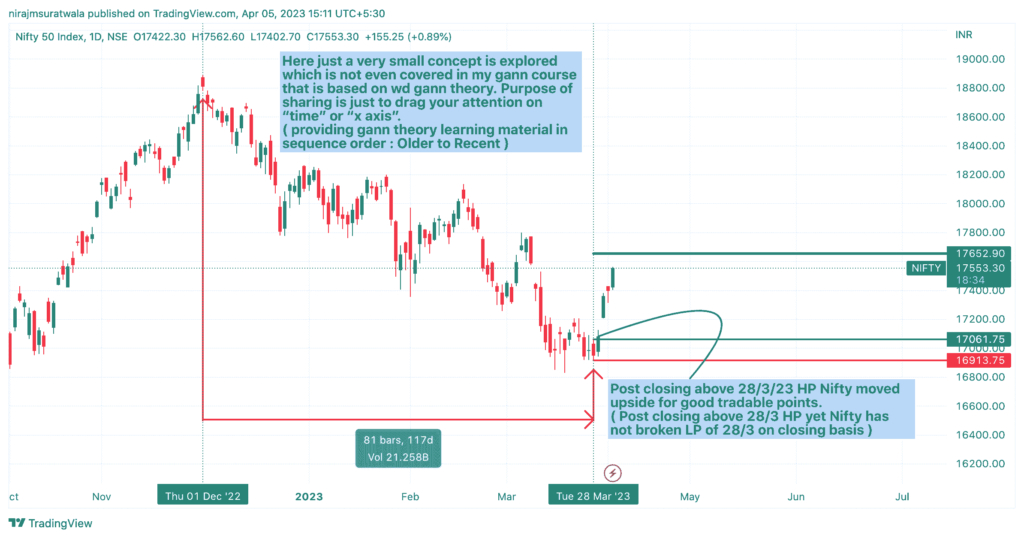

Nifty Trading Strategy: Added 81th Trading Bars from 01/12/22 & we got 28/03/23 as a Level Candle.

The image highlights two key points. First, adding 81 trading bars from December 1, 2022, results in March 28, 2023.

After the Nifty index closes above the high price of March 28, 2023, it experiences a significant upward movement.

Number 2)

After that successful result, have added 81 trading bars from 14/12/22 which gave us 13/4/23 date. After closing below 17729 (Low price of 13/4/23) we are seeing negative trend now.

Nifty Trading Strategy Explained:

After calculating 81 trading bars from 01/12/22 we arrive at 28/3/23. I marked the high price (HP) and low price (LP) of 28/03 on the Nifty Trading View Price Chart.

On March 28, 2023, Nifty’s high was 17,061, low was 16,913, marked on the Spot Chart. A one-day period determined Gann Levels for trading Nifty 50. Closing above 17,061 triggered an upside rally. We set the stop-loss at 16,913 on a closing basis.

Do not trade on this concept without walking through all examples as given below & backtesting them properly.

This helps in doing nifty gann analysis & with this, nifty prediction is doable with ease. This must help you to learn How to trade in nifty 50.

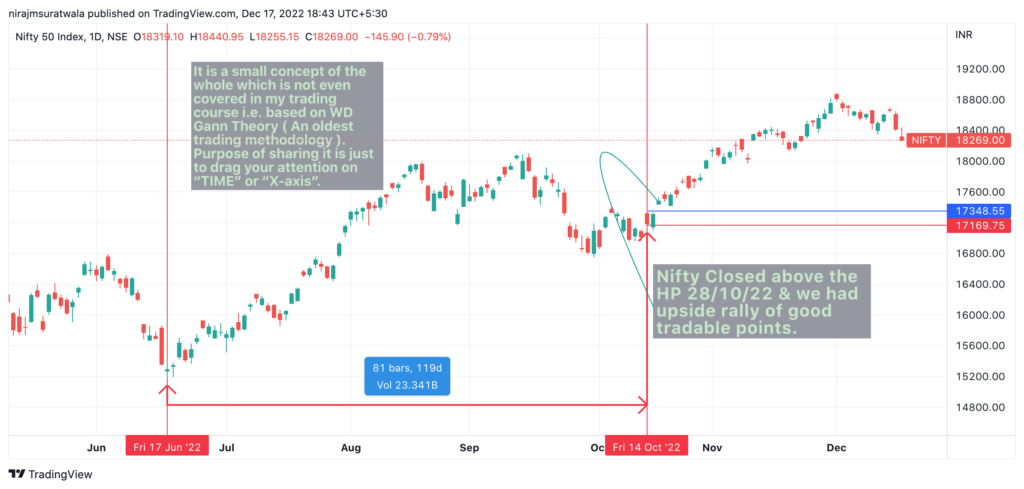

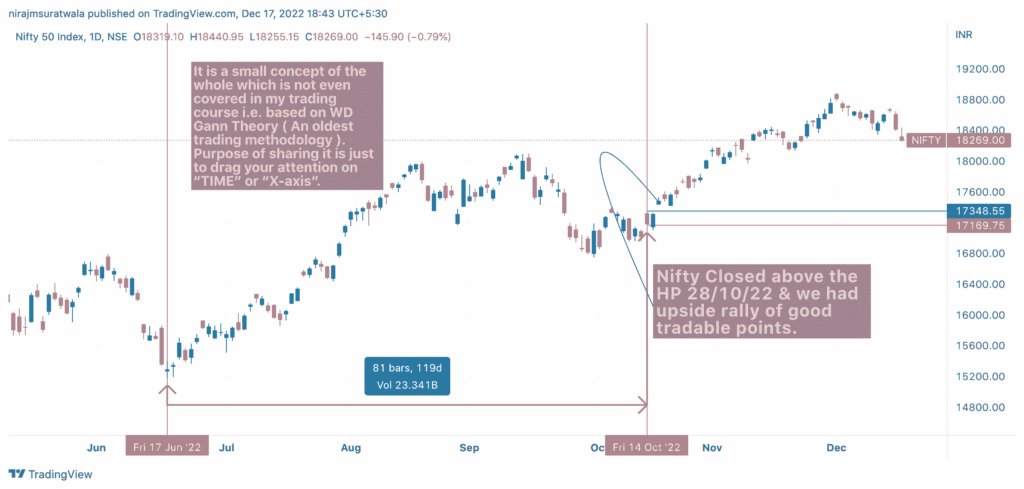

Nifty Trading Strategy: Added 81th Trading Bars from 17/6/22 & we got 14/10/22 as a Level Candle. (How to trade in nifty 50 & Nifty Prediction 2023 or Nifty gann analysis explained)

Nifty Gann Trading Strategy Explained:

After calculating 81 trading bars from 17/06/22 we arrive at 14/10/22.

We marked the high price (HP) and low price (LP) of 14/10 on the Nifty Price Chart.

On October 14, 2022, Nifty’s high was 17,348, low was 17,169, marked on the Spot Chart. A one-day close above or below these set Gann Levels for Nifty. Closing above 17,348 sparked a tradable upside rally. We set the stop-loss at 17,169 on a closing basis.

(This helps in doing nifty gann analysis, with this nifty prediction 2023 or nifty gann prediction is doable with ease. This must help you to learn How to trade in nifty 50.)

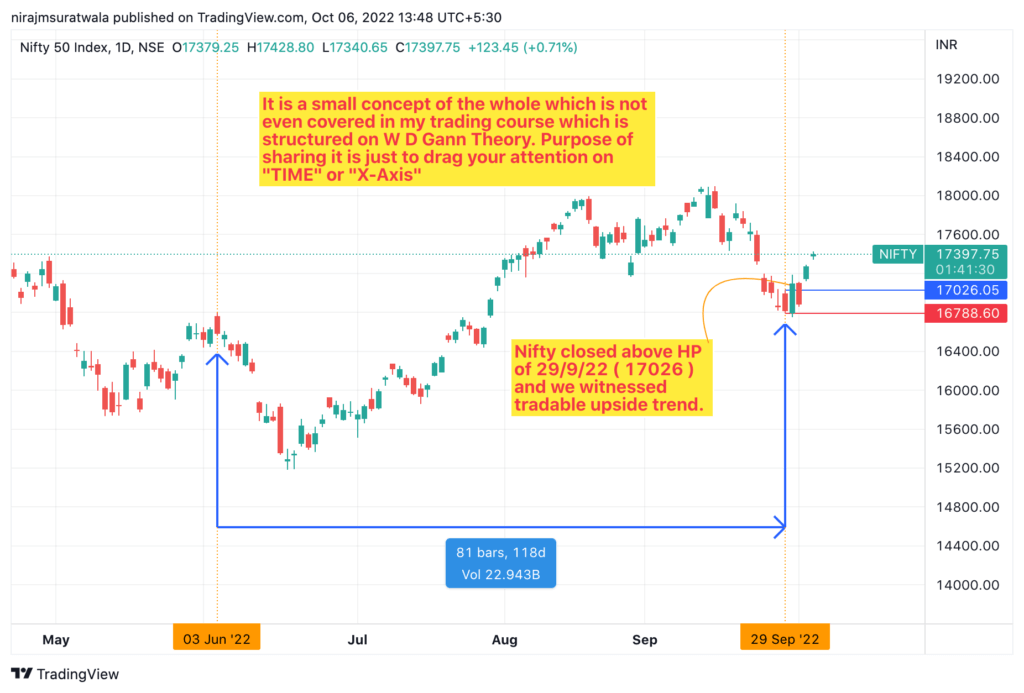

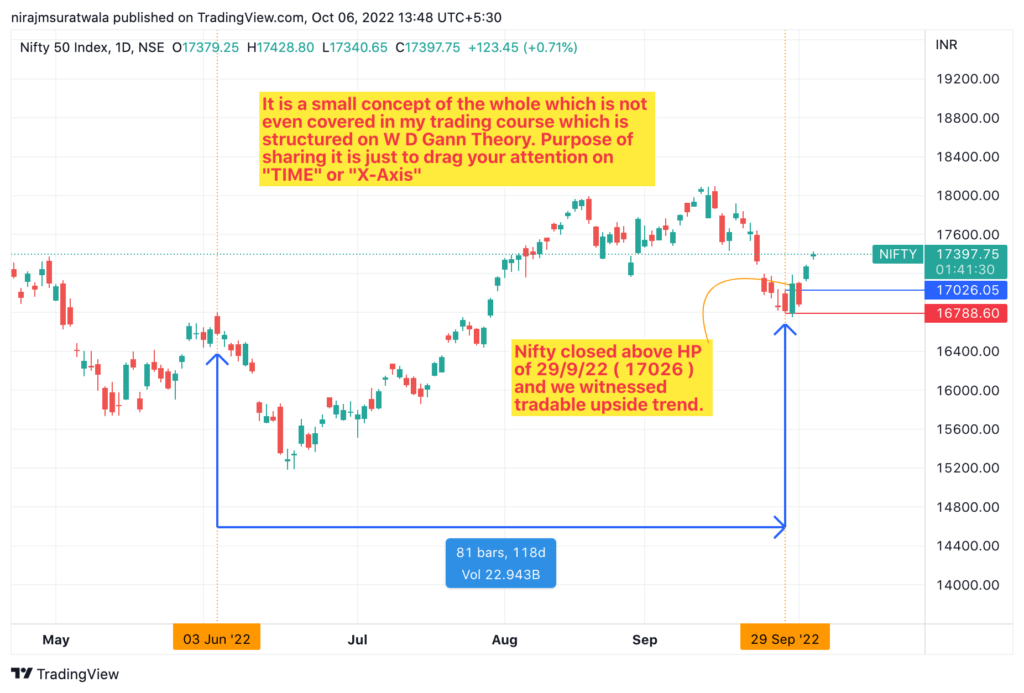

After calculating 81 trading bars from 03/06/22 we arrive at 29/09/22. We marked the high price (HP) and low price (LP) of 29/09 on the Nifty Price Chart.

Let a day close above or below the HP/LP of 29/9/22 to get gann levels for nifty & an idea of Nifty outlook. HP is 17026 & LP is 16788 as marked them on Nifty Spot Price Chart.

The Nifty closes above the high price of September 29, triggering a tradable upside rally (set stop-loss at the low price of September 29, i.e., 16,788 on a closing basis).

With this you can make & back test nifty prediction for 2024.

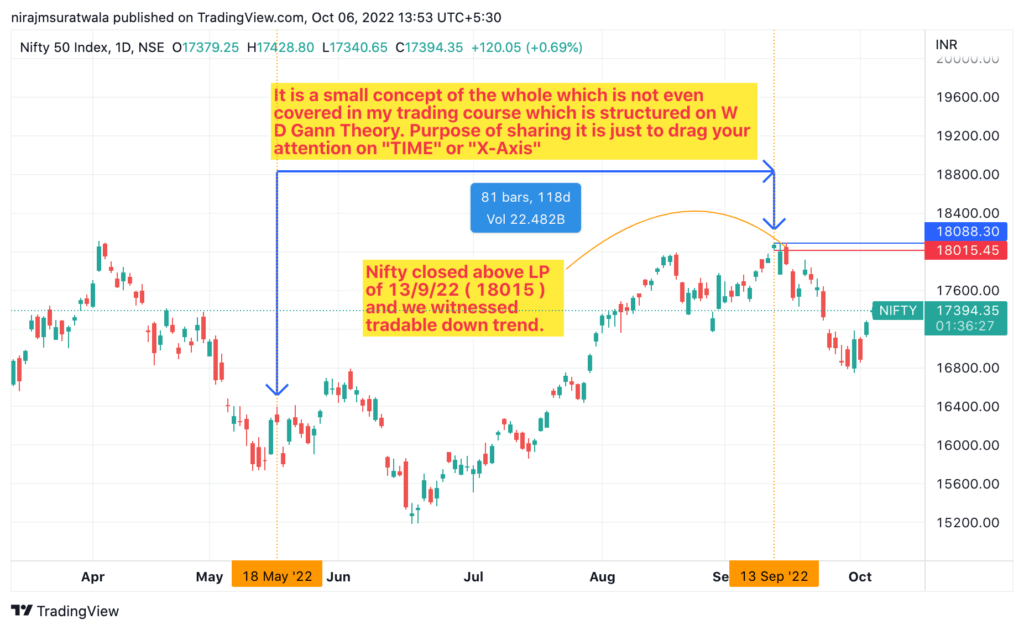

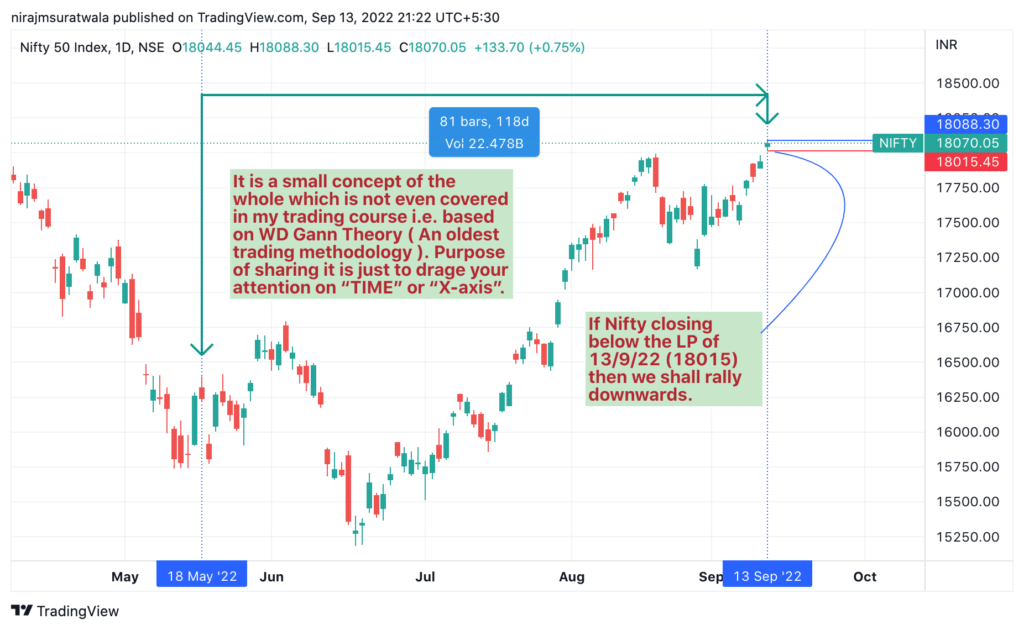

We added 81 trading bars from 18/5/22, which brought us to 13/9/22 as the Level Candle. This is a Nifty trading strategy that explains how to trade in Nifty 50.

After calculating 81 trading bars from 18/05/22 we arrive at 13/09/22. We marked the high price (HP) and low price (LP) of 13/09 on the Nifty Price Chart.

On September 13, 2022, Nifty’s high was 18,088, low was 18,015, marked on the Spot Chart. A one-day close above or below these set Gann Levels for Nifty. Closing below 18,015 could trigger a downside rally. We set the stop-loss at 18,088 on a closing basis.

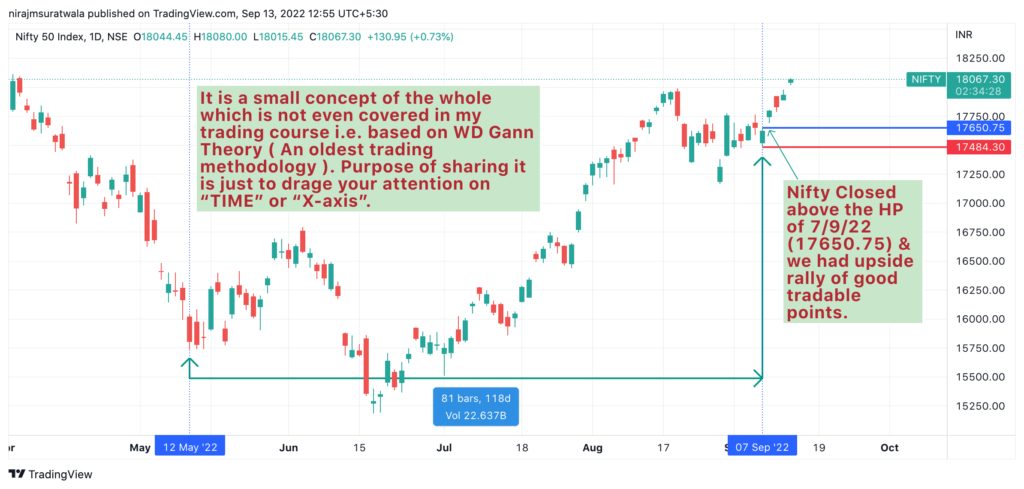

Added 81th Trading Bars from 12/5/22 & we got 7/9/22 as a Level Candle. (I share a Nifty Trading Strategy for trading in Nifty 50.)

After calculating 81 trading bars from 12/05/22 we arrive at 07/09/22. We marked the high price (HP) and low price (LP) of 07/09 on the Nifty Price Chart.

We were suppose to Let a day close above or below the HP/LP of 07/9/22 to get gann levels for nifty & an idea of Nifty outlook. HP is 17650.75 & LP is 17484.30 as marked them on Nifty Spot Price Chart. Nifty did close above the HP of 7/9 & activated buy signal. After giving buy signal Nifty went up for good tradable points.

After the buy signal activates, Nifty does not close below the low price of September 7, so the stop-loss does not trigger.

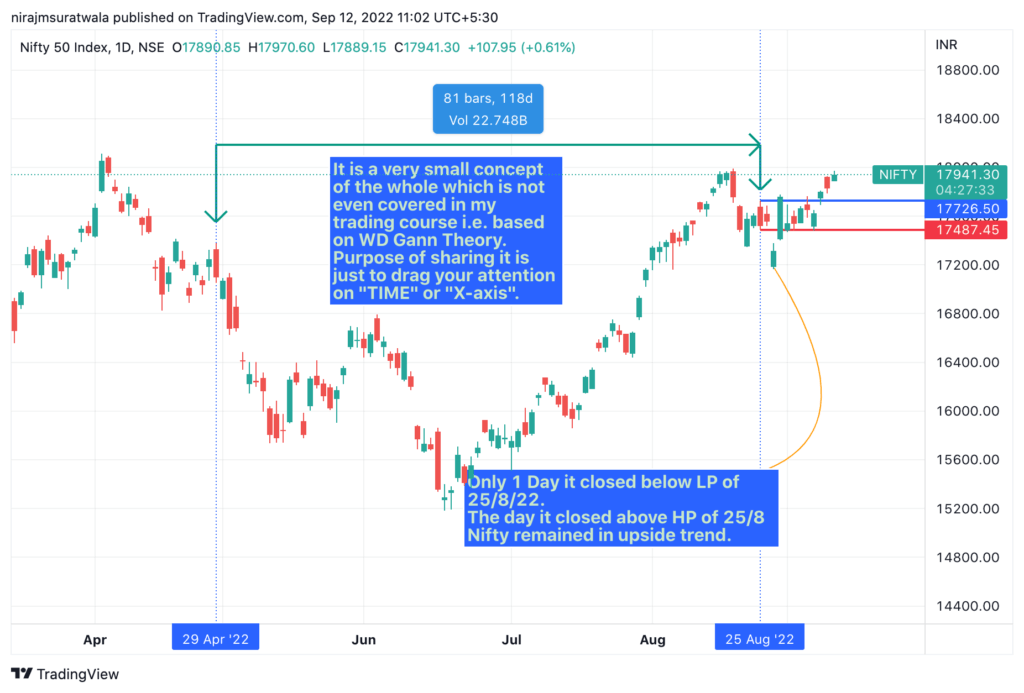

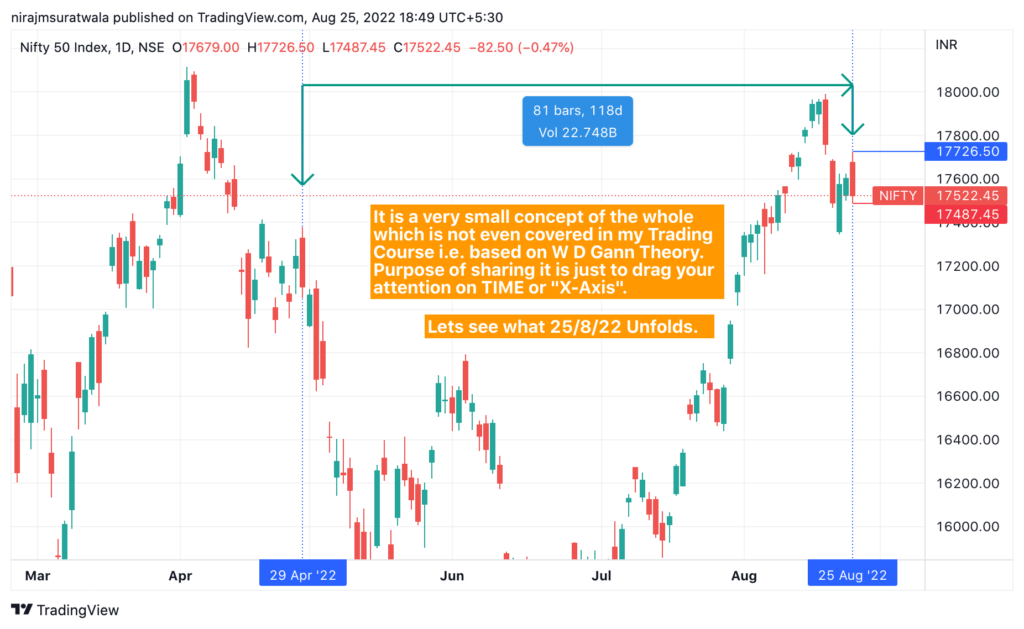

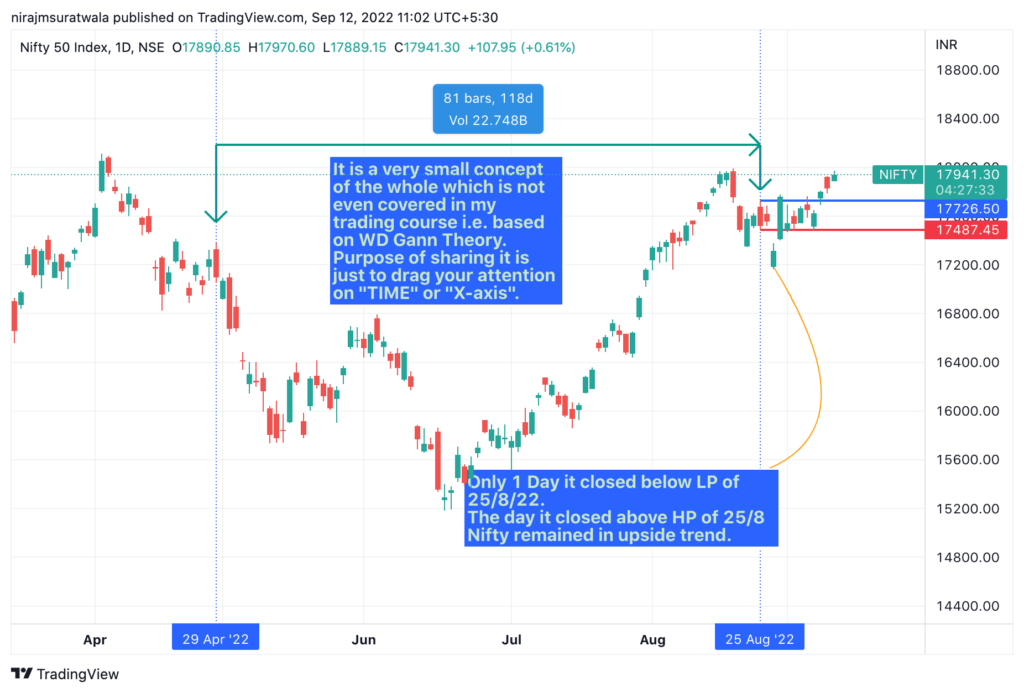

I added the 81st trading bar from April 29, 2022.I cover how to trade in Nifty 50 using W.D. Gann theory and share a Nifty trading strategy.

Adding 81 trading bars from April 29, 2022, gives August 25, 2022, for Nifty Gann Levels. We marked the high and low prices of August 25 on the Nifty Price Chart.

The high price (HP) and low price (LP) of August 25 are significant; a closing on either side indicates the upcoming trend in Nifty.

A) Nifty closed below the low price of August 25, 2022, triggering a short position. A close above the high price of 17,726 activated the stop-loss on August 30, 2022.

B) We could see only 1 candle closed below the LP of 25/8 date. Once Nifty closed above the HP of 25/8 it went upside for good tradable points. Yes, this strategy failed once & then Nifty reacted as per expectation as it has till date (refer all examples mentioned below)

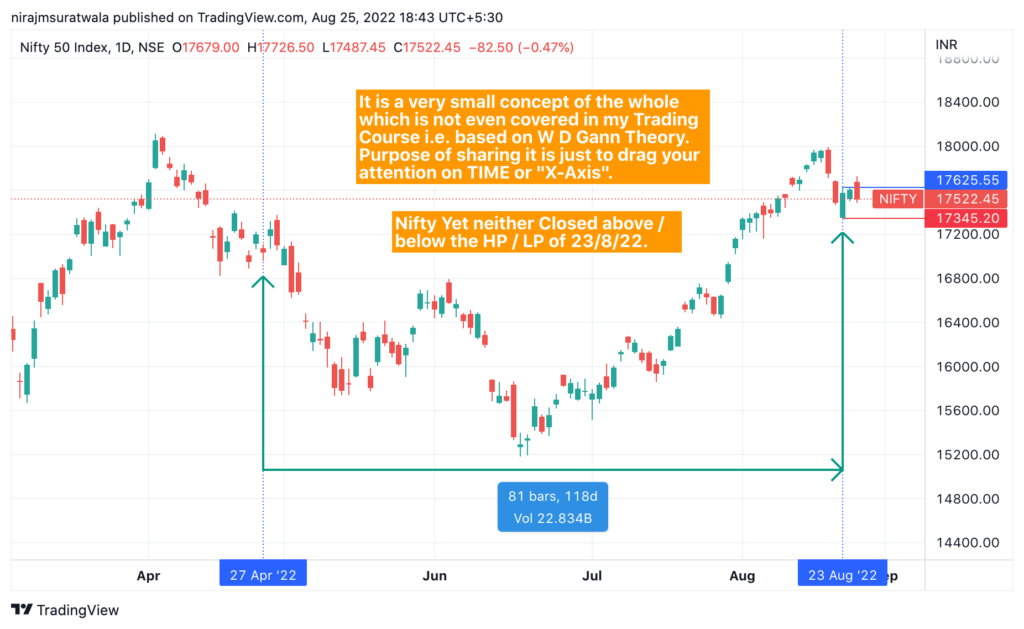

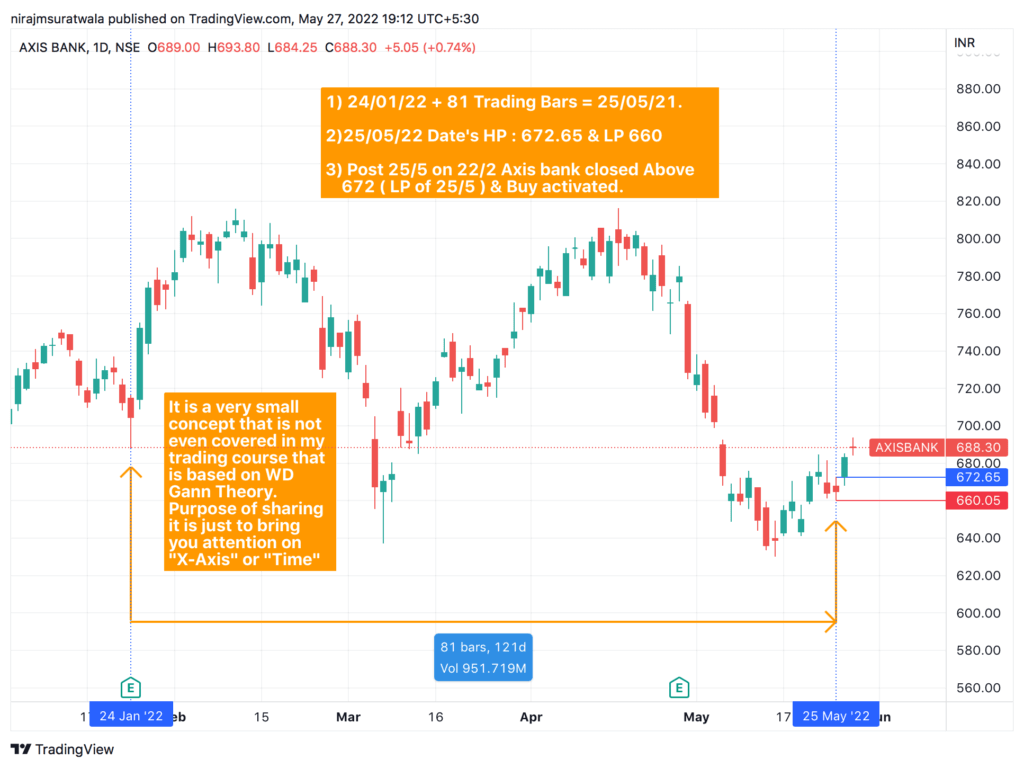

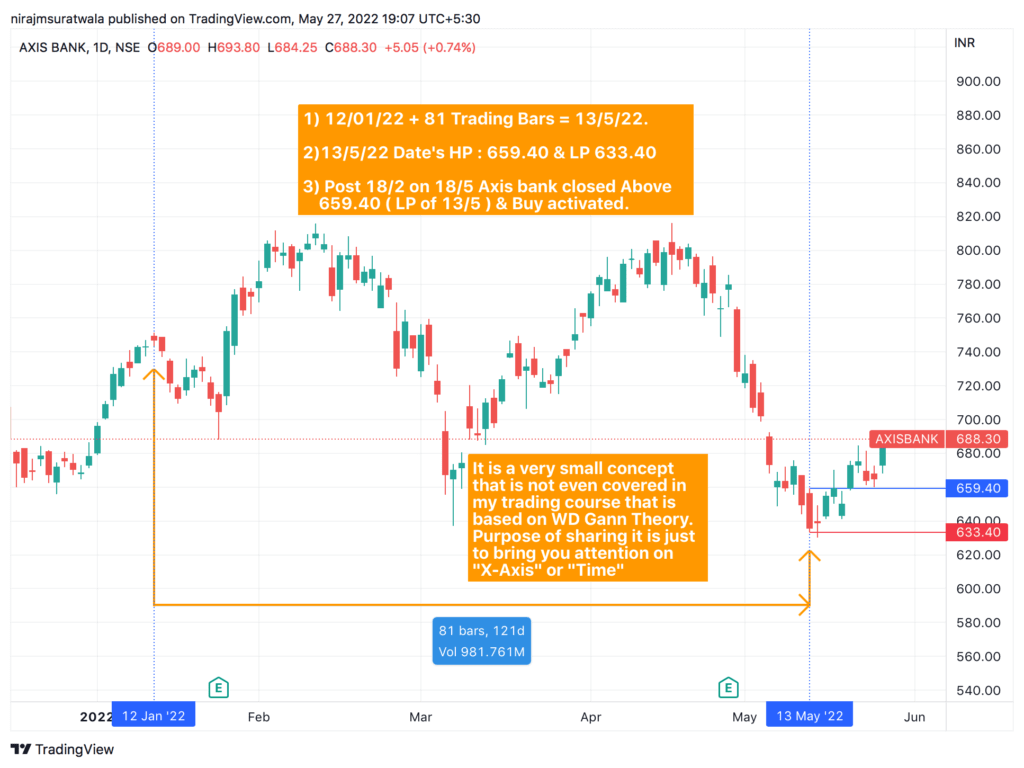

I added the 81st trading bar from April 27, 2022.I showcase how to trade in Nifty 50 using W.D. Gann Theory and present a Nifty trading strategy.

After calculating 81 trading bars from 27/04/22 we arrive at 23/08/22. We marked the high price (HP) and low price (LP) of 23/08 on the Nifty Price Chart.

Let a day close above or below the HP/LP of 23/8/22 to get an idea of Nifty outlook. HP is 17625 & LP is 17345 as marked them on Nifty Spot Price Chart.

The Nifty neither crosses nor breaks the high price (HP) or low price (LP) of August 23 on a closing basis to date, and no trade activates based on that date.

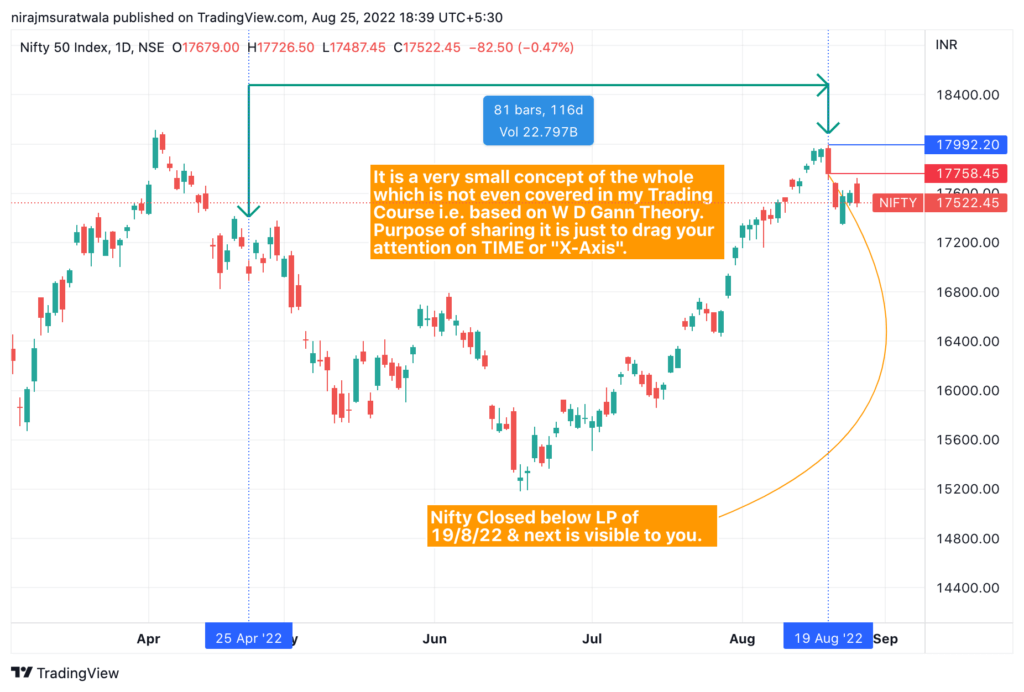

After calculating 81 trading bars from 25/04/22 we arrive at 19/08/22. We marked the high price (HP) and low price (LP) of 19/08 on the Nifty Price Chart.

Let a day close above or below the HP/LP of 19/8/22 to get an idea of Nifty outlook.

The Nifty Spot Price Chart marks the high price (HP) at 17,992 and the low price (LP) at 17,758, which it breaks, and the expected impact occurs.

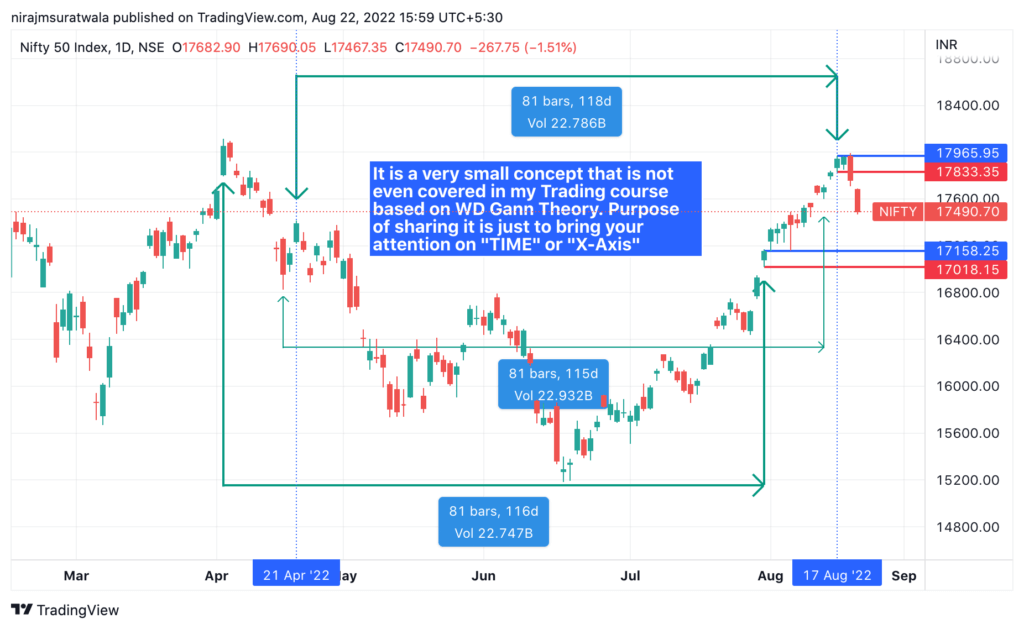

How to trade in nifty 50 as per gann theory which is a simple Nifty trading strategy: (Added 81th Trading Bars from 21/4/22)

Nifty 50 Prediction/Outlook 22/8/22 Onwards:

To get gann levels for nifty, calculated 81 trading bars from 21/04/22 we arrive at 17/08/22. We marked the high price (HP) and low price (LP) of 17/08 on the Nifty Price Chart.

Let a day close above or below the HP/LP of 17/8/22 to get an idea of Nifty outlook.

I marked the high price (HP) at 17965 and the low price (LP) at 17833 on the Nifty Spot Price Chart. The price broke the low.

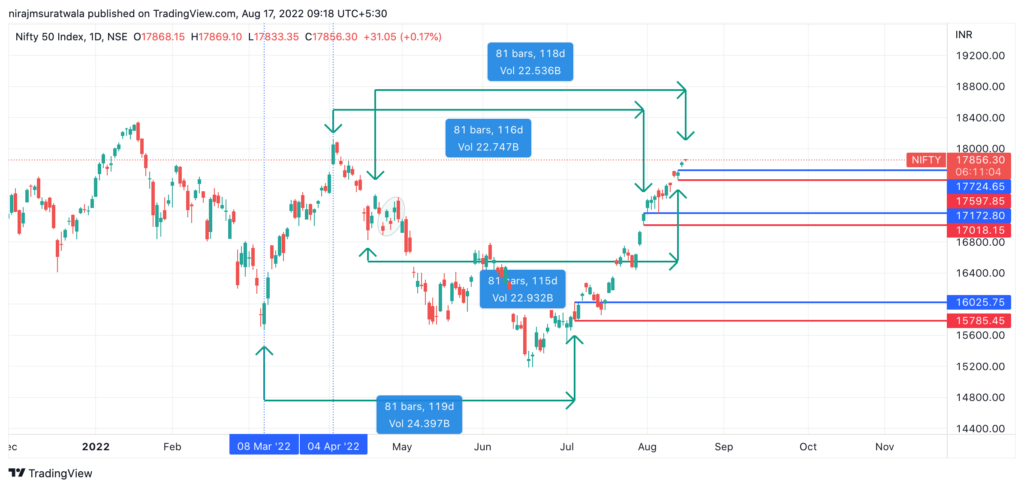

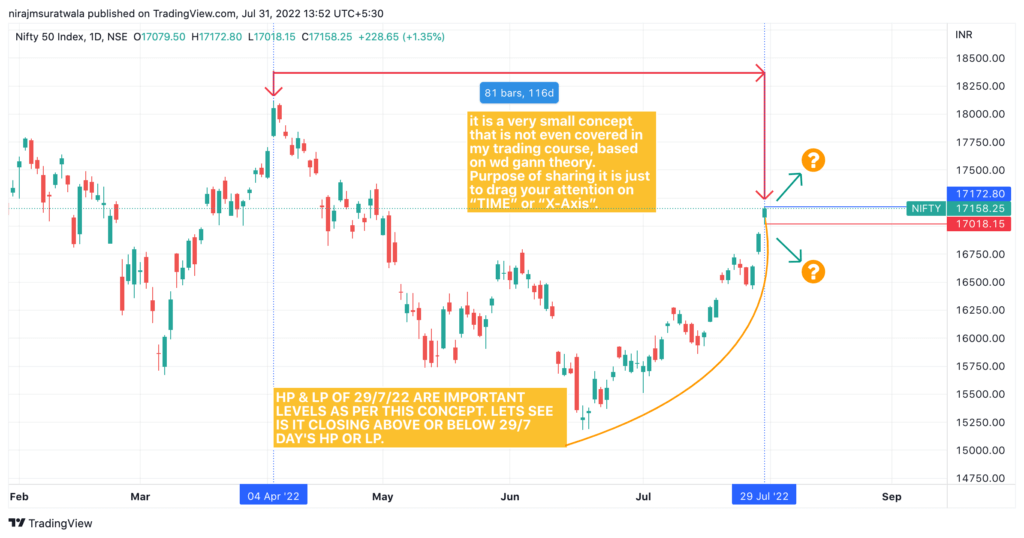

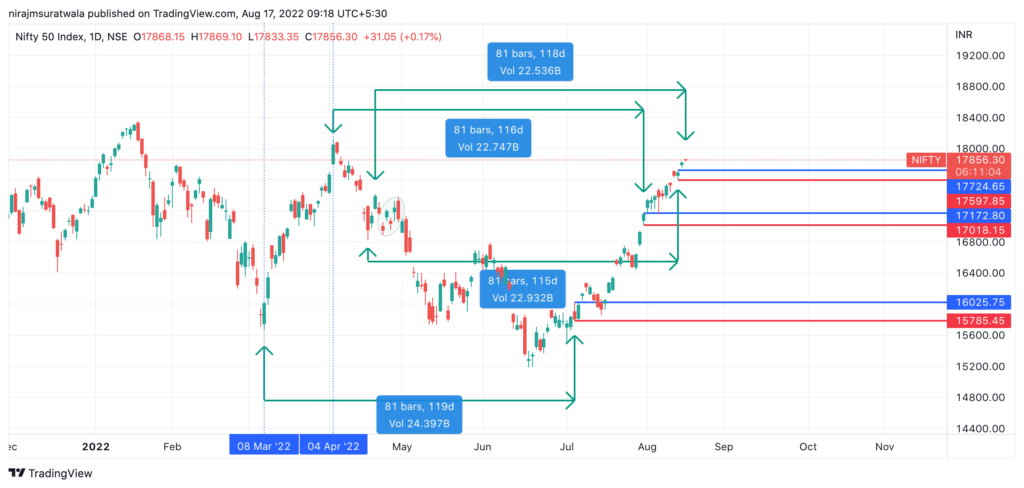

81Trading Bar from 04/04/22

Nifty Outlook tomorrow 1/7/22 onwards:

To get gann levels for nifty, calculated 81 trading bars from 04/04/22, we arrive at 29/07/22. HP & LP of 29/07 is marked on chart.

Let a day close above or below the HP/LP of 29/7/22 to get an idea of Nifty outlook. HP is 17172 & LP is 17018 as marked them on Nifty Spot Price Chart.

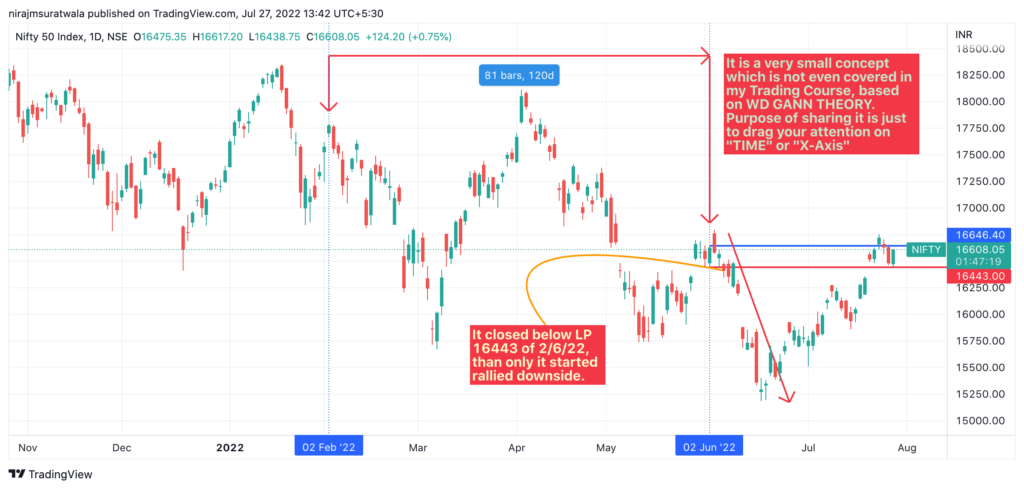

I share how to trade Nifty intraday and its reaction at Nifty Gann levels (81st trading bar from February 2, 2022) up to now.

To get gann levels for nifty, calculated 81 trading bars from 02/02/22, we arrive at 02/06/22. HP & LP of 02/06 is marked on chart.

Point to note:

A) Just on Subsequent trading day from 02/06 (81th trading bars from 02/02) Nifty 50 made a TOP,

B) Nifty 50 did not close above the high price (HP) of 16646 on 02/06, so it did not activate a buy signal.

C) Nifty 50 fell down immediately only after it closed below the low price (LP) of 16443 on 02/06.

Nifty options trading 4 simple strategies are there this is one of them.

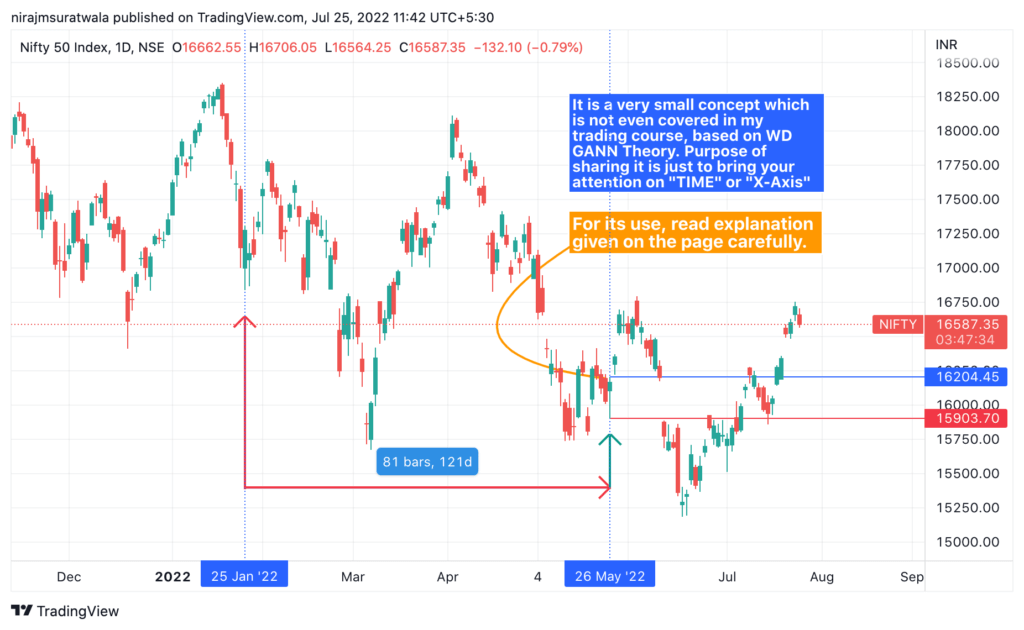

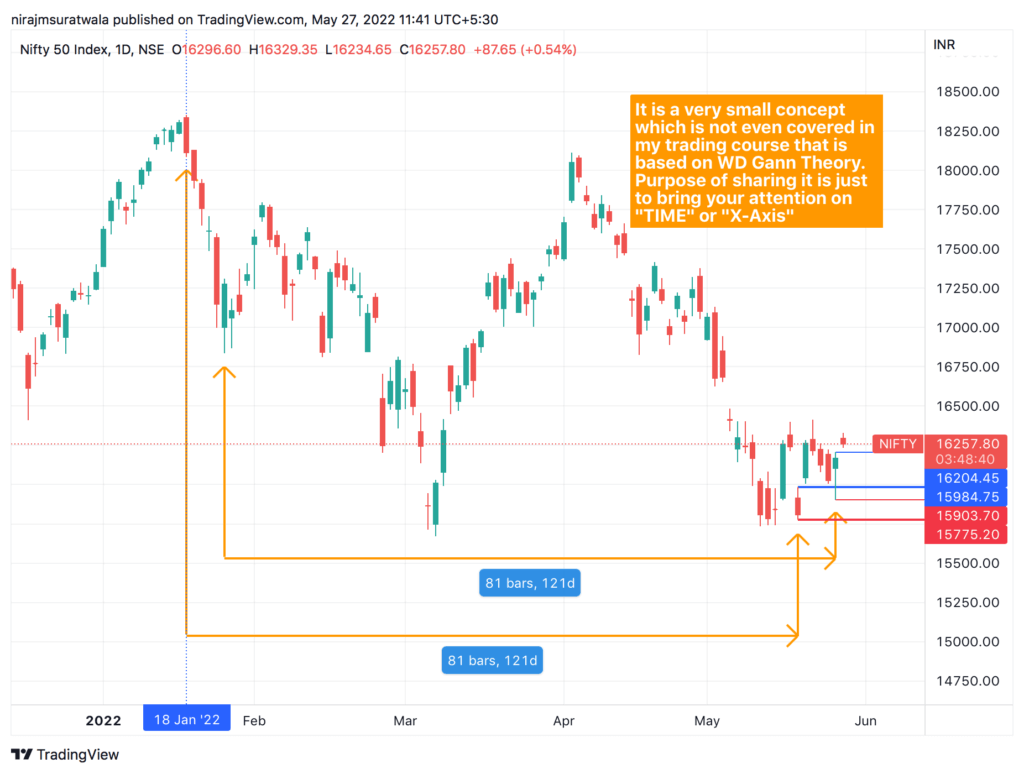

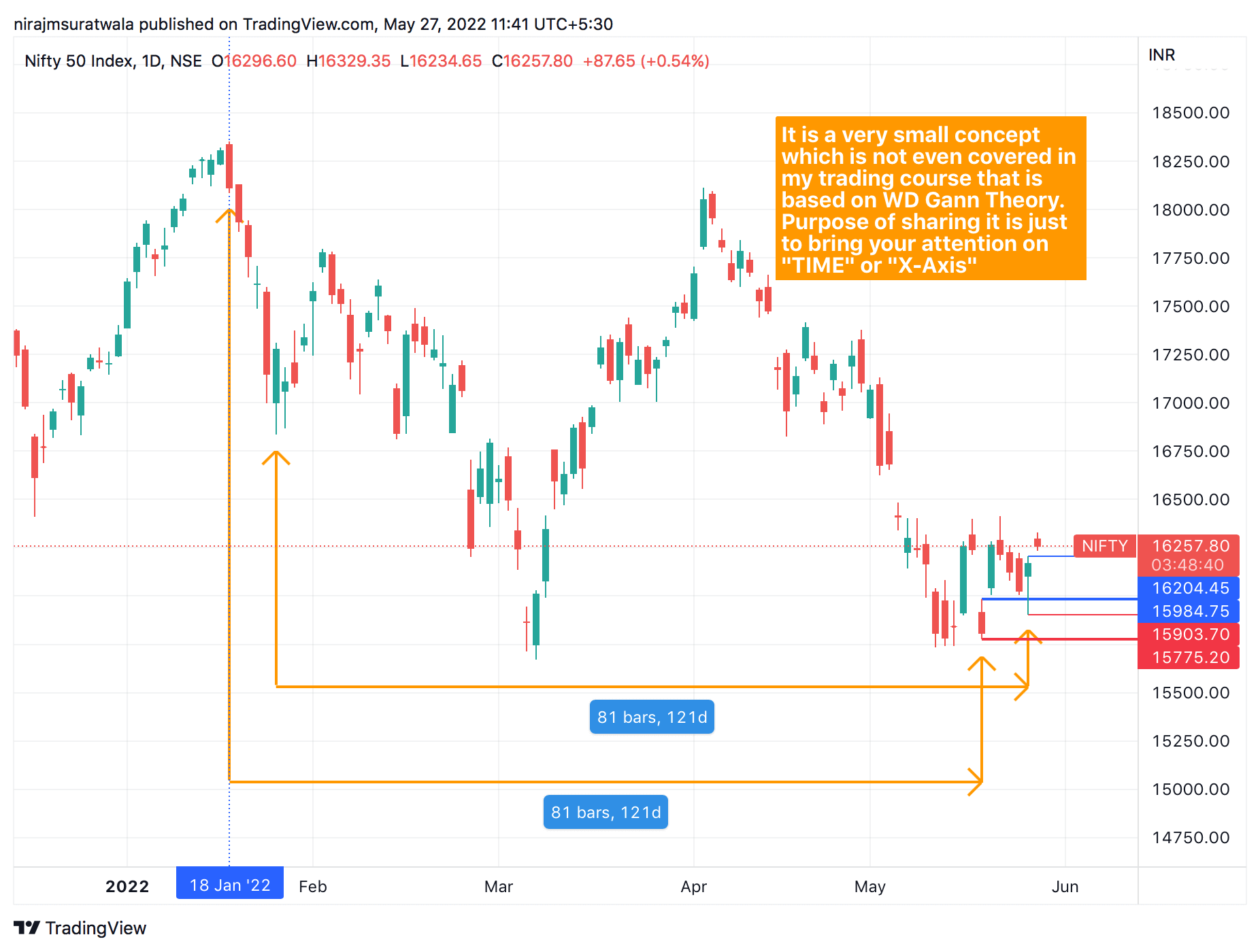

81 Trading Bar from 25/1/22

To get gann levels for nifty, calculated 81 trading bars from 25/1/22, we arrive at 26/5/22. HP & LP of 26/5 is marked on chart.

Point to note:

A) On 26/5 (81th trading bars from 25/1) Nifty 50 made a bottom,

B) Post closing above the HP of 26/5 i.e. 16204 Nifty 50 begun its rally again!,

C) Only after getting closed below the LP of 26/5 i.e. 15903 Nifty 50 fell down immediately,

D) When Nifty 50 reclaimed HP of 26/5 (16204) then only it begun its rally upside again!

Same is applicable to setup “bank nifty trading strategy”.

81Trading Bar from 18/1/22

How to trade in nifty 50 as per Gann theory: 81 trading bars Applied On Nifty On 18/01/22 & 25/1/22.

The dates January 18, 2022, and January 25, 2022, mark important candles (IC), as they initiate a specific trend.

From these specific Important Candle (IC) points, I added 81 bars and identified May 19, 2022, and May 26, 2022, as Level Candles (LC). Their high price (HP) and low price (LP) represent the Nifty Gann Levels.

We need to notice if it is closing above the High Price of 19/05/22 date & 26/05/22. If it is happening than it is to be considered as a Buy Trading signal. After getting the Buy trading signal, it should not close below the Low Price of Level Candle i.e. 19/05/22 & 26/5/22. If it happens consider it as a SL (Stop Loss).

(Request to all Traders before trading as per this concept, first watch the video in which have explained well how to use this by taking more than 5-6 examples. Youtube Video button is given below.)

You can plan Nifty predictions for Monday or any day using this strategy.

You can make and backtest Nifty Gann Predictions for 2022 using this concept.

With same process you can get gann levels for bank nifty

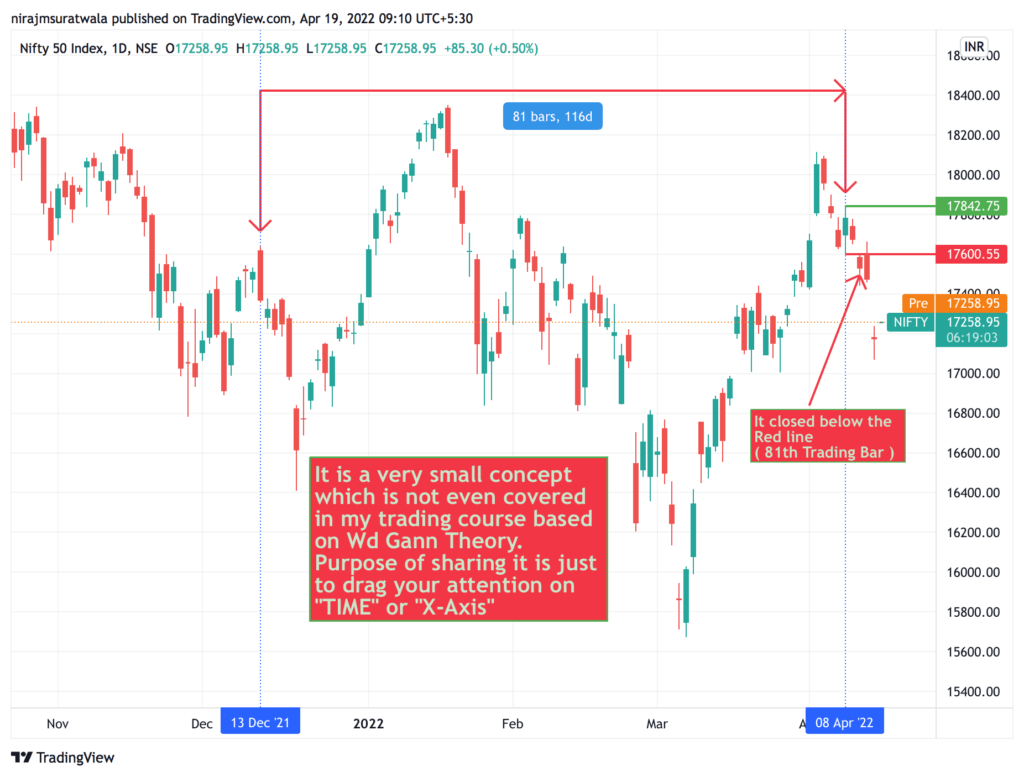

Nifty Gann Prediction 2022: 81 bars Applied On 13/12/21.

The date December 13, 2021, marks an important candle (IC), as it initiates a trend.

From this specific IC point added 81 bars and we got gann levels for nifty & 08/04/22

as Level Candle (LC).

We noticed it closed Below the Low Price of 08/04/22 date & Sell Trading signal was emitted by this. After the Sell trading signal, it could not close above the High Price of Level Candle i.e. 08/04/22 for a Good period of Time & rallied downside for good tradable points!

(Request to all Traders before trading as per this concept, first watch the video in which have explained well how to use this by taking more than 5-6 examples. Youtube Video button is given below.)

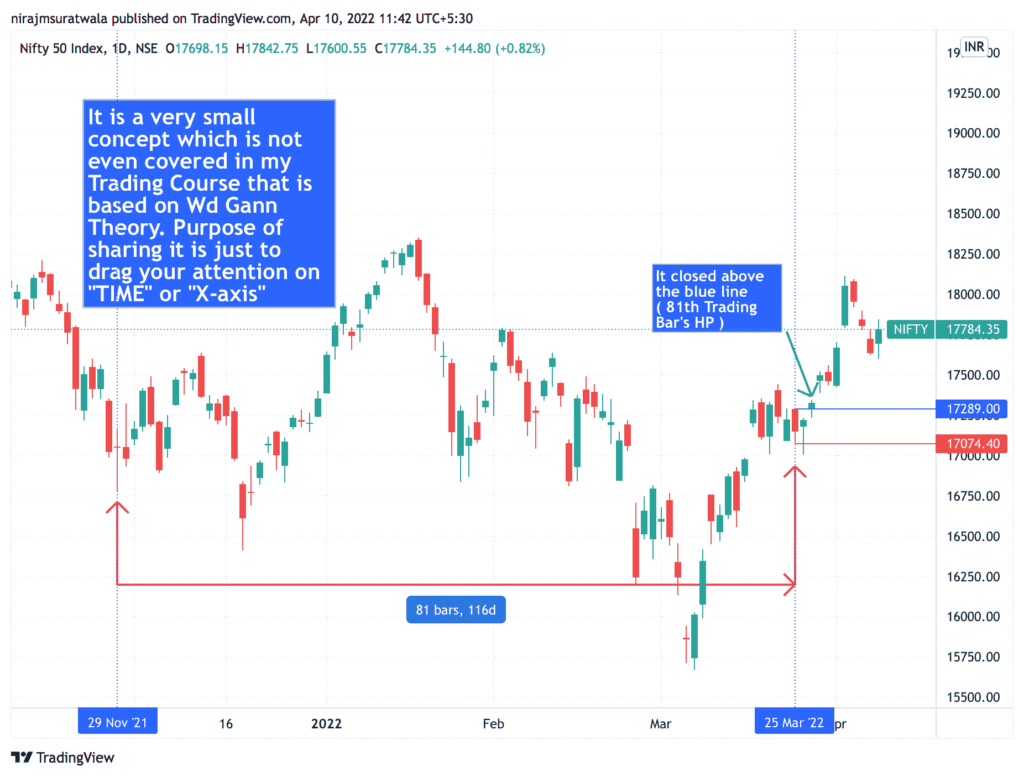

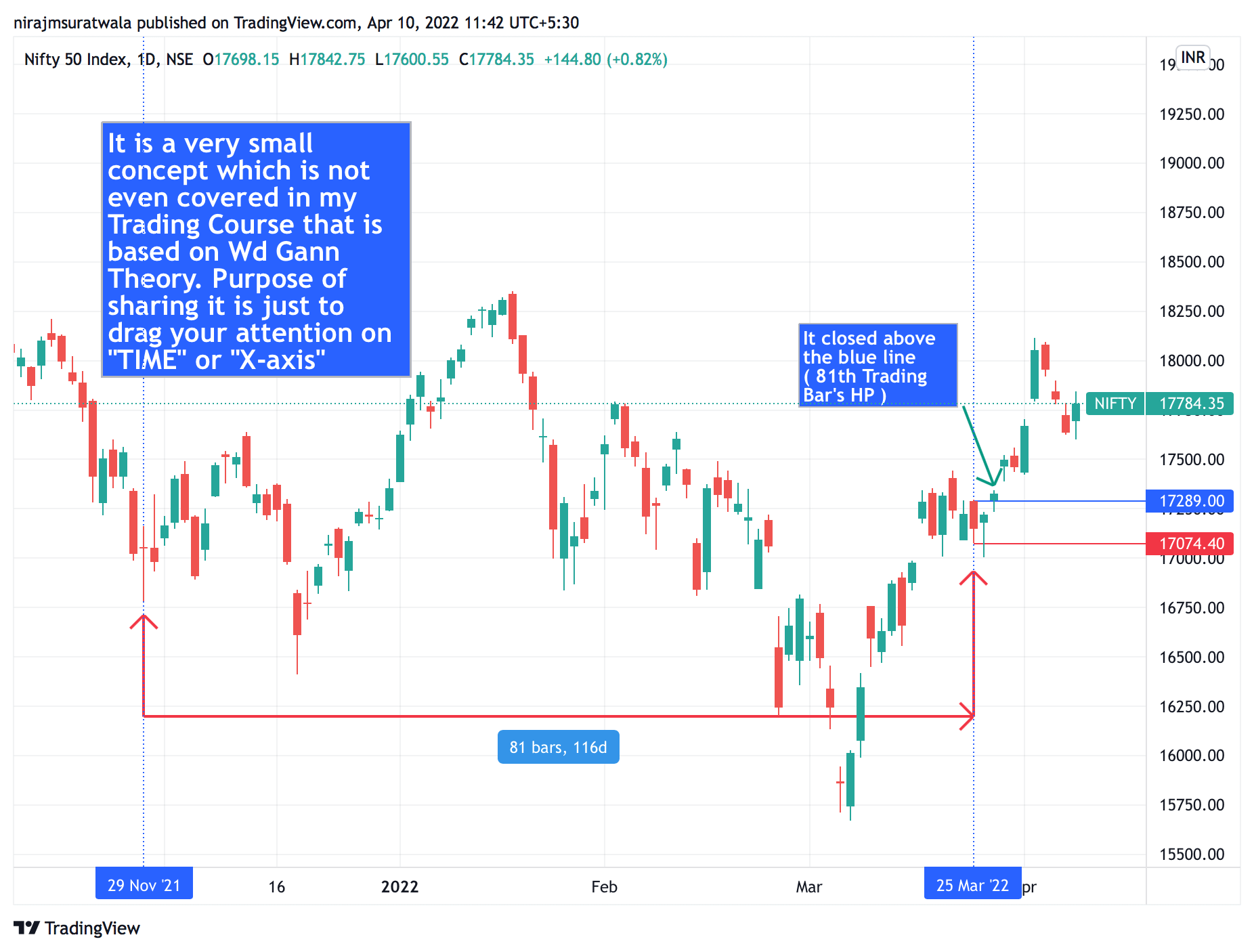

Nifty Trading Strategy: 81 bars Applied On 29/11/21.

The date November 29, 2021, marks an important candle (IC), as it initiates a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 25/03/22 date

as Level Candle (LC).

The Nifty closes above the high price of March 25, 2022, triggering a buy trading signal.

After the Buy trading signal, it could not close below the Low Price of Level Candle i.e. 25/03/22 for a Good period of Time & rallied upside for good tradable points!

(Request to all Traders before trading per this concept, first watch the video in which have explained well how to use this by taking more than 5-6 examples. Youtube Video button is given below.)

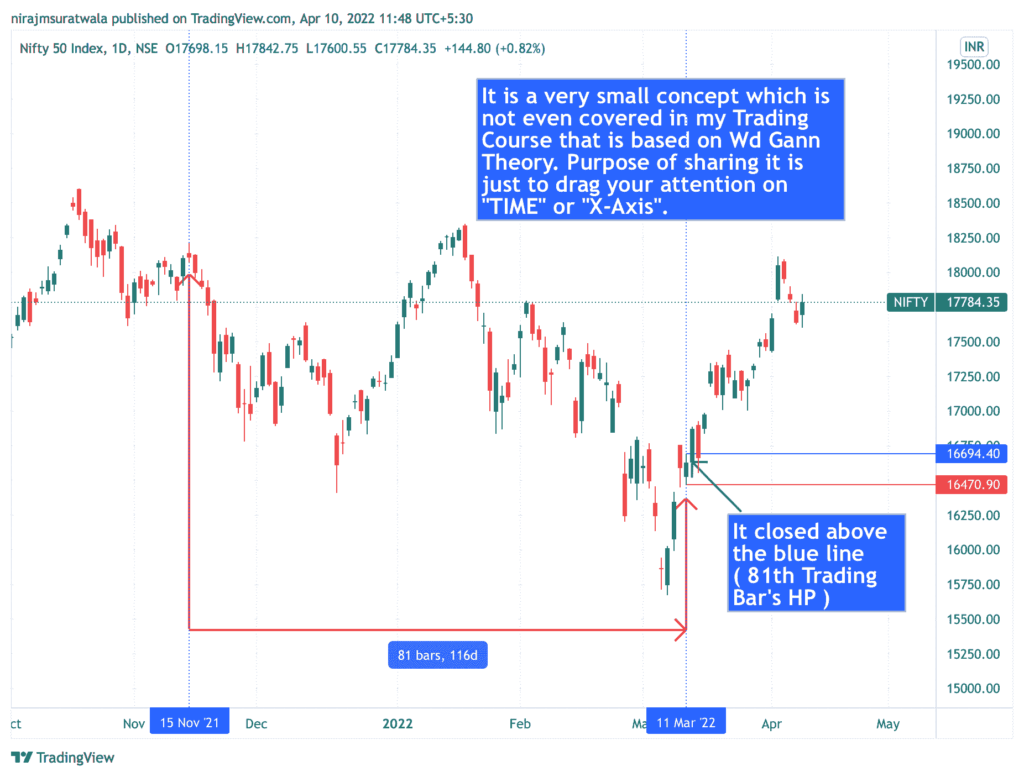

"what is the prediction of nifty tomorrow ?" is common question, know how to get answer of it: 81 bars Applied On 15/11/21.

The candle on 15/11/21 was considered an important candle (IC) because it was the starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 11/03/22 date

as Level Candle (LC).

Closing above the high price of the 15/11/21 date, this emitted a Buy Trading signal.

After the Buy trading signal, it could not close below the Low Price of Level Candle i.e. 11/03/22 for a Good period of Time & rallied upside for good tradable points!

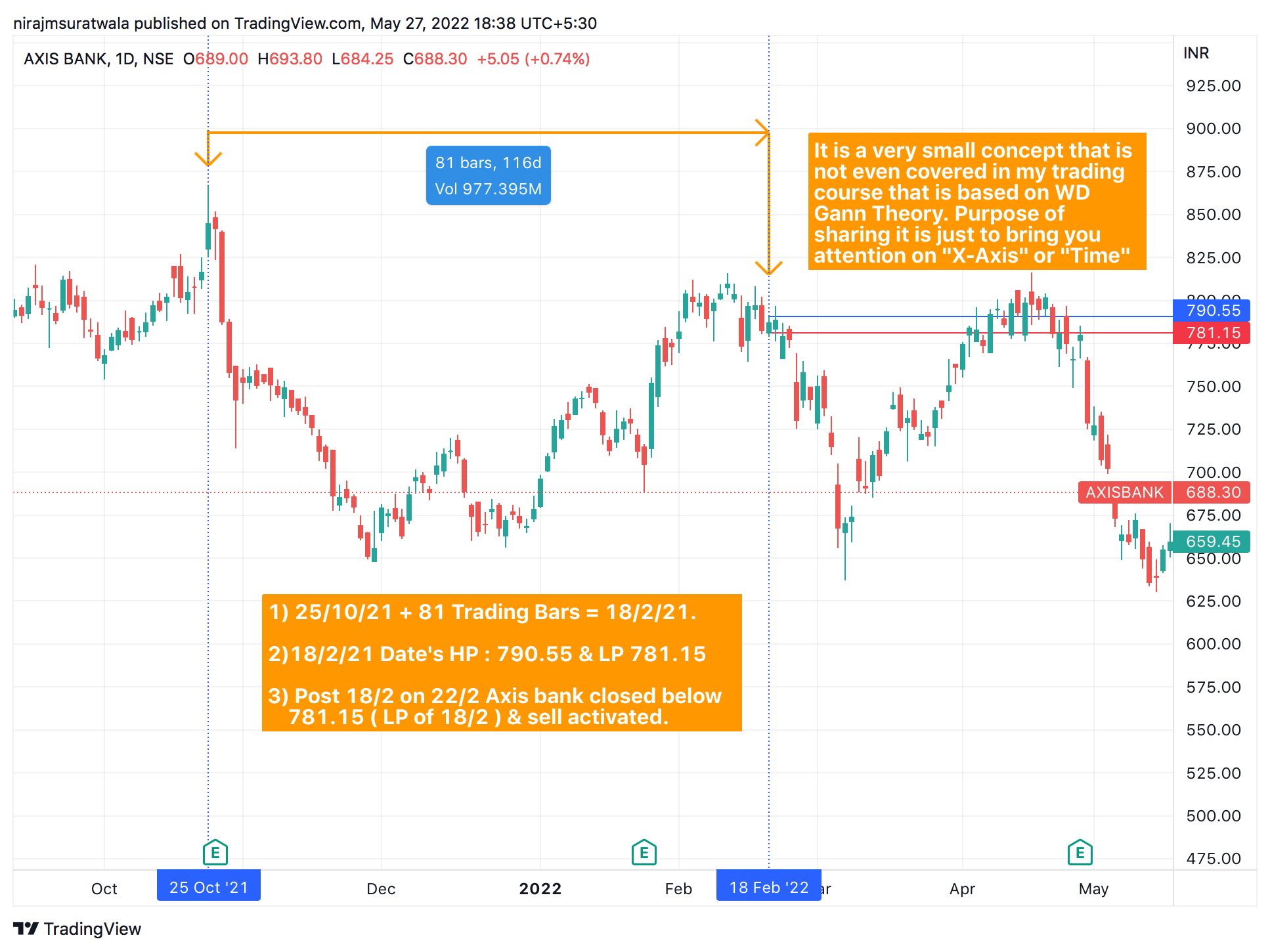

Nifty Gann Prediction Using 81 bars On 25/10/21.

25/10/21 date was considered as an important candle (IC), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 18/02/22 date

as Level Candle (LC).

After closing below the low price of 18/02/22, it emitted a Sell Trading signal.

After the Sell trading signal, it could not close above the High Price of Level Candle i.e. 18/02/22 for a Good period of Time & rallied downside for good tradable points!

Nifty Gann Prediction 2021: 81 bars Applied On 19/10/21. It helps to make nifty prediction for tomorrow.

19/10/21 date was considered as an important candle (IC), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 14/02/22 date

as Level Candle (LC).

The Nifty closes above the high price of February 14, 2022, triggering a buy signal. After this signal, it fails to sustain an upward rally and hits the stop-loss after just eight trading bars, as it breaks the low price of February 14, 2022 (LC).

Nifty Outlook As Per Gann Theory: 81 bars Applied On 1/10/21.

01/10/21 date was considered as an important candle (IC), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 28/01/22

as Level Candle (LC).

The close above the high price of the 28/01/22 date emitted a Buy signal.

After the buy trading signal, it could not close below the Low Price of Level Candle i.e. 28/01/22 for a short period of time & rallied upside for some small tradable points!

Nifty Trading Strategy: 81 trading Applied On 24/09/21.

24/9/21 date was considered as an important candle (IC), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 20/01/22

as Level Candle (LC).

The close below the low price of the 20/01/22 date emitted a sell signal.

After the short trading signal, it could not close above the High Price of Level Candle i.e. 20/01/22 for a good period of time & rallied downside for good tradable points!

Nifty Trading Strategy: 81 trading Applied On Nifty On 21/09/21.

On September 21, 2021, an important candle (IC) marked the trend’s starting point. Adding 81 bars from this IC gave Gann Levels for Nifty and January 17, 2022, as the Level Candle (LC).

The close below the low price of the 17/01/22 date emitted a sell signal.

After the short trading signal, it could not close above the High Price of Level Candle i.e. 17/01/22 for a good period of time & rallied downside for good tradable points!

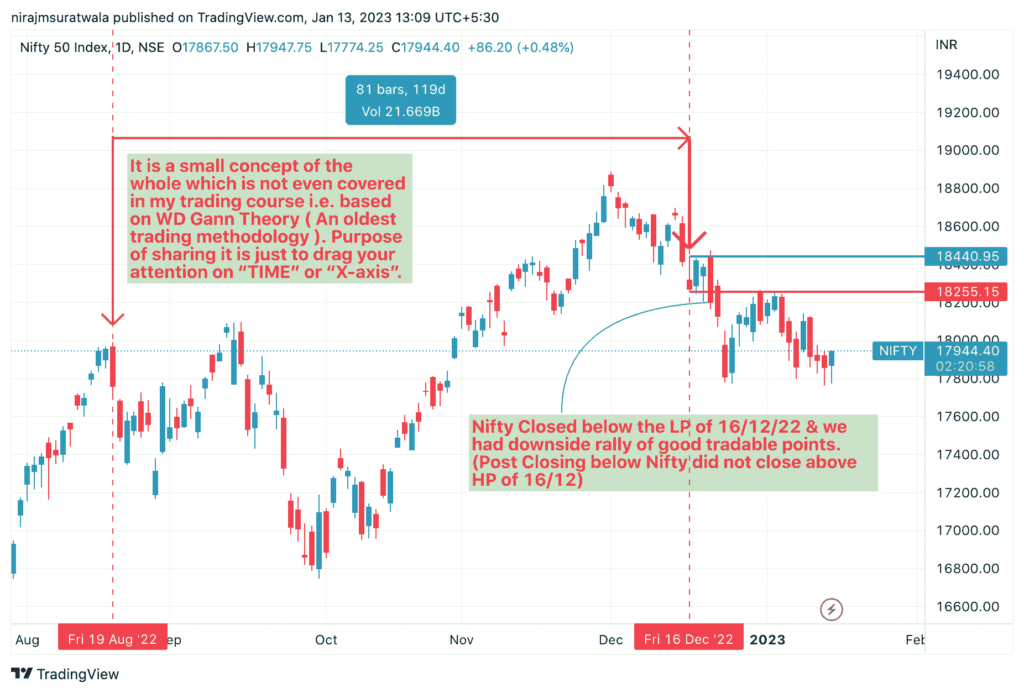

Nifty Gann Analysis: Added 81th Trading Bars from 19/8/22 & we got 16/12/22 as a Level Candle. (How to trade in nifty 50 & Nifty Prediction 2023 explained)

After calculating 81 trading bars from 19/08/22 we arrive at 16/12/22. HP & LP of 16/12 is marked on Nifty Trading View Price Chart.

Allowed a day to close above or below the HP/LP of 16/12/22 to get Gann Levels for Nifty & an idea of Nifty outlook. HP was 18440 & LP is 18255 as marked them on Nifty Spot Price Chart.

Nifty closed below the LP of 16/12 & we could see tradable downside rally (SL can was LP of 16/12 i.e. 18255 on closing basis)

Nifty Trading Strategy - Added 81th Trading Bars from 17/6/22 & we got 14/10/22 as a Level Candle.

Nifty Trading Strategy Explained :

After calculating 81 trading bars from 17/06/22 we arrive at 14/10/22. HP & LP of 14/10 is marked on Nifty Price Chart.

Let a day close above or below the HP / LP of 14/10/22 to get gann levels for nifty & an idea of Nifty outlook. HP is 17348 & LP is 17169 as marked them on Nifty Spot Price Chart.

Nifty is closed above the HP of 14/10 & we could see tradable upside rally (SL can was LP of 14/10 i.e. 17169 on closing basis)

After calculating 81 trading bars from 03/06/22 we arrive at 29/09/22. HP & LP of 29/09 is marked on Nifty Price Chart.

Let a day close above or below the HP / LP of 29/9/22 to get gann levels for nifty & an idea of Nifty outlook. HP is 17026 & LP is 16788 as marked them on Nifty Spot Price Chart.

Nifty is closed above the HP of 29/9 & we could see tradable upside rally (SL can LP of 29/9 i.e. 16788 on closing basis).

Added 81th Trading Bars from 18/5/22 & we got 13/9/22 as a Level Candle. (Nifty trading method)

After calculating 81 trading bars from 18/05/22 we arrive at 13/09/22. HP & LP of 13/09 is marked on Nifty Price Chart.

Let a day close above or below the HP / LP of 13/9/22 to get gann levels for nifty & an idea of Nifty outlook. HP is 18088 & LP is 18015 as marked them on Nifty Spot Price Chart.

If Nifty is closing below the LP of 13/9 than we shall have downside rally (SL can HP of 13/9 i.e. 18088 on closing basis)

We added 81 trading bars from 12/5/22, which brought us to 7/9/22 as the Level Candle. This is a Nifty trading strategy that shows you how to trade in Nifty 50.

After calculating 81 trading bars from 12/05/22 we arrive at 07/09/22. HP & LP of 07/09 is marked on Nifty Price Chart.

We were suppose to Let a day close above or below the HP / LP of 07/9/22 to get gann levels for nifty & an idea of Nifty outlook. HP is 17650.75 & LP is 17484.30 as marked them on Nifty Spot Price Chart. Nifty did close above the HP of 7/9 & activated buy signal. After giving buy signal Nifty went up for good tradable points. After activating buy signal Nifty did not close below the LP of 7/9 So SL was not triggered.

Added 81th Trading Bars from 29/4/22 (How to trade in nifty 50 as per W D Gann theory or using gann levels)

After calculating 81 trading bars from 29/04/22 we arrive at 25/08/22 to get gann levels for nifty, HP & LP of 25/08 is marked on Nifty Price Chart.

HP & LP of 25/8 was important any side getting closing was to be considered as an upcoming trend in Nifty.

A) Nifty closed below the LP of 25/8/22 & activated short & then Stop loss got triggered on 30/8 by closing above the HP 17726.

B) We could see only 1 candle closed below the LP of 25/8 date. Once Nifty closed above the HP of 25/8 it went upside for good tradable points. Yes, this strategy failed once & then Nifty reacted as per expectation as it has till date (refer all examples mentioned below)

Added 81th Trading Bars from 27/4/22 (How to trade in nifty 50 as per WD Gann Theory or using Gann levels)

After calculating 81 trading bars from 27/04/22 we arrive at 23/08/22. HP & LP of 23/08 (gann levels for nifty) is marked on Nifty Price Chart.

Let a day close above or below the HP/LP of 23/8/22 to get an idea of Nifty outlook. HP is 17625 & LP is 17345 as marked them on Nifty Spot Price Chart. Neither HP nor LP is crossed or broken on closing basis till date & no trade is activated on the basis of 23/8 date.

Added 81th Trading Bars from 25/4/22 (How To Trade in Nifty 50 as per Gann Theory or using Gann Levels)

After calculating 81 trading bars from 25/04/22 we arrive at 19/08/22. HP & LP of 19/08 (gann levels for nifty) is marked on Nifty Price Chart.

Let a day close above or below the HP/LP of 19/8/22 to get an idea of Nifty outlook. HP is 17992 & LP is 17758 (Broken) as marked them on Nifty Spot Price Chart & Expected Impact Noticed.

How to trade in nifty 50 as per gann theory or using gann levels : (Added 81th Trading Bars from 21/4/22)

Nifty 50 Prediction/Outlook 22/8/22 Onwards:

To get gann levels for nifty, calculated 81 trading bars from 21/04/22 we arrive at 17/08/22. HP & LP of 17/08 is marked on Nifty Price Chart.

Let a day close above or below the HP/LP of 17/8/22 to get an idea of Nifty outlook. HP is 17965 & LP is 17833 (Broken) as marked them on Nifty Spot Price Chart.

I am sharing how to trade in Nifty 50 and its reaction at Nifty Gann levels, starting from the 81st trading bar on 04/04/22.

Nifty Outlook tomorrow 1/7/22 onwards:

To get gann levels for nifty, calculated 81 trading bars from 04/04/22, we arrive at 29/07/22. HP & LP of 29/07 is marked on chart.

Let a day close above or below the HP/LP of 29/7/22 to get an idea of Nifty outlook. HP is 17172 & LP is 17018 as marked them on Nifty Spot Price Chart.

I am sharing how to trade in Nifty Intraday and its reaction to Nifty Gann levels, starting from the 81st trading bar on 02/02/22.

To get gann levels for nifty, calculated 81 trading bars from 02/02/22, we arrive at 02/06/22. HP & LP of 02/06 is marked on chart.

Point to note:

A) Just on Subsequent trading day from 02/06 (81th trading bars from 02/02) Nifty 50 made a TOP,

B) Nifty 50 did not close above the HP of 02/06 i.e. 16646 (So BUY WAS NOT ACTIVATED),

C) Only after getting closed below the LP of 02/06 i.e. 16443 Nifty 50 fell down immediately,

Nifty options trading 4 simple strategies are there this is one of them.

I'm sharing a Nifty trading strategy for long-term investment and its reaction to Nifty Gann levels, starting from the 81st trading bar on 25/1/22.

To get gann levels for nifty, calculated 81 trading bars from 25/1/22, we arrive at 26/5/22. HP & LP of 26/5 is marked on chart.

Point to note:

A) On 26/5 (81th trading bars from 25/1) Nifty 50 made a bottom,

B) Post closing above the HP of 26/5 i.e. 16204 Nifty 50 begun its rally again! ,

C) Only after closing below the low price (LP) of 15903 on 26/5 did Nifty 50 fall immediately.

D) When Nifty 50 reclaimed HP of 26/5 (16204) then only it begun its rally upside again!

Same is applicable to setup “bank nifty trading strategy”.

I am sharing how to initiate a trade in Nifty 50 and its reaction at Nifty Gann levels, starting from the 81st trading bar on 18/1/22.

How to trade in nifty 50 as per Gann theory: 81 trading bars Applied On Nifty On 18/01/22 & 25/1/22.

The candles on 18/01/22 and 25/01/22 started a specific trend, which is why they were considered important candles (IC).

From these specific IC points added 81 bars and we got 19/05/22 & 26/5/22

as Level Candle (LC) & also its HP & LP is known as Nifty Gann Levels.

We need to notice if it is closing above the High Price of 19/05/22 date & 26/05/22. If it is happening than it is to be considered as a Buy Trading signal. After getting the Buy trading signal, it should not close below the Low Price of Level Candle i.e. 19/05/22 & 26/5/22. If it happens consider it as a SL (Stop Loss).

(Request to all Traders before trading as per this concept, first watch the video in which have explained well how to use this by taking more than 5-6 examples. Youtube Video button is given below.)

You can use this to plan a Nifty prediction for Monday or any other day.

You can make and backtest a Nifty Gann Prediction for 2022 with this concept.

With same process you can get gann levels for bank nifty

Nifty Gann Prediction 2022: 81 bars Applied On 13/12/21.

13/12/21 date was considered as an important candle (IC), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty & 08/04/22

as Level Candle (LC).

We noticed that after closing below the low price of the 08/04/22 date, this emitted a Sell Trading signal.

After the Sell trading signal, it could not close above the High Price of Level Candle i.e. 08/04/22 for a Good period of Time & rallied downside for good tradable points!

Nifty Trading Strategy - 81 bars Applied On 29/11/21.

29/11/21 date was considered as an important candle (IC), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 25/03/22 date

as Level Candle (LC).

We noticed that after closing above the low price of the 25/03/22 date, this emitted a Sell Trading signal.

After the Buy trading signal, it could not close below the High Price of Level Candle i.e. 25/03/22 for a Good period of Time & rallied upside for good tradable points!

"what is the prediction of nifty tomorrow ?" is common question, know how to get answer of it: 81 bars Applied On 15/11/21.

The date 15/11/21 marked an important candle (IC) because it was the starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 11/03/22 date

as Level Candle (LC).

We noticed that after closing above the high price of the 11/03/22 date, this emitted a Sell Trading signal. After the Buy trading signal, it could not close below the Low Price of Level Candle i.e. 11/03/22 for a Good period of Time & rallied upside for good tradable points!

Nifty Gann Prediction Using 81 bars On 25/10/21.

The candle on 25/10/21 started a trend, which is why traders considered it an important candle (IC).

From this specific IC point added 81 bars and we got gann levels for nifty as well as 18/02/22 date

as Level Candle (LC).

We noticed that after it closed below the low price of the 18/02/22 date, this emitted a Sell Trading signal.

After the Sell trading signal, it could not close above the High Price of Level Candle i.e. 18/02/22 for a Good period of Time & rallied downside for good tradable points!

Nifty Gann Prediction 2021: 81 bars Applied On 19/10/21. It helps to make nifty prediction for tomorrow.

The candle on 19/10/21 started a trend, which is why traders considered it an important candle (IC).

From this specific IC point added 81 bars and we got gann levels for nifty as well as 14/02/22 date

as Level Candle (LC).

We noticed that its close above the high price of the 14/02/22 date emitted a Buy signal. After the signal, it could not rally for long and hit the stop-loss (SL) just 8 trading bars later, when it broke the low price of the 14/02/22 date (LC).

Nifty Outlook As Per Gann Theory: 81 bars Applied On 1/10/21.

The candle on 01/10/21 started a trend, which is why traders considered it an important candle (IC).

From this specific IC point added 81 bars and we got gann levels for nifty as well as 28/01/22

as Level Candle (LC).

The close above the high price of the 28/01/22 date emitted a Buy signal.

After the buy trading signal, it could not close below the Low Price of Level Candle i.e. 28/01/22 for a short period of time & rallied upside for some small tradable points!

Nifty Trading Strategy: 81 trading Applied On 24/09/21.

The candle on 24/9/21 started a trend, which is why traders considered it an important candle (IC).

From this specific IC point added 81 bars and we got gann levels for nifty as well as 20/01/22

as Level Candle (LC).

The close below the low price of the 20/01/22 date emitted a sell signal.

After the short trading signal, it could not close above the High Price of Level Candle i.e. 20/01/22 for a good period of time & rallied downside for good tradable points!

Nifty Trading Strategy: 81 trading Applied On Nifty On 21/09/21.

The candle on 21/9/21 started a trend, which is why traders considered it an important candle (IC).

From this specific IC point added 81 bars and we got gann levels for nifty as well as 17/01/22 date

as Level Candle (LC).

The close below the low price of the 17/01/22 date emitted a sell signal.

After the short trading signal, it could not close above the High Price of Level Candle i.e. 17/01/22 for a good period of time & rallied downside for good tradable points!

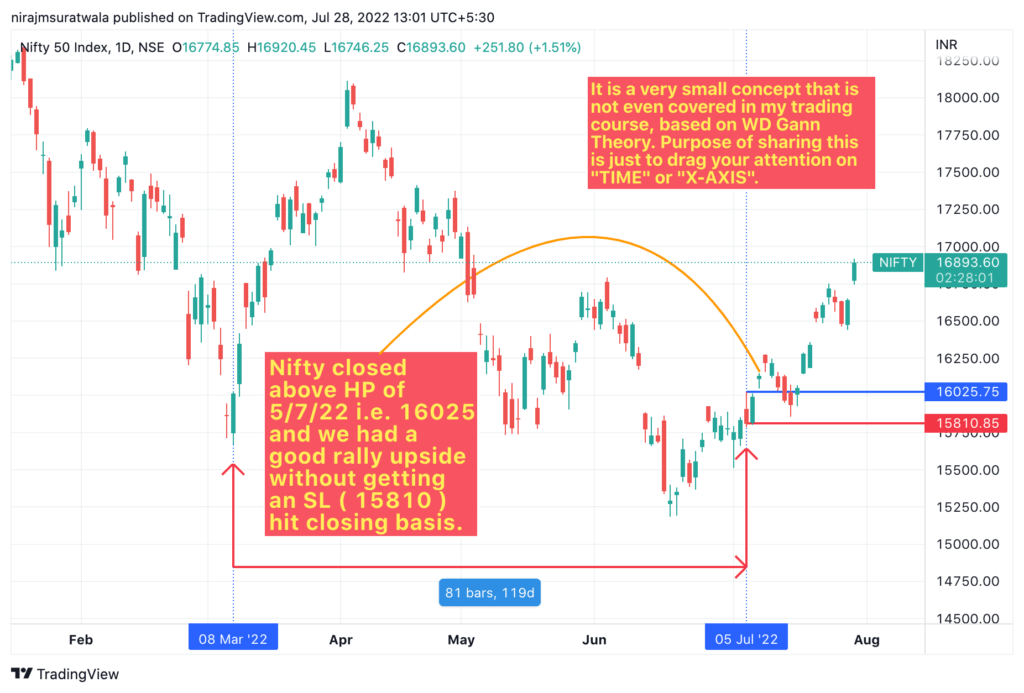

I have shared how to trade in Nifty 50 and its reaction at Nifty Gann levels, starting from the 81st trading bar on 08/03/22.

We calculated the Gann levels for Nifty by counting 81 trading bars from 08/03/22, which brought us to 05/07/22. We then marked the high price (HP) and low price (LP) of 05/07 on the chart.

Point to note:

A) Just on Subsequent trading day from 05/07 (81th trading bars) Nifty 50 did not close below LP of 5/7 for a single day,

B) Nifty 50 closed above the HP of 05/07 i.e. 16025 & ACTIVATED BUY SIGNAL.

C) Post activating BUY signal, SL line 15810 (LP of 5/7) remained unbroken on closing basis & we rallied further upside.

I am sharing how to trade in Nifty 50 and its reaction at Nifty Gann levels, starting from the 81st trading bar on 02/02/22.

We calculated the Nifty’s Gann levels by counting 81 trading bars from 02/02/22, which brought us to 02/06/22. We marked the high price (HP) and low price (LP) of 02/06 on the chart.

Point to note:

A) Just on Subsequent trading day from 02/06 ( 81th trading bars from 02/02 ) Nifty 50 made a TOP,

B) Nifty 50 did not close above the high price (HP) of 02/06 (16646), so it did not activate a buy signal.

C) Nifty 50 fell down immediately after it closed below the low price (LP) of 02/06 (16443).

I have shared how to plan a trade in Nifty 50 and its reaction at Nifty Gann levels, starting from the 81st trading bar on 25/1/22.

We calculated the Gann levels for Nifty by counting 81 trading bars from 25/1/22, which brought us to 26/5/22. We then marked the high price (HP) and low price (LP) of 26/5 on the chart.

Point to note:

A) On 26/5 (81th trading bars from 25/1) Nifty 50 made a bottom,

B) Post closing above the HP of 26/5 i.e. 16204 Nifty 50 begun its rally again!,

C) Only after Nifty 50 closed below the low price (LP) of 15903 on 26/5 did it fall immediately.

D) When Nifty 50 reclaimed HP of 26/5 (16204) then only it begun its rally upside again!

I have shared how to initiate a trade in Nifty 50 and its reaction at Nifty Gann levels, starting from the 81st trading bar on 18/1/22.

How to trade in nifty 50 as per Gann theory: 81 trading bars Applied On Nifty On 18/01/22 & 25/1/22.

The candles on 18/01/22 and 25/01/22 started a specific trend, which is why they were considered important candles (IC).

From these specific IC points added 81 bars and we got gann levels for nifty as well as 19/05/22 & 26/5/22.

as Level Candle (LC) & also its HP & LP is known as Nifty Gann Levels.

We need to notice if it is closing above the High Price of 19/05/22 date & 26/05/22. If it is happening than it is to be considered as a Buy Trading signal. After getting the Buy trading signal, it should not close below the Low Price of Level Candle i.e. 19/05/22 & 26/5/22. If it happens consider it as a SL (Stop Loss).

How to trade in nifty 50 as per Gann theory: 81 bars Applied On 13/12/21.

13/12/21 date was considered as an important candle (IC), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 08/04/22 date

as Level Candle (LC).

The close below the low price of the 08/04/22 date emitted a Sell Trading signal. After the Sell trading signal, it could not close above the High Price of Level Candle i.e. 08/04/22 for a Good period of Time & rallied downside for good tradable points!

Nifty Trading Strategy: 81 bars Applied On 29/11/21.

29/11/21 date was considered as an important candle (IC), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 25/03/22 date

as Level Candle (LC).

The close above the high price of the 25/03/22 date emitted a Buy Trading signal. After the Buy trading signal, it could not close below the Low Price of Level Candle i.e. 25/03/22 for a Good period of Time & rallied upside for good tradable points!

To find the answer to the common question, "What is the prediction of Nifty tomorrow?", you can apply 81 bars on 15/11/21.

15/11/21 date was considered as an important candle (IC), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 11/03/22 date

as Level Candle (LC).

After it closed above the high price of the 15/11/21 date, this emitted a Buy Trading signal. After the Buy trading signal, it could not close below the Low Price of Level Candle i.e. 11/03/22 for a Good period of Time & rallied upside for good tradable points!

Nifty Gann Prediction Using 81 bars On 25/10/21.

25/10/21 date was considered as an important candle (IC), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 18/02/22

as Level Candle (LC).

The close below the low price of the 18/02/22 date emitted a Sell Trading signal. After the Sell trading signal, it could not close above the High Price of Level Candle i.e. 18/02/22 for a Good period of Time & rallied downside for good tradable points!

Nifty Outlook As Per Gann Theory: 81 bars Applied On 19/10/21.

19/10/21 date was considered as an important candle (IC), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 14/02/22 date

as Level Candle (LC).

We noticed that its close above the high price of the 14/02/22 date emitted a Buy signal. However, it could not rally for long, and it hit the stop-loss (SL) just 8 trading bars later when it broke the low price (LC) of the 14/02/22 date.

Nifty Outlook As Per Gann Theory - 81 bars Applied On 1/10/21.

01/10/21 date was considered as an important candle ( IC ), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 28/01/22 date

as Level Candle ( LC ).

After it closed above the high price of the 28/01/22 date, this emitted a Buy signal. After the buy trading signal, it could not close below the Low Price of Level Candle i.e. 28/01/22 for a short period of time & rallied upside for some small tradable points !!

( Request to all Traders before trading as per this concept, first watch the video in which have explained well how to use this by taking more than 5-6 examples. Youtube Video button is given below. )

Nifty Trading Strategy : 81 trading Applied On 24/09/21.

24/9/21 date was considered as an important candle ( IC ), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 20/01/22

as Level Candle ( LC ).

The close below the low price of the 20/01/22 date emitted a sell signal. After the short trading signal, it could not close above the High Price of Level Candle i.e. 20/01/22 for a good period of time & rallied downside for good tradable points !!

( Request to all Traders before trading as per this concept, first watch the video in which have explained well how to use this by taking more than 5-6 examples. Youtube Video button is given below. )

Nifty Trading Strategy : 81 trading Applied On Nifty On 21/09/21.

21/9/21 date was considered as an important candle ( IC ), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 17/01/22 date

as Level Candle ( LC ).

After it closed below the low price of the 17/01/22 date, this emitted a sell signal. After the short trading signal, it could not close above the High Price of Level Candle i.e. 17/01/22 for a good period of time & rallied downside for good tradable points !!

( Request to all Traders before trading as per this concept, first watch the video in which have explained well how to use this by taking more than 5-6 examples. Youtube Video button is given below. )

Nifty Trading Strategy : 81 bars Applied On Nifty On 20/12/21

20/12/21 date was considered as an important candle ( IC ), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 19/04/22 date

as Level Candle ( LC ).

We should consider a close above the high price of the 19/04/22 date a Buy signal. After getting the Buy signal, it should not close below the Low Price of Level Candle i.e. 19/04/22. If it happens consider it as a SL ( Stop Loss ).

( Request to all Traders before trading in it as per this concept, first watch the video in which have explained well how to use this by taking more than 5-6 examples. Youtube Video button is given below. )

Nifty Trading Strategy : 81 bars Applied On Nifty On 13/12/21.

13/12/21 date was considered as an important candle ( IC ), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 08/04/22 date

as Level Candle ( LC ).

We noticed that its close below the low price of the 08/04/22 date emitted a Sell Trading signal.

After the Sell trading signal, it could not close above the High Price of Level Candle i.e. 08/04/22 for a Good period of Time & rallied downside for good tradable points !!

( Request to all Traders before trading as per this concept, first watch the video in which have explained well how to use this by taking more than 5-6 examples. Youtube Video button is given below. )

Nifty Outlook As Per Gann Theory - 81 bars Applied On Nifty On 29/11/21.

29/11/21 date was considered as an important candle ( IC ), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 25/03/22 date

as Level Candle ( LC ).

The close above the high price of the 25/03/22 date emitted a Buy signal. After the Buy signal, it could not close below the Low Price of Level Candle i.e. 25/03/22 for a Good period of Time & rallied upside for good tradable points !!

( Request to all Traders before trading as per this concept, first watch the video in which have explained well how to use this by taking more than 5-6 examples. Youtube Video button is given below. )

To know WHAT IS THE PREDICTION OF NIFTY TOMORROW, 81 bars Applied On Nifty On 15/11/21.

15/11/21 date was considered as an important candle ( IC ), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 11/03/22 date

as Level Candle ( LC ).

The close above the high price of the 15/11/21 date emitted a Buy signal. After the Buy signal, it could not close below the Low Price of Level Candle i.e. 11/03/22 for a Good period of Time & rallied upside for good tradable points !!

( Request to all Traders before trading as per this concept, first watch the video in which have explained well how to use this by taking more than 5-6 examples. Youtube Video button is given below. )

to know WHAT IS THE PREDICTION OF NIFTY TOMORROW, Nifty Trading Strategy, 81 bars Applied On 25/10/21.

25/10/21 date was considered as an important candle ( IC ), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 18/02/22 date

as Level Candle ( LC ).

The close below the low price of the 18/02/22 date emitted a Sell signal. After the Sell signal, it could not close above the High Price of Level Candle i.e. 18/02/22 for a Good period of Time & rallied downside for good tradable points !!

( Request to all Traders before trading as per this concept, first watch the video in which have explained well how to use this by taking more than 5-6 examples. Youtube Video button is given below. )

to know WHAT IS THE PREDICTION OF NIFTY TOMORROW, Nifty Trading Strategy, 81 bars Applied On 19/10/21.

19/10/21 date was considered as an important candle ( IC ), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 14/02/22 date

as Level Candle ( LC ).

We noticed that its close above the high price of the 14/02/22 date emitted a buy signal. However, the rally didn’t last long, and it hit the stop-loss (SL) just 81 bars later when it broke the low price (LC) of the 14/02/22 date.

( Request to all Traders before trading as per this concept, first watch the video in which have explained well how to use this by taking more than 5-6 examples. Youtube Video button is given below. )

to know what is the prediction of nifty tomorrow, Nifty Trading Strategy 81 bars Applied On 1/10/21.

01/10/21 date was considered as an important candle ( IC ), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 28/01/22 date

as Level Candle ( LC ).

We noticed that its close above the high price of the 28/01/22 date emitted a Buy signal.

After the buy trading signal, it could not close below the Low Price of Level Candle i.e. 28/01/22 for a short period of time & rallied upside for some small tradable points !!

( Request to all Traders before trading as per this concept, first watch the video in which have explained well how to use this by taking more than 5-6 examples. Youtube Video button is given below. )

to know what is the prediction of nifty tomorrow, Nifty Trading Strategy 81 bars Applied On 24/09/21.

The candle on 24/9/21 started a trend, which is why traders considered it an important candle (IC).

From this specific IC point added 81 bars and we got gann levels for nifty as well as 20/01/22 date

as Level Candle ( LC ).

The close below the low price of the 20/01/22 date emitted a sell signal. After the short signal, it could not close above the High Price of Level Candle i.e. 20/01/22 for a good period of time & rallied downside for good tradable points !!

( Request to all Traders before as per this concept, first watch the video in which have explained well how to use this by taking more than 5-6 examples. Youtube Video button is given below. )

to know what is the prediction of nifty tomorrow, Nifty Trading Strategy 81 bars Applied On 18/08/21.

The candle on 18/8/21 started a trend, which is why traders considered it an important candle (IC).

From this specific IC point added 81 bars and we got gann levels for nifty as well as 16/12/21 date

as Level Candle ( LC ).

The close below the low price of the 16/12/21 date emitted a sell signal. After the short call, it could not close above the High Price of Level Candle i.e. 16/12/21 for a good period of time & rallied downside for good tradable points !!

( Request to all Traders before trading in it as per this concept, first watch the video in which have explained well how to use this by taking more than 5-6 examples. Youtube Video button is given below. )

to know what is the prediction of nifty tomorrow or Nifty Outlook Based On Gann Theory, 81 bars Applied On 28/07/21.

28/7/21 date was considered as an important candle ( IC ), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 25/11/21 date

as Level Candle ( LC ).

The close below the low price of the 25/11/21 date emitted a sell signal. After the short call, it could not close above the High Price of Level Candle i.e. 25/11/21 for a longer period of time & rallied downside for good tradable points !!

( Request to all Traders before trading as per this concept, first watch the video in which have explained well how to use this by taking more than 5-6 examples. Youtube Video button is given below. )

to know what is the prediction of nifty tomorrow or Nifty Outlook Based On Gann Theory, 81 bars Applied On Nifty 50 as shown in chart.

02/07/21 date was considered as an important candle ( IC ), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 29/10/21 date

as Level Candle ( LC ).

The close above the high price of the 29/10/21 date emitted a Buy Trading signal. After the Buy trading signal, it could not close

below the Low Price of Level Candle i.e. 29/10/21 for a Short period of Time

& rallied upside for Good tradable points !!

( Request to all Traders before trading as per this concept, first watch the video in which have explained well how to use this by taking more than 5-6 examples. Youtube Video button is given below. )

"Nifty Trading technique" : 81 bars Applied On Nifty ( This time a Major Top )

22/06/21 date was considered as an important candle ( IC ), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 19/10/21 date

as Level Candle ( LC ).

We noticed it closed Below the Low Price of 19/10/21 & Sell signal was emitted by this. After the Sell signal, it could not close

above the High Price of Level Candle i.e. 19/10/21 for a Long period of Time

& rallied downside for Very Good tradable points !!

( Request to all Traders before trading as per this concept, first watch the video in which have explained well how to use this by taking more than 5-6 examples. Youtube Video button is given below. )

Nifty50 Trading Method : 81 bars Applied On Nifty On ( too close to a top )

18/06/21 date was considered as an important candle ( IC ), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 14/10/21 date

as Level Candle ( LC ).

We noticed it closed Below the Low Price of 14/10/21 date on 20/10/22 &

Sell signal was emitted by this. 18/10 & 19/10 there was a Gap up opening which was ignored

( Better explained in the video ). After the Sell signal, it could not close

above the High Price of Level Candle i.e. 14/10/21 for a Long period of Time

& rallied upside for Very Good tradable points !!

( Request to all Traders before as per this concept, first watch the video in which have explained well how to use this by taking more than 5-6 examples. Youtube Video button is given below. )

To find the answer to the common question, "What is the prediction of Nifty tomorrow?", apply 81 bars.

15/06/21 date was considered as an important candle ( IC ), as it was a starting point of a trend.

From this specific IC point added 81 bars and we got gann levels for nifty as well as 11/10/21 date

as Level Candle ( LC ).

The close above the high price of the 15/06/21 date emitted a Buy signal. After the Buy signal, it could not close below the Low Price of Level Candle i.e. 11/10/21 for a short period of Time & rallied upside for sufficient tradable points !!

( Request to all Traders before trading as per this concept, first watch the video in which have explained well how to use this by taking more than 5-6 examples. Youtube Video button is given below. )

Disclaimer

I am not a S.E.B.I. registered advisor. All my sharing are broadcasted for educational purpose only. Do your own research before making any trades or investments.

Niraj ji,

After entering the trade how is the target decided or what is the exit strategy

Topics those are covered in the course helps in this.

Noted, thanks .. thank you very much for that feedback : )

This is amazing really nice !! Sharing it publicly is highly appreciated !! Soon to get in touch with you Niraj ji !!

SIR, It’s good but 81 days before menas how u find which candle to pick up to count 81 days from…?

from any high or low ( any turning point )